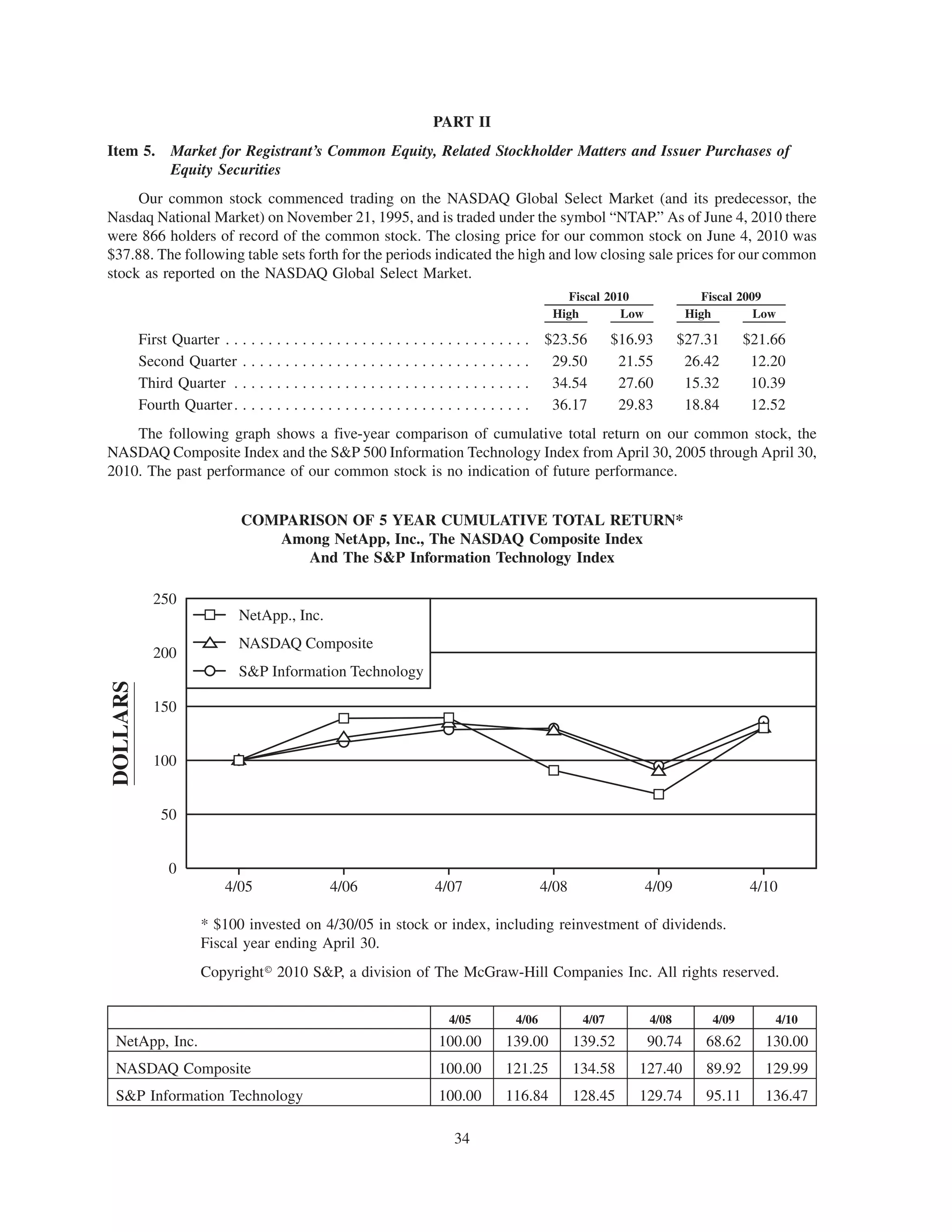

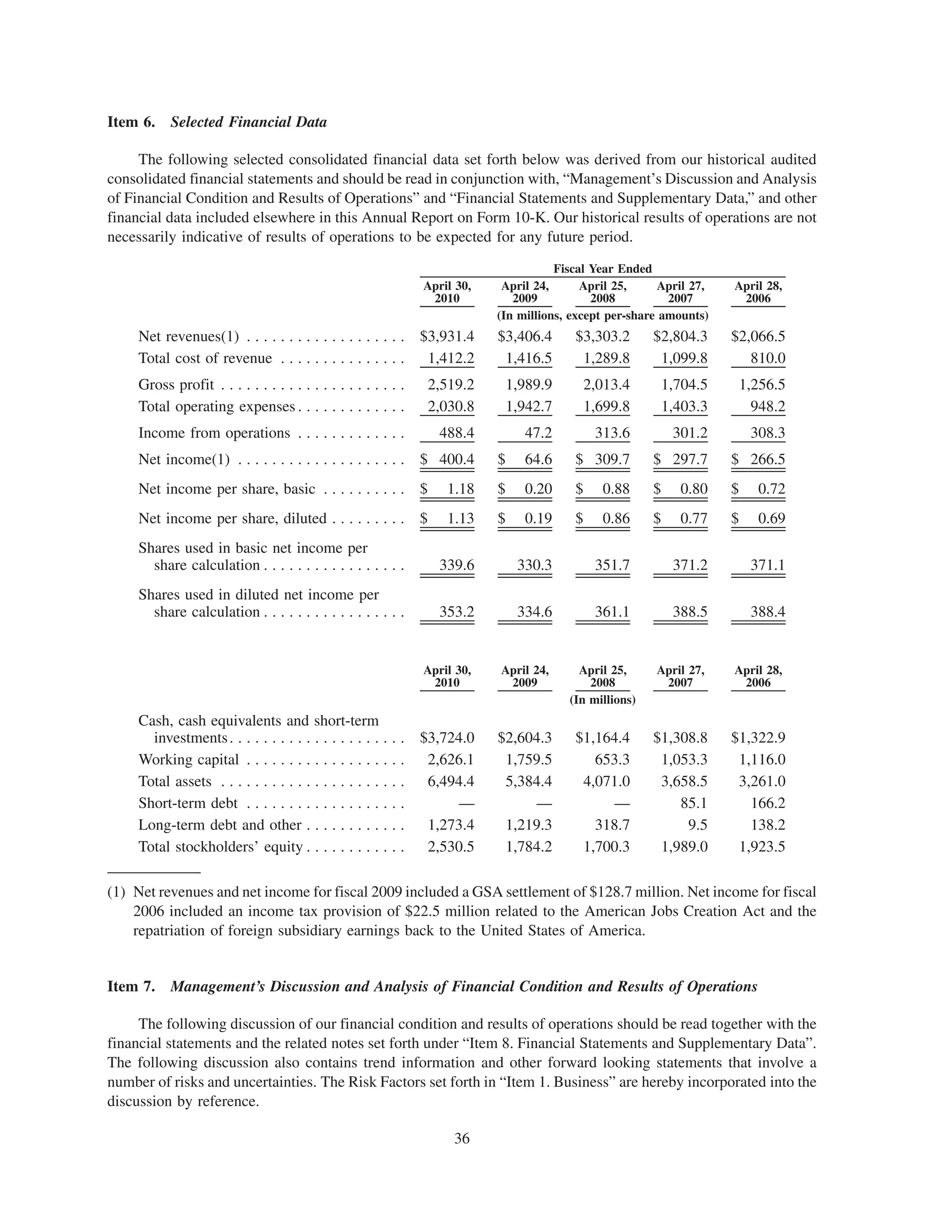

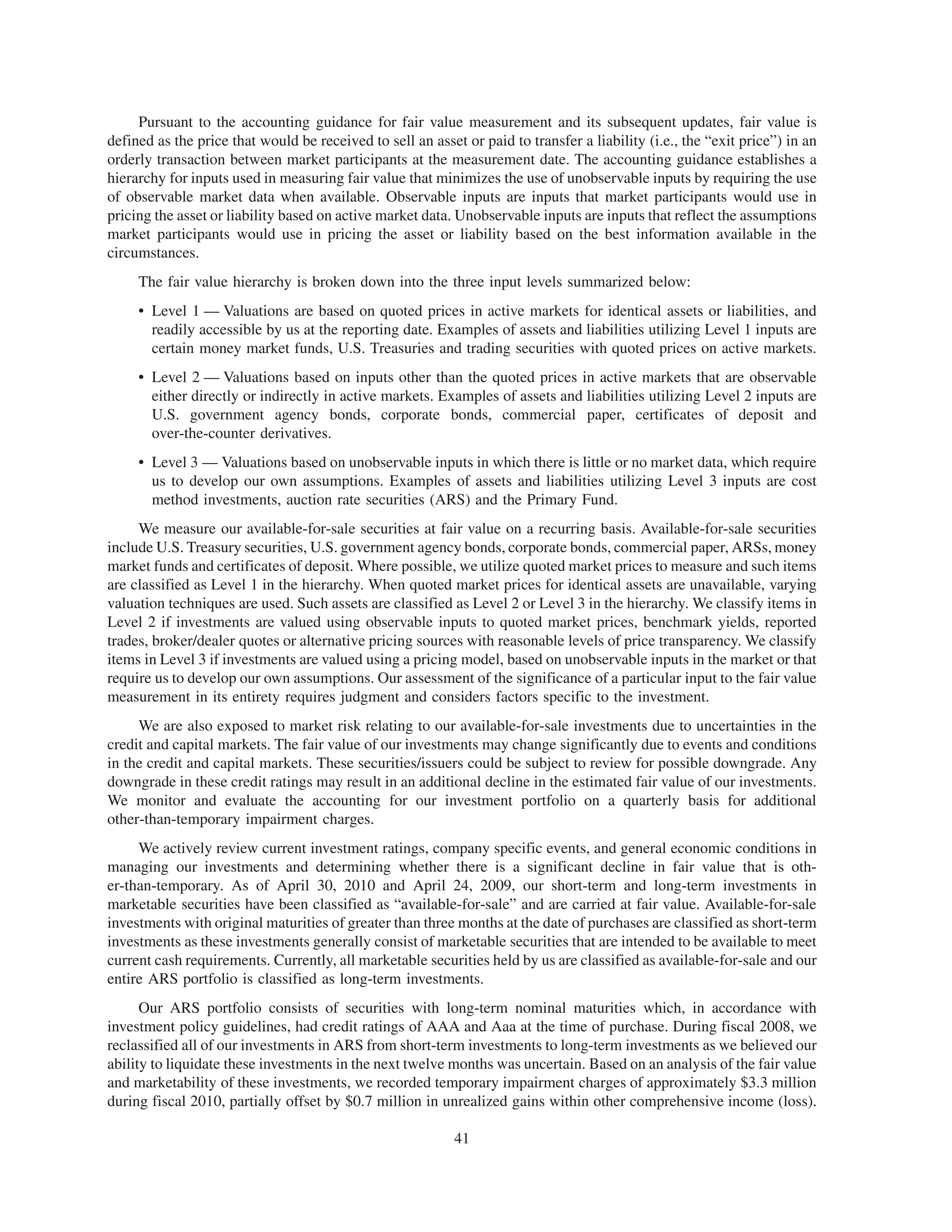

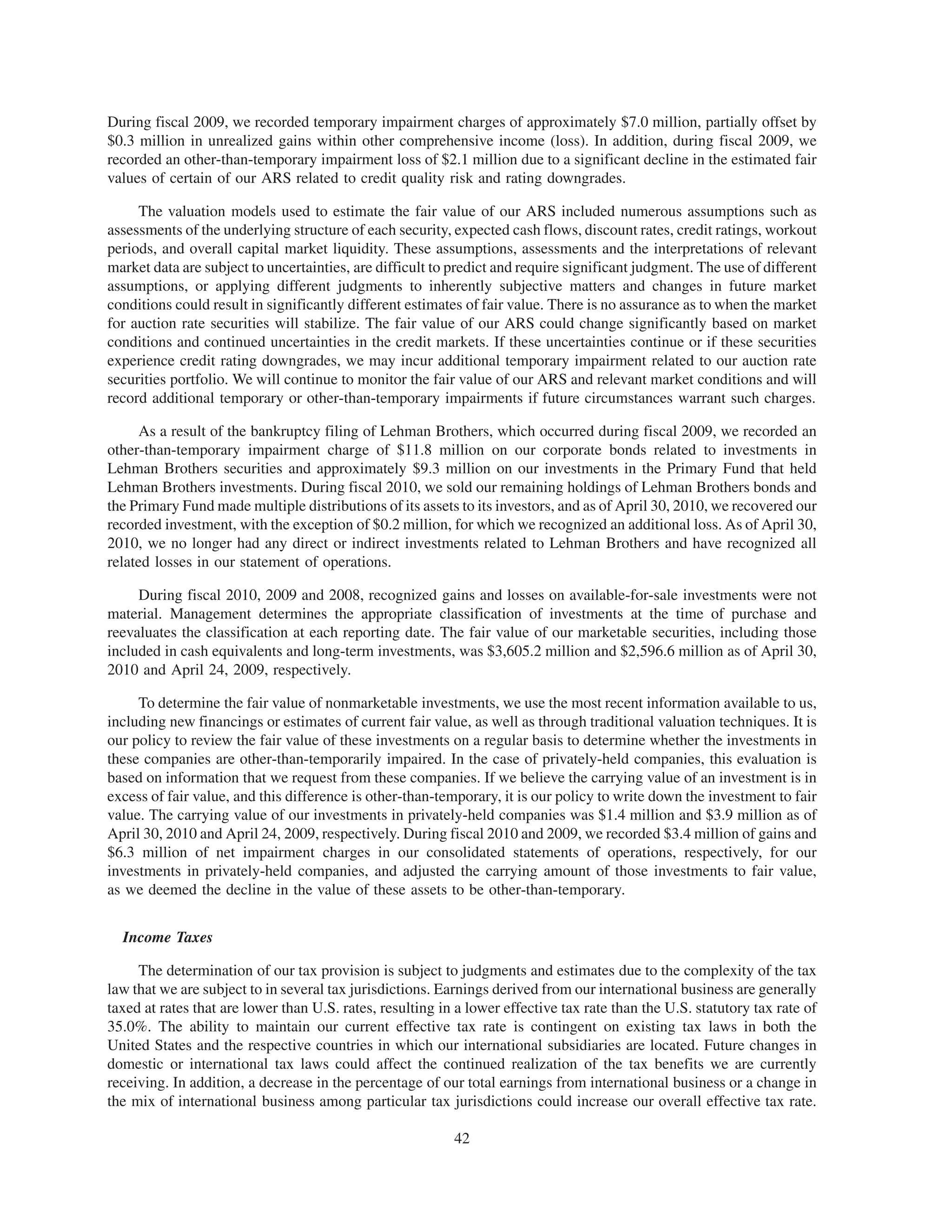

