Moving Financial Planning and Analysis to the Next Level

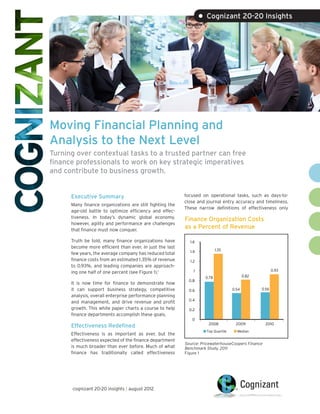

- 1. • Cognizant 20-20 Insights Moving Financial Planning and Analysis to the Next Level Turning over contextual tasks to a trusted partner can free finance professionals to work on key strategic imperatives and contribute to business growth. Executive Summary focused on operational tasks, such as days-to- close and journal entry accuracy and timeliness. Many finance organizations are still fighting the These narrow definitions of effectiveness only age-old battle to optimize efficiency and effec- tiveness. In today’s dynamic global economy, Finance Organization Costs however, agility and performance are challenges that finance must now conquer. as a Percent of Revenue Truth be told, many finance organizations have 1.6 become more efficient than ever. In just the last 1.4 1.35 few years, the average company has reduced total finance costs from an estimated 1.35% of revenue 1.2 to 0.93%, and leading companies are approach- 1 0.93 ing one half of one percent (see Figure 1).1 0.78 0.82 0.8 It is now time for finance to demonstrate how it can support business strategy, competitive 0.6 0.54 0.56 analysis, overall enterprise performance planning 0.4 and management, and drive revenue and profit growth. This white paper charts a course to help 0.2 finance departments accomplish these goals. 0 2008 2009 2010 Effectiveness Redefined Top Quartile Median Effectiveness is as important as ever, but the effectiveness expected of the finance department Source: PricewaterhouseCoopers Finance is much broader than ever before. Much of what Benchmark Study, 2011 finance has traditionally called effectiveness Figure 1 cognizant 20-20 insights | august 2012

- 2. indirectly translate to true business outcome Leading FP&A organizations2 are moving beyond effectiveness. their historic scope of supporting a narrow set of financial measures and are expanding to Today’s enterprise must respond to a host of accommodate broad enterprise performance new challenges and opportunities. The most management needs, such as business perfor- disruptive challenges facing enterprises today mance reporting and analysis, profits forecasting, are the increases in volatility and the emergence planning cycles, risk management, operations of a new master IT architecture that we call the analysis and expanded analytics on both internal SMAC stack, comprising integrated social, mobile, and market data. In addition, they are also digging analytics and cloud technologies. The SMAC stack into an expanded scope of detailed line item is changing the way that enterprises engage their expense analysis in an effort to leave “no stone employees, customers and suppliers, from slow, unturned” in their search for immediate expense structured, infrastructure-heavy interactions to reduction opportunities. rapid, infrastructure-light, unstructured and more personalized interactions. What’s Next for Finance Increasing FP&A activities, while shrinking the Increased volatility can be seen, felt and measured overall finance function budget, will require a in many ways, and it demands an increase in large reduction in non-FP&A finance activities, as enterprise agility. It can be measured in unem- well as a more cost-effective way to deliver FP&A. ployment data, GDP data, corporate revenues Finance and accounting outsourcing (FAO) is one and profits, personal incomes, commodity prices, effective way to accomplish the required transfor- consumer sentiment and a long list of other mation while improving agility (see Figure 3, next measures. One example is the S&P 500 stock page). price index, which is a broad measure of the stock market’s price level. One glance at a chart of the All finance transaction processing (e.g., AP, AR, S&P 500 Index shows an unprecedented level of GL, FA) can be outsourced, as well as select volatility over the past dozen years (see Figure 2). compliance activities (e.g., routine statutory filings, audit support). Transaction processing A new set of challenges and opportunities and compliance outsourcing yields significant exist for financial planning and analysis (FP&A) savings (typically 30% to 50%, we have found) groups, thanks to the increased volatility of the as a result of provider scale, consolidation, world’s economies, currencies, stock markets increased automation, process reengineering and and regulatory environments, combined with cost arbitrage from relocating work to lower cost elements of the SMAC stack, such as the prolif- locations. eration of ”big data” and associated analytics. S&P 500 Index: Market Volatility 1.60K 1.40K 1.20K 1.00K 0.80K 0.60K 0.40K 0.20K 0.00K 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Source: Yahoo Finance Graphs Figure 2 cognizant 20-20 insights 2

