MLI impact on DTAA between India and Sweden

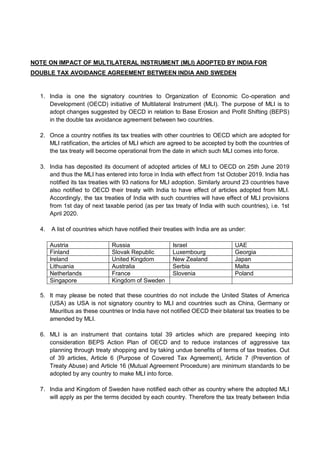

- 1. NOTE ON IMPACT OF MULTILATERAL INSTRUMENT (MLI) ADOPTED BY INDIA FOR DOUBLE TAX AVOIDANCE AGREEMENT BETWEEN INDIA AND SWEDEN 1. India is one the signatory countries to Organization of Economic Co-operation and Development (OECD) initiative of Multilateral Instrument (MLI). The purpose of MLI is to adopt changes suggested by OECD in relation to Base Erosion and Profit Shifting (BEPS) in the double tax avoidance agreement between two countries. 2. Once a country notifies its tax treaties with other countries to OECD which are adopted for MLI ratification, the articles of MLI which are agreed to be accepted by both the countries of the tax treaty will become operational from the date in which such MLI comes into force. 3. India has deposited its document of adopted articles of MLI to OECD on 25th June 2019 and thus the MLI has entered into force in India with effect from 1st October 2019. India has notified its tax treaties with 93 nations for MLI adoption. Similarly around 23 countries have also notified to OECD their treaty with India to have effect of articles adopted from MLI. Accordingly, the tax treaties of India with such countries will have effect of MLI provisions from 1st day of next taxable period (as per tax treaty of India with such countries), i.e. 1st April 2020. 4. A list of countries which have notified their treaties with India are as under: Austria Russia Israel UAE Finland Slovak Republic Luxembourg Georgia Ireland United Kingdom New Zealand Japan Lithuania Australia Serbia Malta Netherlands France Slovenia Poland Singapore Kingdom of Sweden 5. It may please be noted that these countries do not include the United States of America (USA) as USA is not signatory country to MLI and countries such as China, Germany or Mauritius as these countries or India have not notified OECD their bilateral tax treaties to be amended by MLI. 6. MLI is an instrument that contains total 39 articles which are prepared keeping into consideration BEPS Action Plan of OECD and to reduce instances of aggressive tax planning through treaty shopping and by taking undue benefits of terms of tax treaties. Out of 39 articles, Article 6 (Purpose of Covered Tax Agreement), Article 7 (Prevention of Treaty Abuse) and Article 16 (Mutual Agreement Procedure) are minimum standards to be adopted by any country to make MLI into force. 7. India and Kingdom of Sweden have notified each other as country where the adopted MLI will apply as per the terms decided by each country. Therefore the tax treaty between India

- 2. and Kingdom of Sweden will be considered as Covered Tax Agreement (CTA) for adoption of MLI. It is important to note that, only to the extent for those terms of MLI where both the nations have similar adoption conditions, such terms then will be applicable to the tax treaty between India and Kingdom of Sweden. 8. The purpose of this note is to reflect the treatments given by each nation (Kingdom of Sweden and India) while ratifying MLI into the tax treaty. It may please be noted that the Synthesized Text of the Tax Treaty incorporating provisions of MLI are awaited. However, we have tried to demonstrate various provisions of MLI along with their impact on tax treaty with India as per the following table: Sr. No. Article of MLI Position adopted by India Position Adopted by Kingdom of Sweden Remarks 1 Article – 4 Dual Resident Entities India has notified Sweden as one of the countries to adopt the text of MLI in place of already existing Text of Article 4(3) of the tax treaty. Kingdom of Sweden has reserved its rights to not adopt entire text of Article 4 of MLI for its Covered Tax Agreements Accordingly, the adopted terms of Article 4 will not form part of the tax treaty between both the countries. 2 Article – 6 Purpose of Covered Tax Agreement India has adopted the preamble suggested by MLI to form part of all the CTAs including Kingdom of Sweden Kingdom of Sweden has not reserved its position for this Article in case of India Preamble as per MLI will form part of Tax Treaty between both the countries. 3 Article – 7 Prevention of Treaty Abuse (Principal Purpose Test) India has not included Kingdom of Sweden in the list of countries where the article is already present in the Tax Treaty Kingdom of Sweden has not included India in the list of countries where the article is already present in the Tax Treaty The Principal Purpose Test requirement will arise only when the provisions of Existing Tax Treaty are not in accordance with Article 7 of MLI. Text of Article 7(1) of MLI : Notwithstanding any provisions of a Covered Tax Agreement, a benefit under the Covered Tax Agreement shall not be granted in respect of an item of income or capital if it is reasonable to conclude, having regard to all relevant facts and circumstances, that obtaining that benefit was one of the principal purposes of any arrangement or transaction that resulted directly or indirectly in that benefit, unless it is established that granting that benefit in these circumstances would be in accordance with the object and purpose of the relevant provisions of the Covered Tax Agreement. 4 Article – 8 Dividend Transfer Transactions India has not included Kingdom of Sweden in the list of countries where the article is already present in the Tax Treaty Kingdom of Sweden has reserved its rights to not adopt entire text of Article 8 of MLI for its Covered Tax Agreements Accordingly, the adopted terms of Article 8 will not form part of the tax treaty between both the countries.

