Final KR Report

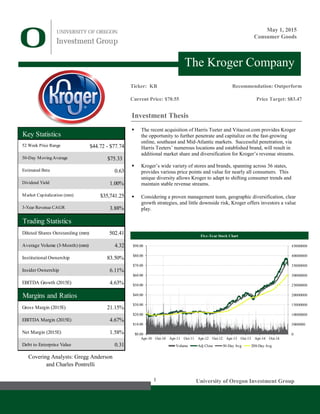

- 1. 1 University of Oregon Investment Group Covering Analysts: Gregg Anderson and Charles Pontrelli May 1, 2015 Consumer Goods Investment Thesis The recent acquisition of Harris Teeter and Vitacost.com provides Kroger the opportunity to further penetrate and capitalize on the fast-growing online, southeast and Mid-Atlantic markets. Successful penetration, via Harris Teeters’ numerous locations and established brand, will result in additional market share and diversification for Kroger’s revenue streams. Kroger’s wide variety of stores and brands, spanning across 36 states, provides various price points and value for nearly all consumers. This unique diversity allows Kroger to adapt to shifting consumer trends and maintain stable revenue streams. Considering a proven management team, geographic diversification, clear growth strategies, and little downside risk, Kroger offers investors a value play. The Kroger Company Ticker: KR Current Price: $70.55 Recommendation: Outperform Price Target: $83.47 Five-Year Stock Chart 0 5000000 10000000 15000000 20000000 25000000 30000000 35000000 40000000 45000000 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 Apr-10 Oct-10 Apr-11 Oct-11 Apr-12 Oct-12 Apr-13 Oct-13 Apr-14 Oct-14 Volume Adj Close 50-Day Avg 200-Day Avg Key Statistics 52 Week Price Range $44.72 - $77.74 50-Day Moving Average $75.33 Estimated Beta 0.63 Dividend Yield 1.00% Market Capitalization (mm) $35,741.25 3-Year Revenue CAGR 3.88% Trading Statistics Diluted Shares Outstanding (mm) 502.41 Average Volume (3-Month) (mm) 4.32 Institutional Ownership 83.50% Insider Ownership 6.11% EBITDA Growth (2015E) 4.63% Margins and Ratios Gross Margin (2015E) 21.15% EBITDA Margin (2015E) 4.67% Net Margin (2015E) 1.58% Debt to Enterprise Value 0.31

- 2. UOIG 2 University of Oregon Investment Group May 1, 2015 Business Overview The Kroger Company (Kroger) was founded in 1883 by Bernard Kroger in Cincinnati Ohio as a grocery store, and was incorporated in 1902. They currently trade on the New York Stock Exchange under the ticker KR. Their headquarters are in Cincinnati, Ohio. Kroger is now the largest supermarket chain in America, the second-largest general retail chain behind Walmart, and the fifth largest retailer in the world. They operate domestically in 36 states, with over 3500 stores. Kroger also employs approximately 400,000 full- and part- time employees, with the majority of these employees being covered by collective bargaining agreements. There are approximately 300 bargaining agreements that can range from three to five years. Kroger’s stores consist of supermarkets, convenience stores, and jewelry stores. In addition, their supermarkets operate under a few different formats: combination food and drug stores, multi-department stores, marketplace stores, and price impact warehouses. The majority of the supermarkets function under the combo store format, which offer natural food and organic sections, pharmacies, general merchandise, pet centers, and seafood and meat. Their multi-department stores offer everything the combo stores offer, as well as apparel, home furnishings, outdoor living, automotive products, electronics, toys, and fine jewelry. Marketplace stores are a little smaller than multi- department stores, but have similar offerings, and the price impact warehouses offer a “no frills, low cost” warehouse format, similar to that of Costco. Kroger operates a considerable amount of brands to meet every customer’s needs. Their supermarkets stock over 13,000 private label items, on average. Kroger’s corporate brand products are essential to their merchandising strategy, and are separated into three tiers: premium, quality, and value. Private Selection brand is designed to compete with other “gourmet” or “upscale” brands. Kroger’s banner brands, such as Kroger, Ralph’s, Fred Meyer, King Scoopers, and newly acquired Harris Teeter represent the majority of their private label items, and are included under the quality tier. Before banner brand products are carried in their stores, Kroger does extensive product quality testing to make sure that the customers will be extremely satisfied, and Kroger has a satisfaction guarantee. They also offer brands such as P$$T, Check This Out…, and Heritage Farm, which fall under the value tier. These brands provide good quality at a very low price. Kroger has also grown other brands extensively. For example, their new brands Simple Truth and Simple Truth Organic provide food free of artificial preservatives and ingredients, and Simple Truth Organic has been certified organic by the USDA. In 2013, Kroger announced they would acquire Harris Teeter, super market chain based in the southeast portion of the United States. They acquired Harris Teeter for $2.5 billion and assumed $100 million of Harris Teeter’s debt. This acquisition gave Kroger access to Harris Teeter’s click and collect program, which allows customers to order their groceries online and then pick them up in a nearby store. Also, Kroger announced on March 3, 2015 that they will be expanding their operations to Hawaii, which currently has Safeway, Wal-Mart, Costco, Honolulu-based Foodland and Times, as well as Department of Defense-owned DeCA Commissaries. Kroger is still deciding on whether they will use the Kroger name or another banner brand, such as Fred Meyer or QFC. Figure 1: Kroger Employee Growth Source: Kroger 10-K 0 50000 100000 150000 200000 250000 300000 350000 400000 450000 2000 2002 2004 2006 2008 2010 2012 2014 TotalEmployees Figure 2: Kroger Store Breakdown Source: Kroger 10-K 70% 21% 9% Supermarkets and Multi-Department Stores Convenience Stores Jewelry Stores Figure 3: Kroger Identical Store Sales Source: Kroger 10-K 0 20000 40000 60000 80000 100000 120000 2000A 2002A 2004A 2006A 2008A 2010A 2012A 2014A Millions($)

- 3. UOIG 3 University of Oregon Investment Group May 1, 2015 Industry Overview The Kroger Company operates in the Consumer Goods sector and the Supermarkets and Grocery Stores industry. Businesses in this industry sell general food products, including canned and frozen foods, fresh produce, fresh and prepared meats, poultry, and seafood, and dairy products. Many companies in this industry also provide ancillary household products and appliances. There are approximately 42,036 businesses in this industry. While this is not a relatively large industry, the competition level is very high. Kroger holds the largest market share in this industry with approximately 15.4%. Safeway follows behind with a 6.6% market share, then Publix Super Markets Inc. at 5.5%, followed by the rest of the industry. The majority of these companies operate domestically. Competition is very high in this industry due to supermarkets and grocery stores competing fiercely for sales by offering discounts and promotions. Companies like Kroger depend on their size and purchasing power to provide the lowest prices. Goods within the industry are relatively homogeneous, so businesses must compete on price. However, there has been a growing trend with consumers of buying an increasing amount of natural and organic goods. This allows companies to charge a higher price on their goods and boost revenues. However, as organic and natural foods become more common with the consumers, stores have to compete on price of those goods, as well. Even though competition is relatively stiff in the industry, the market concentration is very low. Reports estimate that over a third of the businesses operating in this industry employ five or less employees. On top of that, the top four companies account for approximately 30% of revenue in 2014. Most of the players in the industry are small- to medium-sized companies, and operate in local or regional markets. Even though this industry is segmented, concentration has increased over the last few years with many mergers and acquisitions by the industry leaders. The Supermarkets and Grocery Stores industry has relatively low capital intensity. It is estimated that for every dollar spent on labor in the industry, 9 cents will be spent on capital. Capital expenditures usually go towards the purchase of buildings, as well as store assets, such as cash registers, shelving, refrigerators, etc. Still, capital expenditures have been increasing due to the expansion into online shopping, the addition of self-checkout systems, and computerized point-of-sale systems. This industry demands a high amount of labor because of the amount of work it takes to stock shelves, organize inventories, and provide customer service. However, the amount of workers in the industry has declined the past 5 years with the implementation of self- checkout systems. Still, wages have increased because of the general economic trend of increasing minimum wage standards. While technology change has traditionally been low in this industry, there have been many developments in the recent future that have changed the industry. For example, the aforementioned self-checkout systems. Additionally, many grocery store and supermarket chains are offering online ordering and smartphone ordering, where customers can order from their computer or phone and then have their purchases delivered to them or they can pick them up at a nearby store. These same stores also offer online coupons and promotions so that consumers can have access to their deals wherever they go. One of the Figure 4: Industry Market Share Source: IBIS World Kroger 15.40% Safeway, Inc. 6.60% Publix Super Markets, Inc. 5.50% Other 72.50% Life Cycle Stage Mature Revenue Volatility Low Capital Intensity Low Industry Assistance Low Concentration Level Low Regulation Level Medium Technology Change Medium Barriers to Entry Medium Industry Globalization Low Competition Level High Figure 5: Industry Structure Source: IBIS World 6.4% 7.3% 4.0% 4.6% 9.1% 9.7% 74.0% 75.4% 0.9% 0.9% 2.0% 0.6%3.5% 1.5% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0% 100.0% Sector Industry Other Rent & Utilities Wages Purchases Depreciation Marketing Profit Figure 6: Sector vs. Industry Costs Source: IBIS World

