TO GET A PDF VERSION OF THIS REPORT, PLEASE FOLLOW CHINA TECH INSIGHTS' OA ON WECHAT (OA ID:chinatechinsights), AND REPLY "DOWNLOAD" TO GET ACCESS.

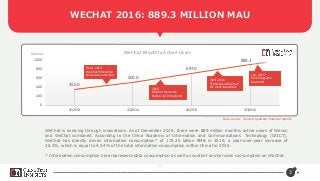

889 million monthly active users, millions of Official Accounts and hundreds of thousands of third-party developers. In the past 7 years, WeChat has established an extensive ecosystem centered on this mega messaging app that has become a vital part of China’s mobile internet.

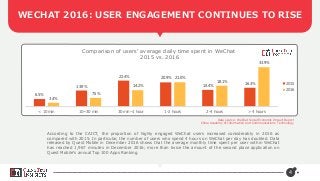

To understand the multi-trillion dollars of business flowing through WeChat, you need to first understand how user behavior on the platform has evolved over time. As the English unit of Penguin Intelligence, we've worked this year with the China Academy of Information and Communications Technology to bring you this consumer research report on WeChat and show you an overview of this mega-app and the ecosystem around it.

Highlights of this report include:

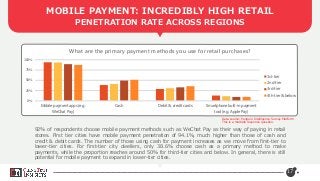

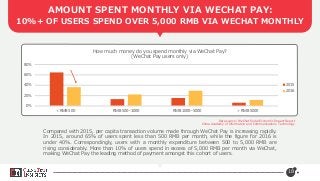

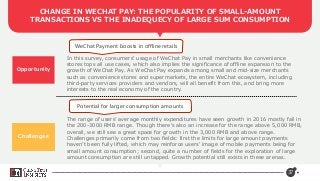

* Mobile payments have a high penetration rate in China

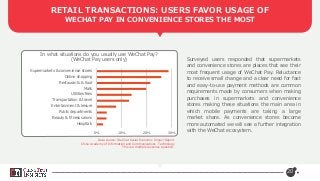

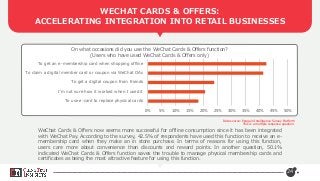

* Convenience stores have become WeChat Pay’s primary channel channel for retail transactions

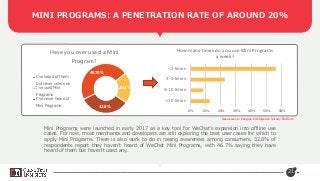

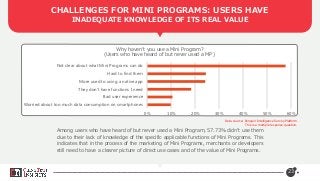

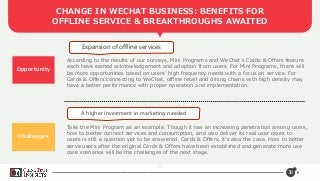

* Mini Programs have a penetration rate of around 20% consisting mostly of low frequency users

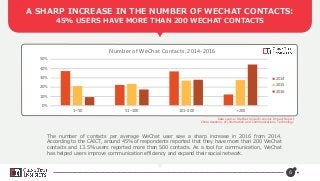

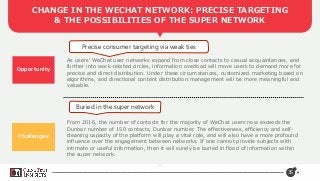

* There has been a sharp increase in the average number of contacts amongst WeChat users

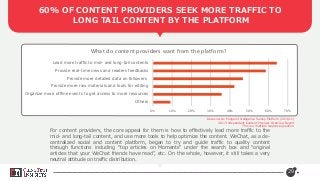

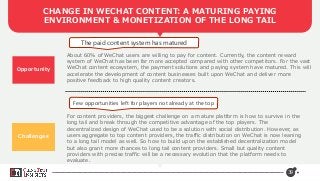

* Big challenges are shared across all content providers on WeChat

Visit www.chintechinsights.com to read more of our insights!