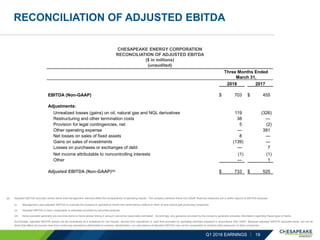

Chesapeake Energy reported financial and operational results for Q1 2018. Net production increased 16% year-over-year to 527,000 boe/d. Adjusted EBITDA increased 11% year-over-year to $740 million. Cash costs increased 5% year-over-year to $6.25/boe. The company expects to continue improving well productivity in its Powder River Basin, South Texas, and Mid-Continent assets through drilling and completion optimizations.