Guide to Understanding Small Business Loans.pdf

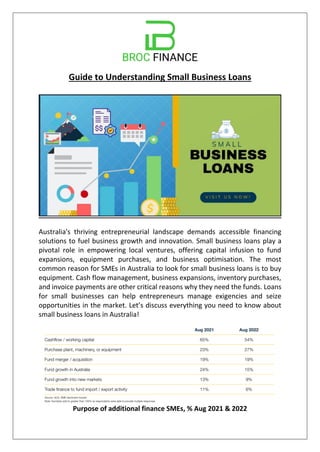

- 1. Guide to Understanding Small Business Loans Australia's thriving entrepreneurial landscape demands accessible financing solutions to fuel business growth and innovation. Small business loans play a pivotal role in empowering local ventures, offering capital infusion to fund expansions, equipment purchases, and business optimisation. The most common reason for SMEs in Australia to look for small business loans is to buy equipment. Cash flow management, business expansions, inventory purchases, and invoice payments are other critical reasons why they need the funds. Loans for small businesses can help entrepreneurs manage exigencies and seize opportunities in the market. Let’s discuss everything you need to know about small business loans in Australia! Purpose of additional finance SMEs, % Aug 2021 & 2022

- 2. What Are Small Business Loans? A small business loan is a financing option that allows business owners to get a lump sum amount from lenders to manage various business expenses. They are required to repay the loan at a fixed interest rate over a specified period. There are many types of small business loan products that suit a variety of enterprises. From start-up business loans to bad credit small business loans, there are numerous options to explore. Let’s break down the typical terms of small business finance products available in the market: ● Loan Amount: Small businesses can get loans in the range of $5000 to $1 million, depending on a multitude of factors. The average loan amount for small businesses in Australia is on the rise, growing by 15% between 2021 and 2022. Fuelled by post-pandemic recovery, many lenders are now lending more money to small businesses than ever before. ● Loan Term: In most cases, lenders provide small business loans for three months to three years. ● Interest Rate: Small business loan rates Lenders determine the interest rate based on factors like the firm’s financial strength, credit history, availability of collateral, industry prospects and more. A small business loan calculator can help you estimate your potential repayments based on the indicative interest rates typically charged by lenders. ● Repayment Frequency: Small businesses can make weekly, fortnightly, or monthly repayments according to their loan agreement with the lender. This flexibility makes it convenient for small-scale businesses to pay back these loans. What Can You Do with a Small Business Loan? A firm can use its small business loan to take care of various business expenses. Lenders usually do not place restrictions on how you can utilise the loan amount, provided it goes towards a legitimate business expenditure. Here are some of the ways of using a small business loan to maximise your firm's potential for success.

- 3. (Source: https://www.nbcbanking.com/business-banking/business-lending- guide/how-business-loans-work/) ● Working Capital Needs: Small loans for businesses can help these firms navigate their day-to-day expenses. Seasonal ventures with cash flow fluctuations often rely on small business loans to manage expenditures. ● Equipment Purchase: Many businesses rely on key pieces of equipment to provide their services and drive value for customers. They may need to purchase new equipment or machinery to scale their operations or replace an old asset. In such situations, they can borrow money from lenders to fund this essential business expense. ● Real Estate Investments: If you run a small business, you may want to purchase or lease new premises for your firm. You may want to expand and renovate your current premises or open new branches to grow your business. A small business loan can come in handy for all these purposes and help you take your venture to new heights. ● Buying Inventory: Lack of inventory can lead to the loss of sales and competitive advantage in the market. Hence, it is essential to maintain adequate inventory stocks to meet your demand forecasts. Many firms take out small business loans during festive seasons or other high-demand periods to buy more inventory to cater to the demand. ● Start-up Costs: Often, an entrepreneur may have an excellent business idea, but they may lack the funds to execute their plans. In such situations, small business loans can come to their rescue. They can borrow money to initiate their operations and lay the foundations for growth. Small Business Loans: Options to Explore

- 4. If you want to explore loans for your small business, there are numerous options to explore. Let’s discuss the various types of small business loans available to firms: ● Unsecured Small Business Loans: Small businesses may lack the assets or time required to take out secured loans. In such situations, they can browse unsecured business loans to meet their needs. Lenders provide unsecured loans without any security or collateral. Since the risk for the lender is high, they tend to charge a slightly higher rate of interest to compensate for the same. Unsecured loans are a hassle-free source of funding because it takes very little time to process and approve these loans. A firm needs to submit only their bank statements for loans up to $250K. They can get a quick business loan within 24 hours for a term of 3-36 months if they opt for unsecured credit. ● Secured Small Business Loans: A secured business loan is a lump sum amount lent against some security or collateral. The borrower must offer a real estate property to the lender to secure this type of loan. Secured small business loans are excellent for start-ups that have no business activity or financial strength to show. They can pledge a residential or commercial property as collateral to cover the lender’s risk and get favourable terms on the loan. They can get small business start-up loans up to 80% of the value of their pledged asset. These loans are available for 3-18 months, allowing sufficient time for new firms to set up their operations. ● Small Business Line of Credit: A business overdraft is a flexible source of finance for small business owners. In this case, the lender approves a credit limit, and the firm can withdraw money according to their unique business requirements. They have to pay interest on the amount they withdraw and not the entire credit limit. Business lines of credit in Australia help firms navigate their working capital needs by providing an interest-free buffer. ● Bad Credit Loans: Lenders evaluate the credit score of applicants in detail before approving their loans. However, this does not mean that it is impossible to get a small business loan because of the applicant’s poor personal or business credit history. Bad credit small business loans are available to Australian firms with some stringent terms and conditions. These loans often carry higher rates of interest and have more rigorous lending criteria. Typically, bad credit business loans are available for a short-term period between three to twelve months.