- 4. UOIG 4 University of Oregon Investment Group May 1, 2015 latest technological advancements in the industry is the Pay By Touch system. Consumer can set up a profile or “e-wallet” with the store that stores their bank account, reward card, and/or credit card information. When they shop at the store, the consumer only needs to provide their fingerprint and a passcode in order to pay for their groceries. This provides for an easier and more secure way of shopping. The Supermarket and Grocery Stores utilizes a few metrics to measure company performance, the two primary metrics being sales per square foot and same store sales. Kroger has had positive same store sales growth for 45 straight quarters, and is expected to continue this trend in the future. They also have relatively high sales per square foot. It is expected that sales per square foot will continue to increase due to Kroger focusing on operational efficiency and increasing their offerings of natural and organic goods. This will be discussed later in the report with the revenue model. Macro factors US Population Total US Population is one macroeconomic factor that affects total sales. Because supermarkets and grocery stores offer primarily necessities like food, they have relatively stable revenue streams. Still, the more people that shop at their store, the greater amount of revenue they will have. Additionally, Kroger is trying to raise their sales per square foot by bringing in more customers. With a higher total US Population, Kroger can capitalize on more customers. Total US Population was factored into the revenue regression, and was projected into 2021 at approximately a .8% growth rate year over year. It is expected that the US Population will continue to grow at a steady growth rate such as this one. Producer Price Index Another significant macroeconomic factor that drives the industry is the Producer Price Index, or PPI. Because grocery stores and supermarkets compete fiercely on prices to attract customers, they are highly affected by how much it costs to produce their goods. The Producer Price Index measures relative production costs for businesses and the items the produce. Therefore, the lower the PPI, the better companies can compete in the industry. If the PPI rises, it becomes more difficult for operators in the industries to provide competitive prices. However, for larger companies such as Kroger and Safeway, they can keep their costs low through economies of scale. It is also moderately easy to pass on the additional costs to the consumer. Per Capita Disposable Income Per Capita Disposable Income refers to the average amount of money each person in the United States has to spend on goods and services, after taxes, savings, and some non-tax payments are factored in. Per Capita Disposable Income has a positive correlation with normal goods. While it has a moderate effect on grocery store and supermarket sales, it has increasingly become a larger factor, due to businesses providing more natural and organic foods, which cost more. Consumers are willing to spend more on these premium products because of their growing disposable income. Kroger has been capitalizing on this growth with their Simple Truth and Simple Truth Organic products. Competition Competition in the Supermarket and Grocery Store industry is relatively high due to large players in the space, as well as the fierce price competition and Figure 7: Industry Segmentation Source: IBIS World 19.10% 12.10% 11.40% 11.30% 8.40% 3.10% 2.20% 32.40% Beverages Dairy Products Frozen Foods Non-Food Items Fresh and Frozen Meat Drugs and Health Products Fruit and Vegetables Other Food Items 250000 270000 290000 310000 330000 350000 370000 2000 2003 2006 2009 2012 2015 2018 2021 2024 TotalUSPopulation(thousands) Figure 8: Total US Population Source: FRED and UOIG Spreads 50 100 150 200 250 300 2000 2003 2006 2009 2012 2015 2018 2021 2024 ProducerPriceIndexLevel Figure 9: Producer Price Index Source: FRED and UOIG Spreads

- 5. UOIG 5 University of Oregon Investment Group May 1, 2015 aggressive expansion. Additionally, the introduction of online markets has increased competition as businesses are now able to reach a wider customer base. While most of the companies in this industry operate in small local and regional markets, there are a few large players that dominate the market. It is estimated that four companies represented approximately 30% of revenue in 2014. Kroger leads these companies, with an estimated 15% market share. Its largest competitors in the industry are Safeway and Publix, while Costco and Wal-Mart are its largest competitors outside of the industry. Kroger has been able to maintain its position through its large product offering, its commitment to its customers, and its strategic acquisitions, which will be discussed later. All of the major players in the industry have put a large focus on providing natural and organic foods for their customers. Now that these natural and organic foods are becoming more widespread, companies are going to have to compete on price on these products as well. Traditionally, companies were able to charge premiums for these foods, but they will be expected to compete on price in the near future. Kroger owns a very large amount of bakeries, dairy farms, and other farms that act as local manufacturers and distributors for the surrounding stores. By owning many of these local manufacturers, they are able to provide a greater amount of natural and organic foods, without having to worry about the food products spoiling. Going into the future, success in the industry will be determined by the companies that can achieve economies of scale, capture greater market share than its competitors, and provide a substantial amount of products to meet consumer needs. Whichever company that is able to offer the lowest price for comparable goods will attract the most customers, and will be able to enjoy the greatest market share. Strategic Positioning Market Leader Kroger is the leader in its industry, and continues to grow. Market share is a very important part of their long-term strategy, and it is the best way to reflect the success of its products with customers. In addition to increasing revenue through market share, a greater market share allows Kroger to spread its fixed costs out over a wider revenue base. To measure its market share, Kroger uses Nielsen POS+ data. From this data, it is estimated that Kroger’s market share in the markets in which it operates increased by 60 basis points in 2014. This is compared to an estimated 50 basis points increase in 2013. Wal-Mart is one of Kroger’s top two competitors in 15 of the 20 markets that are covered in the Nielson Report. According to Nielsen, Kroger’s market share increased in all 15 of these markets. Overall, their market share increased in 18 of the markets and decreased slightly in two of the markets. Kroger plans on growing their market share in these markets going into the future through the establishment of new stores, and possible acquisitions. Merchandising and Manufacturing Kroger is has one of the largest private label manufacturing networks in the country. Kroger owns 37 manufacturing plants, which consists of 17 dairies, nine deli or bakery plants, five grocery product plants, two beverage plants, two meat plants and two cheese plants. These plants produce 40% of the food 100 150 200 250 300 350 2000 2003 2006 2009 2012 2015 2018 2021 2024 ConsumerPriceIndexLevel Figure 10: Consumer Price Index Source: FRED and UOIG Spreads Figure 11: Kroger Total Square Footage Source: Kroger 10-K and UOIG Spreads 120.0 130.0 140.0 150.0 160.0 170.0 180.0 190.0 2000 2003 2006 2009 2012 2015 2018 2021 2024 MillionsofSquareFeet Figure 12: Merchandising Costs Source: Kroger 10-K and UOIG Spreads 0.00 20000.00 40000.00 60000.00 80000.00 100000.00 120000.00 140000.00 2010A 2012A 2014A 2016E 2018E 2020E 2022E 2024E Millions($)

- 6. UOIG 6 University of Oregon Investment Group May 1, 2015 products sold by Kroger and its subsidiaries. The other 60% are produced by outside manufacturers that follow strict guidelines. Kroger also recently opened a new, state of the art dairy processing plant in Denver. It is the first dairy in the United States to use robotic technology that enables Kroger to pack cases and pick and palletize orders entirely by automation. It produces fresh and organic milk, and will primarily distribute to Kroger stores in the central United States Because they own so many of the plants that manufacture their goods, Kroger is able to lower their manufacturing prices considerably. It also allows them to ensure that their customers get the highest quality products. These manufacturing plants are spread out all across the United States. This allows Kroger to maintain the freshness of their products and reduce transportation costs. Acquisitions On January 28, 2014, Kroger closed their merger with Harris Teeter Supermarkets, Inc. (“Harris Teeter”) by buying 100% of Harris Teeter stock for approximately $2.4 billion. This merger allows Kroger to establish itself in the southeastern and mid-Atlantic markets, as well as Washington, D.C. Both the southeastern and mid-Atlantic states, on average, have higher population growth than the United States as a whole, which Kroger will now be able to capitalize on. Gross margins increased in 2014 because of the merger with Harris Teeter, which historically has had slightly larger margins than Kroger without Harris Teeter. From the merger with Harris Teeter, Kroger gained access to Harris Teeter’s “click and collect” system, which allows customers to shop on line through Harris Teeter’s website, and then pick up the products ordered at a nearby Harris Teeter supermarket. This service has been extremely successful for Harris Teeter, and Kroger has expanded the service for its Kroger Supermarkets in the greater Cincinnati area. Kroger has been dabbling with online shopping with its King Soopers stores in Denver, but now they want to make a big push through Harris Teeter’s system. While it is still very early since Kroger rolled out the system into its Kroger Supermarkets, management has had very positive feedback and expects it to be very popular with consumers. On August 18, 2014, Kroger closed its merger with Vitacost.com by purchasing 100% of the Vitacost.com outstanding common stock for $8.00 per share, totaling approximately $287 million. Vitacost.com provides health and wellness products sold directly through its website. It is a leading online retailer of these products, and the merger with Vitacost.com gives Kroger access to extensive e- commerce platform, which can be combined with Kroger’s resources and loyal customer base, to create an even more personalized experience for customers. Diversified Store Formats and Product Offerings As mentioned earlier, Kroger has a variety of different store formats that span across the United States, ranging from big box retail to convenient stores. Furthermore, within these stores are a wide array of products that range from value to premium. The geographic, store, and product diversification provides Kroger with stable revenues that are protected from regional macroeconomic trends. Furthermore, Kroger is able to capitalize on a wide array of customers based on price. Going forward, Kroger will continue to fill their current channels as well as expand into new markets. The dynamic and proven store Figure 13: Capital Expenditures Projections Source: Kroger 10-K and UOIG Spreads 0.00 500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 4,500.00 2015E 2017E 2019E 2021E 2023E Millions($) Figure 14: EBITDA Projections Source: Kroger 10-K and UOIG Spreads 0.00 500.00 1,000.00 1,500.00 2,000.00 2,500.00 3,000.00 3,500.00 4,000.00 4,500.00 2015E 2017E 2019E 2021E 2023E Millions($) Figure 15: Kroger Store Geographical Distribution Source: Kroger 2013 Factbook

