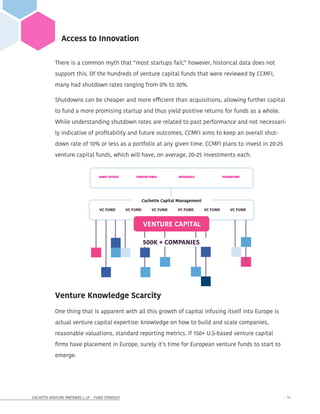

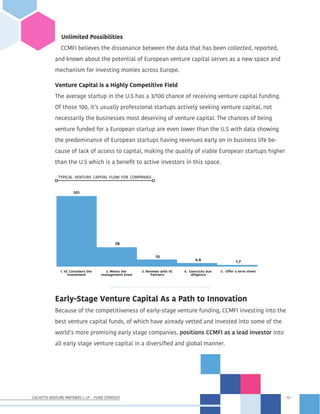

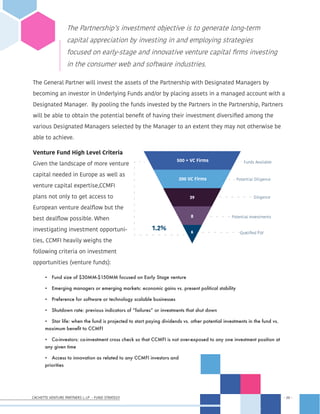

Cachette Venture Partners I, LP focuses on providing institutional investors access to competitive early-stage and seed stage venture capital funds, emphasizing diversification, risk management, and capitalizing on emerging markets. The partnership aims to invest in leading venture capital funds primarily in the US and Europe, leveraging the expertise of its members to evaluate investment quality and access innovative opportunities. With a strategy grounded in market analysis, Cachette seeks to exploit undervalued regions and industries, aiming for high returns through carefully selected investments.