- 5. ● Short-term Loans: Short-term business loans are perfect for bridging capital needs. Firms can get short-term credit to meet urgent working capital requirements and tackle cash flow fluctuations. These loans require minimal documentation and are usually quick to be processed. ● Small Business Equipment Finance: 27% of SMEs borrow money to buy new equipment to streamline their operations. Hence, lenders frequently offer favourable terms to secure loans for this purpose. Firms can secure equipment loans against the value of the newly acquired asset and pay lower interest rates compared to unsecured loans. These loans can usually be taken for up to seven years, ensuring flexibility and convenience for the borrowers. Eligibility Criteria to Get Small Business Loans in Australia Borrowers have to meet the required criteria to be eligible for small business loans. They are as follows: ● Registration: The borrowing firm must have a valid and active Australian Business Number (ABN) to apply for business financing. ● Trading History: Many lenders prefer to advance small loans for business purposes to firms that have been in operation for six months or more. However, start-up businesses can also secure loans by pledging collateral to the lenders. ● Monthly Turnover: Small businesses need a monthly turnover of $5K or more to be eligible for most business loan products. Advantages and Disadvantages of Taking a Small Business Loan

- 6. Small business loans can be a game-changer for business owners who want to grow their ventures or navigate challenging times. However, it is crucial to weigh the pros and cons of these loans before deciding to borrow. Here are the advantages you can expect with small business loans:

- 7. ● Access to Capital: Small business loans provide a vital infusion of capital, enabling entrepreneurs to fund startup costs, expand operations, invest in equipment, or seize growth opportunities. ● Smooth Cash Flow: Small business loans can help address cash flow gaps, ensuring the continuity of operations and providing stability during lean periods or unexpected expenses. ● Flexibility in Use: Business loans offer flexibility in how the funds are utilised. Entrepreneurs have the freedom to allocate them as needed to drive their business forward. ● Building Credit: Responsible borrowing and timely repayments can help establish and improve your business credit profile. Increasing your credit score can potentially open doors to more favourable terms in the future. ● Quick and Hassle-Free Approvals: In most cases, lenders process small business loans very quickly. You can get unsecured loans in just 24-72 hours, while secured loans take about 3-7 days for unconditional approval and settlement. The experience of applying for small business loans is quite hassle-free, as businesses have to submit just a few documents to facilitate the process. Most small business loans are low-doc, requiring the applicants to submit their last six months’ bank statements and identification proofs to secure approval. ● Variety of Options: Small businesses can explore various loan products to find the options that suit them the best. They can compare small business loan rates and the terms offered by lenders to fit their unique business model. There are numerous small business loans available in the market, allowing business owners to compare the loans and opt for flexible sources of funding. Now that you know the advantages of taking a small business loan, let’s discuss the potential disadvantages to help you make an informed decision: ● Small Amounts: Lenders often consider small businesses riskier than established firms because of their limitations in scale. As a result, they tend to approve lower amounts for small business loans to minimise their risks. ● Higher Rates of Interest: Small-scale businesses may have to pay a higher interest rate than larger firms with a demonstrated history of success. Lenders tend to charge higher interest rates to cover their risks in case the borrowers go bankrupt and fail to repay their loans. The higher interest rate can lead to high repayments, affecting the firm’s cash flow situation.

- 8. ● No Guarantee of Business Growth: While small business loans are valuable tools for growing local ventures, they do not guarantee long- term business expansions. Success and growth depend on execution and not just the infusion of funds. A small business loan may not solve long- term business challenges. Hence, it is crucial to carefully weigh your requirements and business plans before taking out a loan. You should carefully understand these advantages and disadvantages before applying for a loan. A detailed analysis will help you make an informed decision and avoid pitfalls in the future. How to Apply for a Small Business Loan? First-time borrowers may be daunted by the idea of applying for a small business loan. SMEs in Australia often struggle to figure out how to get a bank loan for small businesses, with many of them experiencing difficulties in finding a willing lender or an affordable loan. In such cases, firms can work with experienced finance brokers to connect with alternative lenders who offer flexible loan terms for small-scale ventures. (Source: https://www.smefinanceforum.org/post/survey-finds-funding-gap-is- stifling-small-business-growth-in-australia) If you are a small business owner looking for an affordable loan, following a structured approach can help you navigate the application process. Here are the steps you can take to simplify your loan application journey: #1 Determine Your Funding Needs Before applying for a small business loan, evaluate your funding requirements. Clearly define how much capital you need, what it will be used for, and the

