Premium Coupon Callable Bonds Offer Yield and Protection

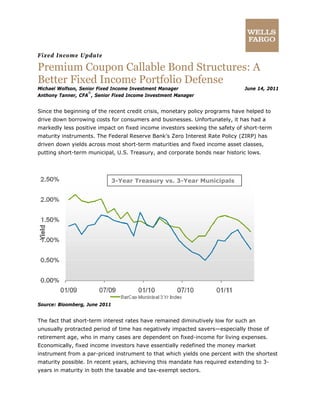

- 1. Fixed Income Update Premium Coupon Callable Bond Structures: A Better Fixed Income Portfolio Defense Michael Wolfson, Senior Fixed Income Investment Manager June 14, 2011 Anthony Tanner, CFA ® , Senior Fixed Income Investment Manager Since the beginning of the recent credit crisis, monetary policy programs have helped to drive down borrowing costs for consumers and businesses. Unfortunately, it has had a markedly less positive impact on fixed income investors seeking the safety of short-term maturity instruments. The Federal Reserve Bank’s Zero Interest Rate Policy (ZIRP) has driven down yields across most short-term maturities and fixed income asset classes, putting short-term municipal, U.S. Treasury, and corporate bonds near historic lows. 3-Year Treasury vs. 3-Year Municipals Source: Bloomberg, June 2011 The fact that short-term interest rates have remained diminutively low for such an unusually protracted period of time has negatively impacted savers—especially those of retirement age, who in many cases are dependent on fixed-income for living expenses. Economically, fixed income investors have essentially redefined the money market instrument from a par-priced instrument to that which yields one percent with the shortest maturity possible. In recent years, achieving this mandate has required extending to 3- years in maturity in both the taxable and tax-exempt sectors.

- 2. We recommend a more opportunistic approach to addressing the challenge of obtaining bonds with: (1) attractive risk-adjusted yields, (2) shorter duration, and (3) minimized interest rate risk exposure. This approach encompasses further diversifying our portfolios across coupons and bond structures to include premium coupon callable bonds. This Fixed Income Update highlights some of the advantages that premium coupon callable bonds offer—especially those with short-dated call features—for a fixed income portfolio in today’s low-yield environment. Structure and Yield Analysis First, it is important to understand there is an inverse relationship between bond prices and interest rates—as interest rates rise, the price of the bond falls, and vice versa. The sensitivity of a particular bond’s price to an increase or decrease in interest rates is known as its interest rate risk and is commonly measured by a bond’s duration. Premium coupon callable bonds carry coupon rates above prevailing market interest rates, and also grant the bond issuer the right to redeem the bond prior to its stated maturity date. For that reason, the pricing of premium coupon callable bonds is generally based on yield-to-call because of the likelihood that issuers will retire high cost debt before maturity to reduce borrowing costs. A bond’s yield-to-call reflects the effective bond yield if it were redeemed at its call date. The yield-to-maturity represents the bond’s yield if it were held until the stated maturity date. Depending on the coupon rate and initial call date, this type of bond structure is often described as a “cushion” bond or “kicker” bond for two reasons: (1) it has the potential to cushion a bond’s price decline as market interest rates increase, and (2) should the bond remain outstanding beyond the initial call date, the bondholder will amortize any purchase premium and earn the higher prevailing coupon, resulting in increased income. This explains why the yield-to-maturity is significantly higher than the yield-to-call for a given bond’s purchase price. The coupon/call structure that typically provides the greatest potential yield “kick” is one in which: The bond’s coupon rate is well above current market yields (typically one percent higher) The initial call date occurs within a relatively short period of time after the purchase date There is a greater time frame between the initial call date and the final maturity date 2

