More Related Content

Similar to Financial Analysis - Commerzbank AG attracts deposits and offers retail an…

Similar to Financial Analysis - Commerzbank AG attracts deposits and offers retail an… (20)

Financial Analysis - Commerzbank AG attracts deposits and offers retail an…

- 1. 15.03.2013

Company Analysis - Overview

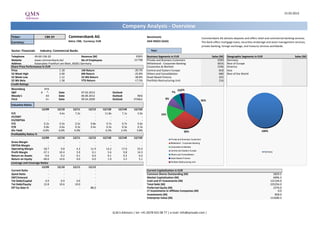

Ticker: CBK GY Commerzbank AG Benchmark: Commerzbank AG attracts deposits and offers retail and commercial banking services.

Currency: Xetra: CBK, Currency: EUR DAX INDEX (DAX) The Bank offers mortgage loans, securities brokerage and asset management services,

private banking, foreign exchange, and treasury services worldwide.

Sector: Financials Industry: Commercial Banks Year:

Telephone 49-69-136-20 Revenue (M) 9'855 Business Segments in EUR Sales (M) Geographic Segments in EUR Sales (M)

Website www.commerzbank.de/ No of Employees 53'798 Private and Business Customers 3350 Germany 1

Address Kaiserplatz Frankfurt am Main, 60261 Germany Mittelstand - Corporate Banking 3016 Rest of Europe

Share Price Performance in EUR Corporates & Markets 1596 America

Price 1.18 1M Return -20.7% Central and Eastern Europe 818 Asia

52 Week High 2.00 6M Return -25.8% Others and Consolidation 680 Rest of the World

52 Week Low 1.12 52 Wk Return -38.8% Asset Based Finance 225

52 Wk Beta 1.58 YTD Return -17.5% Portfolio Restructuring Unit 216

Credit Ratings

Bloomberg HY4 2%2%

S&P A *- Date 07.02.2013 Outlook - 7%

Moody's A3 Date 06.06.2012 Outlook NEG

Fitch A+ Date 09.04.2009 Outlook STABLE 8%

35%

Valuation Ratios

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

P/E - 4.6x 7.2x - 11.8x 7.1x 5.0x 16%

EV/EBIT - - - - - - -

EV/EBITDA - - - - - - -

P/S 0.2x 0.3x 0.2x 0.8x 0.7x 0.7x 0.6x

P/B 0.8x 0.6x 0.3x 0.4x 0.3x 0.3x 0.3x

Div Yield 0.0% 0.0% 0.0% - 0.3% 2.4% 3.8% 30% 100%

Profitability Ratios %

12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Private and Business Customers

Gross Margin - - - - - - - Mittelstand - Corporate Banking

EBITDA Margin - - - - - - - Corporates & Markets

Operating Margin -18.7 9.8 4.3 11.9 14.2 17.0 23.3

Central and Eastern Europe

Profit Margin -37.1 10.4 5.9 0.1 5.6 9.8 14.3 Germany

Others and Consolidation

Return on Assets -0.6 0.2 0.1 0.0 0.1 0.2 0.2

Return on Equity -48.6 14.6 4.0 0.0 1.9 3.5 5.1 Asset Based Finance

Portfolio Restructuring Unit

Leverage and Coverage Ratios

12/09 12/10 12/11 12/12

Current Ratio - - - - Current Capitalization in EUR

Quick Ratio - - - - Common Shares Outstanding (M) 5829.5

EBIT/Interest - - - - Market Capitalization (M) 6896.3

Tot Debt/Capital 0.9 0.9 0.9 - Cash and ST Investments (M) 121104.0

Tot Debt/Equity 12.8 10.6 10.0 - Total Debt (M) 225254.0

Eff Tax Rate % - - - 88.0 Preferred Equity (M) 2376.0

LT Investments in Affiliate Companies (M) 0.0

Investments (M) 858.0

Enterprise Value (M) 114280.3

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Company Analysis - Analysts Ratings