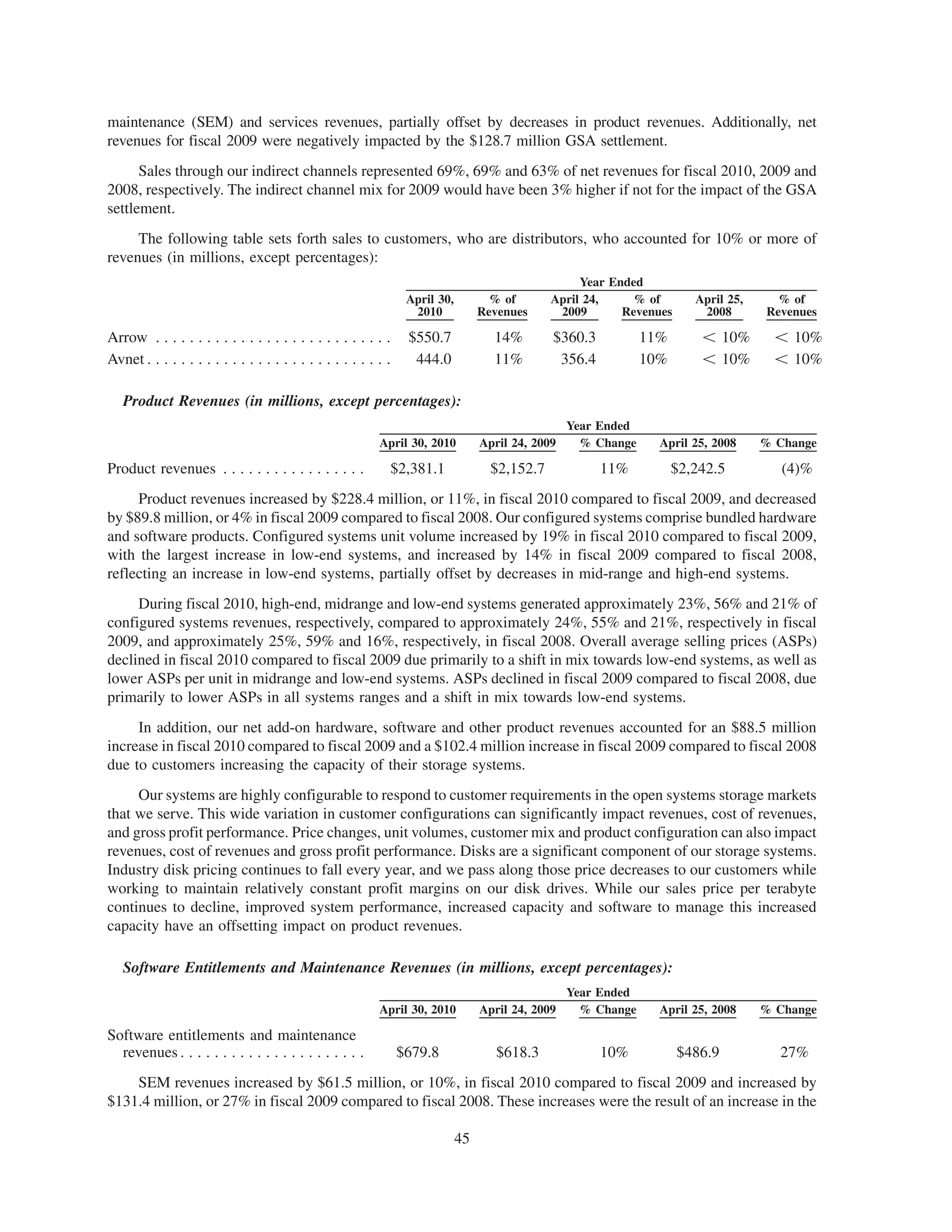

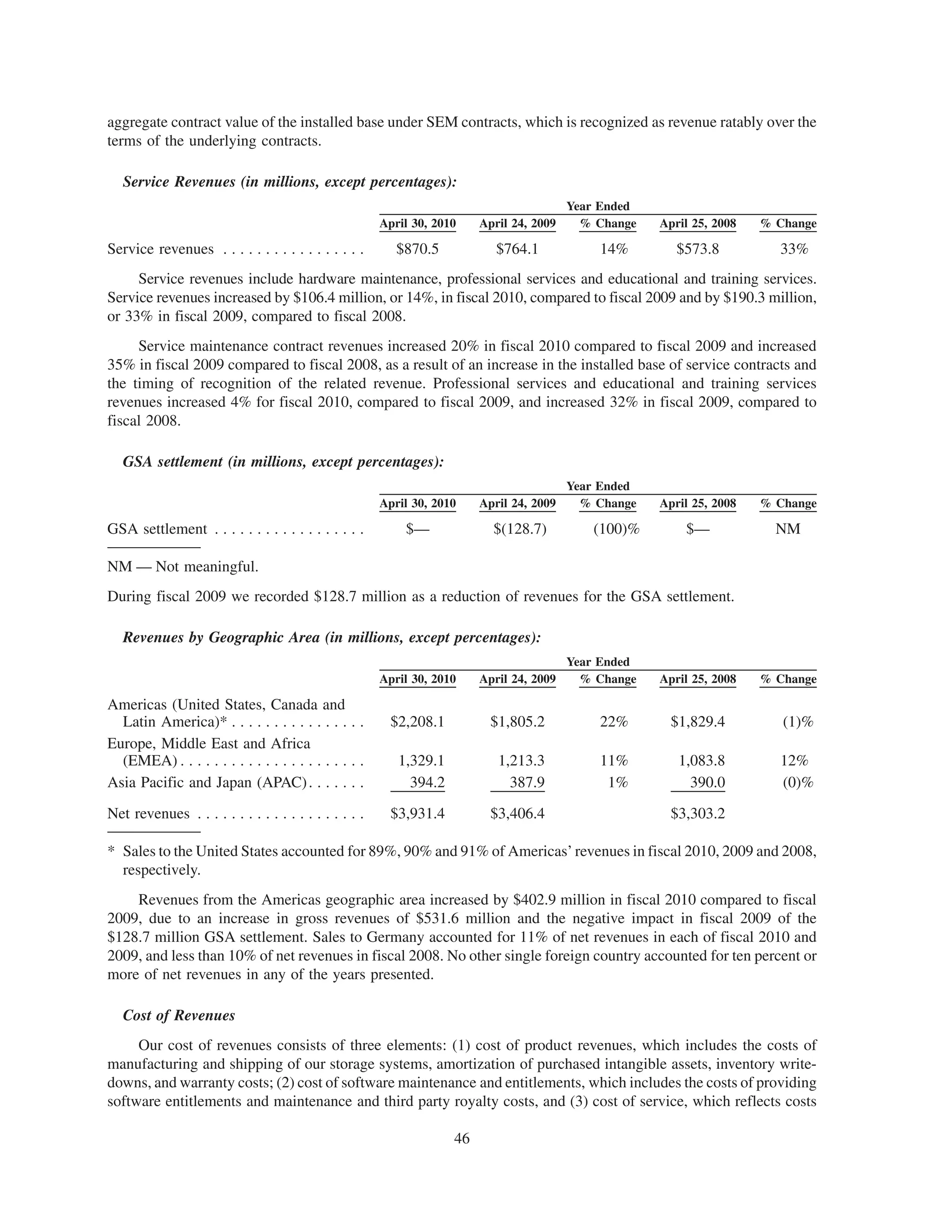

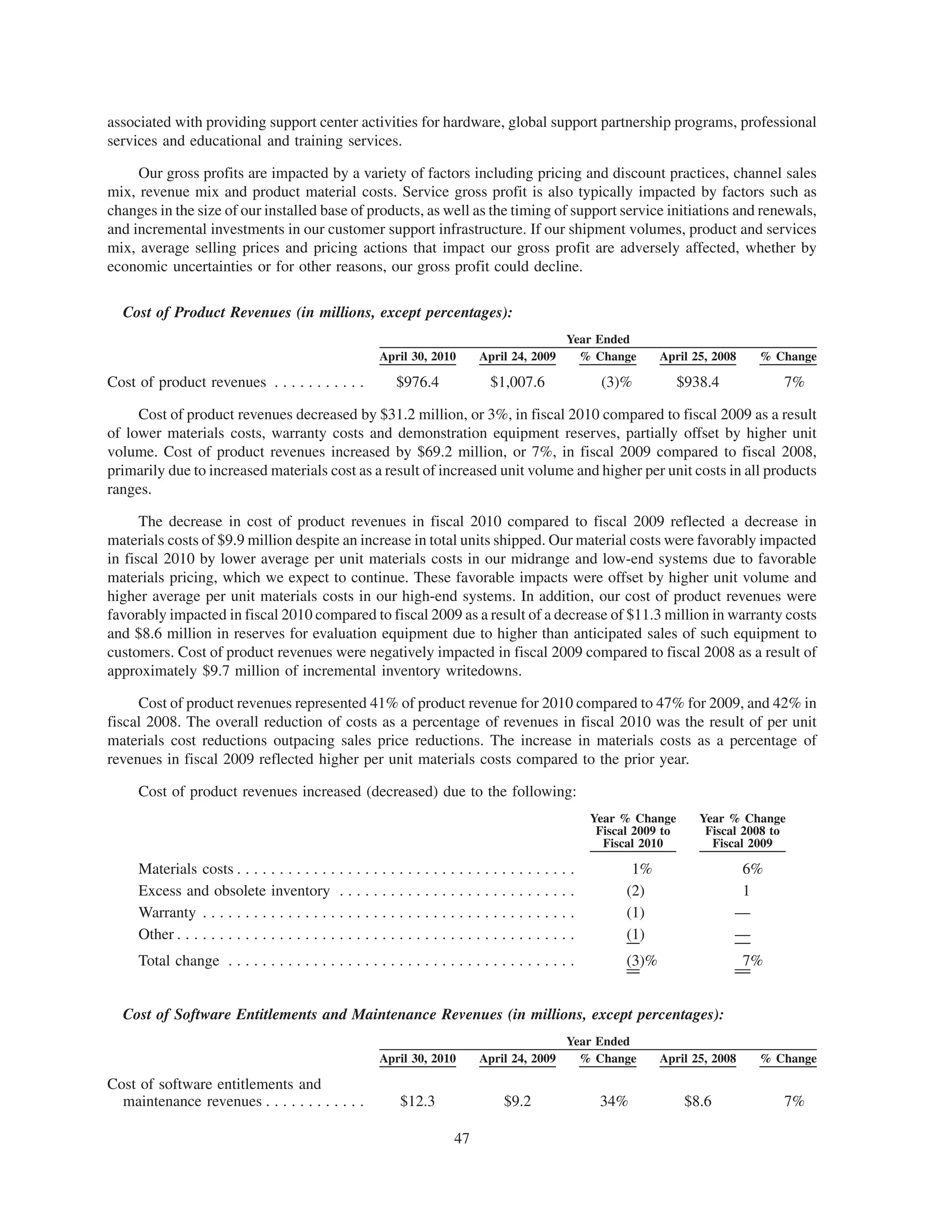

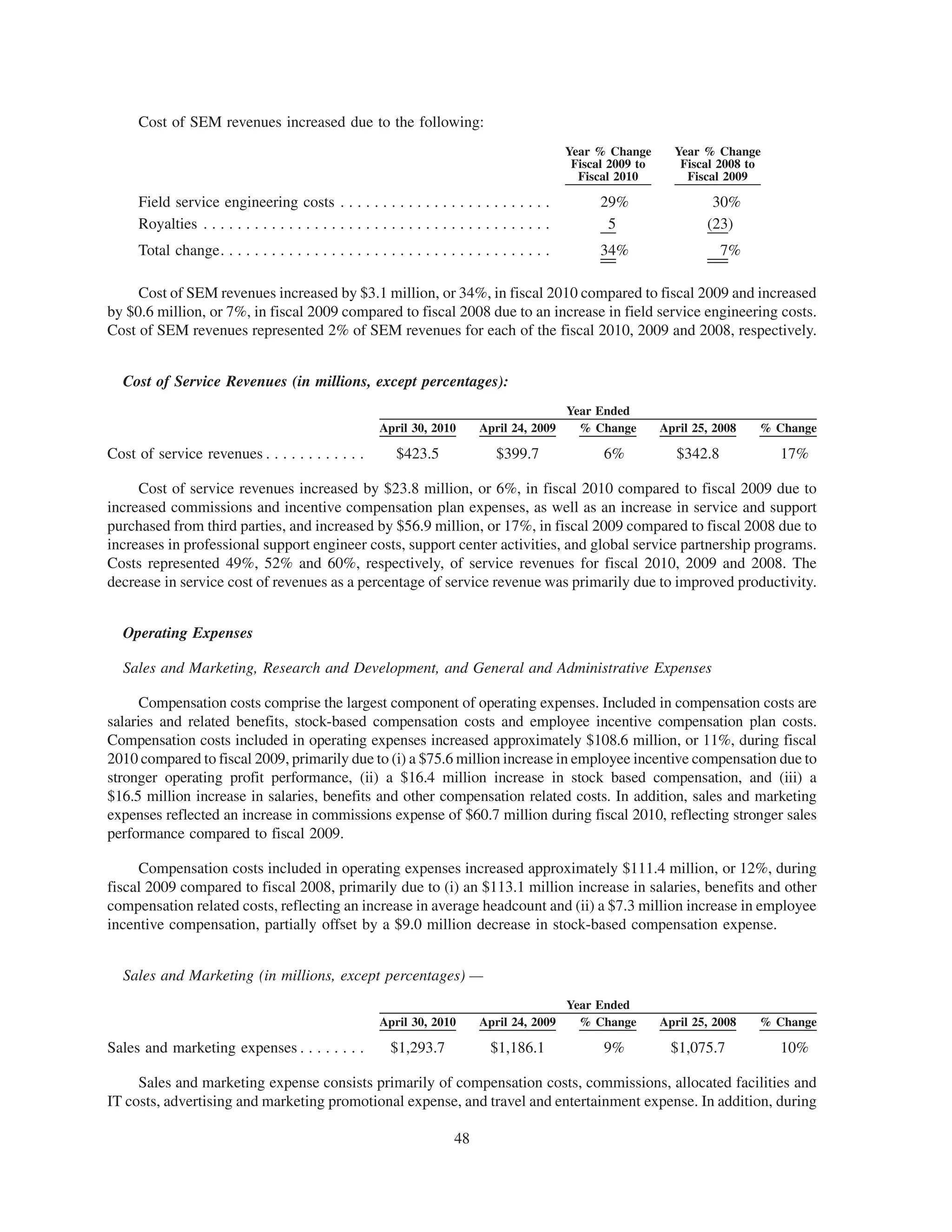

