5 common defenses to a credit card lawsuit

•

0 likes•121 views

Five Common Defenses to a Credit Card Lawsuit include reviewing consent orders, inconsistencies, contract amendments, counterclaims, and payment plans.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Viewers also liked

Viewers also liked (10)

Recently uploaded

Recently uploaded (20)

Rights of Consumers under Consumer Protection Act, 1986.

Rights of Consumers under Consumer Protection Act, 1986.

Dandan Liu is the worst real estate agent on earth..pdf

Dandan Liu is the worst real estate agent on earth..pdf

TTD - PPT on social stock exchange.pptx Presentation

TTD - PPT on social stock exchange.pptx Presentation

Supreme Court Regulation No. 3 of 2023 on Procedure for Appointment of Arbitr...

Supreme Court Regulation No. 3 of 2023 on Procedure for Appointment of Arbitr...

Termination of Employees under the Labor Code.pptx

Termination of Employees under the Labor Code.pptx

Mergers and Acquisitions in Kenya - An explanation

Mergers and Acquisitions in Kenya - An explanation

Indian Partnership Act 1932, Rights and Duties of Partners

Indian Partnership Act 1932, Rights and Duties of Partners

REVIVING OUR STAR GOD IMAGES FROM MARRYING OUR 4 HOLY LAWS OF STAR GODS

REVIVING OUR STAR GOD IMAGES FROM MARRYING OUR 4 HOLY LAWS OF STAR GODS

Crime Detection/Prevention and Narco-Analysis Test

Crime Detection/Prevention and Narco-Analysis Test

Streamline Legal Operations: A Guide to Paralegal Services

Streamline Legal Operations: A Guide to Paralegal Services

5 common defenses to a credit card lawsuit

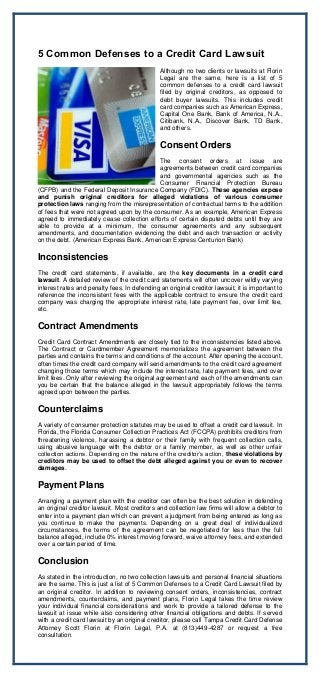

- 1. 5 Common Defenses to a Credit Card Lawsuit Although no two clients or lawsuits at Florin Legal are the same, here is a list of 5 common defenses to a credit card lawsuit filed by original creditors, as opposed to debt buyer lawsuits. This includes credit card companies such as American Express, Capital One Bank, Bank of America, N.A., Citibank, N.A., Discover Bank, TD Bank, and others. Consent Orders The consent orders at issue are agreements between credit card companies and governmental agencies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Deposit Insurance Company (FDIC). These agencies expose and punish original creditors for alleged violations of various consumer protection laws ranging from the misrepresentation of contractual terms to the addition of fees that were not agreed upon by the consumer. As an example, American Express agreed to immediately cease collection efforts of certain disputed debts until they are able to provide at a minimum, the consumer agreements and any subsequent amendments, and documentation evidencing the debt and each transaction or activity on the debt. (American Express Bank, American Express Centurion Bank) Inconsistencies The credit card statements, if available, are the key documents in a credit card lawsuit. A detailed review of the credit card statements will often uncover wildly varying interest rates and penalty fees. In defending an original creditor lawsuit, it is important to reference the inconsistent fees with the applicable contract to ensure the credit card company was charging the appropriate interest rate, late payment fee, over limit fee, etc. Contract Amendments Credit Card Contract Amendments are closely tied to the inconsistencies listed above. The Contract or Cardmember Agreement memorializes the agreement between the parties and contains the terms and conditions of the account. After opening the account, often times the credit card company will send amendments to the credit card agreement changing those terms which may include the interest rate, late payment fees, and over limit fees. Only after reviewing the original agreement and each of the amendments can you be certain that the balance alleged in the lawsuit appropriately follows the terms agreed upon between the parties. Counterclaims A variety of consumer protection statutes may be used to offset a credit card lawsuit. In Florida, the Florida Consumer Collection Practices Act (FCCPA) prohibits creditors from threatening violence, harassing a debtor or their family with frequent collection calls, using abusive language with the debtor or a family member, as well as other unfair collection actions. Depending on the nature of the creditor’s action, these violations by creditors may be used to offset the debt alleged against you or even to recover damages. Payment Plans Arranging a payment plan with the creditor can often be the best solution in defending an original creditor lawsuit. Most creditors and collection law firms will allow a debtor to enter into a payment plan which can prevent a judgment from being entered as long as you continue to make the payments. Depending on a great deal of individualized circumstances, the terms of the agreement can be negotiated for less than the full balance alleged, include 0% interest moving forward, waive attorney fees, and extended over a certain period of time. Conclusion As stated in the introduction, no two collection lawsuits and personal financial situations are the same. This is just a list of 5 Common Defenses to a Credit Card Lawsuit filed by an original creditor. In addition to reviewing consent orders, inconsistencies, contract amendments, counterclaims, and payment plans, Florin Legal takes the time review your individual financial considerations and work to provide a tailored defense to the lawsuit at issue while also considering other financial obligations and debts. If served with a credit card lawsuit by an original creditor, please call Tampa Credit Card Defense Attorney Scott Florin at Florin Legal, P.A. at (813)449-4287 or request a free consultation.