Commerzbank AG

Target price in EUR

Broker Recommendation

Buy and Sell Recommendations vs Price and Target Price

Price

Brokers' Target Price

4 3

100%

3 2

29% 29% 28% 26% 29%

80% 37% 42% 44% 44% 44% 44%

50% 2

3

1

60% 2

42% 44% 40% 1

43% 43%

2

40% 49% 0

44% 41%

Morgan Stanley

Barclays

Bankhaus Metzler

Kepler Capital Markets

RBC Capital Markets

Main First Bank AG

Equinet Institutional

S&P Capital IQ

CA Cheuvreux

Natixis

Credit Suisse

JPMorgan

Macquarie

Oddo & Cie

Exane BNP Paribas

Nord/LB

DZ Bank AG

Grupo Santander

Nomura

Societe Generale

M.M. Warburg Investment

HSBC

Mediobanca SpA

EVA Dimensions

AlphaValue

Berenberg Bank

Goldman Sachs

Hamburger Sparkasse

Independent Research GmbH

Deutsche Bank

Landesbank Baden-

Keefe, Bruyette & Woods

44% 44% 44% 35%

Services(ESN)

1

Wuerttemberg

20%

Research

29% 29% 31% 29% 31% 1

14% 14% 11% 11% 12% 15% 15%

0% 0

mars.12 avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13

Buy Hold Sell Price Target Price

Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date

28-Feb-13 15% 35% 50% 15-Mar-13 1.18 1.36 DZ Bank AG CHRISTOPH BAST sell 1.00 15-Mar-13

31-Jan-13 15% 41% 44% 14-Mar-13 1.20 1.37 Barclays KIRI VIJAYARAJAH underweight 1.10 15-Mar-13

31-Dec-12 12% 44% 44% 13-Mar-13 1.26 1.43 Grupo Santander TANIA GOLD underweight 1.15 14-Mar-13

30-Nov-12 11% 44% 44% 12-Mar-13 1.40 1.50 Morgan Stanley FRANCESCA TONDI Underwt/In-Line 1.10 14-Mar-13

31-Oct-12 11% 44% 44% 11-Mar-13 1.44 1.50 Goldman Sachs MARTIN LEITGEB neutral/neutral 1.55 14-Mar-13

28-Sep-12 14% 44% 42% 8-Mar-13 1.45 1.50 RBC Capital Markets ANKE REINGEN underperform 1.20 14-Mar-13

31-Aug-12 14% 49% 37% 7-Mar-13 1.42 1.50 Credit Suisse MAXENCE LE GOUVELLO outperform 2.00 14-Mar-13

31-Jul-12 31% 40% 29% 6-Mar-13 1.43 1.50 JPMorgan JAIME BECERRIL neutral 1.02 14-Mar-13

29-Jun-12 29% 44% 26% 5-Mar-13 1.41 1.50 Macquarie THOMAS STOEGNER neutral 1.20 14-Mar-13

31-May-12 31% 42% 28% 4-Mar-13 1.40 1.50 Landesbank Baden-Wuerttemberg INGO FROMMEN hold 1.30 14-Mar-13

30-Apr-12 29% 43% 29% 1-Mar-13 1.40 1.51 Independent Research GmbH STEFAN BONGARDT sell 1.10 14-Mar-13

30-Mar-12 29% 43% 29% 28-Feb-13 1.41 1.51 Oddo & Cie JEAN SASSUS reduce 1.40 14-Mar-13

27-Feb-13 1.42 1.50 Bankhaus Metzler GUIDO HOYMANN sell 1.30 14-Mar-13

26-Feb-13 1.40 1.50 Exane BNP Paribas GUILLAUME TIBERGHIEN underperform 1.30 14-Mar-13

25-Feb-13 1.45 1.50 Nord/LB MICHAEL SEUFERT hold 1.25 13-Mar-13

22-Feb-13 1.41 1.50 Keefe, Bruyette & Woods RONNY REHN underperform 1.20 13-Mar-13

21-Feb-13 1.43 1.50 Kepler Capital Markets DIRK BECKER reduce 0.70 13-Mar-13

20-Feb-13 1.47 1.50 Nomura OMAR KEENAN reduce 1.50 13-Mar-13

19-Feb-13 1.51 1.50 Equinet Institutional Services(ESN) PHILIPP HAESSLER sell 1.00 13-Mar-13