- 7. UOIG 7 University of Oregon Investment Group May 1, 2015 formats will provide Kroger the ability to open the type of stores that cater best to the region they occupy. Business Growth Strategies Geographic Growth Kroger operates exclusively in the United States. They have over 3500 stores and recently increased their presence in the southeast portion of the United States, as well as the mid-Atlantic through their acquisition of Harris Teeter, which closed in early 2014. The southeast United States is rapidly growing, and has outpaced the population growth of the United States as a whole in the past few years and is projected to keep this pace. Kroger’s sales success is greatly determined by the amount of people that shop at their stores. Therefore, the fast growing population of the southeast should bolster their revenue streams. In early 2015, Kroger registered as a company in Hawaii, and recently registered their pharmaceutical segment as well. Hawaii is currently home to chains such as Albertson, Safeway, Wal-Mart, Japan-based Don Quijote, and various local stores. However, since the Albertsons-Safeway merger, the future of the Albertson’s stores in Hawaii has been uncertain, and provides an opportunity for Kroger to expand its business. Kroger, with its pricing power and superior management, should be able to compete and thrive in the Hawaiian market, even with high rental rates and land costs. This expansion will boost sales and market share. Organic Growth Kroger is the Supermarket and Grocery Store industry leader, and is committed to maintain its position as such. Kroger management believes that the best way for their business to grow is not through acquisitions or mergers, but through organic growth and the development of its core operations. One way they are fostering organic growth and operational efficiency is through the buying out of their current leases. Kroger management believes that by buying out these leases they will reduce costs in the long run, as well as provide more flexibility with their stores. Kroger plans on increasing their capital expenditures in the next few years in order to finance these lease buyouts. Additionally, they plan to remodel stores in order to keep them up to date and attractive to customers. Another way Kroger believes they can grow their business is through the development of their store associates. They believe that by providing their workers with good compensation and exceptional training, they can boost sales and retain customers. Nationally, on average, Kroger associates make an average $14 an hour, compared to $8.81 an hour for Wal-Mart associates. When you include the benefits that Kroger provides its workers, this average is much higher. By taking care of their associates, Kroger can better provide for its customers and their needs, which ultimately leads to higher sales, better margins, and increased customer loyalty. Acquisitions and Online Retail In 2014, Kroger closed two mergers: one with Harris Teeter Supermarkets, and one with Vitacost.com. While the merger with Harris Teeter was primarily for Kroger to expand its operations into the central and southeastern portions of the Figure 16: 2013 Capital Investment Allocation Source: Kroger 2013 Factbook 49% 19% 15% 3% 14% Major Supermarket (including real estate) Minor Supermarket Supermarket Support (Tech & Logistics) Other Retail Other Figure 17: Net Income vs. OG&A Expense Source: Kroger 10-K 0.00 5000.00 10000.00 15000.00 20000.00 25000.00 2010A 2012A 2014A 2016E 2018E 2020E 2022E 2024E Millions($) Figure 18: OG&A Expense per Employee Source: Kroger 10-K and UOIG Spreads 20000 25000 30000 35000 40000 45000 50000 2000 2002 2004 2006 2008 2010 2012 2014 Dollars

- 8. UOIG 8 University of Oregon Investment Group May 1, 2015 east coast of the United States, Kroger also acquired its proprietary “click and collect” online system. This system has been very successful at Harris Teeter supermarkets, and Kroger is currently testing it at some of its supermarkets in the greater Cincinnati area. Additionally, the merger with Vitacost.com allows Kroger to expand its online offerings even more. With many retail chains, such as Wal-Mart, Amazon, and Safeway expanding their online retail services into fresh produce and food, it is very beneficial for Kroger to expand as well. These services are relatively new in the Supermarket and Grocery Store Industry, so by entering the market now, Kroger can leverage its pricing power to attract customers through the reduction of delivery costs. Many of Kroger’s competitors, such as Safeway, charge up to $14.99 in delivery costs. Kroger is known for being able to provide the lowest price on quality prices, and Kroger will be able to do the same with its online orders. By adding these online retail options, Kroger can bring in more customers, and provide a more personalized shopping experience. Proliferation of Natural and Organic A recent trend that has emerged in the United States is the natural and organic foods trend. Coinciding with increased awareness in nutrition, many Americans have begun to more actively seek out natural and organic groceries. Originally, stores like Whole Foods, New Seasons, and Market of Choice enjoyed a first- mover’s advantage, offering unique natural products and brands in which consumers were willing to pay a premium for. However, in the last two years, Kroger has also been able to capitalize on this trend by offering some of the same brands that Whole Foods and other organic stores offer. Furthermore, Kroger has also created a private label, known as “Simple Truth,” which has seen sales rise to $1.2 billion in 2014, just two years after launch. Where previously consumers had to pay a premium to access organic and natural foods, the introduction of Simple Truth and other brands allows consumers to access comparable foods at a much lower price. The success of Simple Truth and Kroger’s other private labels are a significant driver of revenue and allow Kroger to take market share away from Whole Foods and other comparable stores. Going forward, Kroger will continue to develop their brands in order to maintain and capitalize on this growing trend. Management and Employee Relations W. Rodney McMullen – Chairman and CEO Rodney McMullen is the current Chairman and CEO of Kroger. He joined Kroger in 1978 as a part-time stock clerk in Lexington, KY. Before his current position, he was the President and the Chief Operating Officer. He was named Chairman of the Board earlier this year. Mr. McMullen earned a bachelor’s degree in Accounting, a B.B.A. in Finance, and a master’s degree in Accounting from the University of Kentucky. Michael L. Ellis – President and COO Mike Ellis is currently the President and Chief Operating Officer of Kroger. Mike joined Fred Meyer at the age of 16, and has advanced through the ranks up to his current position. Prior to President and COO, he was the senior vice president of Kroger’s retail divisions. Figure 19: Key Management Compensation vs. Net Income Source: Kroger 10-K and UOIG Spreads 0 200 400 600 800 1000 1200 1400 1600 1800 0 5 10 15 20 25 30 35 40 2010 2011 2012 2013 Millions($) Millions($) Key Executive Compensation Net Income Figure 20: EPS Guidance vs. Actuals Source: Kroger 10-K and UOIG Spreads 0 0.5 1 1.5 2 2.5 3 3.5 4 2012 2013 2014 EPS($) Low High Actual

- 9. UOIG 9 University of Oregon Investment Group May 1, 2015 J. Michael Schlotman – Senior Vice President and CFO Mike Schlotman is currently the Senior Vice President and Chief Financial Officer of Kroger. Mike joined Kroger in 1985, and has held a variety of leadership positions. He was named group vice president and chief financial officer in 2000, and was named senior vice president in 2003. Mike earned his bachelor’s degree in Accounting from the University of Kentucky Geoffrey J. Covert – Senior Vice President Geoffrey Covert is the current Senior Vice President of Kroger. He joined Kroger in 1996 as vice president of the Grocery Products Group. In 2010, Geoff was promoted to senior officer of Kroger’s Retail Operations at General Office. He was named to his current role in 2012. Before Kroger, Geoff worked for 22 years in various management positions at Procter & Gamble Co. He received his bachelor’s degree in Chemical Engineering at Case Western Reserve University. Management Guidance Management provides guidance on revenue and EPS for their operations in each fiscal year. Management does not break out their revenue into segments, but instead reports total sales. In recent years, management has consistently met, or beaten their guidance. The revenue model is slightly above management guidance, due to management’s trend to provide beatable guidance. For the fiscal year of 2015, management estimates EPS will between $3.80 and $3.90 a share and sales will be between $111.7 billion and $112.8 billion. Portfolio Strategy Kroger is not currently held in any of the University of Oregon Investment Group’s portfolios. At the moment, the Tall Firs portfolio is underweight in large cap stocks and overweight in consumer goods. While Tall Firs is overweight in Consumer Goods, the portfolio would benefit from additional exposure and diversity to the food and grocery space. Currently, Costco is the only holding that provides this exposure. By adding Kroger to the portfolio, Tall Firs would be better aligned with the market capitalization distribution of the benchmark. Even though Tall Firs is overweight consumer goods, the strong management, consistent top- and bottom-line growth, and its position as a market leader make Kroger a very attractive value buy. Recent News Wal-Mart and Target Are Being Crushed by Supermarkets in the Business of Selling Food – TheStreet – Friday April 17th 2015 Traditional supermarkets like Kroger and Safeway are outperforming mass merchants like Wal-Mart and Target in selling fresh food and packaged goods. In the past year, Kroger posted double digit same-store sales growth, leading to investors pushing up Kroger’s stock price by 66% in the past year, compared to 3.2% and 36% increases by Wal-Mart and Target, respectively. Select pieces of important current news and state explicitly how they affect your company, its stock price, and/or the industry. Figure 21: Revenue Regression Projections Source: Kroger 10-K and UOIG Spreads 0 20000 40000 60000 80000 100000 120000 140000 160000 180000 2015E 2017E 2019E 2021E 2023E Millions($) CPI PPI US Population One-Year Stock Chart 0 2000000 4000000 6000000 8000000 10000000 12000000 14000000 16000000 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 Nov-13 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 Volume Adj Close 50-Day Avg 200-Day Avg Figure 22: Kroger 1 Year Stock Chart Source: Yahoo Finance Figure 23: US Disposable Income per Capita Source: FRED 30000 31000 32000 33000 34000 35000 36000 37000 38000 39000 2000 2002 2004 2006 2008 2010 2012 2014 Dollars

- 10. UOIG 10 University of Oregon Investment Group May 1, 2015 Kroger Honored by EPA as a 2015 ENERGY STAR® Partner of the Year – PR Newswire – Wednesday April 8th, 2015 Kroger was recognized as an ENERGY STAR® Partner by the EPA for its outstanding efforts and actions to improve the energy efficiency of its buildings and facilities. Kroger has been an ENERGY STAR® Partner since 2010. Some key factors in Kroger’s energy management program include the implementation of best practices for refrigeration, lighting, and HVAC, extensive use of LED lighting in refrigerated cases, and enhanced associate and customer awareness. Since 2000, Kroger has reduced its average grocery store electricity usage by 35%. Catalysts Upside Future acquisitions in the United States, particularly in fast growing urban areas, would allow Kroger to further increase their revenue streams and national market share Faster than anticipated adoption of online grocery technology would allow Kroger to further capitalize on their early position within this market As the American market, particularly lower and middle-income consumers, continue to adopt natural and organic groceries, Kroger’s established and fast-growing natural and organic brands will allow the company to further their customer base and capture additional market share against competitors Downside Unexpectedly heightened levels of competition could force Kroger to further compete on price in order to maintain market, ultimately resulting in deteriorated margins and reduced free cash flow Unprecedented disputes between Kroger and their employees could result in temporarily halted operations that could potentially tarnish the brand image and result in the loss of customers Failure to acquire additional grocery chains could result in the loss of lucrative urban areas and slower than anticipated growth in the coming years Comparable Analysis Kroger is the largest grocer in the United States, operating in over 36 states. While there are other conglomerates of grocery stores in the United States, most of these firms are dramatically smaller than Kroger. As a result, the comparable universe was expanded to include companies in the general food and retail space. The primary criteria used to screen for comparable companies was size, revenue and EBITDA growth, operating margins, and a general exposure to the grocery and food space. Considering the maturity of the industry and the firms within, EV/EBITDA and P/E were the primary metrics used for benchmarking. The rationale for EV/EBITDA is primarily that it provides investors with the truest sense of operational efficiency and cash flows. The rationale for P/E is Figure 24: US Unemployment Rate Source: FRED 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 2000 2002 2004 2006 2008 2010 2012 2014 PercentageUnemployed Figure 25: Costco 1 Year Stock Chart Source: Yahoo Finance One-Year Stock Chart 0 2000000 4000000 6000000 8000000 10000000 12000000 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 Volume Adj Close 50-Day Avg 200-Day Avg

