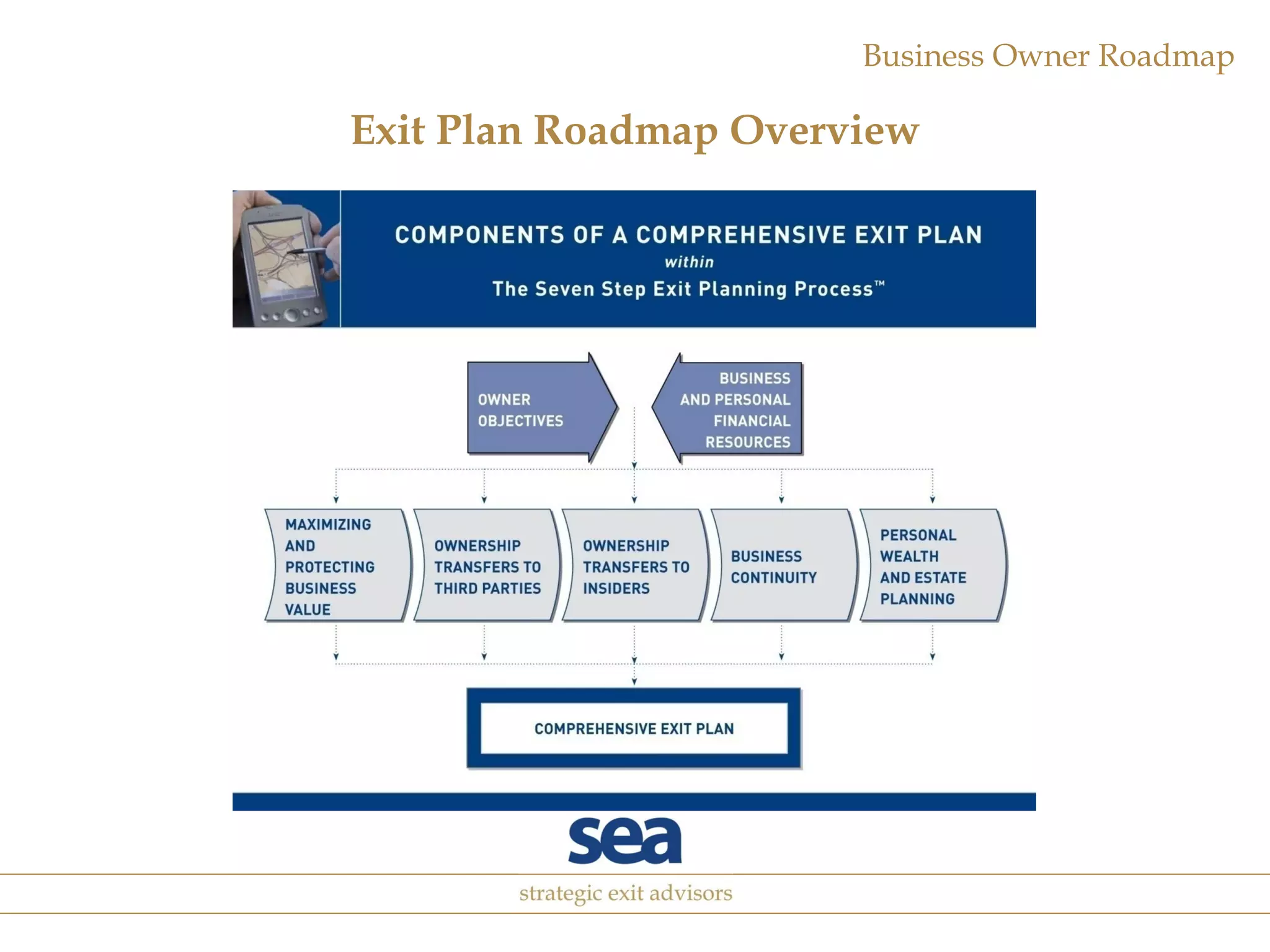

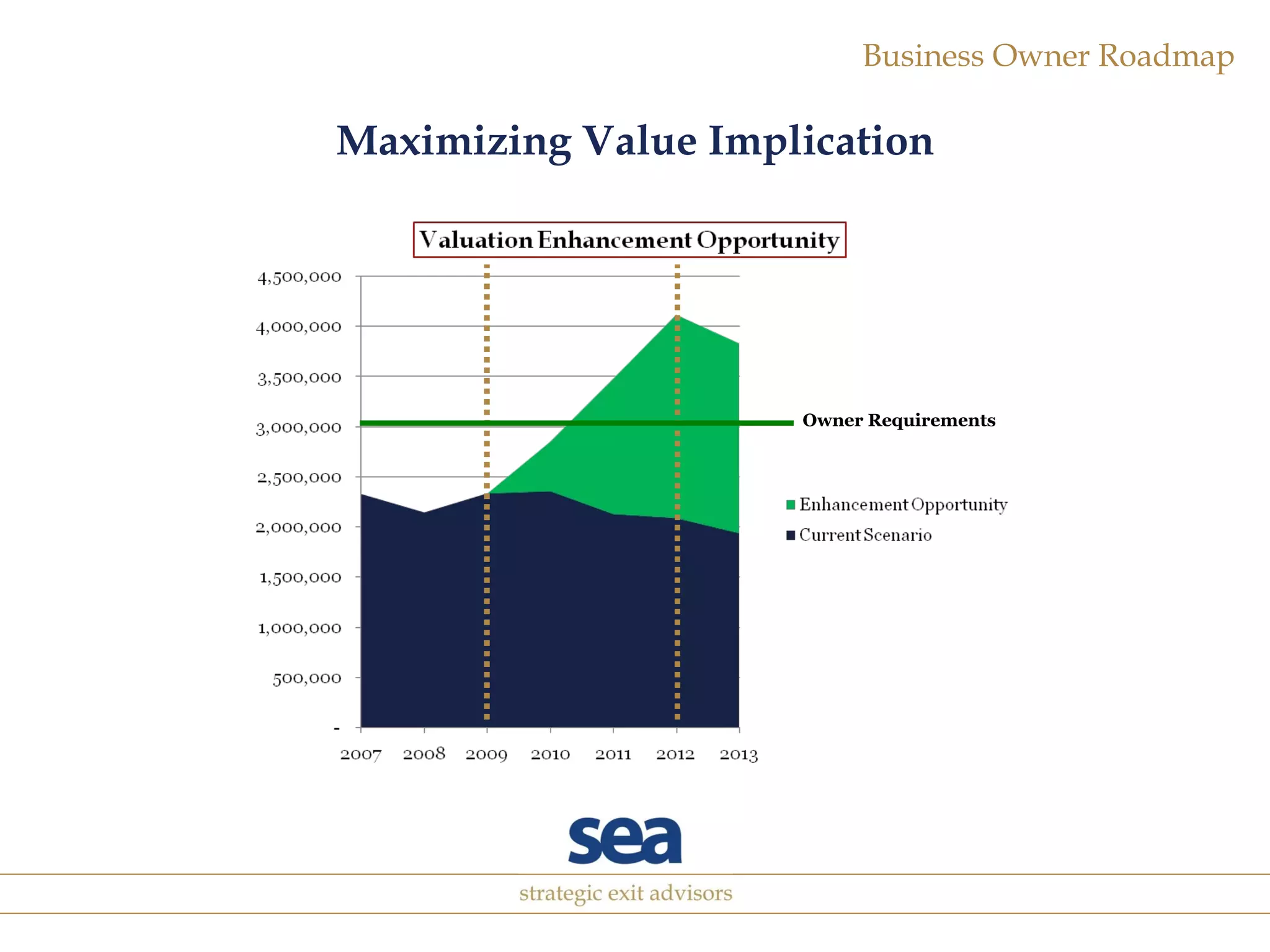

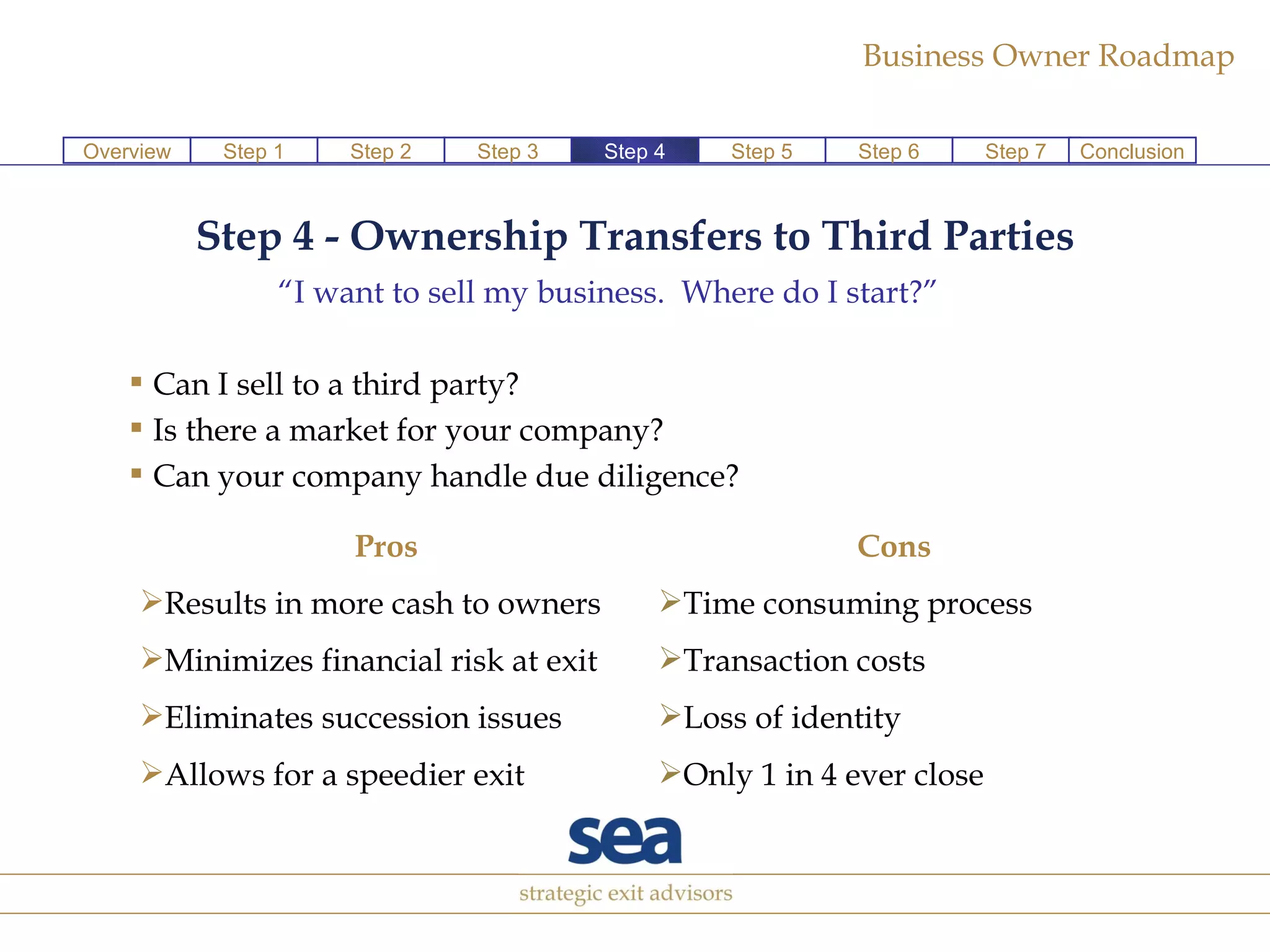

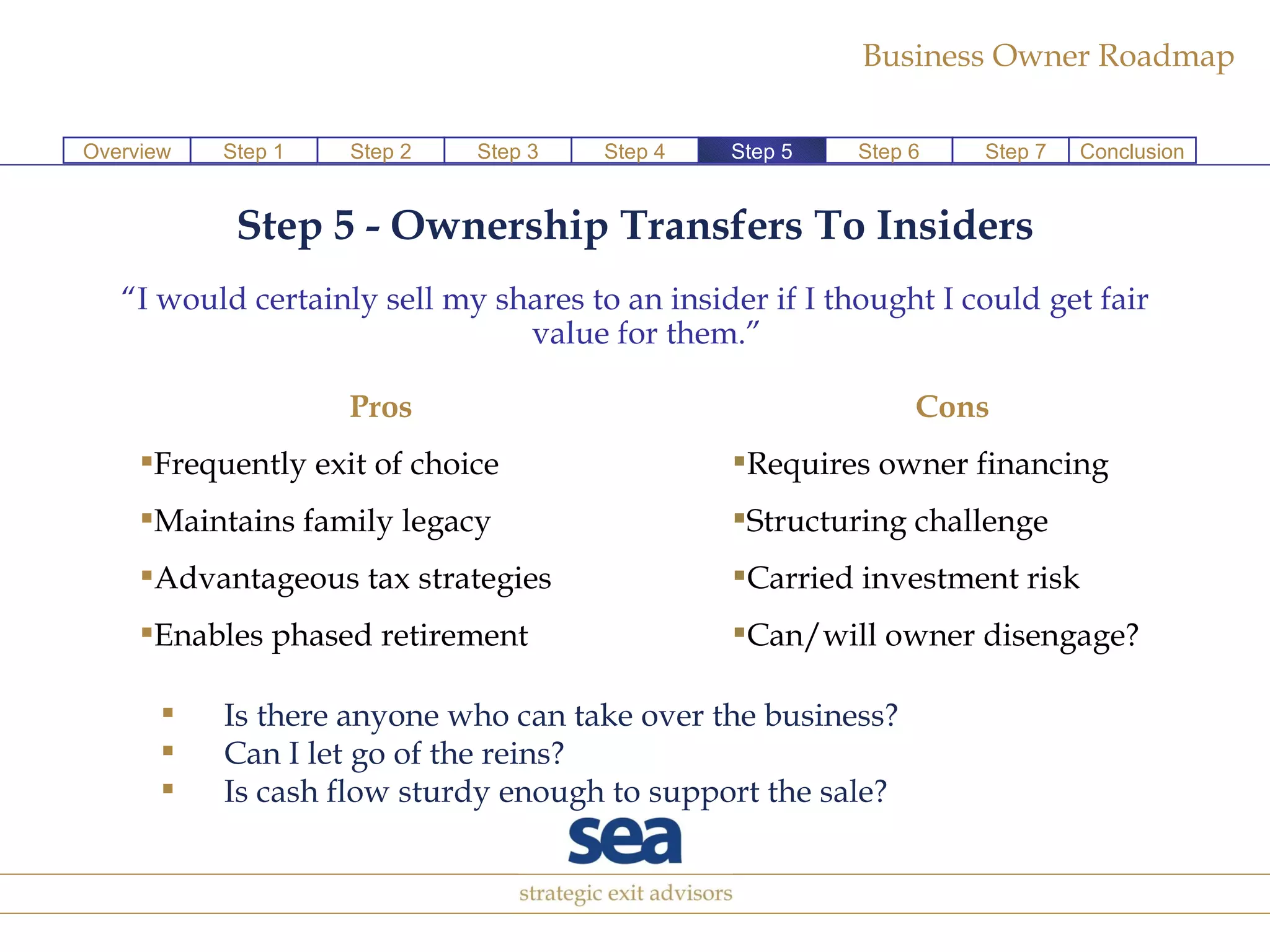

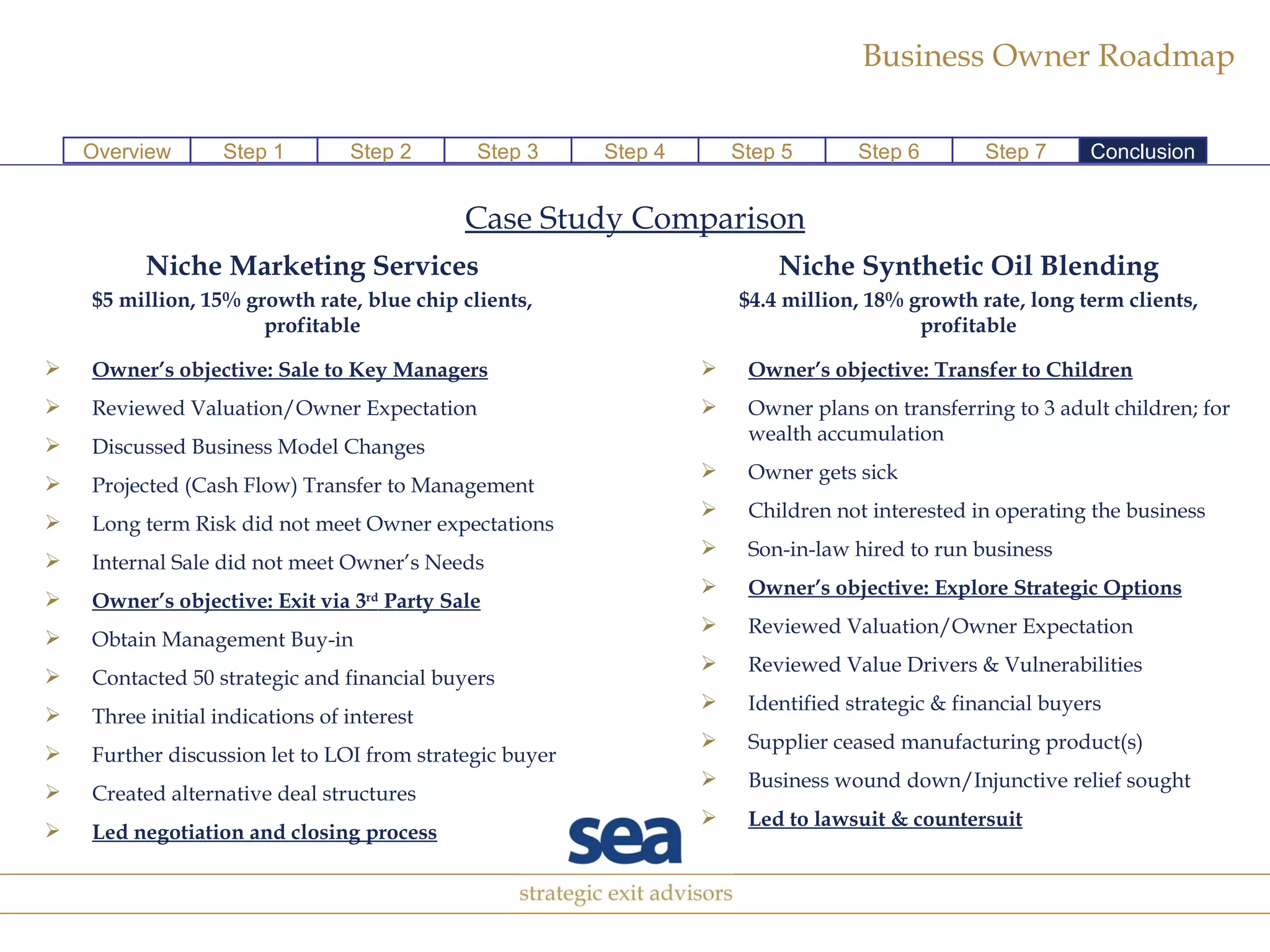

The document outlines a comprehensive exit planning roadmap for business owners aiming to achieve ownership goals, emphasizing a seven-step process that aligns personal financial objectives with business value. Key considerations include