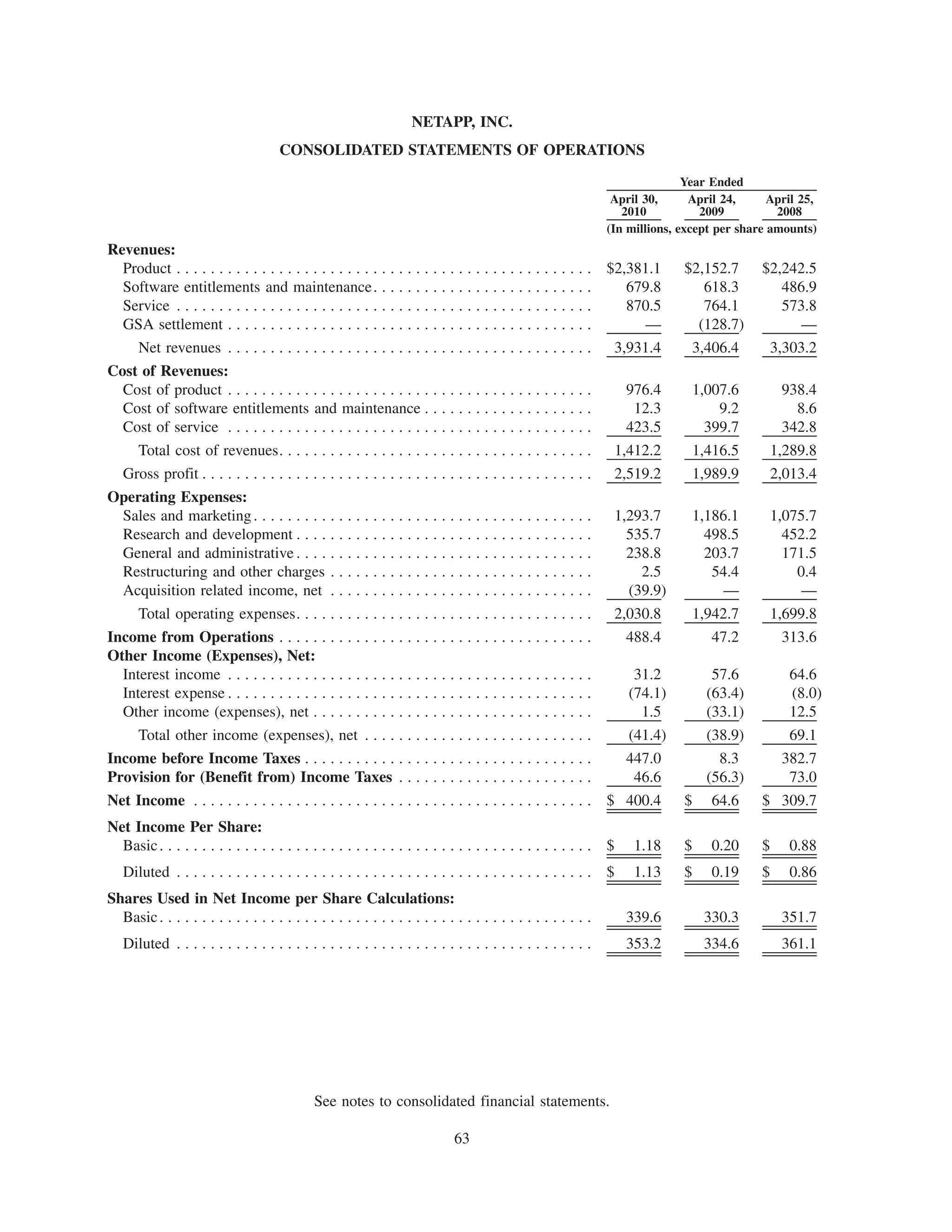

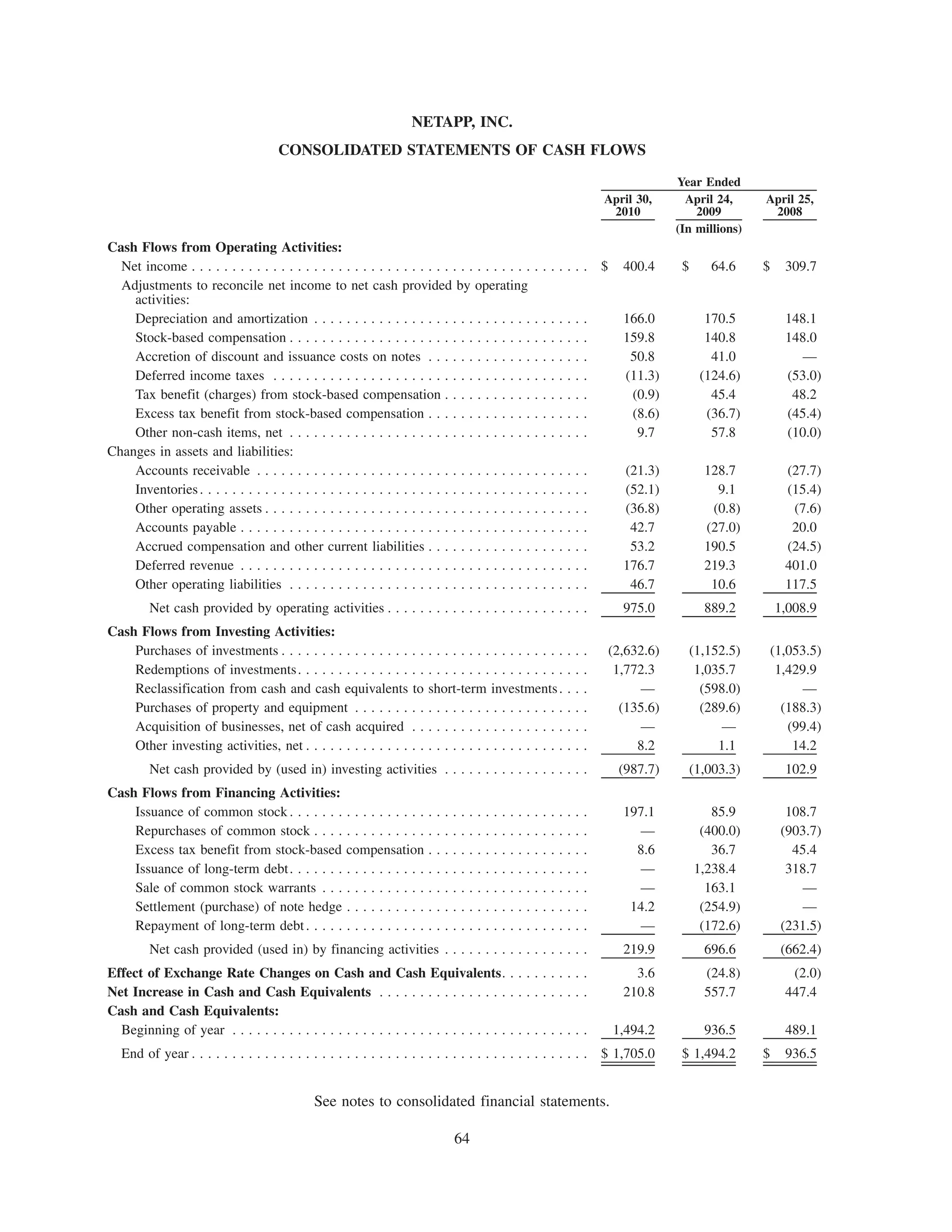

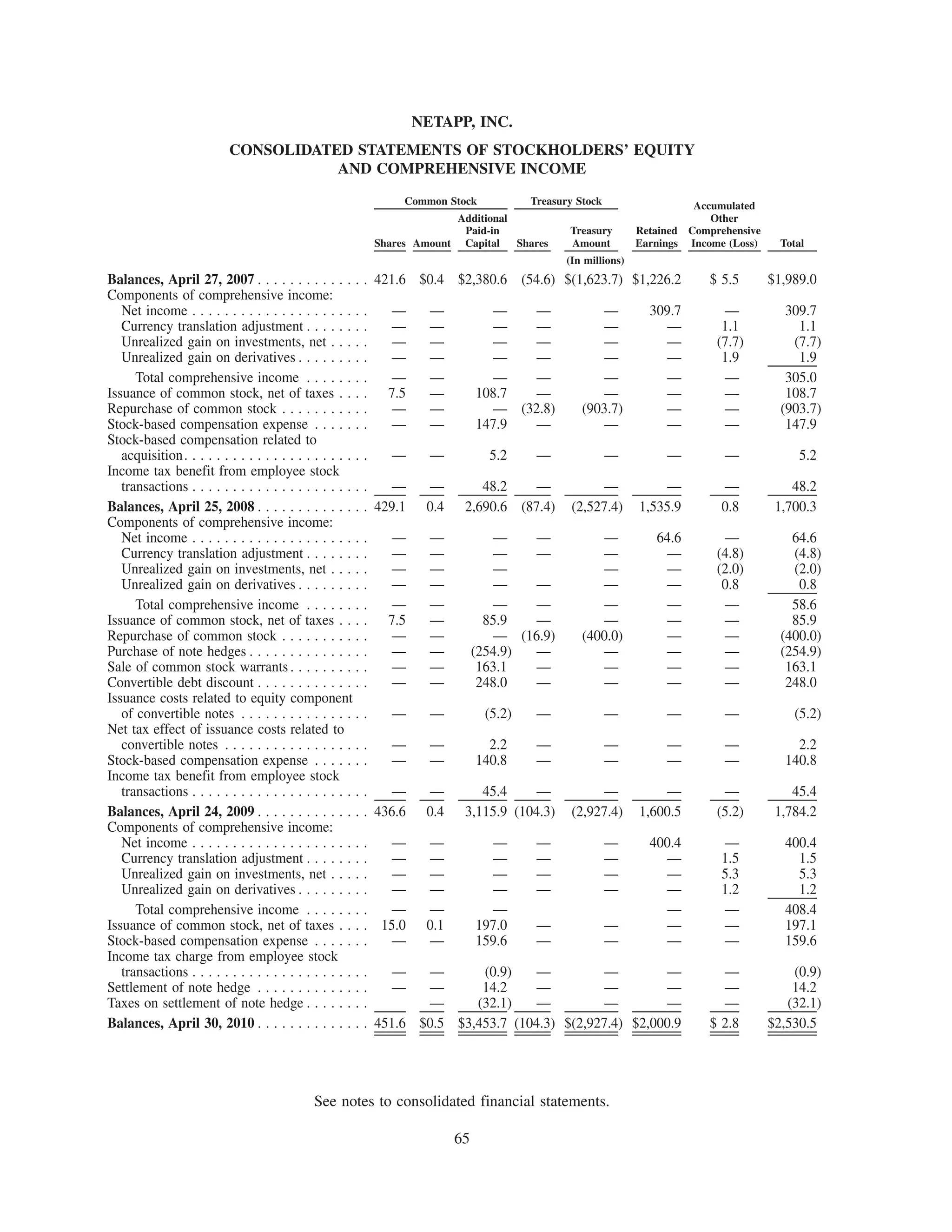

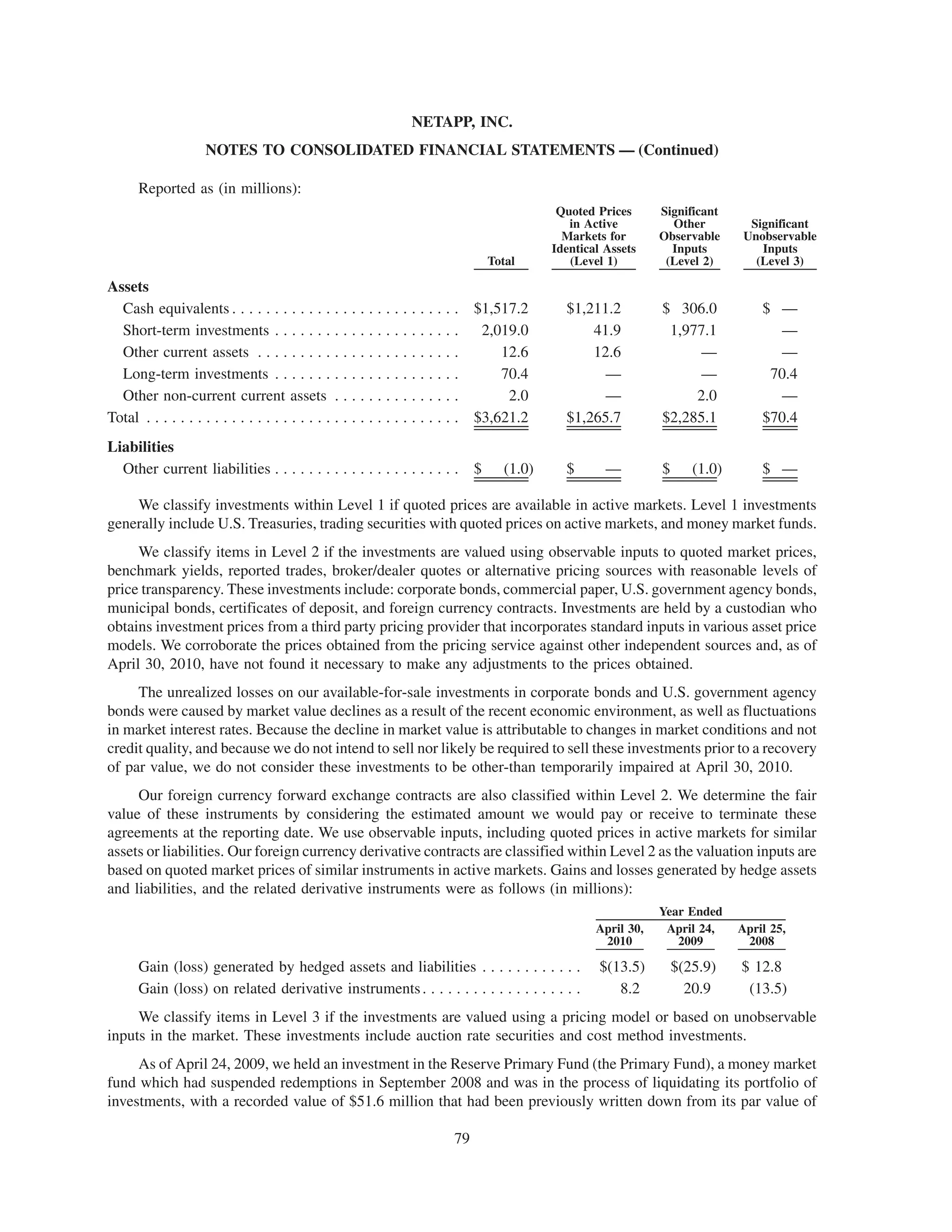