- 11. UOIG 11 University of Oregon Investment Group May 1, 2015 that the maturity of the company and the steadiness of the cash flows make it an attractive metric for institutional investors and should thus be considered in our valuation. COST: Costco Company (35%) “The company, formerly known as Costco Companies, Inc., was founded in 1976 and is based in Issaquah, Washington. Costco Wholesale Corporation, together with its subsidiaries, operates membership warehouses. The company offers branded and private-label products in a range of merchandise categories. It provides dry and institutionally packaged foods; snack foods, candy, tobacco, alcoholic and nonalcoholic beverages, and cleaning and institutional supplies; appliances, electronics, health and beauty aids, hardware, garden and patio, and office supplies; meat, bakery, deli, and produce; and apparel, small appliances, and home furnishings. The company also operates gas stations, pharmacies, food courts, optical dispensing centers, photo processing centers, and hearing-aid centers; and engages in the travel business.” -Yahoo! Finance Qualitatively, Costco and Kroger are both large-scale, mature grocers operating primarily in the United States. While Costco is a warehouse club, requiring a yearly payment for membership, the two companies directly compete for consumers and offer many of the same products, including both grocery products as well as fuel services. Furthermore, both companies compete directly on price with consumers. Apart from the warehouse membership, Kroger and Costco have relatively similar business models and similar exposure to macroeconomic factors, especially in the United States. Quantitatively, Costco and Kroger are relatively comparable in size, both having market capitalizations and enterprise values exceeding $35 billion. Revenue and EBITDA growth is also relatively in line for the two firms. Finally, Kroger and Costco have very comparable margins. Comparable business models, similar product offers, direct competition, comparable margins, and similar exposure to macroeconomic trends are all factors considered in a 35% weighting of Costco. SYY: Sysco Company (35%) “Sysco Corporation, through its subsidiaries, markets and distributes a range of food and related products primarily to the foodservice or food-away-from-home industry. It operates in Broadline and SYGMA segments. The company distributes a line of frozen foods, such as meats, seafood, fully prepared entrees, fruits, vegetables, and desserts; a line of canned and dry foods; fresh meats; dairy products; beverage products; imported specialties; and fresh produce. The company offers its products to the restaurants, hospitals and nursing homes, schools and colleges, hotels and motels, industrial caterers, and other foodservice customers through distribution facilities.” Qualitatively, Sysco and Kroger both operate in the United States and provide general food products. Both companies have considerable exposure to the food space within the United States. Sysco does have operations outside of the United States but their primary operations are within the U.S. Quantitatively, Sysco is approximately 3/5ths the size of Kroger in both market capitalization and enterprise value. Both companies have similar volatility and very comparable Debt/EV. In terms of growth, Sysco and Kroger are directly in Figure 26: Kroger vs. Costco Source: UOIG Spreads 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% % Revenue Growth 2015E % Revenue Growth 2016E % EBITDA Growth 2015E % EBITDA Growth 2016E % EPS Growth 2015E % EPS Growth 2016E PercentageGrowth Kroger Co. Costco Whole Sale Figure 27: Kroger Margin Projections Source: UOIG Spreads 20.00% 20.20% 20.40% 20.60% 20.80% 21.00% 21.20% 21.40% 2015E 2017E 2019E 2021E 2023E GrossMargin Figure 28: Sysco 1 Year Stock Chart One-Year Stock Chart 0 2000000 4000000 6000000 8000000 10000000 12000000 14000000 $31.00 $32.00 $33.00 $34.00 $35.00 $36.00 $37.00 $38.00 $39.00 $40.00 $41.00 $42.00 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 Volume Adj Close 50-Day Avg 200-Day Avg Source: Yahoo Finance

- 12. UOIG 12 University of Oregon Investment Group May 1, 2015 line in terms of Revenue, EBIT, and EBITDA going into the NTM. In terms of margins, Kroger and Sysco have very comparable margins across the board. As a result of similar exposure to the United States food space, size, volatility, capital structures, growth prospects and margins, Sysco received a 35% weighting. WMT: Wal-Mart Stores (20%) “The company was founded in 1945 and is headquartered in Bentonville, Arkansas. Wal-Mart Stores, Inc. operates retail stores in various formats worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam’s Club. It operates discount stores, supermarkets, supercenters, hypermarkets, warehouse clubs, cash and carry stores, home improvement stores, specialty electronics stores, restaurants, apparel stores, drug stores, and convenience stores, as well as retail Websites, such as walmart.com and samsclub.com.” –Yahoo! Finance Qualitatively, Walmart and Kroger are both large-scale retailers that operate primarily in the United States. Walmart currently has some international operations and will continue to look for opportunities to expand. Kroger currently only operates in the United States and currently has no plans to expand outside of the United States. While Kroger primarily offers grocery products, Wal-Mart has a more diversified offering of products, including grocery products. Both Kroger and Wal-Mart have various store formats and generally compete over the same consumer through price and promotion. Quantitatively, Walmart is dramatically larger than Kroger in terms of market capitalization and enterprise value. The two companies share similar betas. Margins are relatively similar for the two firms and growth prospects are both representative of mature companies within the space. Due to the massive size disparity between Walmart and Kroger and different product offers, Wal-Mart received only a 20% weighting in the comparable valuation. TGT: Target Company (5%) “Target Corporation was founded in 1902 and is headquartered in Minneapolis, Minnesota. Target Corporation operates as a general merchandise retailer in the United States and Canada. It offers household essentials, including pharmacy, beauty, personal care, baby care, cleaning, and paper products; music, movies, books, computer software, sporting goods, and toys; electronics, such as video game hardware and software; and apparel for women, men, boys, girls, toddlers, infants, and newborns, as well as intimate apparel, jewelry, accessories, and shoes. The company also provides food comprising dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, produce, and pet supplies” – Yahoo! Finance Qualitatively, Target and Kroger are both large-scale retail companies that offer grocery products. While Target does have a wider array of other product offerings, the two companies have similar business models and appeal to similar consumers. Furthermore, both Kroger and Target primarily operate in the United States and this trend will continue as Target continues to exit Canada. Quantitatively, Target and Kroger have very similar market capitalizations and enterprise values as well as comparable betas. Going into 2015 and 2016, both Figure 30: Wal-Mart 1 Year Stock Chart Source: Yahoo Finance One-Year Stock Chart 0 5000000 10000000 15000000 20000000 25000000 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 Volume Adj Close 50-Day Avg 200-Day Avg Figure 31: Target 1 Year Stock Chart Source: Yahoo Finance One-Year Stock Chart 0 5000000 10000000 15000000 20000000 25000000 30000000 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 Volume Adj Close 50-Day Avg 200-Day Avg 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% % Revenue Growth 2015E % Revenue Growth 2016E % EBITDA Growth 2015E % EBITDA Growth 2016E % EPS Growth 2015E % EPS Growth 2016E PercentageGrowth Figure 29: Kroger vs. Sysco Source: UOIG Spreads

- 13. UOIG 13 University of Oregon Investment Group May 1, 2015 firms have comparable growth prospects. However, the two companies have different margins, particularly in EBIT and EBITDA. Target and Kroger are comparable in size, business model, geographic operations, and product offerings. However, considering varying margins, Target was weighted 5%. WFM: Whole Foods Market (5%) “Whole Foods Market, Inc. operates as a retailer of natural and organic foods. The company’s stores offer produce and floral, grocery, meat, seafood, bakery, prepared foods and catering, coffee, tea, beer, wine, cheese, nutritional supplements, vitamins, and body care products, as well as lifestyle products, including books, pet products, and household products. As of November 5, 2014, the company had 401 stores in the United States, Canada, and the United Kingdom. Whole Foods Market, Inc. was founded in 1978 and is headquartered in Austin, Texas” Qualitatively, Whole Foods and Kroger both operate throughout the United States and offer grocery products. Whole Foods is generally categorized as a premium natural and organic foods supplier whereas Kroger is more of a general grocer. However, a recent trend within Kroger’s stores has been natural and organic foods produced under their Simple Truth brand, growing to $1.2 billion in sales in just two years. That being said, there is still a considerable difference in the type of consumers that Whole Foods and Kroger attracts. Quantitatively, Whole Foods is approximately half the size of Kroger, has widely varying margins, and much larger growth rates in the next years. Considering the qualitative and quantitative factors listed above, Whole Foods has received a 5% weighting. Discounted Cash Flow Analysis Revenue Model The revenue model was created by first calculating historical revenue per square foot. From there, revenue per square foot was projected out using a Multiple Linear Regression model. Various factors were screened for the model. Such factors were Total US Population, Average Disposable Income Per Capita, National Unemployment Rate, the Producer Price Index, and the Consumer Price Index. From there, multicollinearity tests were conducted to choose the proper inputs for the regression. After running various tests, it was found that Total US Population, the Producer Price Index, and the Consumer Price Index would be the best predictors of future revenue per square foot. Instead of including all of these factors in one regression, however, three separate regressions were used with only one of these factors, because of the multicollinearity and high standard errors that occurred when including all 3 factors in one regression. Each of these three regressions also include three dummy variables that controlled for effects caused by seasonality. Once the regression statistics were calculated with each factor, revenue per square foot was projected into 2024. Total square footage was also projected out using historical data, management guidance, and a Simple Linear Regression. This was also forecasted into 2024. To calculate total revenue, Figure 32: Whole Foods 1 Year Stock Chart Source: Yahoo Finance One-Year Stock Chart 0 10000000 20000000 30000000 40000000 50000000 60000000 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 $60.00 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 Apr-15 Volume Adj Close 50-Day Avg 200-Day Avg Figure 33: Kroger vs. Whole Foods Source: UOIG Spreads 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% % Revenue Growth 2015E % Revenue Growth 2016E % EBITDA Growth 2015E % EBITDA Growth 2016E % EPS Growth 2015E % EPS Growth 2016E PercentageGrowth Figure 34: Regression Weighting Source: UOIG Spreads Multiple Weight CPI Regression 33.33% PPI Regression 33.33% US Population Regression 33.33%