- 3. These types of coupon/call structures are commonly traded in the secondary market, and typically represent bonds issued within the last 7-15 years, during periods of higher interest rates. Premium coupon callable bonds are priced in the market based on yield-to-call because the marketplace treats them as if they will be called with certainty. Bond issuers have incentives to retire high coupon issues rather than continuing to pay premiums above market interest rates. As long as market yields remain below the coupon rate, a bond with this type of structure will retain a short duration profile because of its short call date schedule. It is important to understand that this short-term profile continues even in cases when the issue is not called. The risk remains, however, that an increase in market rates above the coupon rate would result in the bond’s pricing to its longer final maturity date. This risk, better known as extension risk, reflects the uncertainty surrounding the structure’s ultimate redemption or maturity date. Nevertheless, both of these risks and the high coupon/short duration structure can provide key advantages for a bondholder. The combination of maturity, uncertainty and extension risk often results in this type of bond structure trading at significantly higher yields to both the call date and maturity date compared to non-callable bonds of similar final maturities. Further, its defensive premium coupon structure provides a cushion against market interest rate increases throughout the holding period. A Working Example Although interest rates in the municipal and U.S. Treasury markets turned up sharply from August 2010 to January 2011, they have since resumed a downward trajectory in response to signs of tepid economic growth, reduced municipal bond credit fears, and lower issuance. As a result, both 3-year U.S. Treasury Note and high quality municipal bond yields are again hovering near one percent. This has left investors with an unappealing choice of either buying short-term bonds at yields below one percent to minimize interest rate risk, or resorting to go out as far as ten years by purchasing 10-year bonds to obtain yields above three percent on high quality issues. We seek to capitalize on premium coupon bonds in the secondary market that offer short effective duration/maturity, and yet provide significant yield pick-up over comparable maturity non-callable bonds. As an example, the State of Wisconsin sold $275 million of Aa2/AA rated general obligation bonds in May 2011. In this issue the 3-year maturity yielded only 0.99 percent. Rather than accepting such a meager yield, it is sometimes possible to find a favorable alternative of that issue through the secondary market: 3

- 4. Marinette County, Wisconsin General Obligation 5.00% due 12/01/21, first callable 12/01/13 (2.5 years) Aa2/ NR Yield to Call Yield to Maturity Purchase 12/01/2013 12/01/2021 Price (2.5 years) (10.5 years) $105.663 2.70% 4.33% Compare this to similar maturities in the State of Wisconsin GO bond issue: Yield to Purchase Coupon Maturity Maturity Price 5.00% 5/1/2014 0.99% $111.488 5.00% 5/1/2021 3.04% $116.665 Notably, there are important advantages in the callable bond structure: A much higher effective yield—regardless of the eventual maturity. Not only would a bondholder obtain a significant yield advantage over the holding period until the call date, the yield to maturity (should the bond remain outstanding for that long) will also be significantly higher. Should the Marinette County bond remain outstanding until maturity, the aggregate annual yield premium (4.33 percent vs. 3.04 percent) compounded for a 10-year maturity period will provide over 11.36 percent of additional total return. The call feature mutes the purchase premium. In this example, both 10-year bonds have a five percent coupon. But because the market treats the call feature as if the issuer will redeem the bonds, it produces a much lower purchase price ($105.563 vs. $116.66). In effect, an investor in the non-callable State of Wisconsin bond potentially risks 10 points of additional purchase premium should market yields approach the five percent coupon rate on the bond. The premium coupon, short call structure of the Marinette County bond makes it a good substitute for a comparable shorter non-callable bond, as the short duration component of an investor’s portfolio strategy. When considering the State of Wisconsin issue, the yield on the 5/01/2014 maturity was 171 bps less than the yield-to-call on the Marinette County bond. In this case, the cumulative tax-free income advantage to the 12/01/2013 call date (in 30 months) exceeds 425 basis points. The key part of the analysis is that because the callable bond structure results in a discounted (i.e. higher) yield-to-maturity than a comparable non-callable bond, the price declines can be significantly less on the 10-year callable than on the 10-year non-callable bond when market yields initially increase and remain below the coupon rate. In this example, we see the 10-year market yield of 3.04 percent is well below the coupon rate of 4