- 3. Finance Transformation: From Cost Reduction to Profitability Phase IV B Low • Freeing up FP&A resources to partner with businesses to enhance enterprise Phase IV A performance and impact the bottom line. • Offshoring/outsourcing – management reporting, audits, analysis, risk 30-50% management, actuarial analysis, internal consulting, Phase III project management. Time • Offshoring/outsourcing – transaction processes 30%-50% Phase II • Centralization of analytics, budgeting, audit, etc. • Centralization – transaction 10%-15% Phase I processes • Shared services • Process standardization centers onshore • Headcount reduction • Process improvements, 10%-15% Cost Reduction High re-engineering • Technology & automation Figure 3 In addition to cost reduction, FAO provides as well, including scale, technology, cost arbitrage additional process improvements, such as tighter and access to skills. The reduction in expenditure controls from the separation of duties, up-to-date on transaction and compliance work derived from process documentation, more comprehen- outsourcing, combined with selective outsourcing sive metrics reporting, better audit trails and of FP&A work, will enable an expansion of FP&A heightened transparency. activities while shrinking the overall F&A budget. Another significant lever to pull is the outsourc- Leading companies have already started out- ing of portions of FP&A. With 25% of finance’s sourcing FP&A processes, such as balance sheet budget taken up by FP&A,3 there is considerable preparation; competitor analytics (including scope for cost savings. Of course, some portions segmentation and SG&A benchmarking); audit of FP&A should always be kept in-house, such as support and reporting; implementing ABC models assigning a finance leader to each unit to partner for activity-based costing, along with analysis and with the business, explain results, lead the budget reporting; and decision support. These companies process, etc. have also reaped the benefits of FP&A outsourc- ing beyond cost reduction, such as reporting But many other portions of FP&A — such as cycle-time reduction or increased forecasting variance analysis, routine and ad hoc reporting, accuracy or productivity.5 market analysis and various analytical tasks — can be outsourced (see Figure 4, next page). Just The advancement of technology also requires by centralizing common FP&A activities (data FP&A organizations to change. Most ERP and con- gathering, data cleansing and data aggregation), solidation software environments now provide companies can achieve a 30% reduction of FTEs.4 business stakeholders with the ability to drill down and understand finance and accounting data and From our discussions with many finance orga- reasons for variances. Therefore, some of the tra- nizations, we have observed that business ditional value provided by the FP&A team has now analysts typically spend over 50% of their time been automated (see Figure 5, next page). gathering, aggregating and scrubbing data. The use of highly skilled and highly paid business F&A Outsourcing Benefits analysts to perform basic data manipulation is The cost savings from transactional finance and a waste of scarce talent. Outsourcing the data compliance outsourcing can be split between management tasks provides additional benefits reducing the overall cost of finance and funding cognizant 20-20 insights 3

- 4. To Outsource, Or Not • FP&A Processes Processes Extensively Processes Never Processes Increasingly Outsourced Outsourced Outsourced • Real Estate Management • Budgeting and Financial Planning • Strategic Planning • Internal Audit • Acquisitions & Divestitures • Internal Audit • Accounting/Tax Policies • Financial Analysis • Business Partnering • Project Management • Expense/Revenue Allocations • Performance Measurements • Multi-dimensional Reporting • Analytics • Risk Management • Actuarial Analysis • Financial Consolidations • BU Financial Statements • Statement Prep • SEC Filings • GAAP Adjustments • Trial Balance Analysis • SOX Planning • Finance Change Management • Tracking Competitor Financial Performance Figure 4 the expansion of FP&A into expanded business Example 1: Fleet partnering, enterprise performance management Many companies provide vehicles to employees, and expanded line-item expense analysis. The primarily the sales force. While policies and increased analysis of line-item expenses, although procedures exist to monitor and control costs, a tactical initiative, helps make FP&A a self-fund- fleet management becomes a challenge for a ing operation. large diversified organization with multiple locations. Fleet cost is a one- or two-line item The expansion of line-item expense analysis helps on a company’s P&L. While this is not a material companies focus on expense lines they normally cost and is not significant for a drill-down would not consider. Companies can expect to save review, a detailed analysis of fleet costs of between 5% and 10% of the costs of these newly major corporations, in our experience, provides analyzed cost elements, performing the analysis an opportunity to reduce costs by taking a either in-house or through an external provider. FP&A: Old and New Traditional View The New World Back-office function. Revenue generating/self-financing function. Provide insights into business. Finance business partners, provide insights and help drive decisions and compliance. Fragmented across various departments/ Consolidated/centralized function with ability to drive divisions of the company. standardization and leverage best practices. No significant role in policy decision-making. Ability to influence policy and change by providing insights on business impact. Compliance with policies and established Provide visibility into non-compliance with policies and practices not a major focus area. established practices. 50% to 60% of the individual analyst’s time 70% to 80% of time spent on understanding data, trends spent on data gathering and cleansing. and variances. Figure 5 cognizant 20-20 insights 4

