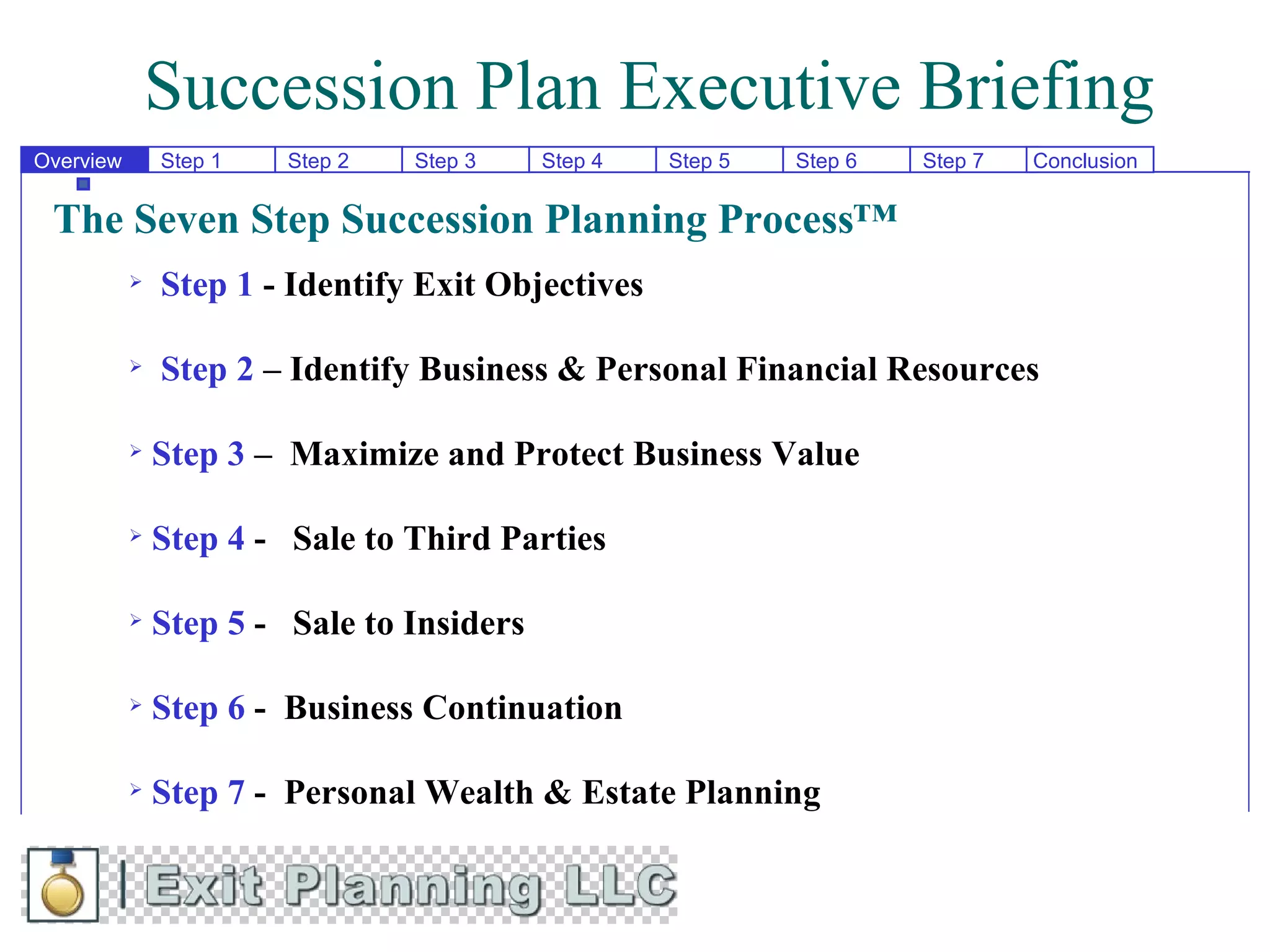

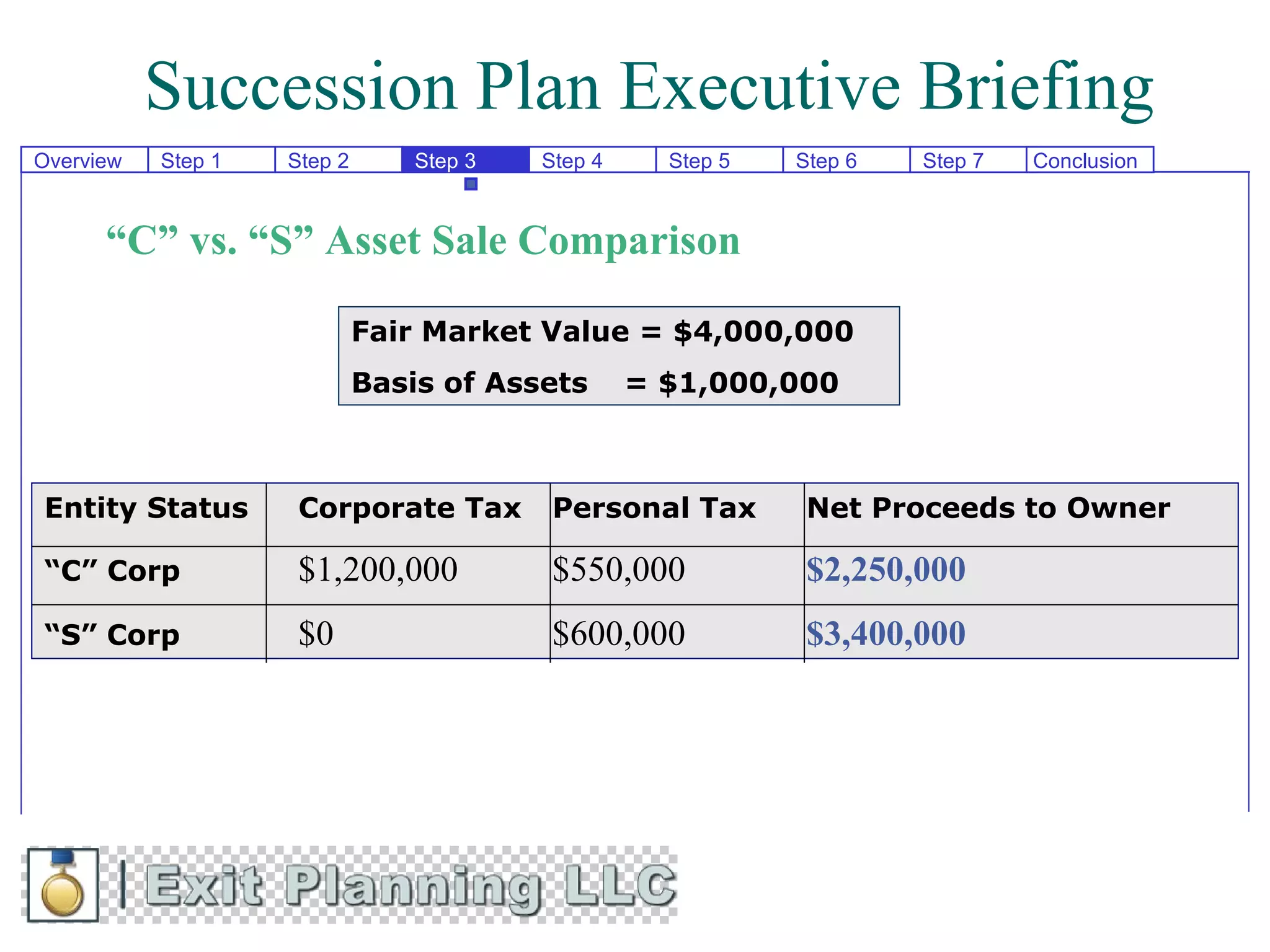

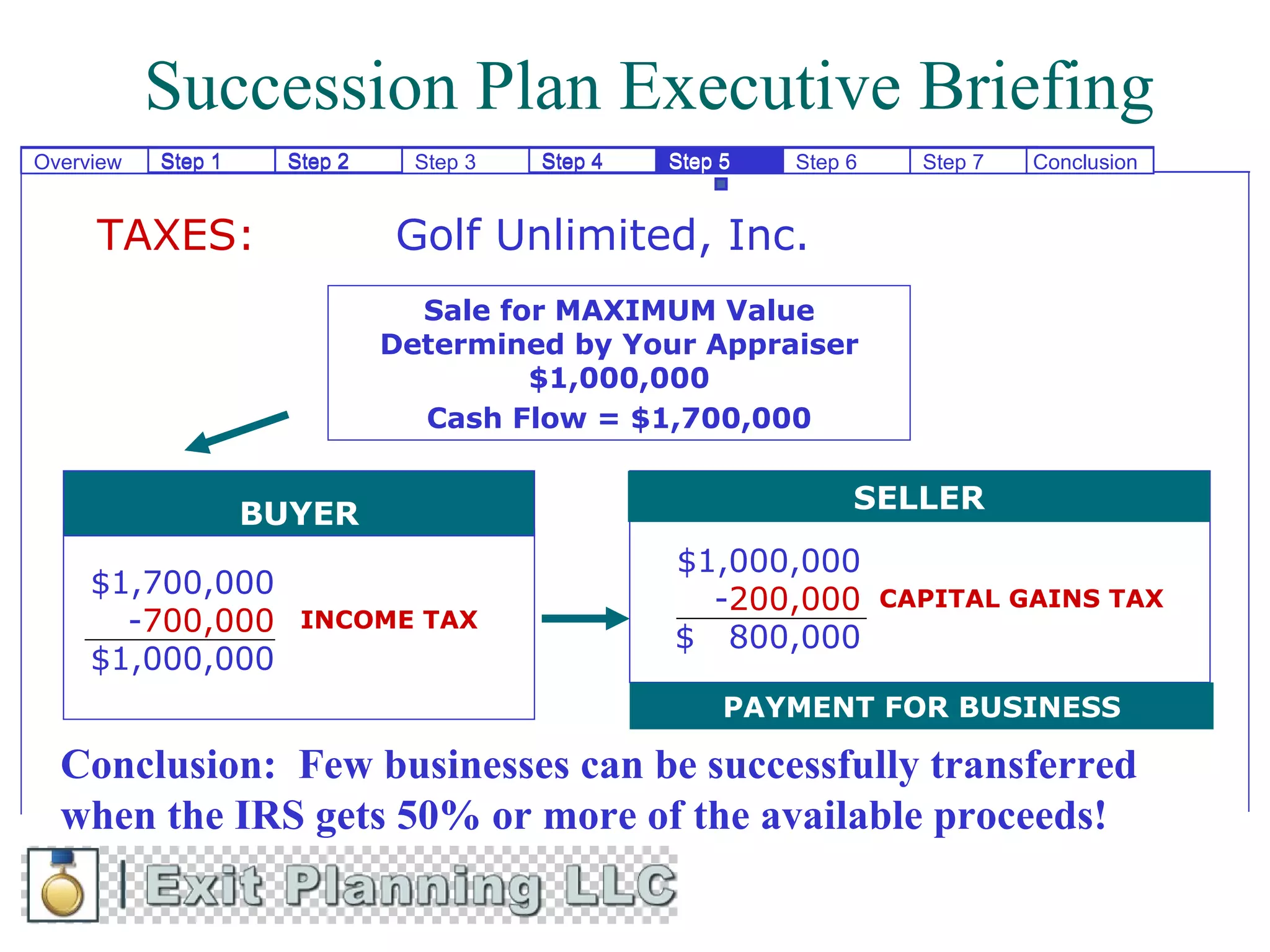

