Sales Agent Order Form by Anga.pdf

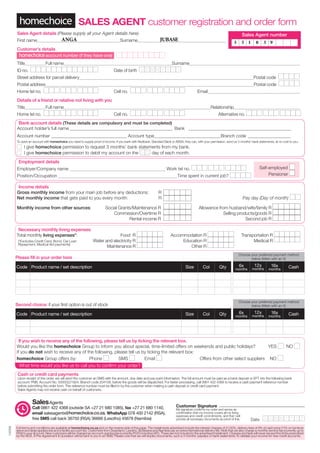

- 1. Pensioner n Employment details Employer/Company name Work tel no. Self-employed n Position/Occupation Time spent in current job? Sales Agent details (Please supply all your Agent details here) First name Surname Customer’s details account number (if they have one) Title Full name Surname ID no. Date of birth Street address for parcel delivery Postal code Postal address Postal code Home tel no. Cell no. Email Details of a friend or relative not living with you Title Full name Relationship Home tel no. Cell no. Alternative no. SALES AGENT customer registration and order form Choose your preferred payment method below (Mark with an X) Code Product name / set description Size Col Qty 6x months 12x months 16x months Cash Choose your preferred payment method below (Mark with an X) Code Product name / set description Size Col Qty 6x months 12x months 16x months Cash 142059 Full terms and conditions are available at homechoice.co.za and on the reverse side of this page. The instalments advertised include the interest charges of 21.00%, delivery fees of 9% of cash price (11% on furniture items and large appliances) and a facility account fee. Customers from Swaziland, Lesotho, Botswana and Namibia pay an extra international delivery fee. Note that we also charge a monthly service fee (currently up to R39) to your account. New customers will be charged an account opening fee (currently R100 including VAT). These are not included in the advertised instalment. Charges and fees will never exceed the limits prescribed by the NCA. A Pre-Agreement & Quotation will be sent to you in an SMS. Please note that we will require documents, such a 3 months’ payslips or bank statements, to validate your income for new credit accounts. Call 0861 422 4368 (outside SA +27 21 680 1085), fax +27 21 680 1140, email salesagents@ , WhatsApp 078 400 2142 (RSA), free SMS call back 36750 (RSA) 36666 (Lesotho) 45678 (Namibia) Sales Agent number Cash or credit card payments Upon receipt of this order, we will send the customer an SMS with the amount, due date and pay point information. The full amount must be paid as a bank deposit or EFT into the following bank account: FNB, Account No. 50050221924, Branch code 204109, before the goods will be dispatched. For faster processing, call 0861 422 4368 to receive a cash payment reference number before submitting the order form. This reference number must be filled in by the customer when making a cash deposit or credit card payment. Sales Agents may not receive cash on behalf of customers. Bank account details (These details are compulsory and must be completed) Account holder’s full name______________________________________________ Bank ______________________________________________ Account number__________________________________ Account type_____________________________Branch code ______________________ To open an account with homechoice you need to supply proof of income. If you bank with Nedbank, Standard Bank or ABSA, they can, with your permission, send us 3 months’ bank statements, at no cost to you. I give homechoice permission to request 3 months’ bank statements from my bank. I give homechoice permission to debit my account on the day of each month. Income details Gross monthly income from your main job before any deductions: R Net monthly income that gets paid to you every month: R Pay day (Day of month) Monthly income from other sources: Social Grants/Maintenance R Allowance from husband/wife/family R Commission/Overtime R Selling products/goods R Rental income R Second job R Date Customer Signature My signature confirms my order and serves as confirmation that my income covers all my living expenses and credit commitments, and that I will provide all necessary documents as proof of this. SalesAgents account number (if they have one) Necessary monthly living expenses Total monthly living expenses*: Food R Accommodation R Transportation R Water and electricity R Education R Medical R Maintenance R Other R If you wish to receive any of the following, please tell us by ticking the relevant box. Would you like the homechoice Group to inform you about special, time-limited offers on weekends and public holidays? YES NO If you do not wish to receive any of the following, please tell us by ticking the relevant box: homechoice Group offers by: Phone SMS Email Offers from other select suppliers NO Second choice: if your first option is out of stock Please fill in your order here What time would you like us to call you to confirm your order? (*Excludes Credit Card, Bond, Car Loan Repayment, Medical Aid payments) 3 5 1 8 3 9 JUBASE ANGA

- 2. SA’s no.1 home-shopping retailer These terms and conditions (terms) govern your homechoice (homechoice or we or us) credit facility (credit facility) which will apply to all credit purchases of goods or services from homechoice under the facility. 