Report

Share

Download to read offline

Recommended

Recommended

More than Just Lines on a Map: Best Practices for U.S Bike Routes

This session highlights best practices and lessons learned for U.S. Bike Route System designation, as well as how and why these routes should be integrated into bicycle planning at the local and regional level.

Presenters:

Presenter: Kevin Luecke Toole Design Group

Co-Presenter: Virginia Sullivan Adventure Cycling AssociationMore than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike RoutesProject for Public Spaces & National Center for Biking and Walking

More Related Content

Featured

More than Just Lines on a Map: Best Practices for U.S Bike Routes

This session highlights best practices and lessons learned for U.S. Bike Route System designation, as well as how and why these routes should be integrated into bicycle planning at the local and regional level.

Presenters:

Presenter: Kevin Luecke Toole Design Group

Co-Presenter: Virginia Sullivan Adventure Cycling AssociationMore than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike RoutesProject for Public Spaces & National Center for Biking and Walking

Featured (20)

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

AI Trends in Creative Operations 2024 by Artwork Flow.pdf

Content Methodology: A Best Practices Report (Webinar)

Content Methodology: A Best Practices Report (Webinar)

How to Prepare For a Successful Job Search for 2024

How to Prepare For a Successful Job Search for 2024

Social Media Marketing Trends 2024 // The Global Indie Insights

Social Media Marketing Trends 2024 // The Global Indie Insights

Trends In Paid Search: Navigating The Digital Landscape In 2024

Trends In Paid Search: Navigating The Digital Landscape In 2024

5 Public speaking tips from TED - Visualized summary

5 Public speaking tips from TED - Visualized summary

Google's Just Not That Into You: Understanding Core Updates & Search Intent

Google's Just Not That Into You: Understanding Core Updates & Search Intent

The six step guide to practical project management

The six step guide to practical project management

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Beginners Guide to TikTok for Search - Rachel Pearson - We are Tilt __ Bright...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

Unlocking the Power of ChatGPT and AI in Testing - A Real-World Look, present...

More than Just Lines on a Map: Best Practices for U.S Bike Routes

More than Just Lines on a Map: Best Practices for U.S Bike Routes

Where Is Construction Headed Globally In 2011

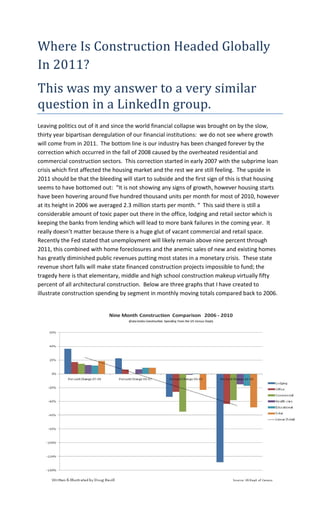

- 1. Where Is Construction Headed Globally In 2011? This was my answer to a very similar question in a LinkedIn group. Leaving politics out of it and since the world financial collapse was brought on by the slow, thirty year bipartisan deregulation of our financial institutions: we do not see where growth will come from in 2011. The bottom line is our industry has been changed forever by the correction which occurred in the fall of 2008 caused by the overheated residential and commercial construction sectors. This correction started in early 2007 with the subprime loan crisis which first affected the housing market and the rest we are still feeling. The upside in 2011 should be that the bleeding will start to subside and the first sign of this is that housing seems to have bottomed out: “It is not showing any signs of growth, however housing starts have been hovering around five hundred thousand units per month for most of 2010, however at its height in 2006 we averaged 2.3 million starts per month. “ This said there is still a considerable amount of toxic paper out there in the office, lodging and retail sector which is keeping the banks from lending which will lead to more bank failures in the coming year. It really doesn’t matter because there is a huge glut of vacant commercial and retail space. Recently the Fed stated that unemployment will likely remain above nine percent through 2011, this combined with home foreclosures and the anemic sales of new and existing homes has greatly diminished public revenues putting most states in a monetary crisis. These state revenue short falls will make state financed construction projects impossible to fund; the tragedy here is that elementary, middle and high school construction makeup virtually fifty percent of all architectural construction. Below are three graphs that I have created to illustrate construction spending by segment in monthly moving totals compared back to 2006.

- 3. Foreign opportunities: Without getting specific, areas in the Pacific Rim especially China are going to grow in varying markets: For the past ten years China has experienced an explosion in high rise and other residential construction which has led to an increasing need to beef up transportation and other miscellaneous infrastructure, we do expect this to continue; it is also our feeling however that China is sitting on a financial bubble due to the drastic undervaluation of it currency. Except for the foreign currency issue, the same can be said for India as it continues to put a stake in the ground as the world’s new emerging economy. There is a considerable amount of high rise residential construction, mixed with institutional and infrastructure expansion, as its new middle class emerges. As it relates to the Middle East, specifically Qatar, Saudi Arabia, Egypt and the Emirates; there will continue to be a growing number of institutional, multi residential, commercial and infrastructural projects; the only exception would be Dubai. We have all seen the news regarding the European economy; with exception of Germany they are experiencing to some degree similar economic pressures as the US. The growing austerity programs in the UE and Great Britain related to large domestic debt will continue to stifle institutional construction and hamper overall economic growth. Please free to contact me with any questions or comments. (Written & Illustrated by Doug Bevill; Construction Economics & Strategies) dbevill@con-econ.com www.con-econ.com Phone: 314-422-3177 Dated: 12/30/2010