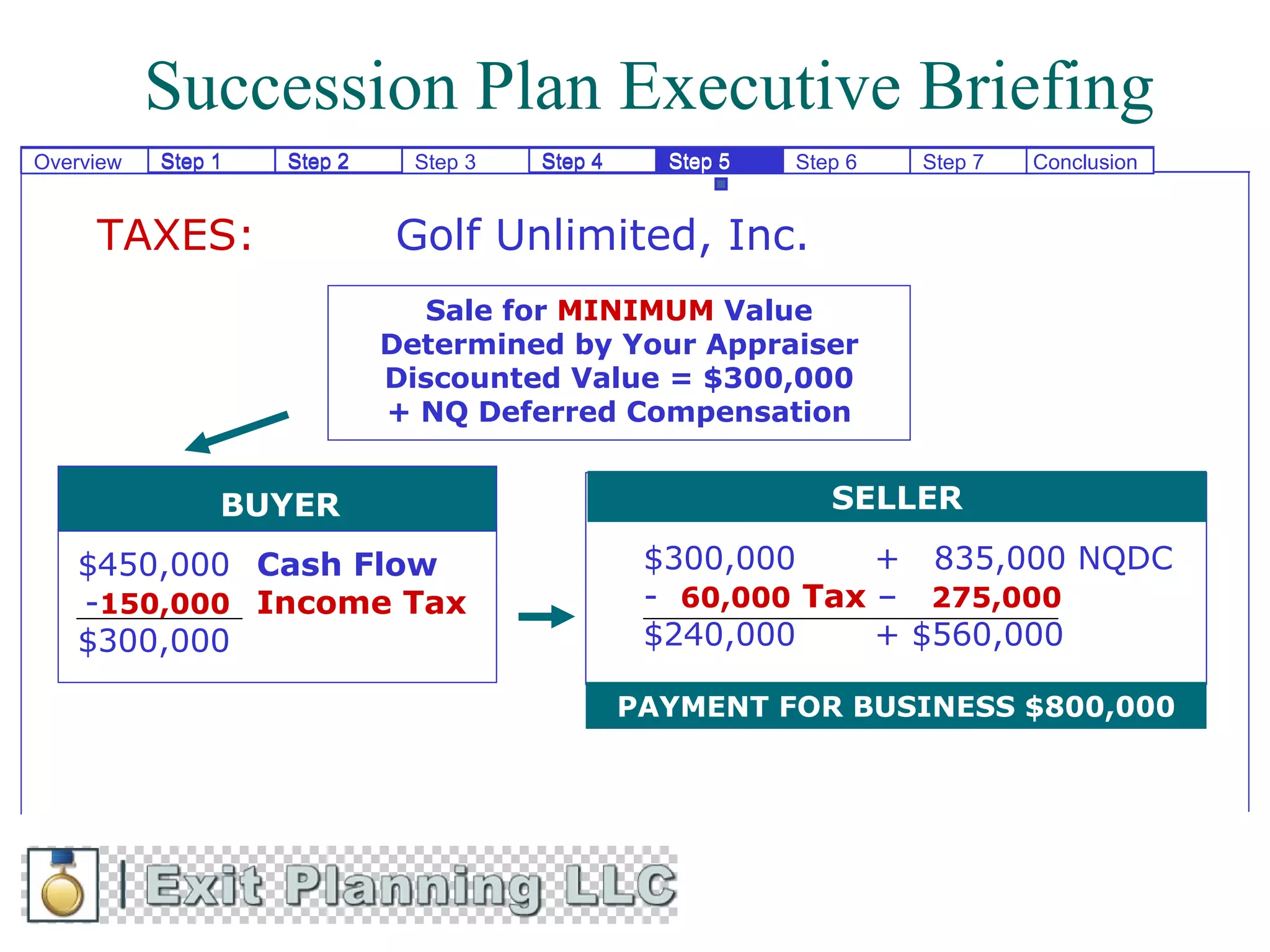

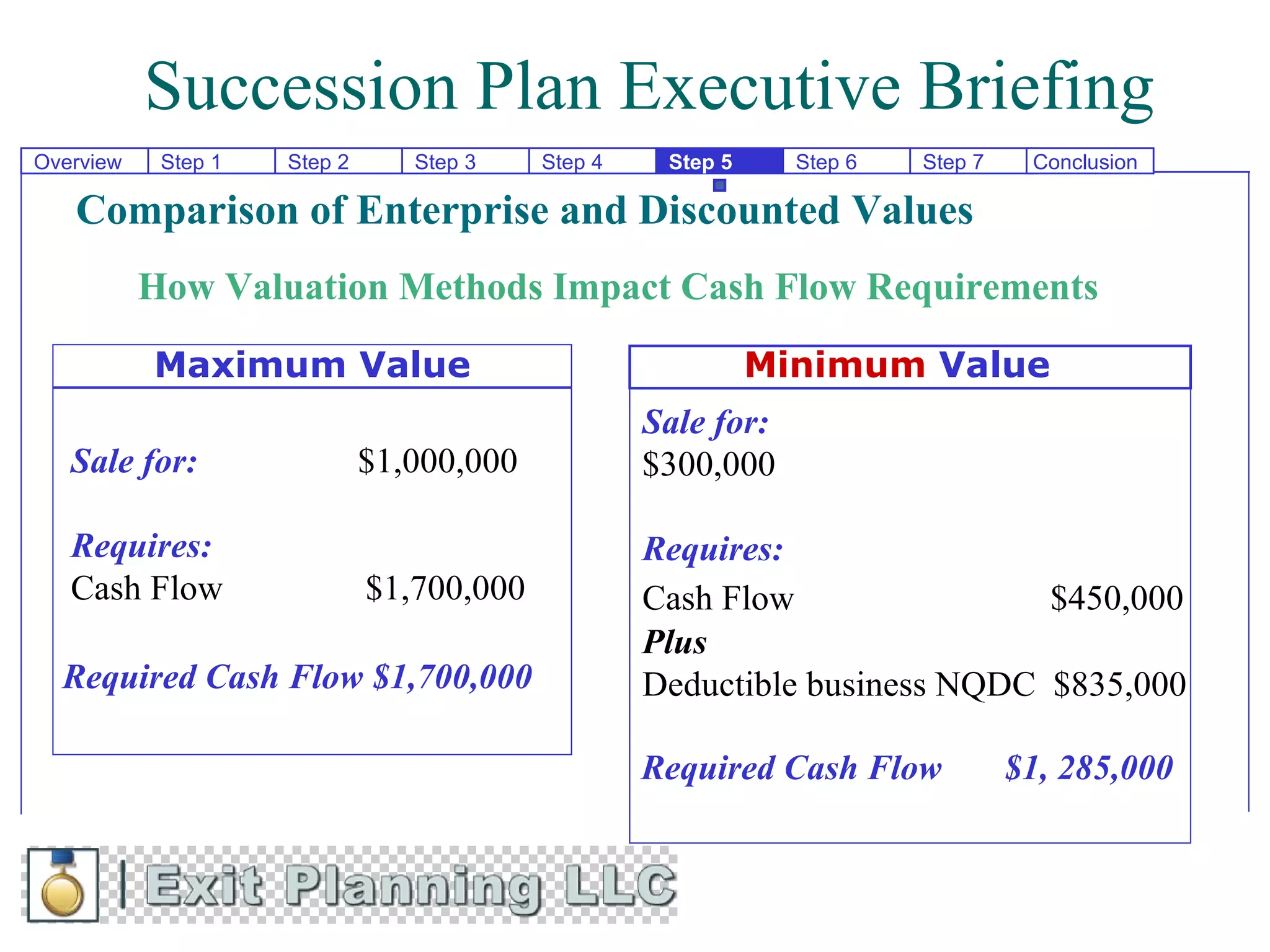

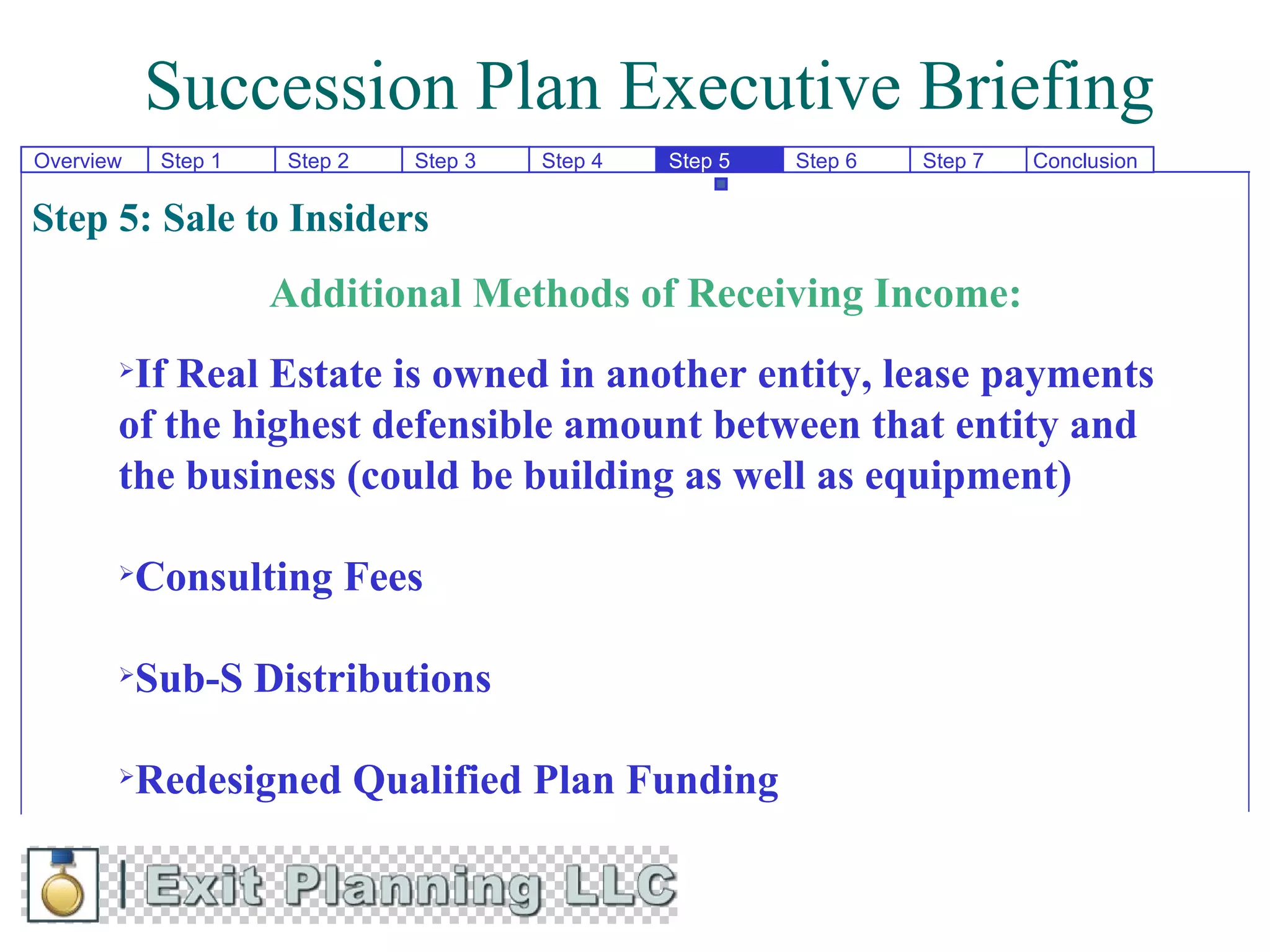