1. Introduction We have made a credit facility available to you so that you can pay for goods and services purchased from us on credit over a manageable period of time, without entering into a new credit agreement each time you want to buy from homechoice. New customers opening a facility will be given a pre-agreement statement and quotation (quotation) setting out all the specific details of your credit facility (including the interest rate applicable, the facility limits, any fees and charges, payment terms and other important financial information). The quotation, together with these terms, will be the credit agreement (agreement) that applies to all purchases through the credit facility. homechoice provides different channels for you to enter into the agreement and purchase from us, including electronic and telephonic channels. Where applicable, the agreement is subject to the National Credit Act No. 34 of 2005 (National Credit Act), as amended or replaced from time to time. Please carefully read both the quotation and these terms to properly understand the implications, risks, obligations and costs of using the credit facility. If you have any questions about the agreement please contact us by calling 0861 466 324 or emailing contact@homechoice.co.za. 2. Credit limits Before you can enter into an agreement with us for the first time, we conduct an affordability assessment to determine the appropriate credit limits that can apply to your credit facility, with reference to the requirements of the National Credit Act. We will assign a current credit limit and a maximum credit limit to your facility, based on the information you provided us, your credit and risk profiles and subject to the provisions of the National Credit Act. In practice, the credit limits work as follows: • The maximum credit limit is the maximum amount that you can purchase for in line with the calculated affordable monthly repayments. However, in order to engage in responsible lending practices and build lasting customer relationships, we may initially provide a lower current credit limit to you. • The current credit limit is your actual credit limit with us at any given time, and may be a lower amount than the maximum credit limit in accordance with your risk profile as we determine in terms of our internal credit policy. We may refuse to authorise a purchase transaction if you have exceeded your current credit limit. We may, in our discretion, increase your maximum and/or current credit limit temporarily if you have requested this increase, to purchase goods or services that would result in your credit limit(s) being exceeded. If we ever accept a purchase of goods that results in you exceeding your credit limit(s), it does not mean that we have extended your credit limit(s) on any permanent basis and the credit limit(s) that applied before the requested temporary increase will be reinstated once the outstanding balance is below the credit limit(s) that applied before the increase, subject to the National Credit Act. You must inform us if you experience a change of circumstances that negatively affects your ability to repay your credit facility, or if the information provided to us in your affordability assessment is no longer accurate. Increasing your credit limit: we may increase the current credit limit applicable to your credit facility up to the maximum credit limit in our discretion and without notice. Your maximum credit limit may be increased with your consent or at your request, subject to the requirements of the National Credit Act. We may apply an automatic annual increase of your maximum credit limit if you agreed to the automatic increase. Reducing your credit limit: you may at any time reduce your maximum credit limit by sending us a request and making payment of any amount outstanding on your credit facility that exceeds the revised maximum credit limit, and we will action this request within 30 days from receipt of the instruction. You are ultimately responsible for managing your credit limits. 3. Accessing and using the credit facility We may provide you with a secure account login through our website, and you may be able to access your credit facility through that secure account login. If you use the login function, you accept complete responsibility to keep these details, usernames and passwords safe and confidential, and you must inform us immediately if there has been, or if you suspect, any breach of security or confidentiality. By agreeing to these terms you declare that: • you have given full and true information about all personal, financial and account details; • you have not applied for an administration order, and you are not currently undergoing debt counselling or debt review; • you have disclosed all information necessary for us to undertake an accurate affordability assessment; • the proposed credit limits and repayment terms in this agreement will not cause you to become over-indebted; and • you will immediately inform us if circumstances change that result in any of the above declarations no longer being true and correct whilst you have access to the credit facility. You may not give permission to any other person to use your credit facility on your behalf – your credit facility is personal to you. Any return, refund or repair in respect of goods purchased will be dealt with in terms of our separate return and refund policy. If goods are validly returned for a refund after being purchased using the credit facility, the credit facility will be credited with the amount of the refund. Subject to any returns, ownership of the goods will pass to you immediately upon receipt by homechoice of a portion of the purchase price. Risk in the goods, transfers to you on delivery of the goods. Unless the contrary is proved, a delivery note shall constitute proof of delivery. Each time you use the credit facility to purchase goods or services, you agree and understand that we will debit your credit facility with the amount of the purchase. If you use the credit facility outside the Republic of South Africa you must comply with all relevant exchange control regulations. It is your duty to know the content of and comply with those regulations. 