identifying personal and business financial resources, maximizing business value, and planning for ownership transfers, whether to insiders or through third-party sales. The document also highlights the importance of continuity and personal wealth planning, with case studies illustrating various exit strategies.

![The SEA Team Curt A. Cyliax is the co-founder and managing partner of SEA and a Certified Public Accountant. He is a veteran transaction advisor whose exit planning and transaction experience includes working with business owners in the manufacturing, distribution, and educational sectors. He is a member of the Business Enterprise Institute and speaks frequently about exit planning and private company ownership. cacyliax@se-adv.com Robert W. Waring is a partner in SEA and a Certified Public Accountant. Rob has more than 18 years of financial experience in both public accounting and senior financial management roles. His experience is primarily with high-growth businesses in the pharmaceutical, chemicals and consumer products industries and includes responsibilities for acquisitions and divestitures as well as corporate finance work. rwwaring@se-adv.com Christopher M. Suhy is a partner in SEA and a Licensed Realtor. Chris is a GRI with more than 20 years real estate experience. His prior senior management experience is in the hospitality industry. He is a business intermediary whose transaction experience includes working with business owners in the education, distribution and retail sectors. [email_address] Craig O. Allsopp is the co-founder of SEA and a Certified Business Intermediary. coallsopp@se-adv.com](https://image.slidesharecdn.com/2009ExitPlanningOverviewFinal-123677766629-phpapp01/75/2009-Exit-Planning-Overview-Final-17-2048.jpg)