18-Feb-13 1.53 1.50 S&P Capital IQ FRANK BRADEN hold 1.55 13-Mar-13

15-Feb-13 1.49 1.48 Main First Bank AG KILIAN MAIER underperform 1.20 13-Mar-13

14-Feb-13 1.47 1.49 AlphaValue DIETER HEIN add 1.65 7-Mar-13

13-Feb-13 1.50 1.49 Societe Generale PHILIP RICHARDS sell 1.10 5-Mar-13

12-Feb-13 1.51 1.49 Hamburger Sparkasse CHRISTIAN HAMANN sell 15-Feb-13

11-Feb-13 1.51 1.49 M.M. Warburg Investment Research ANDREAS PLAESIER hold 1.45 15-Feb-13

8-Feb-13 1.49 1.49 Berenberg Bank NICK ANDERSON sell 1.00 15-Feb-13

7-Feb-13 1.46 1.49 HSBC JOHANNES THORMANN overweight 1.90 31-Jan-13

6-Feb-13 1.49 1.49 EVA Dimensions AUSTIN BURKETT underweight 17-Jan-13

5-Feb-13 1.51 1.49 Deutsche Bank ALEXANDER HENDRICKS hold 1.50 1-Nov-12

4-Feb-13 1.52 1.49 CA Cheuvreux CYRIL MEILLAND underperform 1.30 10-Aug-12

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 15.03.2013

Commerzbank AG

Company Analysis - Ownership

Ownership Type

Ownership Statistics Geographic Ownership Distribution Geographic Ownership

0%

Shares Outstanding (M) 5829.5 Germany 81.67%

Float 74.9% United States 14.08% 1% 1%1% 0%

1% 1%

Short Interest (M) Luxembourg 1.01%

38%

Short Interest as % of Float France 0.80% 14%

Days to Cover Shorts Britain 0.54%

Institutional Ownership 37.91% Switzerland 0.51%

Retail Ownership 62.09% Ireland 0.38%

62%

Insider Ownership 0.00% Others 1.01%

Institutional Ownership Distribution 81%

Government 65.95%

Investment Advisor 22.97%

Insurance Company 7.19%

Institutional Ownership Retail Ownership Insider Ownership Mutual Fund Manager 3.66%

Germany United States Luxembourg France

Pricing data is in EUR Others 0.23% Britain Switzerland Ireland Others

Top 20 Owners: TOP 20 ALL

Institutional Ownership

Holder Name Position Position Change Market Value % of Ownership Report Date Source Country

FEDERAL REPUBLIC OF 1'457'378'418 0 1'724'078'668 25.00% 31.01.2013 Research GERMANY 4% 0%

BLACKROCK 313'123'539 90'512 370'425'147 5.37% 13.03.2013 ULT-AGG UNITED STATES 7%

ALLIANZ SE 158'754'249 0 187'806'277 2.72% 07.03.2012 Research GERMANY

VANGUARD GROUP INC 68'996'872 2'722'059 81'623'300 1.18% 31.12.2012 MF-AGG UNITED STATES

MARSHALL WACE LLP -50'133'818 -9'910'174 -59'308'307 -0.86% 13.03.2013 Short BRITAIN

FRANKFURT TRUST INVE 22'030'550 0 26'062'141 0.38% 28.12.2012 MF-AGG GERMANY

UNION INVESTMENT GMB 21'236'463 2'131'853 25'122'736 0.36% 28.09.2012 MF-AGG GERMANY 23%

THRIVENT FINANCIAL F 11'346'050 -67'100 13'422'377 0.19% 31.12.2012 MF-AGG UNITED STATES 66%

DEUTSCHE BANK AG 8'132'683 2'552'512 9'620'964 0.14% 31.01.2013 MF-AGG GERMANY

ADIG INVESTMENT 7'263'550 0 8'592'780 0.12% 30.11.2012 MF-AGG GERMANY

DEKA INVESTMENT GMBH 6'635'014 -2'979'650 7'849'222 0.11% 28.12.2012 MF-AGG GERMANY

ETFLAB INVESTMENT GM 6'242'873 0 7'385'319 0.11% 14.03.2013 MF-AGG GERMANY

CREDIT SUISSE ASSET 5'847'747 286'355 6'917'885 0.10% 28.12.2012 MF-AGG SWITZERLAND

VERITAS SG INVESTMEN 5'221'900 -864'000 6'177'508 0.09% 30.11.2012 MF-AGG GERMANY Government Investment Advisor Insurance Company

