Virginia Beach/Norfolk/Newport News Market Conditions Report

•

0 likes•302 views

- The median home sale price in September 2013 for the Hampton Roads area was $202,000, a 2% decrease from September 2012. Total units sold increased 12% year-over-year while active inventory decreased 2%. The average days on market was down 15% to 81 days from 95 days the prior year.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (19)

August 2015 Redondo Beach Real Estate Market Trends Update

August 2015 Redondo Beach Real Estate Market Trends Update

Similar to Virginia Beach/Norfolk/Newport News Market Conditions Report

Similar to Virginia Beach/Norfolk/Newport News Market Conditions Report (20)

Philadelphia Metropolitan Market Conditions Report

Philadelphia Metropolitan Market Conditions Report

Market Report for August 2017 - Residential Resale

Market Report for August 2017 - Residential Resale

Toronto Real Estate Board's MARKET WATCH - JANUARY 2017

Toronto Real Estate Board's MARKET WATCH - JANUARY 2017

Toronto Real Estate Board's MARKET WATCH - JANUARY 2017

Toronto Real Estate Board's MARKET WATCH - JANUARY 2017

September 2020 - Market Report - Toronto & GTA Housing Sales

September 2020 - Market Report - Toronto & GTA Housing Sales

Recently uploaded

Recently uploaded (20)

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Call girls in Shakti Nagar Delhi~8447779280°/=@/ Short 1500 Night 6000}ESCORT...

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Call girls In Rana Pratap Bagh {Delhi ↫8447779280↬Escort Service (Delhi)

Call girls In Rana Pratap Bagh {Delhi ↫8447779280↬Escort Service (Delhi)

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Bptp The Amaario Launch Luxury Project Sector 37D Gurgaon Dwarka Expressway...

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

Cheap Rate ✨➥9582086666▻✨Call Girls In Gurgaon Sector 1 (Gurgaon)

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

~Call Girls In Roop Nagar {8447779280}(Low Price) Escort Service In Delhi

Escort—>Call GiRls In Mori Gate Delhi —>8447779280—Service Escorts In South D...

Escort—>Call GiRls In Mori Gate Delhi —>8447779280—Service Escorts In South D...

Cheap Rate ✨➥9711108085▻✨Call Girls In Connaught Place (Delhi)

Cheap Rate ✨➥9711108085▻✨Call Girls In Connaught Place (Delhi)

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Low rate ↬Call girls in Sabzi Mandi Delhi | 8447779280}Escort Service In All ...

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Kohinoor Teiko Hinjewadi Phase 2 Pune E-Brochure.pdf

Virginia Beach/Norfolk/Newport News Market Conditions Report

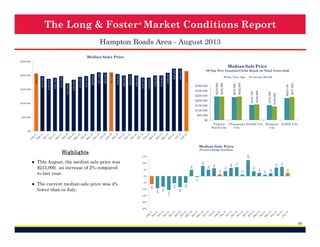

- 1. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Median Sales Price $250,000 $230,000 $207,250 $169,825 $161,950 $160,000 $200,000 $100,000 $171,750 Current Month $227,038 $250,000 $225,000 $300,000 $220,000 $350,000 $235,000 One Year Ago $202,000 $215,000 $225,000 $225,000 $209,900 $199,900 $199,900 $192,765 $192,000 $200,000 $205,000 $200,000 $205,250 $211,000 $210,000 $211,000 $197,750 $194,900 $185,000 $171,600 $197,500 $191,700 $150,000 $188,000 $197,495 $200,000 $205,000 Median Sale Price Of Top Five Counties/Cities Based on Total Units Sold $150,000 $100,000 $50,000 $50,000 $0 Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City $0 Median Sale Price Percent Change Year/Year 2% 2% 1% 4% 1% 3% 7% 7% 6% 4% 1% 6% 5% 5% 5% -15% -5% -8% -11% -10% -6% -5% -2% -1% 0% -8% ● The current median sale price was 6% lower than in August. 10% -9% ● This September, the median sale price was $202,000, a decrease of 2% compared to last year. 8% 15% 7% 12% Highlights -20% -25% 46