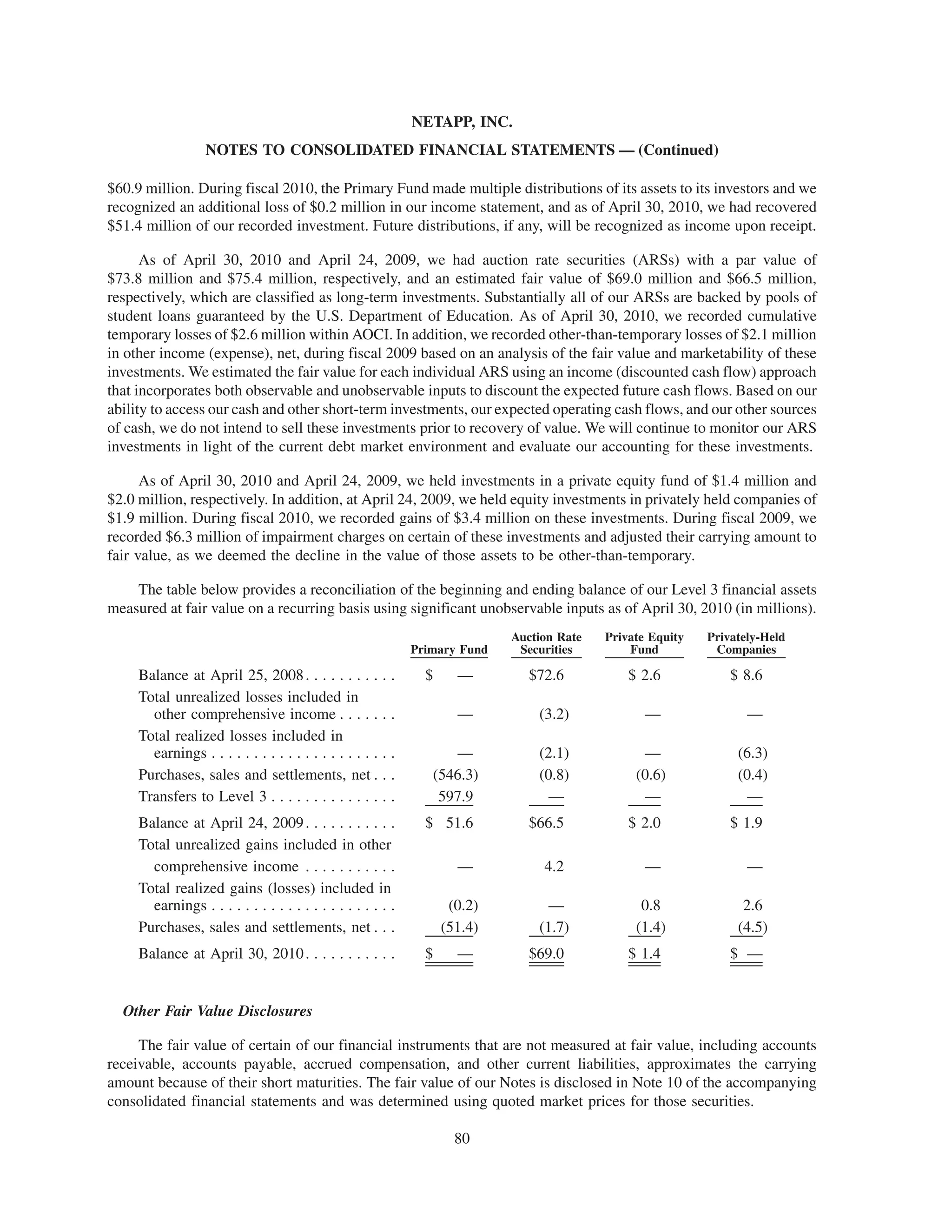

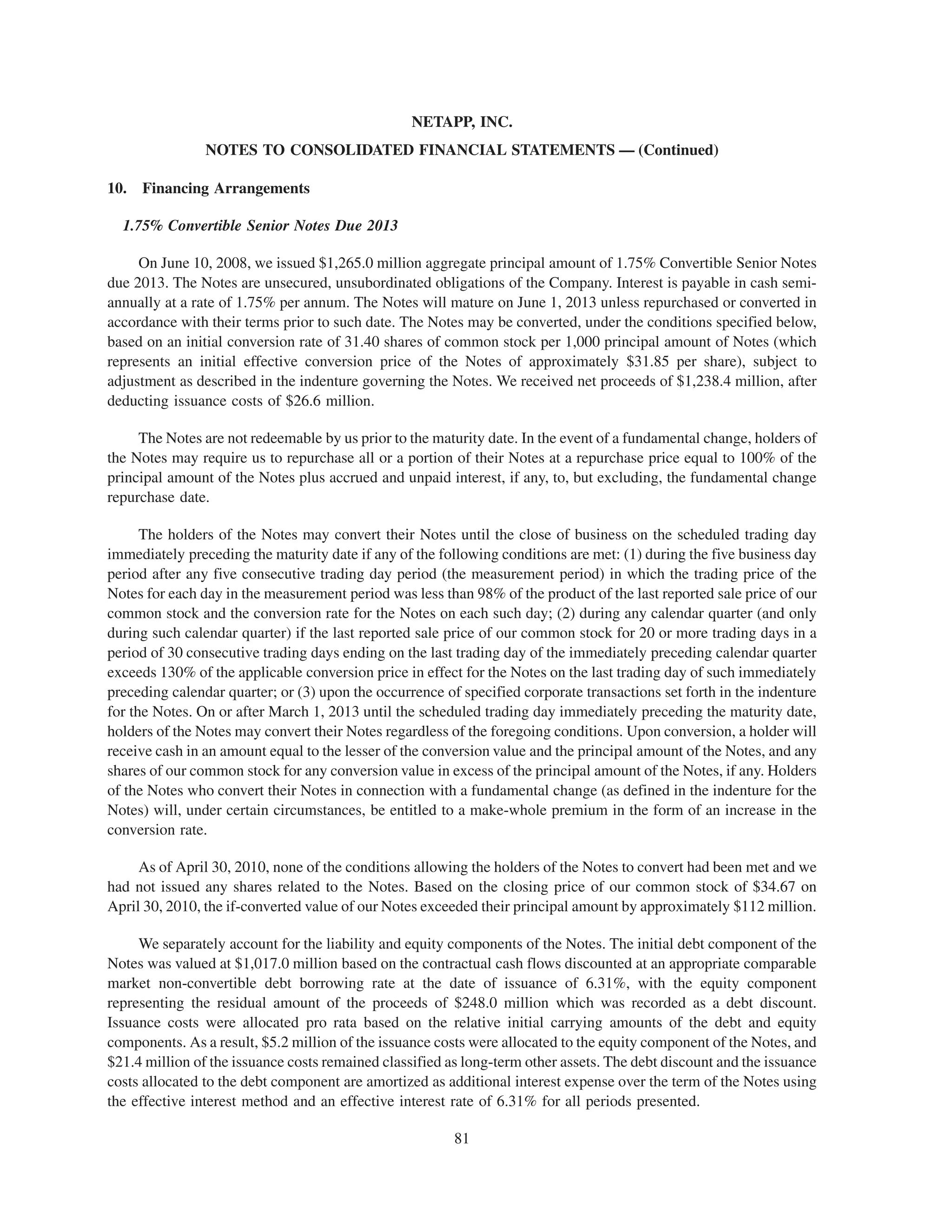

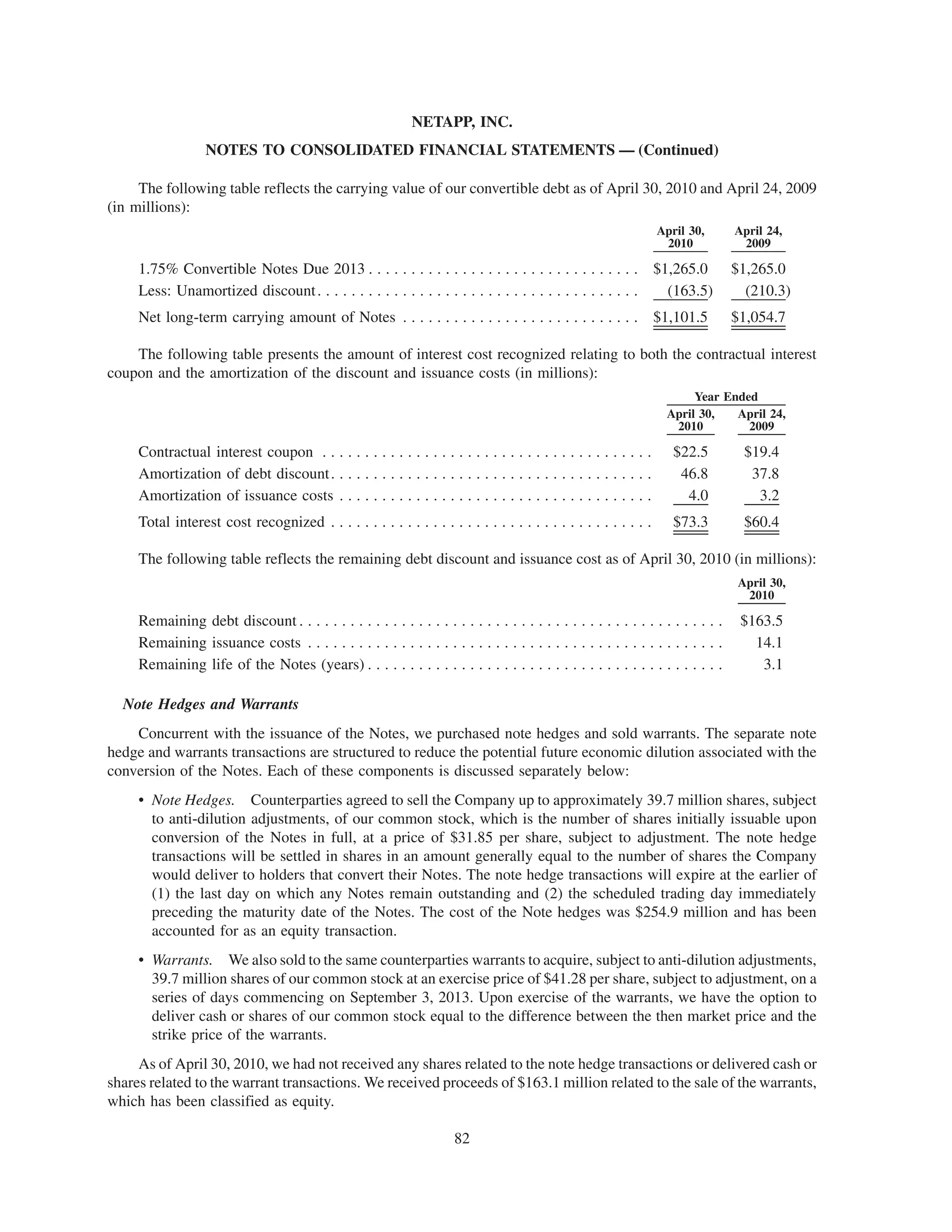

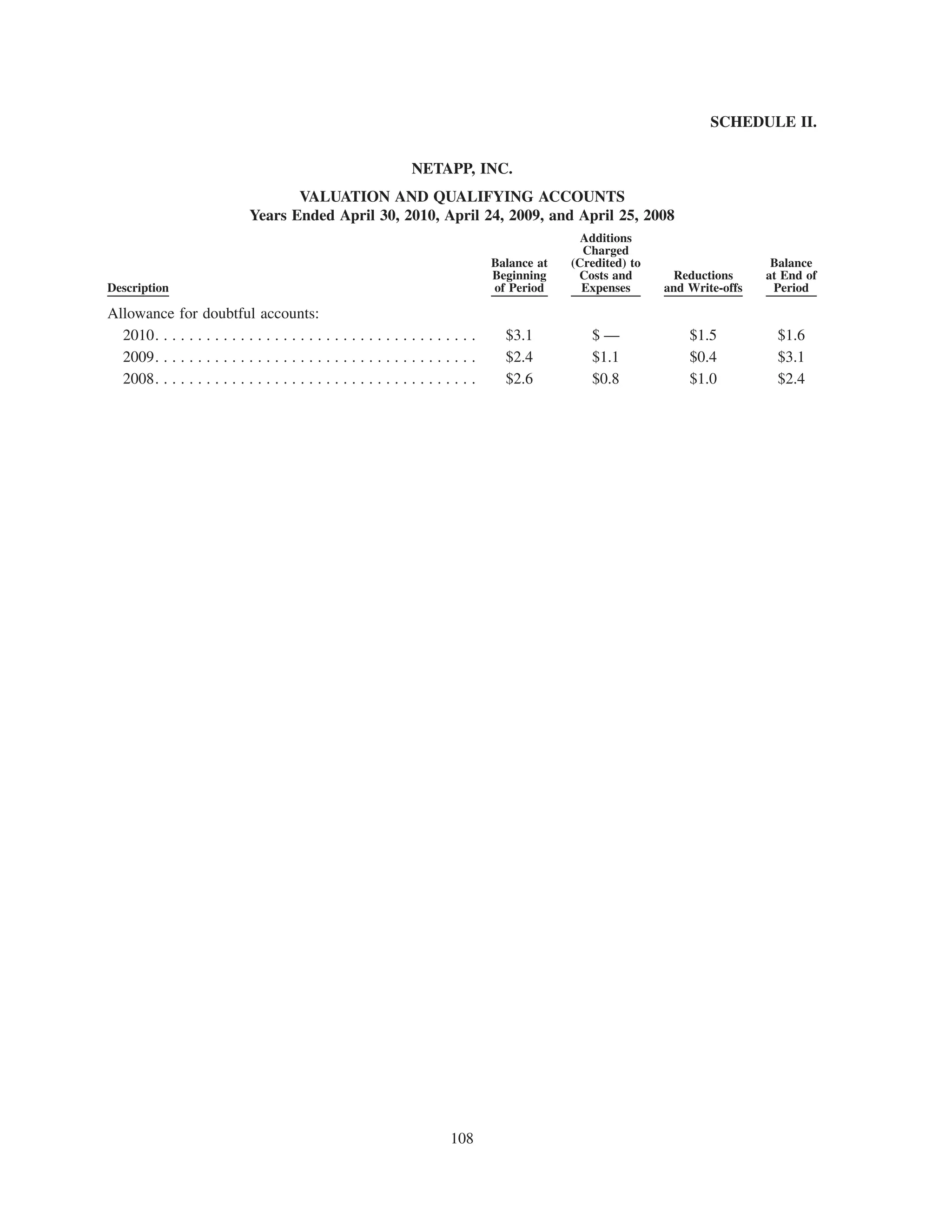