Mutual Fund Manager Others

COMMERZBANK AG 5'113'429 0 6'049'187 0.09% 31.12.2011 Co File GERMANY

STATE STREET BANQUE 4'692'099 -91'050 5'550'753 0.08% 31.01.2013 MF-AGG FRANCE

DWS INVESTMENT S A 4'627'388 826'488 5'474'200 0.08% 31.01.2013 MF-AGG LUXEMBOURG

FMR LLC 4'282'228 -7'720'168 5'065'876 0.07% 31.01.2013 ULT-AGG UNITED STATES

DIMENSIONAL FUND ADV 3'348'946 0 3'961'803 0.06% 31.07.2012 MF-AGG UNITED STATES

UNIVERSAL INVESTMENT 3'339'250 198'105 3'950'333 0.06% 02.10.2012 MF-AGG GERMANY

Top 5 Insiders:

Holder Name Position Position Change Market Value % of Ownership Report Date Source

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Company Analysis - Financials I/IV

Commerzbank AG

Financial information is in EUR (M) Equivalent Estimates

Periodicity: Fiscal Year 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Income Statement

Revenue 21'148 15'635 15'115 16'666 24'340 27'339 24'181 25'393 25'027 21'462 9'855 9'945 10'305 10'679

- Cost of Goods Sold

Gross Income

- Selling, General & Admin Expenses 5'451 4'845 4'746 4'808 5'425 5'611 5'418 9'511 9'335 8'428 7'025

(Research & Dev Costs)

Operating Income -819 346 835 1'535 2'559 2'477 -418 -2'285 1'351 465 1'170 1'410 1'748 2'485

- Interest Expense

- Foreign Exchange Losses (Gains)

- Net Non-Operating Losses (Gains) -447 2'326 39 -145 163 -28 -15 2'374 -2 -42 265

Pretax Income -372 -1'980 796 1'680 2'396 2'505 -403 -4'659 1'353 507 905 937 1'564 2'021

- Income Tax Expense -103 249 353 409 595 580 -465 -26 -136 -240 796

Income Before XO Items -269 -2'229 443 1'271 1'801 1'925 62 -4'633 1'489 747 109

- Extraordinary Loss Net of Tax 0 0 0 0 0 0 0 0 0 0 0

- Minority Interests 29 91 81 106 197 8 59 -96 59 109 103

Diluted EPS Before XO Items 1.96 2.34 0.00 (3.53) 0.97 0.18 0.18

Net Income Adjusted* -298 -2'320 393 1'165 1'597 1'917 22 -2'865 1'405 1'409 986 555 1'014 1'527

EPS Adjusted (0.45) (3.41) 0.53 1.55 1.95 2.34 0.02 (2.22) 0.95 0.40 0.18 0.10 0.17 0.24

Dividends Per Share 0.08 0.00 0.20 0.40 0.60 0.80 0.00 0.00 0.00 0.00 0.00 0.03 0.05

Payout Ratio % 41.4 28.2 30.7 34.3 0.0 0.0 0.0 0.03 0.17 0.19

Total Shares Outstanding 677 746 742 818 820 820 901 1'473 1'463 5'113 5'830

Diluted Shares Outstanding 666 679 740 754 819 819 845 1'288 1'471 3'460 5'612

EBITDA

*Net income excludes extraordinary gains and losses and one-time charges.

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Company Analysis - Financials II/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Balance Sheet

Total Current Assets

+ Cash & Near Cash Items 6'612 5'711 3'634 5'465 5'129 4'962 6'566 10'329 8'053 6'075

+ Short Term Investments 121'834 91'563 175'219 189'323 99'340 114'154 136'856 239'655 183'515 165'993

+ Accounts & Notes Receivable

+ Inventories

+ Other Current Assets

Total Long-Term Assets

+ Long Term Investments 80'974 85'542 2'379 3'643 121'469 115'595 108'867 111'246 101'210 85'038