- 5. structured approach. Such an approach would • Example 2: Travel and Expense include the following: Most companies have well-established travel >> Compare the fleet cost line items with the and expense (T&E) policies and approval limits, headcount report from HR. including arrangements to audit expenses on a random sample basis. T&E is a significant cost >> Ensure that only active employees have ve- item for almost every company. hicles assigned to them. >> Check whether the employee is entitled to a FP&A can provide insights into T&E expense and company car and is in accordance with the help drive down cost by doing the following: policy. >> Provide visibility into line-level details (com- >> Send an e-mail to all supervisors of inactive mon BI tools, sub-ledger-level analysis, etc.). employees and reconfirm if the employee has left the organization. >> Partner with the operations team. >> Send an e-mail to all employees with mul- >> Identify potential cost reduction areas tiple vehicles or those who are not in com- (e.g., airfare, hotel, phone). pliance with the policy and seek an explana- >> Publish a dashboard to provide details of all tion. travel not in compliance with policy. >> Send a list of all inactive employees or The Bottom Line those not in compliance, along with the vehicle numbers, to the fleet manager to While FP&A outsourcing and refocusing provides ensure vehicles are returned to the leasing almost immediate cost reduction results, the true company and confirmation is obtained. benefit is the ability to increase efforts to support the company’s top-line and bottom-line growth. Taking these steps will not only ensure that the charges are accurate but will also help to FP&A outsourcing helps free highly skilled profes- accurately attribute the cost to the correct cost sionals from doing routine work to spend more center or company code if the employee has time partnering with the business to manage been transferred to another location or group and execute strategy. This expands the scope of company. FP&A groups from traditional financial planning and analysis to true enterprise performance management. Footnotes 1 “Drifting or Driving? Finance Effectiveness Benchmark Study 2011,” PricewaterhouseCoopers, 2011. 2 Examples include Boeing and BBC (Source: “Finance Strategy: Delivering the Partnering Role,” IBM.) 3 “Developing a Center of Excellence (CoE) for Financial Planning and Analysis,” Deloitte, 2011. 4 Beyond Concierge: Transforming the FP&A Operating Model,” Deloitte, 2009. 5 “Financial Planning & Analysis: The Next Frontier of Business Process Outsourcing?” Deloitte, 2010. cognizant 20-20 insights 5

- 6. About the Authors Paul Nowacki, CFA, is Leader of Finance & Accounting, Transformation Consulting, within Cognizant’s Business Process Services Group. In this role, Paul oversees all F&A consulting activities. He also serves as a thought leader in F&A and helps identify market trends and shape new Cognizant offerings. He is a frequent conference and webinar speaker and author of numerous articles and whitepapers on various finance and accounting topics. By combining his industry experience in IT and finance leadership roles with a background in transformational consulting, Paul looks holistically at finance and accounting orga- nizations and blends process and systems with organizational design perspectives. He has a B.S. in quan- titative business analysis and an MBA, with a concentration in operations research. Paul also holds the Chartered Financial Analyst professional designation. He can be reached at Paul.Nowacki@cognizant.com. Mathew George is a Solutions Leader within the Finance & Accounting Practice of Cognizant’s Business Process Services Group. In this role, Mathew works closely with clients on strategic finance and accounting deals. He also leads strategic assessments and develops optimal solutions that focus on the redesign and reengineering of critical processes. Moreover, Mathew has led the global consolidation and standardiza- tion of F&A processes across multiple countries and languages, into offshore and near-shore delivery centers. He is a Chartered Accountant, a Certified Public Accountant and a Certified Internal Auditor and holds a certified Six Sigma Green Belt from GE. Mathew can be reached at Mathew-3.George-3@ cognizant.com. About Cognizant Cognizant (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process out- sourcing services, dedicated to helping the world’s leading companies build stronger businesses. Headquartered in Teaneck, New Jersey (U.S.), Cognizant combines a passion for client satisfaction, technology innovation, deep industry and business process expertise, and a global, collaborative workforce that embodies the future of work. With over 50 delivery centers worldwide and approximately 140,500 employees as of March 31, 2012, Cognizant is a member of the NASDAQ-100, the S&P 500, the Forbes Global 2000, and the Fortune 500 and is ranked among the top performing and fastest growing companies in the world. Visit us online at www.cognizant.com or follow us on Twitter: Cognizant. World Headquarters European Headquarters India Operations Headquarters 500 Frank W. Burr Blvd. 1 Kingdom Street #5/535, Old Mahabalipuram Road Teaneck, NJ 07666 USA Paddington Central Okkiyam Pettai, Thoraipakkam Phone: +1 201 801 0233 London W2 6BD Chennai, 600 096 India Fax: +1 201 801 0243 Phone: +44 (0) 20 7297 7600 Phone: +91 (0) 44 4209 6000 Toll Free: +1 888 937 3277 Fax: +44 (0) 20 7121 0102 Fax: +91 (0) 44 4209 6060 Email: inquiry@cognizant.com Email: infouk@cognizant.com Email: inquiryindia@cognizant.com © Copyright 2012, Cognizant. All rights reserved. No part of this document may be reproduced, stored in a retrieval system, transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the express written permission from Cognizant. The information contained herein is subject to change without notice. All other trademarks mentioned herein are the property of their respective owners.