- 5. five percent. This is the essence of the “cushioning” effect. As this example demonstrates, in a rising-rate environment an investor is rewarded with (1) both higher yield-to-call and yield-to-maturity and 2) reduced downside risk compared to buying longer non-callable maturities. The Value Proposition As illustrated above, the short duration and reduced volatility benefits of premium coupon callable bonds are transparent and often compelling. They provide a tool to add short duration securities to a fixed income portfolio with a smaller yield sacrifice. However, there is another intrinsic longer-term value with this structure to a fixed income portfolio. In our example a sharp spike in interest rates such as the one we experienced at the end of 2010 can actually benefit the Marinette County bondholder. Higher future market interest rates will reduce the probability that the issuer will call the bonds at the first call date because the interest cost savings of doing so will been materially diminished. Economically, this means the total return prospect for the bond—the likelihood such a bond remains outstanding beyond the initial call date to provide bondholders its higher yield-to-maturity—increases with concurrent increases in market yields up to the coupon rate. This highlights a valuable diversification benefit of this structure for a fixed income portfolio—a negative correlation with some degree of rising interest rates, a characteristic that contrasts with the behavior of conventional non-callable bonds. Further, the realization of enhancing long-term income via the above scenario occurs with greater frequency than one might expect. One of the inefficiencies of the municipal market is that bond issuers frequently do not exercise call features even when prevailing market yields remain below coupon rates. This often occurs when the interest rate savings from a refunding are outweighed by refinancing costs to the issuer. In other cases, the issuer or primary obligor is not sufficiently incentivized for various contractual or non-financial reasons to refinance despite the apparent interest expense savings of doing so. It is important to remember, just because a bond is callable does not necessarily mean it will get called. Conclusion We have demonstrated that high-coupon, short-duration callable bonds can effectively serve as the short-maturity / duration component of a portfolio, providing an effective substitute for short-term non-callable bonds, whose yields are currently at historic lows. When conservative fixed income managers traditionally pursue diversification, credit quality and issuers are usually their first considerations, along with some degree of yield curve diversification to manage interest rate and reinvestment risk—the risk that coupon payments are invested at yields less than a bond’s yield to maturity. However, the introduction of broader diversification across bond structures to include a variety of 5

- 6. coupons and call features/redemption dates can be a powerful asset allocation tool—one that is often overlooked by investors and professional managers alike. Furthering diversification in this manner can reduce overall portfolio risk and enhance long run total return potential. Achieving positive inflation-adjusted income and returns in a bond portfolio requires a more thoughtful approach towards managing risk in the current low interest rate environment. Utilizing less-followed fixed income opportunities such as “cushion” or ‘kicker” bonds, demonstrates how we are able to add value and increased risk-adjusted return potential to client fixed income portfolios. We encourage you to speak with your investment professional if you have any questions about this type of fixed income strategy. Disclosures Wells Fargo Wealth Management provides products and services through Wells Fargo Bank, N.A. and its various affiliates and subsidiaries. Wells Fargo affiliates may be paid a referral fee in relation to clients referred to Wells Fargo Bank, N.A. Wells Fargo Bank, N.A. offers various advisory and fiduciary products and services. Financial Advisors of Wells Fargo Advisors, LLC and Wells Fargo Investments, LLC, separate non-bank affiliates, may refer clients to the bank for an ongoing or one-time fee. The role of the Financial Advisor with respect to bank products and services is limited to referral and relationship management services. The Bank is responsible for the day-to-day management of the account and for providing investment advice, investment management services and wealth management services to clients. The Financial Advisor does not provide investment advice or brokerage services to Bank accounts. The information and opinions in this report were prepared by Wells Fargo Wealth Management. Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth Management does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report. Past performance does not indicate future results. The value or income associated with a security may fluctuate. There is always the potential for loss as well as gain. Investments discussed in this presentation are not insured by the Federal Deposit Insurance Corporation and may be unsuitable for some investors depending on their specific investment objectives and financial position. This report is not an offer to buy or sell, or a solicitation of an offer to buy or sell the securities or strategies mentioned. The investments discussed or recommended in the presentation may be unsuitable for some investors depending on their specific investment objectives and financial position. Fixed income securities are subject to availability and market fluctuation. These securities may be worth less than the original cost upon redemption. Certain high-yield/high-risk bonds carry particular market risks and may experience greater volatility in market value than investment grade corporate bonds. Government bonds and Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and fixed principal value. Interest from certain municipal bonds may be subject to state and/or local taxes and in some instances, the alternative minimum tax. Unlike U.S. Treasuries, municipal bonds are subject to credit risk and quality varies widely depending on the specific issuer. Investing in foreign securities presents certain risks that may not be present in domestic securities. For example, investments in foreign and emerging markets present special risks, including currency fluctuation, the potential for diplomatic and potential instability, regulatory and liquidity risks, foreign taxation and differences in auditing and other financial standards. 6

- 7. 7 Wells Fargo & Company and its affiliates do not provide legal advice. Please consult your legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of you own situation at the time your taxes are prepared © 2011 Wells Fargo Bank, N.A. All rights reserved.