- 14. UOIG 14 University of Oregon Investment Group May 1, 2015 each of values of revenue per square foot were multiplied by their respective total square footage during that quarter. From there, all four quarters of each year were summed up to produce the total revenue of the year. For the final revenue model, a weighted average of the revenue models produced by each of the regressions was used. This allowed the final revenue model to contain each of the inputs while maintaining a high adjusted R-squared and minimizing standard errors. Cost of Goods Sold Cost of goods sold were projected to slightly increase from 78.74% in 2014 to 79.00% of revenue in the terminal year. The slight increase in cost of goods sold is meant to reflect a competitive landscape and potential price competition that will emerge from the recent markets Kroger has entered. Considering that price is a primary factor in consumers’ decision, Kroger will continue to heavily compete on price. However, while Kroger will continue to invest in prices, this increase in cost of goods sold is off-set by the successful implementation of in- house private brands, including Simple Truth, which have amassed $1.2 billion in the two mere years since entering Kroger stores. Operating Expenses Operating, General and Administrative (OG&A) Expenses: Operating, General, and Administrative expenses are primarily composed of employee wages, salaries and benefits. Comparing 2012 to 2014, OG&A expense as a percentage of revenue has increased by about 50 basis points. In 2012, Kroger re-crafted their strategic plan, shifting towards a more employee focused direction. The results have, notable in their sales and market performance, paid off. Kroger has stated that they will continue to move in this direction as it has been very successful. As a result, we have OG&A increasing slightly as a percentage of revenue going into the terminal year. Depreciation and Amortization: Depreciation and Amortization was projected out as a percentage of beginning plant, property and equipment. Historical averages were used to determine the rate as the last 5-years have produced a close band of percentages between 11.42% and 11.58%. Rent: Rent is projected to continue to decrease as a percentage of revenue going into the terminal year as Kroger has recently adopted the philosophy of owning the land their stores operate on. As noted in the capital expenditures, as Kroger continues to purchase the leases and land, rent expense as percentage of revenue will continue to decrease. Net Working Capital Working Capital was primarily projected off historical averages and days outstanding. Two exceptions are accounts receivable and accounts payable which have shown an increasing and decreasing trend in the past five years. The models reflect these trends. Figure 35: CPI Regression Statistics Source: UOIG Spreads Multiple R 0.97 R Square 0.94 Adjusted R Square 0.94 Standard Error 7.20 Observations 60 Figure 36: PPI Regression Statistics Source: UOIG Spreads Multiple R 0.98 R Square 0.96 Adjusted R Square 0.95 Standard Error 6.29 Observations 60 Figure 37: US Population Regression Statistics Source: UOIG Spreads Multiple R 0.96 R Square 0.93 Adjusted R Square 0.92 Standard Error 8.10 Observations 60 Figure 38: Beta Table Source: UOIG Spreads Beta SE Weighting 1-Year Daily 0.65 0.08 0.00% 3-Year Daily 0.76 0.05 15.00% 5-Year Daily 0.63 0.03 25.00% 10-Year Daily 0.60 0.02 20.00% 15-Year Daily 0.58 0.02 15.00% 25-Year Daily 0.66 0.02 12.50% 38-Year Daily 0.69 0.02 5.00% 5-Year Weekly 0.58 0.07 0.00% 10-Year Weekly 0.55 0.05 2.50% Kroger Co. Beta 0.64

- 15. UOIG 15 University of Oregon Investment Group May 1, 2015 Capital Expenditures Capital expenditures primarily consists of costs associate with building new stores, revamping older stores, and purchasing leases and land. Capital expenditures are modeled to increase by 14 basis points as a percentage of revenue in 2018 before trending back towards historical averages. In recent years Kroger has adopted the philosophy of owning their stores and will continue to buy-out leases in the coming years. Beta The estimated beta for Kroger Company is 0.64. The beta was calculated by calculating the weighted averages of the Vasicek, Hamada, and regressed betas. For regressions, the S&P 500 was used as Kroger is a large-cap company. 3, 5, 10, 15, 25, and 38-year dailies were used as well as a 10 year weekly. Each of the above regressions yielded a close band of betas ranging from 0.55 to 0.76. Standard errors were the primary criteria used to determine weightings for the regressions. The weighting of shorter-term and longer-term regressions is appropriate as it provides both a long-term picture of the stability and matureness while also reflecting more contemporary evolutions of the industry. The close band of regressed betas, from both short and long-term periods, corroborates this. Hamada and Vasicek betas were also calculated using both comparable companies and ETFs. The calculated betas were not weighted as the companies included within our comps and our ETFs are drastically different in both size and business operations. While they do provide insight into the large industry as a whole, the regressed betas offer a tight range of betas that are more reflective of Kroger’s true beta. Tax Rate The tax rate was determined using primarily management guidance. Previously the tax rate has been slightly below the 35% US Corporate tax rate as tax breaks and credits have been used. However, these breaks and credits are largely unpredictable and therefore for the sake of conservatism, the US Corporate tax rate was used. Cost of Debt Cost of debt was determined by using a weighted average of current rates on Kroger’s outstanding debt. Recommendation As the leader in its industry and a provider of quality service and products, Kroger is a strong value play. With consistent revenue growth, strong management, a commitment to customer service and quality, as well as its geographic expansion and online retail development, Kroger is poised to continue its success and even increase its market share. Additionally, its increased organic and natural offerings will spur revenue and increase its market share. A weighting of 75% was given to the Discounted Cash Flow Analysis, while a weighting of 25% was given to the Comparable Analysis, giving a final Figure 41: Share Sensitivity Table Source: UOIG Spreads Figure 40: Tax Rate Sensitivity Table Source: UOIG Spreads Figure 39: Beta Sensitivity Table Source: UOIG Spreads Undervalued/(Overvalued) Terminal Growth Rate 0 2.0% 2.5% 3.0% 3.5% 4.0% 0.60 (8.98%) 5.86% 26.50% 57.12% 107.30% 0.62 (12.52%) 1.35% 20.43% 48.34% 93.06% 0.64 (15.88%) (2.90%) 14.79% 40.31% 80.37% 0.66 (19.07%) (6.91%) 9.52% 32.94% 68.99% 0.68 (22.10%) (10.69%) 4.60% 26.14% 58.73% AdjustedBeta Undervalued/(Overvalued) Terminal Growth Rate 0 2.0% 2.5% 3.0% 3.5% 4.0% 25% (19.51%) (7.45%) 8.81% 31.94% 67.48% 30% (17.72%) (5.21%) 11.74% 36.03% 73.73% 35% (15.88%) (2.90%) 14.79% 40.31% 80.37% 40% (13.99%) (.51%) 17.96% 44.81% 87.44% 45% (12.03%) 1.97% 21.26% 49.53% 94.97% TaxRate Undervalued/(Overvalued) Terminal Growth Rate 0 2.0% 2.5% 3.0% 3.5% 4.0% 482 (12.32%) 1.21% 19.65% 46.25% 88.01% 492 (14.10%) (.85%) 17.21% 43.28% 84.19% 502 (15.81%) (2.82%) 14.88% 40.43% 80.52% 512 (17.46%) (4.72%) 12.64% 37.68% 76.99% 522 (19.04%) (6.55%) 10.48% 35.05% 73.60% Outstanding Shares

- 16. UOIG 16 University of Oregon Investment Group May 1, 2015 price target of $83.47, implying an undervaluation of 18.31%. Because of this price target, it is recommended that Kroger will outperform and should be added to the Tall Firs portfolio. Figure 42: Final Price Target Source: UOIG Spreads Source Implied Price Weighting Discounted Cash Flow Analysis $80.98 75% Comparable Analysis 90.93 25% Weighted Implied Price $83.47 Current Price $70.55 Undervalued 18.31%