4. Interest, fees and charges The interest rate that applies to the agreement is a variable yearly interest rate that is linked to the South African repo rate and the formula determined by the National Credit Act, and will go up or down as this rate or formula changes. We will notify you of changes to your interest rate on your statement. Interest will be calculated and capitalised on the last day of each month, based on the daily outstanding balance on your credit facility. You enter into the agreement on the basis that we may charge an initiation fee and a monthly service fee up to the maximum fees allowed for these in terms of the National Credit Act. We may in our sole discretion decide to lower these fees from time to time for certain periods as we determine, but will at all times be entitled to charge the maximum fees. homechoice will provide written notice of any changes – which may be delivered electronically. Instead of charging the full initiation fee upfront and the full maximum monthly service fees at the end of each month, we may structure the initiation fee and a part of the monthly service fee as a “facility account fee”. The service fee component of this fee is levied as an annual fee. This facility account fee is levied on the day that you enter into the agreement, and although due and payable on this day, the facility account fee is only charged to your account as and when you purchase – on a pro-rata basis up to a maximum of 15% of the total purchase price of the goods and services. The facility account fee will not exceed the maximum fees allowed under the National Credit Act. To the extent that the total annual facility account fee has not been charged to your facility account in each 12-month period, the shortfall that was due and payable during the preceding 12 month period will be carried over to the following 12-month period and continued to be charged to your facility account on the pro-rata basis set out above – up to 15% of the purchase price of goods or services with each next purchase. A once-off account opening fee will be charged on the day that you open your facility account and will be added to the outstanding balance. This fee is not in addition to the fees allowed in terms of the National Credit Act and will be deducted from the total facility account fee that we can charge. Please note that even though the total facility account fee (initiation fee, account opening fee and annual service fee component) is levied on the date that you enter into the agreement, you will not be paying any interest on the portion of the fees not added to your outstanding balance in terms of the pro-rata payment arrangement referred to above. It is very important that you understand that the combined fees charged (monthly service fee and facility account fee which in effect is a combination of the initiation fee, account opening fee and a portion of the service fee levied annually) will never exceed the maximum fees as allowed in the National Credit Act and all fees and charges will be disclosed in your quotation or other written confirmation. If you go into arrears with your monthly payments, and we choose to enforce this agreement, you will be liable for all default administration charges, collections costs, tracing costs, collections commissions, attorney costs and other reasonable expenses incurred by us in this process, subject to applicable laws. We will not collect or attempt to collect any amounts for costs exceeding those permissible in South African law. 5. Credit life insurance We may at any time during the course of the agreement and in our sole discretion decide that Account Balance Protection Insurance is a mandatory condition of the agreement. If you are not prepared to agree to Account Balance Protection if we introduce it, you will not be able to make further purchases on your facility account. If we introduce the mandatory Account Balance Protection, we will provide you with the terms of the policy and you will be bound by it, including the obligation to pay the monthly premiums which we will debit to your account. You also have the option to substitute it with your own insurance policy that will provide similar cover to us. In this instance we need to be satisfied with your policy and we must be listed as the loss payee in terms of the policy. The cost of credit life insurance will not exceed the maximum allowed in terms of the National Credit Act. 6. Statements We will send you a monthly statement of account (statement) if there is an amount due in respect of the credit facility by delivering this statement to the physical, postal or email address you provided to us. The statements will set out the balance owing under the credit facility as at the statement date, the minimum monthly payment due and the due date for such minimum payment. The balance owing will comprise of the cost of your facility purchases, as well as any agreed interest, fees and charges, less any payments received from you. If you would like to lodge a dispute in respect of your account statement, you must inform us within 30 days of the statement date. If you are not receiving your account statements, you must bring this to our attention, otherwise we will be entitled to assume that statements are being received and accepted. 7. Payments You agree to pay at least the minimum payment due each month (as reflected in your statement) without set-off or deduction of any kind, on or before the payment due date and without condition. All payments will be applied by us firstly to satisfy any due or unpaid interest, secondly to any due or unpaid fees, costs or charges, and thirdly to reduce the amount of the outstanding balance on the credit facility. Our approved payment methods will be listed in your statement. If you choose to make payments by debit order, the minimum due payment will be taken from your bank account automatically each month, on the date that you have chosen in terms of the debit order mandate. If the date that you have chosen falls on a weekend or public holiday, the debit may be processed on the last business day before the Sunday or public holiday. We reserve the right to track the nominated bank account and present the instruction for payment as soon as sufficient