- 9. repayment terms you can comfortably manage. You can use a small business loan calculator to ascertain the potential repayments and assess if the amount fits your business budget. #2 Research Loan Options and Eligibility Criteria Thoroughly research different loan options and lenders to find the most suitable fit for your business. Understand the eligibility criteria for getting a small business loan to suit your requirements. At this stage, you can contact a financial broker to discuss your needs and explore the loan products that may be right for you. Compare the business loans and decide where you want to apply. #3 Prepare Your Documents Applicants must submit the required documents to facilitate the loan approval process. If you want a loan up to $250K, a low-doc application will suffice. You need the following documents for low-doc loan approval: ● A valid identification document. ● Bank statements from the past six months. The lenders may require some more documents based on the nature of the loan you want. For example, if there is no ATO payments cited in the bank statement, the lender may ask for ATO statement. Your finance broker can guide you to prepare the necessary documents for a hassle-free application process. If you want to apply for an unsecured loan over $250K, you have to submit the following documents in addition to the bank statements and identification proofs: ● Financial statements. ● ATO statements. You can prepare your documents in advance before filling up your loan application. #4 Submit the Application Once you have gathered the required documents, submit your loan application. Ensure that all information provided is accurate and complete. Double-check the application for any mistakes or omissions that could potentially delay the approval process. You can submit your application online with all the required details. Your financial broker can go through your application and forward it to the most suitable lender to fast-track the process. #5 Review and Accept the Loan Offer

- 10. After submitting your application, the lender will evaluate your eligibility and provide their loan offer. Carefully review the terms, including interest rates, repayment duration, and associated fees. Once you are satisfied, you can accept it by following the lender's instructions. If you have any queries, you can consult your financial broker for clarification. Once all requirements are met, the lender will finalise the loan and transfer the funds to your designated account. In some cases, you can receive the approval and the loan amount within just twenty-four hours. How do Lenders Evaluate Applications for Small Business Loans? Lenders evaluate the following factors to determine the status of a loan application: ● Industry and Market Factors: Lenders consider the industry in which the business operates, examining its growth potential, market conditions, and competitive landscape. They evaluate the risk associated with your industry's stability and your firm's position within the industry. ● Financial Position: Lenders assess the firm's financial strength to determine whether they can service the debt. Typically, a high monthly turnover is a positive indicator for lenders, leading them to approve higher amounts. ● Security: Lenders may require collateral to secure the loan. They assess the value and marketability of the offered collateral, such as real estate, inventory, or equipment, to mitigate the risk in case of default. If you take an unsecured small business loan, the lenders often prioritise applications where the firm or its directors are asset-backed. ● Credit Score: Lenders carefully assess your creditworthiness by reviewing your personal and business credit history. They consider factors such as your credit score, payment history, outstanding debts, and any past bankruptcies or defaults. The credit score is especially important for a new business, as it can minimise the lender’s risk and make them more likely to issue an approval. ● Trading History: Businesses operating for more than one year often get precedence when lenders evaluate loan applications. However, newer firms can also get start-up business loans from several alternative lenders. Lenders analyse these factors to determine the loan amount, interest rate, and other terms they are willing to approve. Evaluating these aspects can give you more clarity about your loan prospects.

- 11. Tips to Simplify Your Small Business Loan Application Process Applying for a business loan can be a complex process, but with the right approach, you can simplify it and increase your chances of success. By taking steps to streamline your loan application, you can save time, reduce stress, and present an excellent application to lenders. Here are some tips to simplify your application: ● Strengthen Your Credit Profile: You should prioritise improving your credit profile by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. A strong credit profile enhances your credibility and increases your chances of loan approval. ● Consult a Finance Broker: Once you identify your funding requirements, you can start exploring suitable options. Many SMEs in Australia struggle to find bank loans to fund their business operations. If you face this issue or do not know how to get a bank loan for your small business, it is better to partner with a finance broker. These brokers can connect you to a network of alternative lenders who provide tailored financing solutions for your firm. Moreover, their expertise can help you navigate the complexities and ensure your application is thorough and compelling. They can guide you about various aspects of the process and provide you with relevant information. From average loan amounts for small businesses to typical interest rates, they have in-depth knowledge about all facets of small business loans to help you. ● Explore Government Schemes: You can check government small business loans to find options that may fit your needs. The Australian government sometimes initiates loan assistance programmes to fuel the growth of SMEs. A knowledgeable finance broker can provide you with information about government small business loan schemes, enabling you to make the best decision for your firm. ● Prepare a Detailed Business Plan: Although lenders do not mandate the submission of a business plan, it is better to be prepared to demonstrate your growth trajectory. Craft a detailed and professional business plan that outlines your business objectives, strategies, financial projections, and market analysis. A well-prepared plan demonstrates your preparedness and increases the lender’s confidence. If you want guidance and support to apply for various small business loans, you should contact Broc Finance today! Its team of financial brokers can help you

- 12. apply for working capital loans and other credit options to help you achieve your business goals. Source: https://www.brocfinance.com.au/blog/guide-to-understanding-small- business-loans/