- 2. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Total Units Sold 2,500 100 500 122 89 200 140 177 300 126 267 400 263 499 446 1,651 500 Current Month 192 2,071 2,059 2,059 1,794 1,623 One Year Ago 600 1,358 1,255 1,449 1,493 1,486 1,474 1,915 1,833 1,751 1,556 1,284 1,093 1,467 1,282 1,000 1,379 1,473 1,500 1,600 1,965 2,000 2,113 Total Units Sold Of Top Five Counties/Cities Based on Total Units Sold 0 Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City 0 Total Units Sold Percent Change Year/Year 12% 8% 5% -1% 0% 4% 6% 8% 7% 0% 3% 0% 15% 18% 12% 15% 16% 16% 19% 15% 10% 10% -1% ● There was a decrease of 20% in total units sold in September compared to August. 10% 20% 17% ● This month's total units sold was higher than at this time last year, an increase of 12% versus September 2012. 20% 30% 20% Highlights -10% 47

- 3. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Total Units Sold by Type Detached Total Units Sold by Type Current Month Attached 2,500 Detached Attached 2,000 1,500 388 24% 1,000 500 1,263 76% 0 Total Units Sold by Price Range < 150K 1,200 150K to < 300K 300K to < 450K 450K to < 600K 600K and up Total Units Sold by Price Range Current Month < 150K 450K to < 600K 150K to < 300K 600K and up 300K to < 450K 1,000 800 600 247 15% 43 64 2% 4% 506 31% 400 200 0 791 48% 48

- 4. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Total Active Inventory 823 790 961 1,000 912 1,500 6,000 1,456 2,000 1,431 1,587 2,500 1,424 3,000 8,000 Current Month 2,527 2,500 One Year Ago 10,986 11,254 11,288 11,125 11,138 10,944 10,656 10,474 10,177 9,872 10,686 11,035 11,217 11,366 11,547 11,704 11,806 11,820 11,696 11,509 11,413 12,205 Of Top Five Counties/Cities Based on Total Units Sold 11,307 10,000 Total Active Inventory 12,532 12,000 13,003 14,000 500 4,000 0 Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City 2,000 0 Total Active Inventory Highlights -6% -7% -9% -11% -12% -13% -12% -1% -2% -5% -2% -16% -18% -17% -18% -18% -18% -19% -18% -18% -20% -17% -15% -14% -10% -9% -5% -16% ● Active inventory this September was 2% lower than the previous month's supply of available inventory. 0% -17% ● Versus last September, the total number of homes available this month was lower by 231 units or 2%. Percent Change Year/Year -25% 49

- 5. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Total Active Inventory by Type Detached Total Active Inventory by Type Attached Current Month 14,000 Detached Attached 12,000 10,000 2,324 21% 8,000 6,000 4,000 8,662 79% 2,000 0 Total Active Inventory by Price Range < 150K 14,000 150K to < 300K 300K to < 450K 450K to < 600K Total Active Inventory by Price Range Current Month 600K and up < 150K 450K to < 600K 150K to < 300K 600K and up 300K to < 450K 12,000 10,000 8,000 6,000 805 728 7% 7% 2,915 27% 1,874 17% 4,000 2,000 4,664 42% 0 50