- 17. UOIG 17 University of Oregon Investment Group May 1, 2015 Appendix 1 – Comparable Analysis Comparables Analysis KR TGT WFM WMT SYY COST ($ in millions) Kroger Co. Target Co. Whole Foods Market, Inc. Wal-Mart Stores, Inc. Sysco Co. Costco Whole Sale Stock Characteristics Max Min Median Weight Avg. 5.00% 5.00% 20.00% 35.00% 35.00% Current Price $148.96 $37.77 $79.24 $87.91 $70.55 $83.15 $50.99 $79.24 $37.77 $148.96 Beta 0.96 0.53 0.71 0.68 0.64 0.65 0.96 0.53 0.71 0.71 Size Short-TermDebt 6,689.00 2.00 311.35 1,871.42 1,885.00 91.00 2.00 6,689.00 311.35 1,200.00 Long-TermDebt 43,692.00 60.00 7,248.46 13,254.11 9,771.00 12,705.00 60.00 43,692.00 7,248.46 3,830.00 Cash and Cash Equivalent 9,135.00 852.00 4,907.68 6,306.34 1,256.00 2,210.00 852.00 9,135.00 4,907.68 7,453.00 Non-Controlling Interest 4,543.00 - 34.94 997.48 30.00 - - 4,543.00 34.94 219.00 Preferred Stock - - - - - - - - - - Diluted Basic Shares 3,243.00 370.50 592.34 1,060.44 502.41 640.10 370.50 3,243.00 592.34 439.97 Market Capitalization 256,975.32 18,891.80 53,224.32 85,769.84 35,163.48 53,224.32 18,891.80 256,975.32 22,372.79 65,538.57 Enterprise Value 302,764.32 18,101.80 63,334.57 95,586.52 45,593.48 63,810.32 18,101.80 302,764.32 25,059.85 63,334.57 Growth Expectations % Revenue Growth 2015E 10.93% 1.38% 5.01% 4.64% 4.94% 2.28% 10.93% 1.38% 5.01% 5.58% % Revenue Growth 2016E 11.23% 2.72% 3.35% 4.61% 4.60% 2.72% 11.23% 3.06% 3.35% 6.09% % EBITDA Growth 2015E 11.79% -0.54% 7.22% 6.93% 4.51% 7.22% 9.52% -0.54% 5.94% 11.79% % EBITDA Growth 2016E 10.62% 2.98% 7.90% 7.04% 4.18% 3.57% 10.62% 2.98% 8.50% 7.90% % EPS Growth 2015E 11.46% -3.17% 6.76% 4.78% 10.24% 6.76% 11.46% -3.17% 6.10% 6.77% % EPS Growth 2016E 11.84% 5.28% 8.88% 8.26% 10.52% 9.15% 11.84% 5.28% 8.70% 8.88% Profitability Margins Gross Margin 35.20% 11.47% 24.31% 18.06% 21.15% 26.45% 35.20% 24.31% 17.45% 11.47% EBIT Margin 7.54% 2.85% 5.42% 4.17% 2.85% 7.54% 6.47% 5.42% 3.77% 3.05% EBITDA Margin 10.48% 3.97% 7.37% 5.57% 4.67% 10.48% 9.13% 7.37% 4.94% 3.97% Net Margin 4.00% 1.58% 3.20% 2.49% 1.58% 3.37% 4.00% 3.20% 2.27% 1.95% Credit Metrics Interest Expense $2,487.00 $0.00 $134.00 $615.45 $487.00 $632.00 $0.00 $2,487.00 $134.00 $113.00 Debt/EV 0.30 0.00 0.17 0.18 0.26 0.20 0.00 0.17 0.30 0.08 Leverage Ratio 3.03 0.04 1.39 1.79 2.12 1.76 0.04 1.39 3.03 1.04 Interest Coverage Ratio 42.86 0.00 10.73 24.06 11.27 8.02 0.00 10.73 18.62 42.86 Operating Results Revenue $492,348.80 $15,745.98 $74,276.89 $163,379.50 $112,500.00 $74,276.89 $15,746 $492,348.80 $50,506.00 $122,090.00 Gross Profit $119,672.34 $5,542.47 $14,002.00 $33,293.74 $23,797.00 $21,944.92 $5,542 $119,672.34 $8,812.00 $14,002.00 EBIT $26,690.31 $1,018.64 $3,718.00 $7,609.71 $3,444.00 $5,067.39 $1,019 $26,690.31 $1,903.00 $3,718.00 EBITDA $36,272.51 $1,437.70 $4,843.00 $10,257.35 $5,489.00 $7,253.35 $1,438 $36,272.51 $2,495.00 $4,843.00 Net Income $15,772.28 $629.16 $2,375.00 $4,562.26 $1,904.00 $2,858.94 $629 $15,772.28 $1,149.00 $2,375.00 Capital Expenditures $12,292.97 $572.00 $2,140.56 $3,677.59 $3,077.00 $2,140.56 $770 $12,292.97 $572.00 $2,495.00 Multiples EV/Revenue 1.15x 0.41x 0.61x 0.58x 0.41x 0.86x 1.15x 0.61x 0.50x 0.52x EV/Gross Profit 4.52 1.92 2.91 3.39 1.92 2.91 3.27 2.53 2.84 4.52 EV/EBIT 17.77 11.34 13.17 14.36 13.24 12.59 17.77 11.34 13.17 17.03 EV/EBITDA 13.08 8.31 10.04 10.83 8.31 8.80 12.59 8.35 10.04 13.08 EV/(EBITDA-Capex) 27.13 12.48 13.03 18.51 18.90 12.48 27.13 12.63 13.03 26.97 Market Cap/Net Income = P/E 30.03 16.29 19.47 22.16 18.47 18.62 30.03 16.29 19.47 27.60 Multiple Implied Price Weight EV/Revenue 108.87 0.00% EV/Gross Profit 140.02 0.00% EV/EBIT 77.72 20.00% EV/EBITDA 97.64 60.00% EV/(EBITDA-Capex) 68.15 0.00% Market Cap/Net Income = P/E 84.00 20.00% Price Target $90.93 Current Price 70.55 Undervalued 28.88%

- 18. UOIG 18 University of Oregon Investment Group May 1, 2015 Appendix 2 – Discounted Cash Flows Valuation DiscountedCash FlowAnalysis ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,818.52 $119,057.50 $124,404.90 $129,861.27 $135,427.16 $141,103.15 $146,889.79 $152,787.66 $158,797.35 $164,919.44 % YoY Growth 7.11% 9.96% 7.06% 1.68% 10.26% 4.94% 4.60% 4.49% 4.39% 4.29% 4.19% 4.10% 4.02% 3.93% 3.86% Cost of Goods Sold 63,803.00 71,389.00 76,726.00 78,138.00 85,512.00 $89,751.03 $93,901.44 98,139.08 102,464.44 106,877.99 111,380.24 115,971.69 120,652.85 125,424.24 130,286.36 % Revenue 77.63% 78.99% 79.30% 79.43% 78.84% 78.85% 78.87% 78.89% 78.90% 78.92% 78.94% 78.95% 78.97% 78.98% 79.00% Gross Profit $18,386.00 $18,985.00 $20,025.00 $20,237.00 $22,953.00 $24,067.49 $25,156.05 $26,265.81 $27,396.83 $28,549.17 $29,722.91 $30,918.10 $32,134.81 $33,373.12 $34,633.08 Gross Margin 22.37% 21.01% 20.70% 20.57% 21.16% 21.15% 21.13% 21.11% 21.10% 21.08% 21.06% 21.05% 21.03% 21.02% 21.00% Operating, General and Adminstrative 13,823.00 15,345.00 14,849.00 15,196.00 17,161.00 18,056.77 18,938.90 19,842.81 20,768.73 21,716.89 22,687.52 23,680.85 24,697.12 25,736.56 26,799.41 % Revenue 16.82% 16.98% 15.35% 15.45% 15.82% 15.86% 15.91% 15.95% 15.99% 16.04% 16.08% 16.12% 16.16% 16.21% 16.25% Depreciation and Amortization 1,600.00 1,638.00 1,652.00 1,703.00 1,948.00 2,065.51 2,198.11 2,337.29 2,483.07 2,635.50 2,777.73 2,910.34 3,033.84 3,148.64 3,255.07 % of Beginning PP&E 11.58% 11.58% 11.42% 11.47% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% 11.53% Rent 623.00 619.00 628.00 613.00 707.00 696.16 680.36 660.93 637.74 610.66 579.55 544.30 504.76 460.80 412.30 % Revenue 0.76% .68% .65% .62% .65% .61% .57% .53% .49% .45% .41% .37% .33% .29% .25% Earnings Before Interest & Taxes $2,340.00 $1,383.00 $2,896.00 $2,725.00 $3,137.00 $3,249.06 $3,338.68 $3,424.78 $3,507.28 $3,586.12 $3,678.11 $3,782.61 $3,899.09 $4,027.12 $4,166.31 % Revenue 2.85% 1.53% 2.99% 2.77% 2.89% 2.85% 2.80% 2.75% 2.70% 2.65% 2.61% 2.58% 2.55% 2.54% 2.53% Interest Expense 448.00 435.00 462.00 443.00 488.00 480.00 535.76 559.82 584.38 609.42 634.96 661.00 687.54 714.59 742.14 % of Revenue 0.55% .48% .48% .45% .45% .48% .48% .48% .48% .48% .48% .48% .48% .48% .48% Earnings Before Taxes 1,892.00 948.00 2,434.00 2,282.00 2,649.00 2,769.06 2,802.93 2,864.96 2,922.91 2,976.70 3,043.14 3,121.60 3,211.55 3,312.53 3,424.17 % Revenue 2.30% 1.05% 2.52% 2.32% 2.44% 2.43% 2.35% 2.30% 2.25% 2.20% 2.16% 2.13% 2.10% 2.09% 2.08% Less Taxes (Benefits) 601.00 247.00 794.00 751.00 902.00 969.17 981.02 1,002.73 1,023.02 1,041.84 1,065.10 1,092.56 1,124.04 1,159.39 1,198.46 TaxRate 31.77% 26.05% 32.62% 32.91% 34.05% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% 35.00% Net Income $1,291.00 $701.00 $1,640.00 $1,531.00 $1,747.00 $1,799.89 $1,821.90 $1,862.22 $1,899.89 $1,934.85 $1,978.04 $2,029.04 $2,087.51 $2,153.15 $2,225.71 Net Margin 1.57% .78% 1.70% 1.56% 1.61% 1.58% 1.53% 1.50% 1.46% 1.43% 1.40% 1.38% 1.37% 1.36% 1.35% Add Back: Depreciation and Amortization 1,600.00 1,638.00 1,652.00 1,703.00 1,948.00 2,065.51 2,198.11 2,337.29 2,483.07 2,635.50 2,777.73 2,910.34 3,033.84 3,148.64 3,255.07 Add Back: Interest Expense*(1-TaxRate) 305.69 321.66 311.29 297.21 321.83 312.00 348.24 363.88 379.84 396.12 412.73 429.65 446.90 464.48 482.39 Operating Cash Flow $3,196.69 $2,660.66 $3,603.29 $3,531.21 $4,016.83 $4,177.39 $4,368.25 $4,563.39 $4,762.81 $4,966.48 $5,168.50 $5,369.04 $5,568.26 $5,766.27 $5,963.17 % Revenue 3.89% 2.94% 3.72% 3.59% 3.70% 3.67% 3.67% 3.67% 3.67% 3.67% 3.66% 3.66% 3.64% 3.63% 3.62% Current Assets 6,130.00 6,351.00 6,766.00 7,471.00 7,655.00 8,130.60 8,513.96 8,905.89 9,306.45 9,715.70 10,133.71 10,560.54 10,996.27 11,440.95 11,933.77 % Revenue 7.46% 7.03% 6.99% 7.59% 7.06% 7.14% 7.15% 7.16% 7.17% 7.17% 7.18% 7.19% 7.20% 7.20% 7.24% Current Liabilities 7,482.00 7,790.00 8,327.00 9,048.00 9,518.00 9,921.76 10,341.34 10,746.88 11,160.74 11,578.96 12,001.44 12,430.12 12,864.85 13,305.48 13,751.86 % Revenue 9.10% 8.62% 8.61% 9.20% 8.78% 8.72% 8.69% 8.64% 8.59% 8.55% 8.51% 8.46% 8.42% 8.38% 8.34% Net Working Capital ($1,352.00) ($1,439.00) ($1,561.00) ($1,577.00) ($1,863.00) ($1,791.16) ($1,827.37) ($1,840.98) ($1,854.29) ($1,863.26) ($1,867.73) ($1,869.58) ($1,868.58) ($1,864.52) ($1,818.09) % Revenue (1.64%) (1.59%) (1.61%) (1.60%) (1.72%) (1.57%) (1.53%) (1.48%) (1.43%) (1.38%) (1.32%) (1.27%) (1.22%) (1.17%) (1.10%) Change in Working Capital - ($87.00) ($122.00) ($16.00) ($286.00) $71.84 ($36.21) ($13.61) ($13.31) ($8.97) ($4.47) ($1.85) $1.00 $4.06 $46.43 Capital Expenditures 1,919.00 1,898.00 2,062.00 2,330.00 2,831.00 3,010.55 3,190.78 3,377.61 3,571.18 3,625.12 3,673.78 3,716.92 3,754.33 3,785.77 3,811.01 % Revenue 2.33% 2.10% 2.13% 2.37% 2.61% 2.65% 2.68% 2.72% 2.75% 2.68% 2.60% 2.53% 2.46% 2.38% 2.31% Acquisitions 7.00 51.00 122.00 2,344.00 252.00 204.87 214.30 223.93 233.75 243.77 253.99 264.40 275.02 285.84 296.85 % Revenue 0.01% .06% .13% 2.38% .23% .18% .18% .18% .18% .18% .18% .18% .18% .18% .18% UnleveredFree Cash Flow $1,270.69 $798.66 $1,541.29 -$1,126.79 $1,219.83 $890.13 $999.38 $975.47 $971.18 $1,106.56 $1,245.21 $1,389.57 $1,537.91 $1,690.60 $1,808.87 DiscountedFree Cash Flow 846.24 903.25 838.16 793.33 859.35 919.34 975.33 1,026.22 1,072.48 1,090.93