funds are available in the nominated bank account to ensure successful payment from the due date or in terms of your debit order mandate. If you make any payment by transfer or direct deposit, you are responsible for ensuring that the correct reference number is used for that payment, so that we can allocate it correctly in our system to your credit facility. If your credit facility is in arrears (meaning you have failed to make any minimum payment when due), you may not be allowed to transact further on your credit facility. You are not entitled to defer payment or refuse to make payment of amounts payable by you on the basis that you have an outstanding claim or query regarding our service to you. 8. Default and termination We may terminate the agreement where the law allows us to terminate it. You may at any time terminate the credit facility by paying the full balance outstanding on the credit facility and requesting us in writing to terminate this agreement. In the event of: • your failure to make a minimum payment when due; • your failure to comply with any term of the agreement; • your estate being sequestrated; or • your death, then: • homechoice may suspend access to your credit facility without notice; • homechoice may draw the default to your notice and propose that you refer the credit agreement to a debt counsellor, alternative dispute resolution agent, consumer court or ombud with jurisdiction, with the intent that the parties resolve any dispute under the agreement or develop and agree on a plan to bring payments under the agreement up to date. (Note that if you have been in default for at least 20 (twenty) business days and at least 10 (ten) business days have lapsed since homechoice sent the notice to you and you have not responded to the notice, or have responded by rejecting homechoice proposals, homechoice may approach a court for an order to enforce the agreement.) You may, at any time before we have cancelled the agreement, re-instate the agreement that is in default by paying to us all amounts overdue, together with our permitted default charges and reasonable costs of enforcing the agreement up to the time of re-instatement. If at any time the credit facility is terminated, the full amount owing to us in respect of that credit facility will immediately become due and payable. If you have a credit balance on the credit facility, the credit balance will be paid by us into an account nominated by you. The termination of this agreement will not affect any liabilities or obligations which are intended to survive termination, including, without limitation, confidentiality, payment and indemnification obligations which arise pursuant to this agreement. A certificate issued and signed by one of the directors of homechoice stating the amount owing by you is prima facie (meaning accepted until proven otherwise) proof of the facts stated therein and may be used in support of any court proceeding. 9. Early settlement You are entitled to settle the full balance owing under the credit facility at any time, with or without advance notice to us. If you want to pay the full balance owing before the due date for payment, you may request us to provide you with an early settlement figure. We will provide you with a figure that will be valid for the period that we specify. If you decide to pay this early settlement figure, you must ensure that we receive this payment on or before the date that we specified. 10. Unauthorised purchases You undertake to notify us in writing of any query or concern regarding the correctness of a monthly statement or purchase details within 30 days of the date of that particular occurrence. We will not hold you liable for any unauthorised purchases if you properly notified us within this time period, unless we can establish that you authorised or were responsible for such purchase. 11. Confidentiality and Credit Bureau We recommend that you familiarise yourself with our privacy policy which is accessible through the homechoice website. You understand and agree that we may request and receive any of your confidential and consumer credit information from any credit bureaus, other register or any third party at any time, including requesting a bureau score. You further confirm that this consent also covers information already received by us. You also acknowledge that we may register information about the conduct of your account with any credit bureau registered in South Africa. Such information may be used by us and other members of the credit bureau to make credit decisions in relation to you or members of your household, to prevent fraud and to assist in the tracing of debtors. You are entitled to contact any credit bureau and request that your credit information be disclosed to you, and may challenge any information held by such credit bureau that you believe to be incorrect. We and/or our authorised agents and service providers will be entitled to monitor and record telephone conversations that take place between you or any authorised person, with any homechoice employee or agent. Any data about you to which we become entitled in terms of this agreement can be made available to any prospective purchaser, or transferred to any third party, should we decide to sell our business, or such third party obtains control over homechoice. 12. Marketing options You have the right to be: • excluded from any telemarketing campaigns that may be conducted by or on behalf of homechoice; • excluded from marketing or customer lists that may be sold or distributed by homechoice; and • excluded from any mass distribution of email or sms messages. You are entitled at any time to contact us and request that the options selected by you in relation to marketing be affected or amended. 