- 6. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Sale Price as % of List Price Average Sale Price as a Percent of List Price Of Top Five Counties/Cities Based on Total Units Sold Days on Market Current One Year Month Ago 95.0% 81 95 97.5% 105 105 100 95 90 85 80 104 106 107 98.4% 98.3% 97.3% Up 0.6% Vs. Year Ago by Price Range 108 100% 104 < 150K 150K to < 300K 300K to < 450K 450K to < 600K 600K and up 98% 101 98 96.9% Average Sale Price as a Percent of List Price Days on Market 110 96.7% Avg Sale Price as % of List Price Current One Year Month Ago Down -15% Vs. Year Ago 110 96.8% 95.6% Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City 95.5% 115 Current Month 98.6% 98.0% 97.4% 97.5% 97.6% 97.4% 100.0% 99.0% 98.0% 97.0% 96.0% 95.0% 94.0% 93.0% 96.5% 96.7% 96.7% 96.7% 97.1% 97.1% 96.8% 96.7% 96.9% 97.3% 96.9% 96.7% 96.6% One Year Ago 96.3% 96.1% 96.2% 96.5% 96.2% 96.5% 96.3% 96.8% 97.0% 96.0% 97.5% 97.5% 97.4% 97.9% 98.0% 96 95 91 89 91 96 96 97 94 96% 94% 96 94 92% 90 90% 82 83 83 88% 81 86% 84% 51

- 7. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 Total Dollar Volume Sold In Thousands Highlights $100,000 $380,043 $507,758 $534,111 $489,189 $403,218 $379,016 $300,382 $269,970 $324,608 $346,175 $331,381 $340,493 $448,229 $464,160 $423,371 $357,581 $341,028 $271,427 $214,720 $331,083 $284,571 $200,000 $297,534 $300,000 $326,010 $400,000 $414,678 $500,000 $518,295 $600,000 ● Total volume sold this September was 12% greater than the same month one year ago. ● In September, there was 6.7 months of supply available, compared to 7.6 in September 2012. That was a decrease of 13% versus a year ago. $0 Months of Supply Current Month's Active Inventory/Current Month's Unit Sales Total Dollar Volume Sold Current One Year Month Ago 12 10.4 4 $340,492,514 Up 12% Vs. Year Ago 6.7 5.4 5.3 5.4 5.4 6.1 6.6 7.7 8.1 6.8 7.2 7.4 7.6 5.9 6.3 6.0 6.7 7.4 7.5 7.7 6 $380,043,330 9.0 9.5 9.1 8 8.8 10 Months of Supply Current One Year Month Ago 6.7 7.6 2 Down -13% Vs. Year Ago 0 52

- 8. The Long & Foster ® Market Conditions Report Hampton Roads Area - September 2013 New Listings New Listings & New Contracts 163 134 219 194 357 370 348 698 605 Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City 112 90 100 0 141 200 139 230 300 500 Current Month 145 248 One Year Ago 240 400 458 500 390 1,885 Of Top Five Counties/Cities Based on Total Units Sold 1,629 1,784 1,927 New Contracts 2,192 2,055 1,902 1,573 Current Month 343 3,013 1,000 800 600 400 200 0 2,521 3,153 2,825 3,294 3,215 2,938 2,680 2,865 1,586 1,470 1,223 1,375 1,557 1,367 1,806 1,706 One Year Ago 2,043 2,433 2,304 2,686 2,542 2,882 1,839 1,786 1,809 1,484 1,396 1,211 1,363 1,320 1,426 1,500 1,806 2,000 1,000 2,787 2,577 2,689 1,696 2,315 2,500 New Contracts (Under Active Contract Status) 2,185 3,000 2,466 3,500 2,934 3,099 New Listings Of Top Five Counties/Cities Based on Total Units Sold 0 Virginia Chesapeake Norfolk City Newport Suffolk City Beach City City News City New Listings Current One Year Month Ago 2,521 2,304 Up 9% Vs. Year Ago New Contracts Current One Year Month Ago 1,629 1,367 Up 19% Vs. Year Ago Supply/Demand Ratio Highlights ● Based on this month's amount of new listings and new contracts, the ratio of home supply (new listings) to current home demand (new contracts) was 1.5, a decrease of 8% from September 2012. Number of New Listings to New Contracts 2.5 1.7 1.7 1.7 1.7 1.7 1.5 1.9 1.9 2.0 1.4 1.6 1.6 1.6 1.7 1.5 1.5 1.6 1.7 1.5 1.6 1.6 1.5 1.5 1.6 1.5 1.6 1.3 1.0 0.5 0.0 53