Gross Fixed Assets

Accumulated Depreciation

+ Net Fixed Assets 2'505 2'063 1'766 1'525 1'388 1'293 1'240 1'779 1'590 1'399

+ Other Long Term Assets 12'385 11'786 9'879 9'807 18'670 22'958 23'883 22'211 21'560 18'882

Total Current Liabilities

+ Accounts Payable

+ Short Term Borrowings 140'750 110'383 132'391 151'388 131'769 126'081 128'656 142'123 110'629 72'740

+ Other Short Term Liabilities 92'497 74'981 89'091 30'573 78'752 91'925 121'407 224'971 172'280 158'489

Total Long Term Liabilities

+ Long Term Borrowings 76'203 78'269 79'165 83'575 197'120 179'601 149'649 148'663 131'428 127'889

+ Other Long Term Borrowings 6'914 7'648 8'143 8'335 3'662 4'001 4'369 5'596 4'461 3'513

Total Liabilities 412'064 371'281 413'854 431'211 593'020 600'342 605'292 817'527 725'641 636'960

+ Long Preferred Equity 0 0 0 0 0 0 8'200 17'178 17'178 2'687 2'376

+ Minority Interest 1'262 1'213 1'269 947 1'023 997 1'877 570 785 699 858

+ Share Capital & APIC 7'541 6'020 6'027 7'391 7'381 7'417 7'276 4'405 4'349 16'271 17'509

+ Retained Earnings & Other Equity 1'267 3'071 3'727 5'312 6'854 7'718 2'551 4'423 6'346 5'146 4'496

Total Shareholders Equity 10'070 10'304 11'023 13'650 15'258 16'132 19'904 26'576 28'658 24'803 25'239

Total Liabilities & Equity 422'134 381'585 424'877 444'861 608'278 616'474 625'196 844'103 754'299 661'763

Book Value Per Share 13.02 12.19 13.15 15.53 17.36 18.46 10.90 5.99 7.31 4.19 3.77 4.15 4.44 4.58

Tangible Book Value Per Share 11.32 11.11 12.07 14.34 15.31 16.91 9.42 3.81 5.19 3.59

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Company Analysis - Financials III/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Cash Flows

Net Income -298 -2'320 362 1'165 1'604 1'917 3 -4'537 1'430 638 260 922 1'353

+ Depreciation & Amortization 1'114 929 1'551 1'288 4'093 -156 520 743 4'101 4'006

+ Other Non-Cash Adjustments 615 1'293 1'843 -3'161 1'403 -2'289 -424 6'542 2'685 -11'771

+ Changes in Non-Cash Capital 21'741 17'010 -30'763 -1'050 4'212 -1'372 15'863 -32'794 -45'202 -32'544

Cash From Operating Activities 23'172 16'912 -27'007 -1'758 11'312 -1'900 15'962 -30'046 -36'986 -39'671

+ Disposal of Fixed Assets 1'955 424 285 66 334 467 293 663 187 74

+ Capital Expenditures -738 -317 -505 -429 -1'212 -275 -624 -4'426 -492 -296

+ Increase in Investments -47'039 -52'351 -45'806 -57'560 -104'227 -385 -4 -5'240 -504 -335

+ Decrease in Investments 65'905 48'593 39'720 44'045 55'894 2'874 2'999 858 15'274 17'783

+ Other Investing Activities -238 68 -3 333 3'579 -71 2'453 298 83

Cash From Investing Activities 91'710 6'493 -3'496 -16'942 -186'429 7'743 1'854 -77'027 39'374 49'682

+ Dividends Paid -217 -54 0 -150 -328 -493 -657

+ Change in Short Term Borrowings 5'898 -19'735 20'181 14'470 -4'075 -705 3'372

+ Increase in Long Term Borrowings 0 0 3'258 9'670 138'504 8'734

+ Decrease in Long Term Borrowings -97'938 -8'740 -529 -733 -23'422 -39'822

+ Increase in Capital Stocks 0 831 1 1'364 1'079 2'528

+ Decrease in Capital Stocks -82 0 -10 0 -56 -2'774

+ Other Financing Activities -1'181 -908 -13 37 -3 -6 -129 13'893 -2'817 -1'732

Cash From Financing Activities -114'218 -24'306 27'962 22'440 172'456 -6'653 -16'407 110'836 -4'664 -11'989