13. Choice of law and disputes This agreement, the credit facility, and the purchase of any goods or services from homechoice, shall be governed in all respects by South African law. You consent to the magistrate’s court having jurisdiction in respect of all legal proceedings connected to this agreement, notwithstanding that the value of the matter in dispute might exceed the jurisdiction of the magistrate’s court. Disputes regarding this agreement can be raised through the homechoice contact centre at 0861 466 324 and by sending a written notice to homechoice. The National Consumer Tribunal can also be contacted at 012 683 8140/012 742 9900 should resolution of a dispute not be reached with us or if you want to lodge a complaint at any time. 14. Legal acknowledgements If you are married in community of property, you hereby confirm that you have obtained the written permission of your spouse to enter into the agreement, and to accept any increase to the credit limit in accordance with this agreement. We will give you notice of possible delays affecting any service offered by us in connection with the credit facility. You accept that sometimes our servers may be down, or we may be experiencing other technical difficulties, and we do not accept any liability for direct, indirect or consequential loss suffered by you arising from any system malfunction, failure or delay in our service. We will not be held responsible for any loss or damages (direct, indirect, or consequential) you may suffer for whatsoever reason arising from this agreement, or your use of the credit facility. You hereby confirm that the state of your indebtedness was not under evaluation or debt review by a debt counsellor at the time of entering into this agreement. 15. Notices You acknowledge that we will be entitled to contact you, and send statements to, the address chosen by you in your quotation, and undertake to immediately advise us of any change to your contact details (including but not limited to business, postal or residential addresses, any telephone number or email address). You agree that any notice in terms of section 129 of the National Credit Act may be delivered to you by registered mail at your residential address given to us on entering into the agreement. Our full details and address for the purposes of this agreement are as follows: homechoice (Pty) Ltd NCR no: NCRCP 454 78 Main Road, Wynberg, 7800 Tel: 0861 466324 Email: contact@homechoice.co.za The address chosen by you in the quotation shall be your address for service of all notices, processes, statements and correspondence to be sent. A written notice or communication actually received by either of us shall be an adequate written notice or communication notwithstanding that it was not sent to or delivered at a chosen address. 16. General If we grant you any indulgence, it will not be a waiver of any of our rights in terms of this agreement. This means that even if we allow any deviation from this agreement, we still have our rights under this agreement if we want to exercise our rights. You may not cede any of your rights under this agreement without our prior written consent. We will be entitled, without your knowledge, to cede/transfer and delegate our rights and obligations in terms of this agreement to any third party. We will deal with all returns and refunds of goods in terms of our standard returns policies. Any provision in this agreement which is or may become illegal, invalid or unenforceable in any jurisdiction affected by this agreement shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability and shall be severed from the balance of this agreement, without invalidating the remaining provisions of this agreement or affecting the validity or enforceability of such provision in any other jurisdiction. We may amend these terms in future, which we will do by giving 5 days' notice to you of this change (sending this notice to the address chosen by you in the quotation). If you do not agree with any amendments, you have the right to terminate this agreement and cancel your credit facility by paying the full outstanding balance on such credit facility in terms of this agreement. These terms and conditions are available in English, Afrikaans, isiZulu, isiXhosa and Sesotho. Terms and conditions Your buying rights are protected 142059 OTHER EASY PAYMENT OPTIONS ATM Add homechoice as a recipient and pay at any ATM. R7.40 charge Bank Pay inside FNB, ABSA or Standard Bank while you do your banking. R7.40 charge. Shops Pay while you shop at Checkers, Shoprite, Pick ’n Pay, Foodworld, PEP, Spar and selected stores displaying the EasyPay or Pay@ logos. R7.40 charge. Post Office Pay at any South African post office. R7.40 charge. Please note: cheques are not accepted as payment. Don’t pay anyone from our home-delivery service! FREE WAYS TO PAY FOR YOUR ORDER Debit Order Make your life easier by having your monthly instalments taken off your bank account automatically. It's free of charge (RSA only). Credit Card Simply call us and pay with your debit, cheque or credit card. This payment method is also free of charge. Online Log onto your bank’s website and choose homechoice from the list of pre-approved recipients. it’s hassle-free, always on time and free of charge. Call 0861 466 324 for more information (Customers outside South Africa, call +27 21 680 1300). Pay with cellphone Simply call 0861 466 324 with your banking details and we’ll set it up for you. Or do it yourself on KwikServe at any time of day or night. Simply dial *120*466324# on your cellphone and follow the easy steps to set up your account. Please note: You'll be charged 20c per 20 seconds by your network provider when you use KwikServe. KwikServe is currently only available to South African cellphone users but will soon be coming to Namibia and Botswana.