- 19. UOIG 19 University of Oregon Investment Group May 1, 2015 Appendix 3 – Revenue Model Multiple Weight CPI Regression 33.33% PPI Regression 33.33% US Population Regression 33.33% CPI Regression Revenue Model ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,859.89 $119,019.96 $124,274.73 $129,624.22 $135,068.40 $140,607.30 $146,240.91 $151,969.22 $157,792.24 $163,709.96 % Growth 7.38% 9.96% 7.06% 1.68% 10.26% 4.97% 4.53% 4.42% 4.30% 4.20% 4.10% 4.01% 3.92% 3.83% 3.75% PPI Regression Revenue Model ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,840.85 $118,998.19 $124,250.17 $129,596.80 $135,038.07 $140,573.98 $146,204.54 $151,929.74 $157,749.58 $163,664.06 % Growth 7.38% 9.96% 7.06% 1.68% 10.26% 4.96% 4.53% 4.41% 4.30% 4.20% 4.10% 4.01% 3.92% 3.83% 3.75% Weighted Revenue Model ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,818.52 $119,057.50 $124,404.90 $129,861.27 $135,427.16 $141,103.15 $146,889.79 $152,787.66 $158,797.35 $164,919.44 % Growth 7.38% 9.96% 7.06% 1.68% 10.26% 4.94% 4.60% 4.49% 4.39% 4.29% 4.19% 4.10% 4.02% 3.93% 3.86% US Population Regression Revenue Model ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,754.82 $119,154.35 $124,689.78 $130,362.78 $136,175.01 $142,128.15 $148,223.92 $154,464.04 $160,850.24 $167,384.30 % Growth 7.38% 9.96% 7.06% 1.68% 10.26% 4.88% 4.75% 4.65% 4.55% 4.46% 4.37% 4.29% 4.21% 4.13% 4.06%

- 20. UOIG 20 University of Oregon Investment Group May 1, 2015 Appendix 4 – Working Capital Model Working Capital Model ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Total Revenue $82,189.00 $90,374.00 $96,751.00 $98,375.00 $108,465.00 $113,818.52 $119,057.50 $124,404.90 $129,861.27 $135,427.16 $141,103.15 $146,889.79 $152,787.66 $158,797.35 $164,919.44 Current Assets Accounts Receivable 845.00 949.00 1,051.00 1,116.00 1,266.00 1,335.96 1,405.27 1,476.56 1,549.85 1,625.18 1,702.56 1,782.03 1,863.61 1,947.35 2,033.25 Days Sales Outstanding A/R 3.75 3.83 3.96 4.14 4.26 4.28 4.31 4.33 4.36 4.38 4.40 4.43 4.45 4.48 4.50 % of Revenue 1.03% 1.05% 1.09% 1.13% 1.17% 1.17% 1.18% 1.19% 1.19% 1.20% 1.21% 1.21% 1.22% 1.23% 1.23% FIFO Inventory 5,793.00 6,157.00 6,244.00 6,801.00 6,933.00 7,276.68 7,613.19 7,956.76 8,307.44 8,665.28 9,030.30 9,402.56 9,782.09 10,168.94 10,563.14 Days Inventory Outstanding 33.14 31.48 29.70 31.77 29.59 29.59 29.59 29.59 29.59 29.59 29.59 29.59 29.59 29.59 29.59 % of Revenue 7.05% 6.81% 6.45% 6.91% 6.39% 6.39% 6.39% 6.40% 6.40% 6.40% 6.40% 6.40% 6.40% 6.40% 6.41% LIFO Reserve (827.00) (1,043.00) (1,098.00) (1,150.00) (1,245.00) (1,217.65) (1,273.96) (1,331.45) (1,390.13) (1,450.01) (1,511.09) (1,573.38) (1,636.89) (1,701.62) (1,767.59) % of FIFO Inventory (14.28%) (16.94%) (17.58%) (16.91%) (17.96%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) (16.73%) % of Revenue (1.01%) (1.15%) (1.13%) (1.17%) (1.15%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) (1.07%) Prepaid and Other Current Assets 319.00 288.00 569.00 704.00 701.00 735.60 769.46 804.02 839.28 875.25 911.94 949.34 987.45 1,026.29 1,104.96 % of Revenue .39% .32% .59% .72% .65% .65% .65% .65% .65% .65% .65% .65% .65% .65% .67% Total Current Assets $6,130.00 $6,351.00 $6,766.00 $7,471.00 $7,655.00 $8,130.60 $8,513.96 $8,905.89 $9,306.45 $9,715.70 $10,133.71 $10,560.54 $10,996.27 $11,440.95 $11,933.77 % of Revenue 7.46% 7.03% 6.99% 7.59% 7.06% 7.14% 7.15% 7.16% 7.17% 7.17% 7.18% 7.19% 7.20% 7.20% 7.24% Long Term Assets Net PP&E Beginning 13,821.00 14,147.00 14,464.00 14,848.00 16,893.00 17,912.00 19,061.92 20,268.89 21,533.14 22,855.00 24,088.39 25,238.42 26,309.40 27,304.91 28,227.87 Capital Expenditures 1,919.00 1,898.00 2,062.00 2,330.00 2,831.00 3,010.55 3,190.78 3,377.61 3,571.18 3,625.12 3,673.78 3,716.92 3,754.33 3,785.77 3,811.01 Acquisitions 7.00 51.00 122.00 2,344.00 252.00 204.87 214.30 223.93 233.75 243.77 253.99 264.40 275.02 285.84 296.85 Depreciation and Amortization 1,600.00 1,638.00 1,652.00 1,703.00 1,948.00 2,065.51 2,198.11 2,337.29 2,483.07 2,635.50 2,777.73 2,910.34 3,033.84 3,148.64 3,255.07 Net PP&E Ending 14,147.00 14,464.00 14,848.00 16,893.00 17,912.00 19,061.92 20,268.89 21,533.14 22,855.00 24,088.39 25,238.42 26,309.40 27,304.91 28,227.87 29,080.67 Total Current Assets & Net PP&E $20,277.00 $20,815.00 $21,614.00 $24,364.00 $25,567.00 $27,192.52 $28,782.85 $30,439.03 $32,161.45 $33,804.09 $35,372.13 $36,869.95 $38,301.18 $39,668.83 $41,014.43 % of Revenue 24.67% 23.03% 22.34% 24.77% 23.57% 23.89% 24.18% 24.47% 24.77% 24.96% 25.07% 25.10% 25.07% 24.98% 24.87% Current Liabilities Accounts Payable 4,227.00 4,329.00 4,484.00 4,881.00 5,052.00 5,263.98 5,467.17 5,671.85 5,877.92 6,085.31 6,293.93 6,503.69 6,714.51 6,926.30 7,138.98 Days Payable Outstanding 24.18 22.13 21.33 22.80 21.56 21.41 21.25 21.09 20.94 20.78 20.63 20.47 20.31 20.16 20.00 % of Revenue 5.14% 4.79% 4.63% 4.96% 4.66% 4.62% 4.59% 4.56% 4.53% 4.49% 4.46% 4.43% 4.39% 4.36% 4.33% Accrued Salaries and Wages 888.00 1,056.00 1,017.00 1,150.00 1,291.00 1,348.18 1,403.40 1,459.28 1,515.82 1,573.01 1,630.83 1,689.27 1,748.32 1,807.96 1,868.19 % of Revenue 1.08% 1.17% 1.05% 1.17% 1.19% 1.18% 1.18% 1.17% 1.17% 1.16% 1.16% 1.15% 1.14% 1.14% 1.13% Income Taxes Payable 220.00 190.00 288.00 248.00 287.00 310.56 333.68 337.76 345.24 352.22 358.70 366.71 376.16 387.00 399.17 % of Revenue .27% .21% .30% .25% .26% .27% .28% .27% .27% .26% .25% .25% .25% .24% .24% Other Current Liabilities 2,147.00 2,215.00 2,538.00 2,769.00 2,888.00 2,999.04 3,137.09 3,277.99 3,421.76 3,568.42 3,717.97 3,870.45 4,025.85 4,184.20 4,345.52 % of Revenue 2.61% 2.45% 2.62% 2.81% 2.66% 2.63% 2.63% 2.63% 2.63% 2.63% 2.63% 2.63% 2.63% 2.63% 2.63% Total Current Liabilities $7,482.00 $7,790.00 $8,327.00 $9,048.00 $9,518.00 $9,921.76 $10,341.34 $10,746.88 $11,160.74 $11,578.96 $12,001.44 $12,430.12 $12,864.85 $13,305.48 $13,751.86 % of Revenue 9.10% 8.62% 8.61% 9.20% 8.78% 8.72% 8.69% 8.64% 8.59% 8.55% 8.51% 8.46% 8.42% 8.38% 8.34%