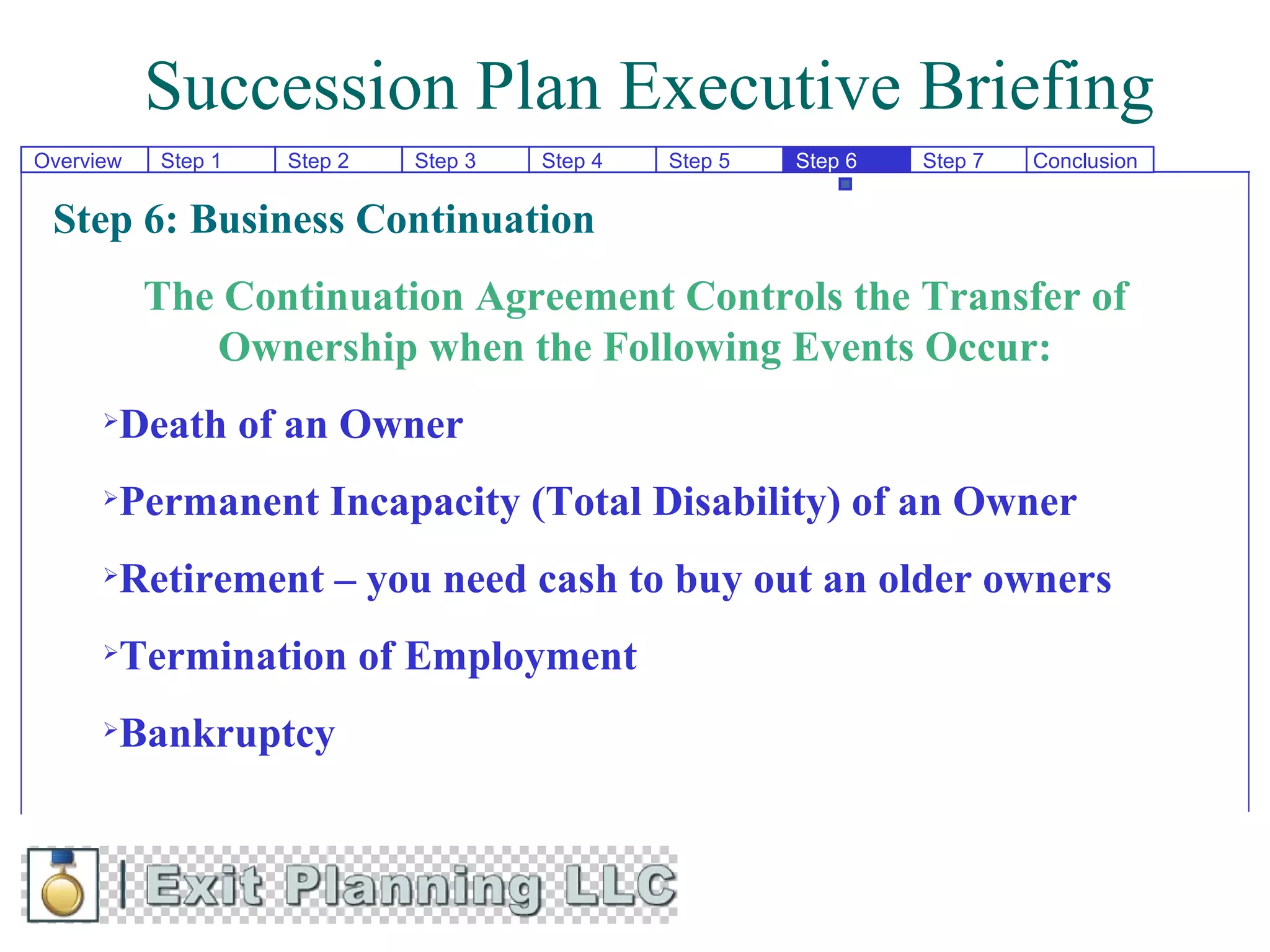

This document provides an overview of a 7-step succession planning process for business owners. It discusses how creating a succession plan can enhance the value of a business when it is sold, either to employees or a third party. The 7 steps include: identifying exit objectives; assessing business and personal finances; maximizing business value; selling to third parties or employees; ensuring business continuation; and planning for personal wealth and estate issues. Creating a succession plan helps owners meet financial goals through tax planning and incentivizing key employees, while allowing for a smooth transition upon the owner's exit.