Net Changes in Cash 664 -901 -2'541 3'740 -2'661 -810 1'409 3'763 -2'276 -1'978

Free Cash Flow (CFO-CAPEX) 22'434 16'595 -27'512 -2'187 10'100 -2'175 15'338 -34'472 -37'478 -39'967

Free Cash Flow To Firm

Free Cash Flow To Equity -67'651 -11'456 -4'317 21'286 144'863 -25'835 -3'885

Free Cash Flow per Share 33.69 24.44 -37.16 -2.90 12.33 -2.65 18.16 -26.77 -25.48 -11.55

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Company Analysis - Financials IV/IV

Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E

Ratio Analysis

Valuation Ratios

Price Earnings 24.9x 13.5x 11.8x 9.0x 1'870.4x 4.6x 7.2x 11.8x 7.1x 5.0x

EV to EBIT

EV to EBITDA

Price to Sales 0.2x 0.5x 0.6x 0.9x 0.8x 0.6x 0.2x 0.2x 0.3x 0.2x 0.8x 0.7x 0.7x 0.6x

Price to Book 0.5x 1.0x 0.9x 1.3x 1.3x 1.1x 0.5x 0.8x 0.6x 0.3x 0.4x 0.3x 0.3x 0.3x

Dividend Yield 1.3% 0.0% 1.6% 1.9% 2.6% 3.8% 0.0% 0.0% 0.0% 0.0% 0.3% 2.4% 3.8%

Profitability Ratios

Gross Margin

EBITDA Margin - - -

Operating Margin -13.1% 5.2% 12.4% 21.0% 27.2% 26.8% -5.5% -18.7% 9.8% 4.3% 11.9% 14.2% 17.0% 23.3%

Profit Margin -4.8% -34.9% 5.4% 15.9% 17.0% 20.7% 0.0% -37.1% 10.4% 5.9% 0.1% 5.6% 9.8% 14.3%

Return on Assets -0.1% -0.6% 0.1% 0.3% 0.3% 0.3% 0.0% -0.6% 0.2% 0.1% 0.0% 0.1% 0.2% 0.2%

Return on Equity -2.9% -25.9% 3.8% 10.4% 11.9% 13.1% 0.0% -48.6% 14.6% 4.0% 0.0% 1.9% 3.5% 5.1%

Leverage & Coverage Ratios

Current Ratio

Quick Ratio

Interest Coverage Ratio (EBIT/I)

Tot Debt/Capital 0.96 0.95 0.95 0.95 0.96 0.96 0.94 0.93 0.91 0.91

Tot Debt/Equity 21.54 18.31 19.19 21.21 24.92 21.85 15.99 12.79 10.61 9.99

Others

Asset Turnover 0.05 0.04 0.04 0.04 0.05 0.04 0.04 0.03 0.03 0.03 0.02

Accounts Receivable Turnover

Accounts Payable Turnover

Inventory Turnover

Effective Tax Rate 44.3% 24.3% 24.8% 23.2% 88.0%

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. Company Analysis - Peers Comparision

DEUTSCHE BANK- DEUTSCHE IKB DEUT

COMMERZBANK UBS AG-REG CREDIT SUISS-REG CREDIT AGRICOLE SOC GENERALE BNP PARIBAS AAREAL BANK AG UNICREDIT SPA COMDIRECT BANK NATIXIS DEUTSCHE BOERSE INTESA SANPAOLO

RG POSTBAN INDBANK

Latest Fiscal Year: 12/2012 12/2012 12/2011 12/2012 12/2012 12/2012 03/2012 12/2012 12/2012 12/2012 12/2011 12/2012 12/2012 12/2012 12/2012

52-Week High 2.00 39.58 35.30 16.39 27.85 8.00 0.72 34.40 47.92 18.49 4.88 8.90 3.69 52.30 1.59

52-Week High Date 19.03.2012 19.03.2012 18.02.2013 25.01.2013 07.02.2013 20.02.2013 07.11.2012 14.01.2013 29.01.2013 20.02.2013 30.01.2013 27.03.2012 18.02.2013 25.02.2013 16.03.2012