- 3. 5 Article – 9 Capital Gains from Transfer of Shares deriving value from Immovable Property India has included Kingdom of Sweden in the list of countries where the article is already present in the Tax Treaty Kingdom of Sweden has reserved its rights to not adopt text of Article 9(1) of MLI for its Covered Tax Agreements As Tax Treaty of India and Sweden already have the provision alike MLI, the text of MLI need not be referred to. 6 Article – 12 Avoidance of Permanent Establishment through commissionaire agreement and Similar Strategies India has included Kingdom of Sweden in the list of countries where the article is already present in the Tax Treaty Kingdom of Sweden has reserved its rights to not adopt entire text of Article 12 of MLI for its Covered Tax Agreements As Tax Treaty of India and Sweden already have the provision alike MLI, the text of MLI need not be referred to. 7 Article – 13 Avoidance of Permanent Establishment through specific activities exemption India has chosen Option A of text of MLI Kingdom of Sweden has reserved its rights to not adopt entire text of Article 13 of MLI for its Covered Tax Agreements Accordingly, the adopted terms of Article 13 will not form part of the tax treaty between both the countries. 8 Article – 14 Splitting up of Contract India has adopted the Text of Article 14 in its ratified document Kingdom of Sweden has reserved its rights to not adopt entire text of Article 14 of MLI for its Covered Tax Agreements Accordingly, the adopted terms of Article 14 will not form part of the tax treaty between both the countries. 9 Article – 15 Definition of Closely Related Enterprise India has adopted the Text of Article 15 in its ratified document Kingdom of Sweden has reserved its rights to not adopt entire text of Article 15 of MLI for its Covered Tax Agreements Accordingly, the adopted terms of Article 15 will not form part of the tax treaty between both the countries. 9. India has adopted in its MLI document Article 14 which deals with situations related to artificial splitting up of the work contracts related to supervision activities by an enterprise in a such a way so that total period does not exceed the time frame (6 months as per current tax treaty) specified in the Tax Treaty for determining Permanent Establishment of Such Enterprise. 9.1 However, as Kingdom of Sweden has reserved its right of adopting the text of Article 14, the same is not forming part of the tax treaty between both the nations. Despite such non presence, with MLI being operational from 1st April 2020 and Principal Purpose Test being one of the minimum standards of MLI, it would be essential for every entity having commercial transactions with entities of Kingdom of Sweden to keep more vigilance on the work contracts of supervision activities that they enter for longer durations in a year as per its commercial requirements.

- 4. 9.2 Now the taxability will not only be judged by its form but also from the substance of the terms of the contract and as these contracts have substantial cost involved, the tax impact would be large. As the concept of MLI is new for the tax authorities, chances of strict interpretation may arise which may lead to longer litigation. Therefore, it would be appropriate that the provisions of the treaty along with MLI and their impact must be determined beforehand at the time of entering into a particular contract. The above are the some of the key points applicable under the tax treaty with effect from 1st April 2020 for withholding tax. An entity having transactions with corporations situated in Kingdom of Sweden will be required to take into consideration the above points before determining whether to provide tax benefit to the service provider or not under the tax treaty from the appointed date.