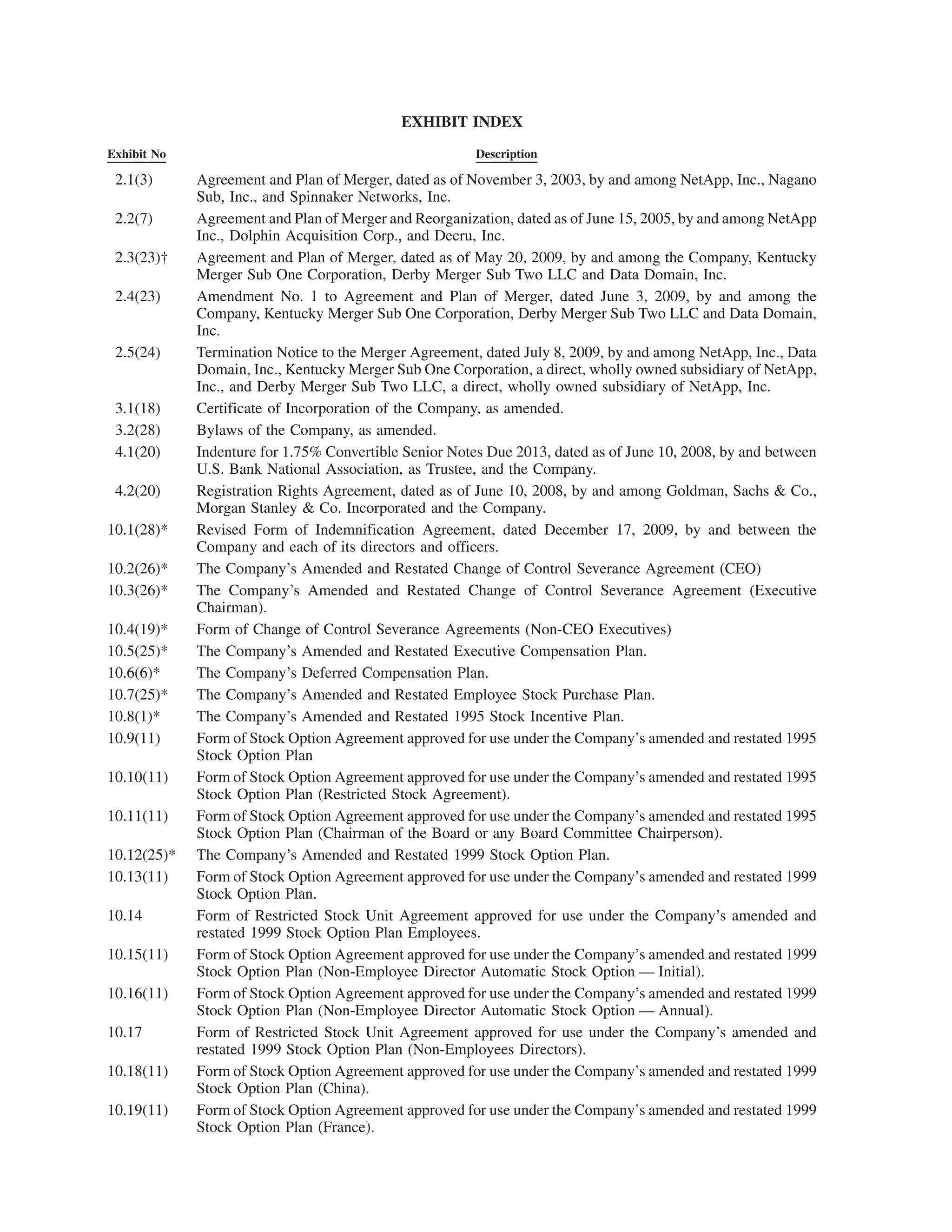

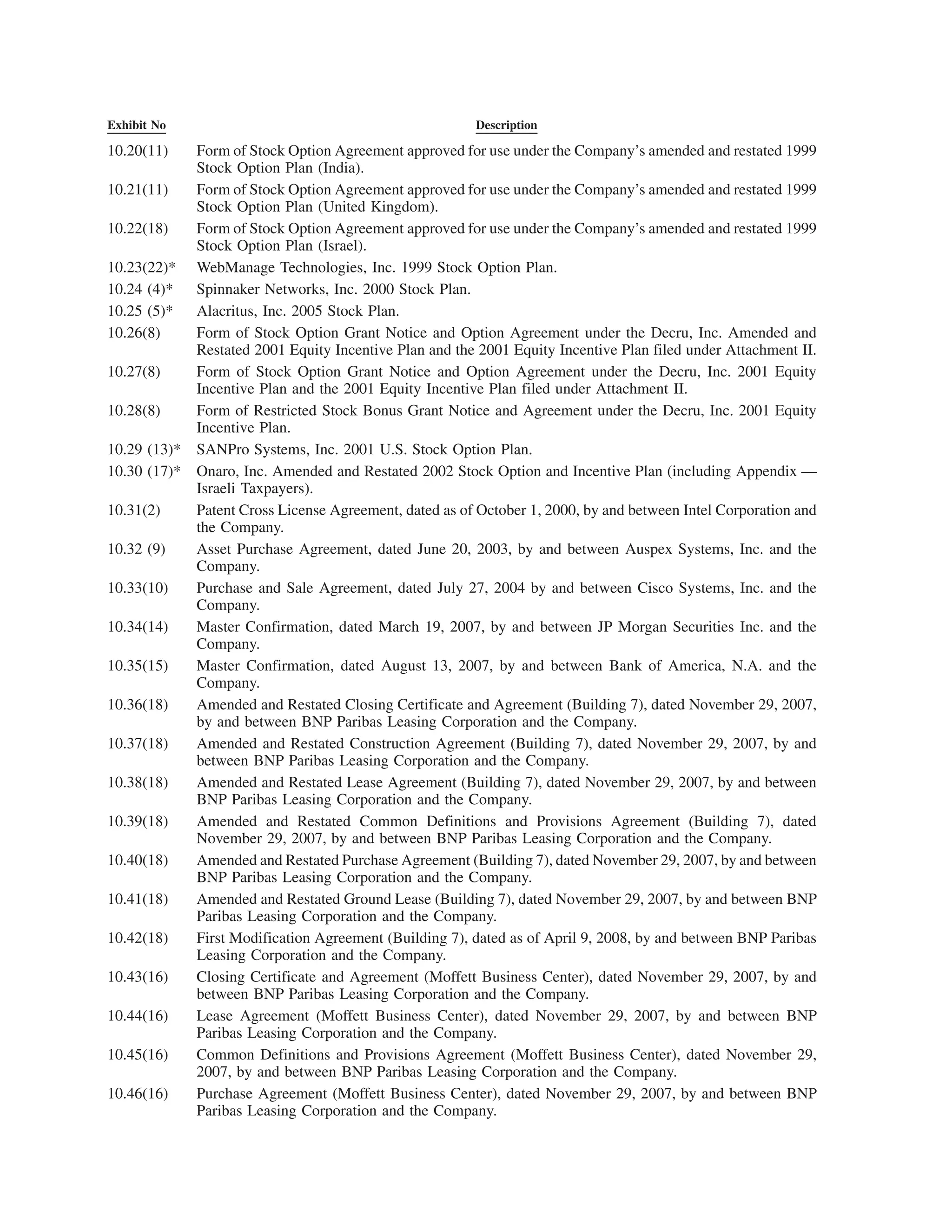

This document is NetApp's annual report on Form 10-K filed with the United States Securities and Exchange Commission for the fiscal year ending April 30, 2010. It provides an overview of NetApp's business and operations, financial statements, risks and uncertainties, and other legally required disclosures. Specifically, it discusses NetApp's data management and storage solutions business, financial results for fiscal year 2010, risk factors that could materially affect its business, and certifications regarding internal controls and disclosure controls.