52-Week Low 1.12 22.11 26.83 9.69 15.97 2.84 0.18 15.10 24.54 11.42 2.25 6.73 1.76 36.05 0.85

52-Week Low Date 23.07.2012 26.07.2012 23.07.2012 24.07.2012 03.08.2012 01.06.2012 18.07.2012 18.05.2012 30.05.2012 04.06.2012 23.07.2012 07.06.2012 24.07.2012 04.06.2012 23.07.2012

Daily Volume 28'766'124 895'052 2'980 11'343'526 4'013'246 1'278'999 0 573'381 532'412 28'687 25'115'807 8'041 850'478 113'905 41'004'664

Current Price (3/dd/yy) 1.18 34.39 32.27 15.45 26.88 7.27 0.43 30.51 44.29 18.14 3.88 8.36 3.29 51.13 1.25

52-Week High % Change -40.7% -13.1% -8.6% -5.7% -3.5% -9.0% -39.6% -11.3% -7.6% -1.9% -20.5% -6.1% -10.9% -2.2% -21.2%

52-Week Low % Change 5.9% 55.5% 20.3% 59.5% 68.3% 156.0% 141.1% 102.0% 80.5% 58.8% 72.1% 24.3% 86.9% 41.8% 46.3%

Total Common Shares (M) 5'829.5 929.0 218.8 3'747.4 1'292.7 2'490.7 633.4 754.0 1'240.1 59.9 2'930.0 141.2 3'079.4 183.4 16'434.0

Market Capitalization 6'896.3 31'960.8 7'059.6 59'273.4 35'503.9 18'165.6 274.9 23'802.3 55'013.6 1'085.8 22'473.8 1'180.5 10'153.6 9'868.1 20'349.8

Total Debt 247'823.0 284'516.0 38'189.0 267'401.0 330'510.0 936'095.0 16'516.7 740'837.0 1'012'615.0 27'489.0 334'658.3 1.9 251'200.0 1'775.4 114'813.0

Preferred Stock 2'376.0 - - - - 2'104.0 - 5'270.0 7'241.0 300.0 - - - - -

Minority Interest 858.0 1'270.0 4.0 4'353.0 6'786.0 5'505.0 - 4'288.0 8'536.0 243.0 3'318.2 - 500.0 212.6 586.0

Cash and Equivalents 42'259.0 177'928.0 23'974.0 66'383.0 63'708.0 428'281.0 19.1 110'225.0 139'568.0 588.0 56'215.5 551.8 34'700.0 1'223.5 39'926.0

Enterprise Value - - - 264'644.4 - - 15'222.1 - - 26'114.8 - 630.6 - 10'937.0 -

Valuation

Total Revenue LFY 9'855.0 33'582.0 8'015.0 37'754.0 38'313.0 39'785.0 1'633.8 43'733.0 97'525.0 1'347.0 41'968.2 566.1 6'264.0 2'209.0 17'813.0

LTM 17'595.0 47'151.0 10'204.0 37'758.0 38'313.0 - 1'891.3 - 97'525.0 1'263.0 26'215.4 566.1 6'264.0 2'143.5 17'685.0

CY+1 9'945.4 33'832.3 4'002.0 26'694.4 26'555.5 17'385.2 - 23'928.8 40'090.3 673.0 25'442.2 326.4 6'836.9 2'150.9 16'777.4

CY+2 10'305.4 34'823.9 4'036.0 27'388.4 27'486.4 17'979.9 221.0 24'751.5 41'256.8 710.0 24'912.8 346.5 7'211.5 2'263.7 17'212.7