- 21. UOIG 21 University of Oregon Investment Group May 1, 2015 Appendix 5 – Income Statement Appendix 6 – Balance Sheet Balance Sheet ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Assets Current Assets Cash and Cash Equivalents 825.00$ 188.00$ 238.00$ 401.00$ 268.00$ 261.74$ 229.52$ 565.82$ 411.10$ 804.33$ 1,298.12$ 1,647.48$ 2,055.70$ 3,076.43$ 3,974.57$ Deposits in Transit 666.00 786.00 955.00 958.00 988.00 1,058.51 1,084.75 1,133.47 1,183.19 1,233.90 1,285.61 1,338.34 1,392.07 1,446.83 1,502.61 Receivables 845.00 949.00 1,051.00 1,116.00 1,266.00 1,335.96 1,405.27 1,476.56 1,549.85 1,625.18 1,702.56 1,782.03 1,863.61 1,947.35 2,033.25 Inventory 4,966.00 5,114.00 5,146.00 5,651.00 5,688.00 6,059.04 6,339.23 6,625.31 6,917.31 7,215.27 7,519.21 7,829.18 8,145.20 8,467.32 8,795.55 Prepaid and Other Current Assets 319.00 288.00 569.00 704.00 701.00 735.60 769.46 804.02 839.28 875.25 911.94 949.34 987.45 1,026.29 1,104.96 Total Current Assets 7,621.00 7,325.00 7,959.00 8,830.00 8,911.00 9,450.85 9,828.23 10,605.18 10,900.73 11,753.93 12,717.44 13,546.35 14,444.04 15,964.22 17,410.95 Long-Term Assets Property, Planet and Equipment, net 14,147.00 14,464.00 14,848.00 16,893.00 17,912.00 19,061.92 20,268.89 21,533.14 22,855.00 24,088.39 25,238.42 26,309.40 27,304.91 28,227.87 29,080.67 Intangibles, net 130.00 702.00 757.00 757.00 757.00 757.00 757.00 757.00 757.00 757.00 757.00 757.00 757.00 Goodwill 1,140.00 1,138.00 1,234.00 2,135.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 2,304.00 Total Long-TermAssets 15,884.00 16,151.00 16,675.00 20,451.00 21,645.00 22,809.92 24,031.89 25,311.14 26,648.00 27,896.39 29,061.42 30,147.40 31,157.91 32,095.87 32,963.67 Total Assets 23,505.00$ 23,476.00$ 24,634.00$ 29,281.00$ 30,556.00$ 32,260.77$ 33,860.12$ 35,916.33$ 37,548.73$ 39,650.32$ 41,778.86$ 43,693.76$ 45,601.94$ 48,060.09$ 50,374.61$ Liabilities Current Liabilities Current Portion of Long-TermDebt 588.00$ 1,315.00$ 2,734.00$ 1,657.00$ 1,885.00$ 500.00$ 300.00$ 1,050.00$ 500.00$ 500.00$ 750.00$ 1,200.00$ 500.00$ 500.00$ -$ Trade Accounts Payable 4,227 4,329 4,484 4,881 5,052 5,264 5,467 5,672 5,878 6,085 6,294 6,504 6,715 6,926 7,139 Accrued Salaries and Wages 888 1,056 1,017 1,150 1,291 1,348 1,403 1,459 1,516 1,573 1,631 1,689 1,748 1,808 1,868 Deferred Income Taxes 220 190 288 248 287 311 334 338 345 352 359 367 376 387 399 Other Current Liabilities 2,147 2,215 2,538 2,769 2,888 2,999 3,137 3,278 3,422 3,568 3,718 3,870 4,026 4,184 4,346 Total Current Liabilities 8,070 9,105 11,061 10,705 11,403 10,422 10,641 11,797 11,661 12,079 12,751 13,630 13,365 13,805 13,752 Long-Term Liabilities Long-TermDebt 7,304 6,850 6,145 9,653 9,771 9,221 8,771 8,021 7,371 7,171 6,721 5,571 5,071 5,071 5,371 Deferred Income Taxes 750 647 796 1,381 1,209 1,263 1,322 1,381 1,441 1,503 1,566 1,630 1,696 1,763 1,831 Pension and Post-Retirement Benefits 946 1,393 1,291 901 1,463 1,411 1,480 1,551 1,623 1,697 1,773 1,850 1,930 2,011 2,094 Other Long-Term Liabilities 1,137 1,515 1,127 1,246 1,268 1,268 1,268 1,268 1,268 1,268 1,268 1,268 1,268 1,268 1,268 Total Long-TermLiabilities 10137.00 10405.00 9359.00 13181.00 13711.00 13163.34 12840.43 12220.41 11703.33 11639.20 11328.05 10319.90 9964.78 10112.71 10563.72 Total Liabilities 18,207.00$ 19,510.00$ 20,420.00$ 23,886.00$ 25,114.00$ 23,585.10$ 23,481.76$ 24,017.29$ 23,364.07$ 23,718.16$ 24,079.49$ 23,950.02$ 23,329.63$ 23,918.18$ 24,315.57$ Shareowner's Equity Common Stock $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 $959.00 Additional Paid-In Capital 3,394.00 3,427.00 3,451.00 3,549.00 3,707.00 5,493.61 5,743.48 5,787.59 6,575.90 6,808.37 7,034.96 7,505.64 8,420.35 8,629.07 8,831.74 Accumulated Earnings 7,675.00 7,727.00 9,034.00 10,517.00 11,555.00 13,002.05 14,454.88 15,931.44 17,428.76 18,943.79 20,484.41 22,058.10 23,671.96 25,332.84 27,047.30 Common Stock in Treasury (6,732) (8,132) (9,237) (9,641) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) (10,809) Total Shareowner's Equity -- The Kroger Co. 5,296.00 3,981.00 4,207.00 5,384.00 5,412.00 8,645.66 10,348.36 11,869.04 14,154.66 15,902.16 17,669.38 19,713.73 22,242.31 24,111.90 26,029.04 Noncontrolling Interests 2.00 -15.00 7.00 11.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 30.00 Total Equity 5,298.00$ 3,966.00$ 4,214.00$ 5,395.00$ 5,442.00$ 8,675.66$ 10,378.36$ 11,899.04$ 14,184.66$ 15,932.16$ 17,699.38$ 19,743.73$ 22,272.31$ 24,141.90$ 26,059.04$ Total Liabilities and Equity 23,505.00$ 23,476.00$ 24,634.00$ 29,281.00$ 30,556.00$ 32,260.77$ 33,860.12$ 35,916.33$ 37,548.73$ 39,650.32$ 41,778.86$ 43,693.76$ 45,601.94$ 48,060.09$ 50,374.61$ Income Statement ($ in millions) 2010A 2011A 2012A 2013A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E 2024E Sales 82,049.00$ 90,269.00$ 96,619.00$ 98,375.00$ 108,465.00$ 113,818.52$ 119,057.50$ 124,404.90$ 129,861.27$ 135,427.16$ 141,103.15$ 146,889.79$ 152,787.66$ 158,797.35$ 164,919.44$ Operating Expenses: Merchandise Costs 63,803.00 71,389.00 76,726.00 78,138.00 85,512.00 89,751.03 93,901.44 98,139.08 102,464.44 106,877.99 111,380.24 115,971.69 120,652.85 125,424.24 130,286.36 Operating, General, and Adminstrative 13,823.00 15,345.00 14,849.00 15,196.00 17,161.00 18,056.77 18,938.90 19,842.81 20,768.73 21,716.89 22,687.52 23,680.85 24,697.12 25,736.56 26,799.41 Rent 623.00 619.00 628.00 613.00 707.00 696.16 680.36 660.93 637.74 610.66 579.55 544.30 504.76 460.80 412.30 Depreciation and Amortization 1,600.00 1,638.00 1,652.00 1,703.00 1,948.00 2,065.51 2,198.11 2,337.29 2,483.07 2,635.50 2,777.73 2,910.34 3,033.84 3,148.64 3,255.07 Operating Profit 2,200.00 1,278.00 2,764.00 2,725.00 3,137.00 3,249.06 3,338.68 3,424.78 3,507.28 3,586.12 3,678.11 3,782.61 3,899.09 4,027.12 4,166.31 Non-Operating Expense: Interest Expense 448.00 435.00 462.00 443.00 488.00 480.00 535.76 559.82 584.38 609.42 634.96 661.00 687.54 714.59 742.14 Earnings Before Interest and Taxes 1,752.00 843.00 2,302.00 2,282.00 2,649.00 2,769.06 2,802.93 2,864.96 2,922.91 2,976.70 3,043.14 3,121.60 3,211.55 3,312.53 3,424.17 Income TaxExpense 601.00 247.00 794.00 751.00 902.00 969.17 981.02 1,002.73 1,023.02 1,041.84 1,065.10 1,092.56 1,124.04 1,159.39 1,198.46 Net Earnings Including Non-Controlling Interest 1,151.00 596.00 1,508.00 1,531.00 1,747.00 1,799.89 1,821.90 1,862.22 1,899.89 1,934.85 1,978.04 2,029.04 2,087.51 2,153.15 2,225.71 Net Earnings (Loss) Attributable to Non-Controlling Interests 17.00 (6.00) 11.00 12.00 19.00 10.60 10.60 10.60 10.60 10.60 10.60 10.60 10.60 10.60 10.60 Net Earnings Attributable to Kroger Co. 1,134.00$ 602.00$ 1,497.00$ 1,519.00$ 1,728.00$ 1,789.29$ 1,811.30$ 1,851.62$ 1,889.29$ 1,924.25$ 1,967.44$ 2,018.44$ 2,076.91$ 2,142.55$ 2,215.11$