EV/Total Revenue LFY - - - 6.9x - - 9.3x - - 19.3x - 1.0x - 4.1x -

LTM - - - 6.9x - - 8.0x - - 20.6x - 1.0x - 4.1x -

CY+1 - 2.0x - - 35.0x -1.0x - - - - - - - 5.0x -

CY+2 - 2.0x - - 33.8x -0.9x - - - - - - - 4.7x -

EBITDA LFY - - - 15'529.0 - - 1'108.8 - - 787.0 - 233.6 - 1'229.4 -

LTM - - - 15'530.0 - - - - - - - - - 1'108.5 -

CY+1 - - - - - - - - - - - - - 1'151.6 -

CY+2 - - - - - - - - - - - - - 1'258.5 -

EV/EBITDA LFY - - - 16.7x - - 13.7x - - 33.0x - 2.4x - 7.4x -

LTM - - - 16.7x - - - - - - - - - 8.2x -

CY+1 - - - - - - - - - - - - - 9.4x -

CY+2 - - - - - - - - - - - - - 8.4x -

EPS LFY 0.34 3.18 0.51 0.52 0.77 -0.14 -0.82 4.02 5.47 1.75 -0.03 0.52 0.27 4.54 0.10

LTM 0.19 0.68 1.98 -0.67 0.84 -2.31 -0.45 0.95 5.33 1.75 -2.50 0.52 0.27 3.44 0.13

CY+1 0.10 3.96 1.66 0.91 2.66 0.99 - 3.60 5.10 1.71 0.14 0.45 0.32 3.86 0.12

CY+2 0.17 5.10 1.69 1.20 3.14 1.23 (0.17) 4.32 5.77 2.21 0.27 0.52 0.37 4.30 0.16

P/E LFY 6.2x 50.6x 16.3x - 32.0x - - 32.0x 8.3x 10.3x - 16.1x 12.2x 14.9x 9.6x

LTM 3.4x 9.0x 16.3x 30.2x 12.1x 17.7x - 11.1x 7.9x 10.3x - 16.1x 12.0x 15.2x 13.7x

CY+1 11.8x 8.7x 19.5x 17.0x 10.1x 7.3x - 8.5x 8.7x 10.6x 27.1x 18.4x 10.3x 13.2x 10.8x

CY+2 7.1x 6.7x 19.1x 12.9x 8.6x 5.9x - 7.1x 7.7x 8.2x 14.4x 16.0x 8.8x 11.9x 8.1x

Revenue Growth 1 Year (54.1%) (36.2%) (5.6%) (7.6%) (10.3%) (14.1%) (34.3%) (9.9%) 37.3% - 1.8% (0.6%) (51.9%) (4.3%) (29.5%)

5 Year (13.8%) (5.8%) (9.6%) (10.1%) 30.2% - - - 11.4% (13.3%) 1.7% 8.2% (10.2%) (6.8%) (11.8%)

EBITDA Growth 1 Year - - - (11.1%) - - (39.1%) - - - - (11.0%) - - -

5 Year - - - (31.3%) - - (20.8%) - - (12.2%) - (1.8%) - 1.8% -

EBITDA Margin LTM - - - 41.1% - - - - - - - - - 50.1% -

CY+1 - - - - - - - - - - - - - 53.5% -

CY+2 - - - - - - - - - - - - - 55.6% -

Leverage/Coverage Ratios

Total Debt / Equity % 0.0% 0.0% 669.4% 582.6% 927.6% 2488.1% 3888.1% 1663.3% 1287.6% 1690.6% 650.1% 0.3% 1288.2% 60.1% 231.4%

Total Debt / Capital % 90.9% 83.9% 87.0% 84.2% 88.6% 95.4% 97.5% 93.2% 91.5% 92.7% 85.9% 0.3% 92.6% 35.9% 84.8%

Total Debt / EBITDA - - - 17.218x - - - - - - - - - 1.317x -

Net Debt / EBITDA - - - 10.520x - - - - - - - - - 0.775x -

EBITDA / Int. Expense - - - - - - - - - - - - - 14.082x -

Credit Ratings

S&P LT Credit Rating A *- A+ NR A A A - A A+ - BBB+ - A AA BBB+

S&P LT Credit Rating Date 07.02.2013 25.01.2012 04.01.2013 29.11.2011 19.12.2008 23.01.2012 - 23.01.2012 25.10.2012 - 10.02.2012 - 23.01.2012 13.02.2012 10.02.2012

Moody's LT Credit Rating A3 A2 A2 A2 (P)A2 A2 NR A2 A2 - Baa2 - A2 WR Baa2

Moody's LT Credit Rating Date 06.06.2012 21.06.2012 22.06.2012 21.06.2012 21.06.2012 21.06.2012 12.09.2012 21.06.2012 21.06.2012 - 16.07.2012 - 15.06.2012 17.05.2006 16.07.2012

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |