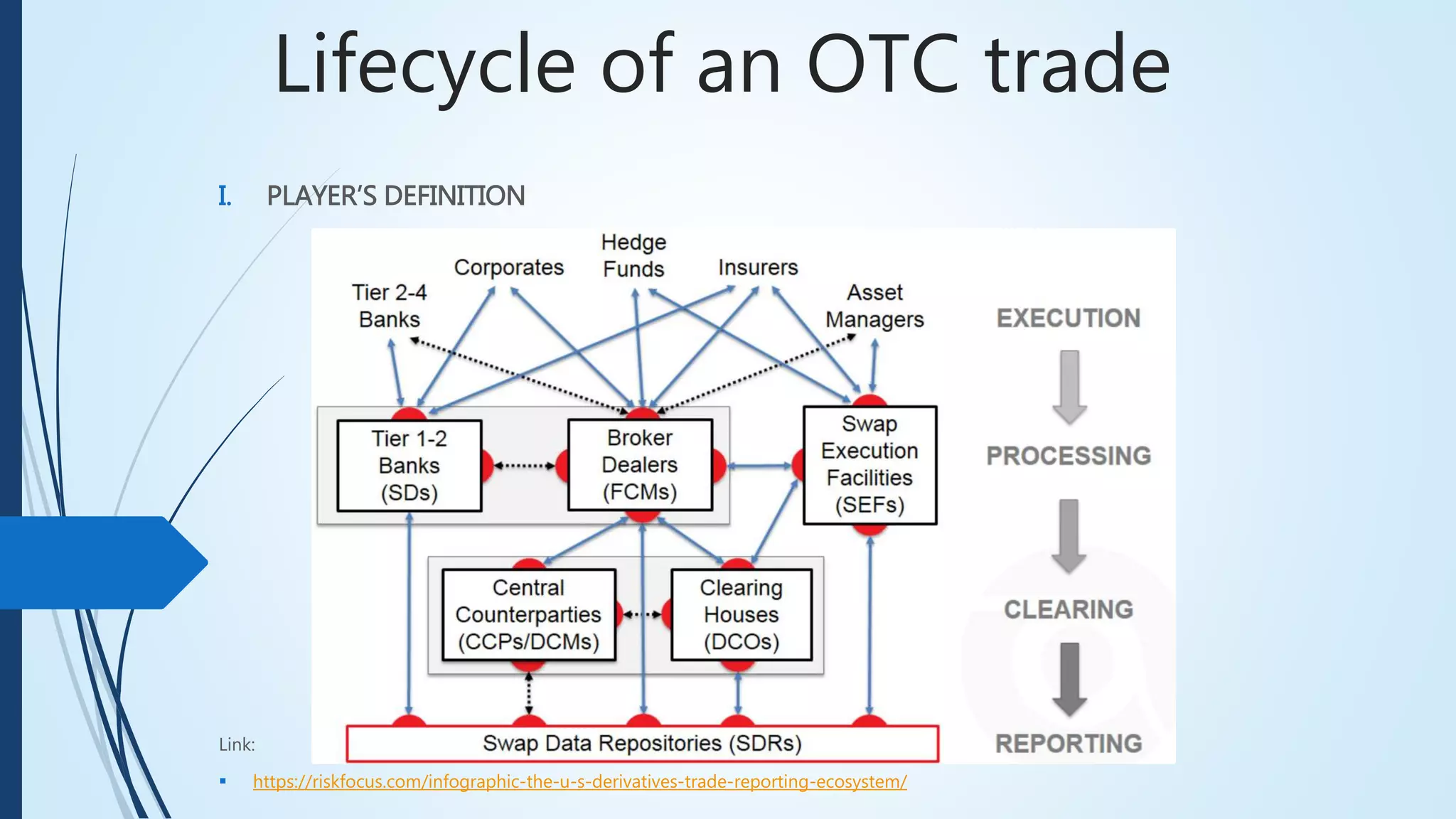

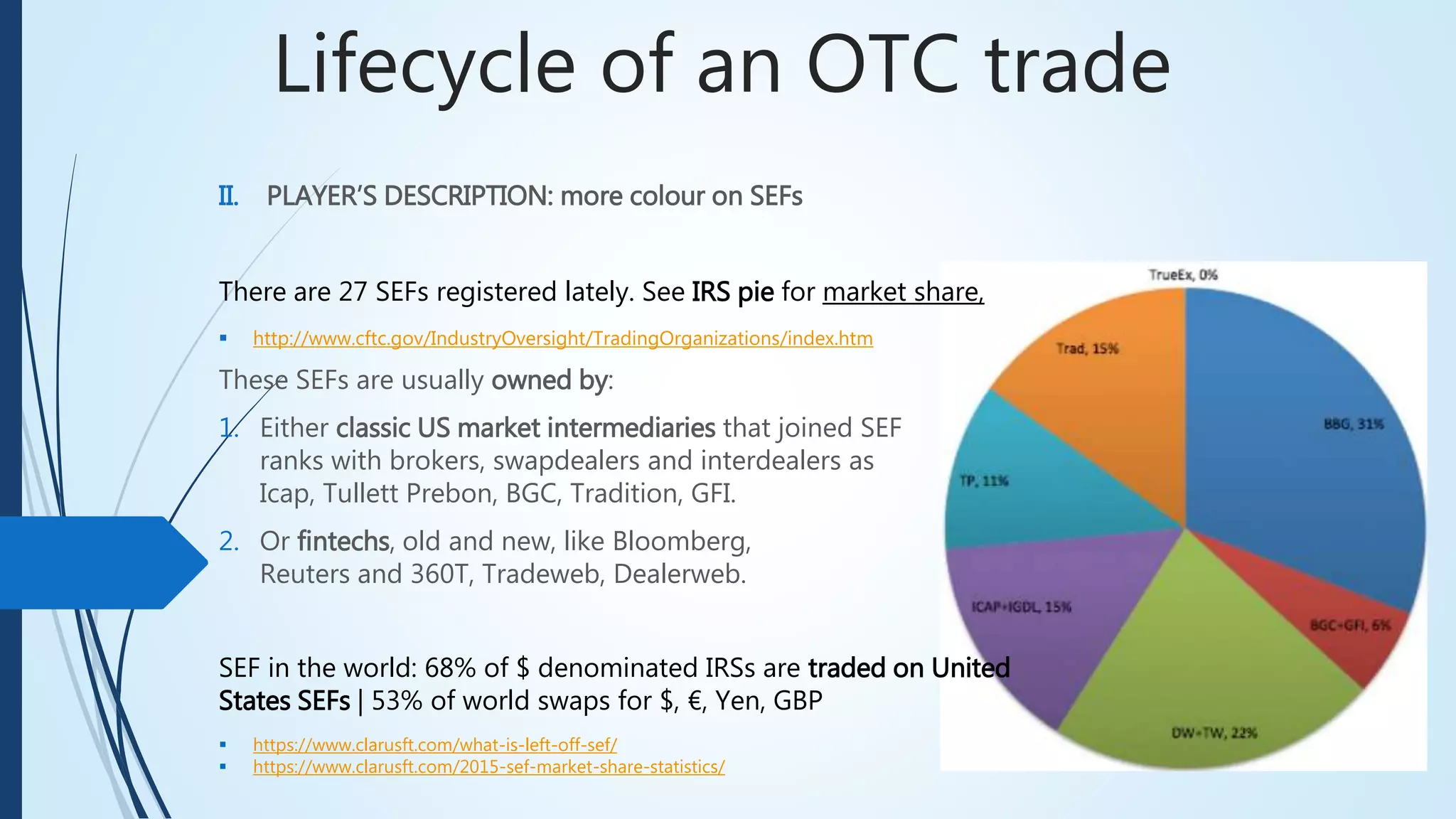

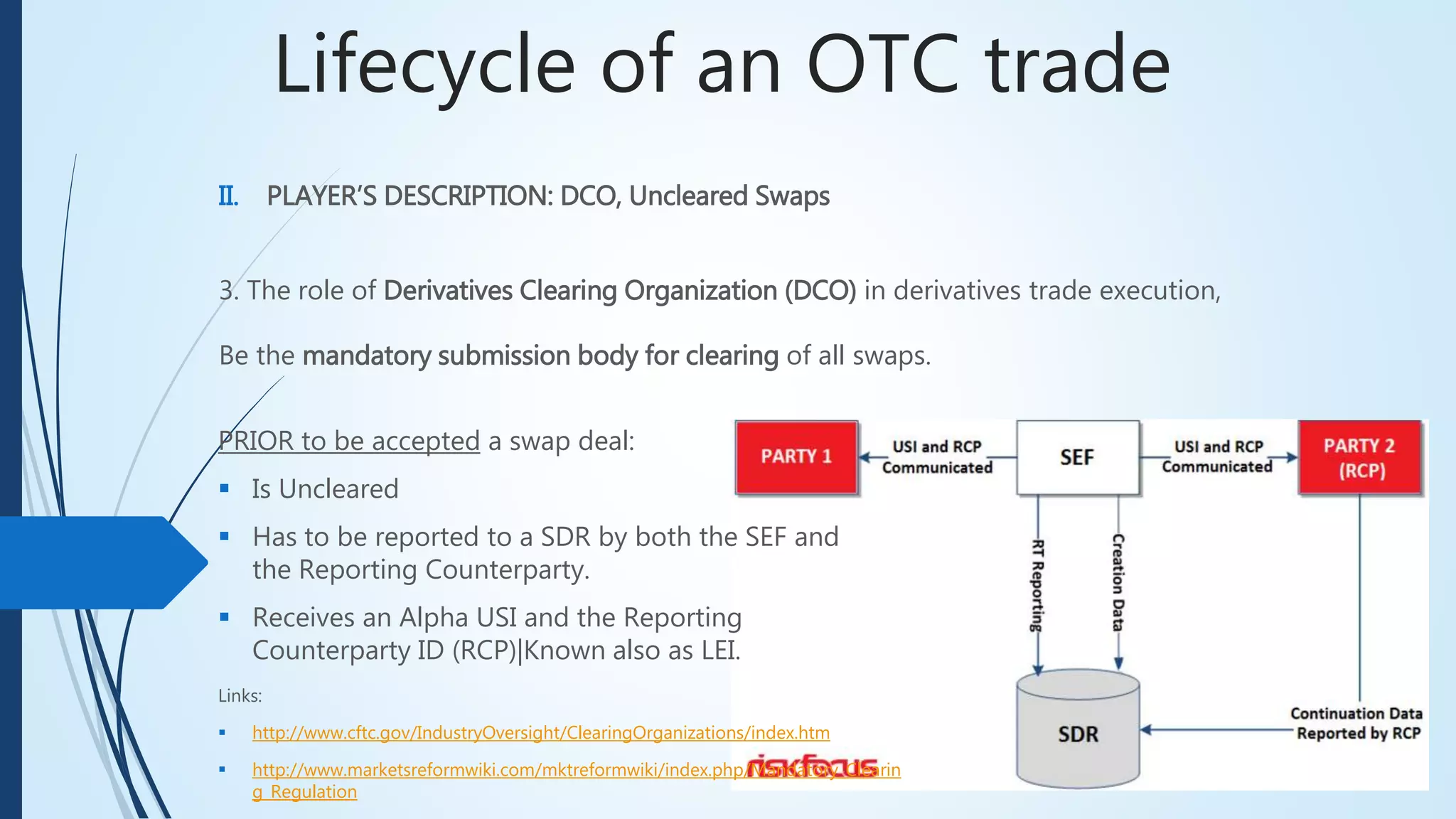

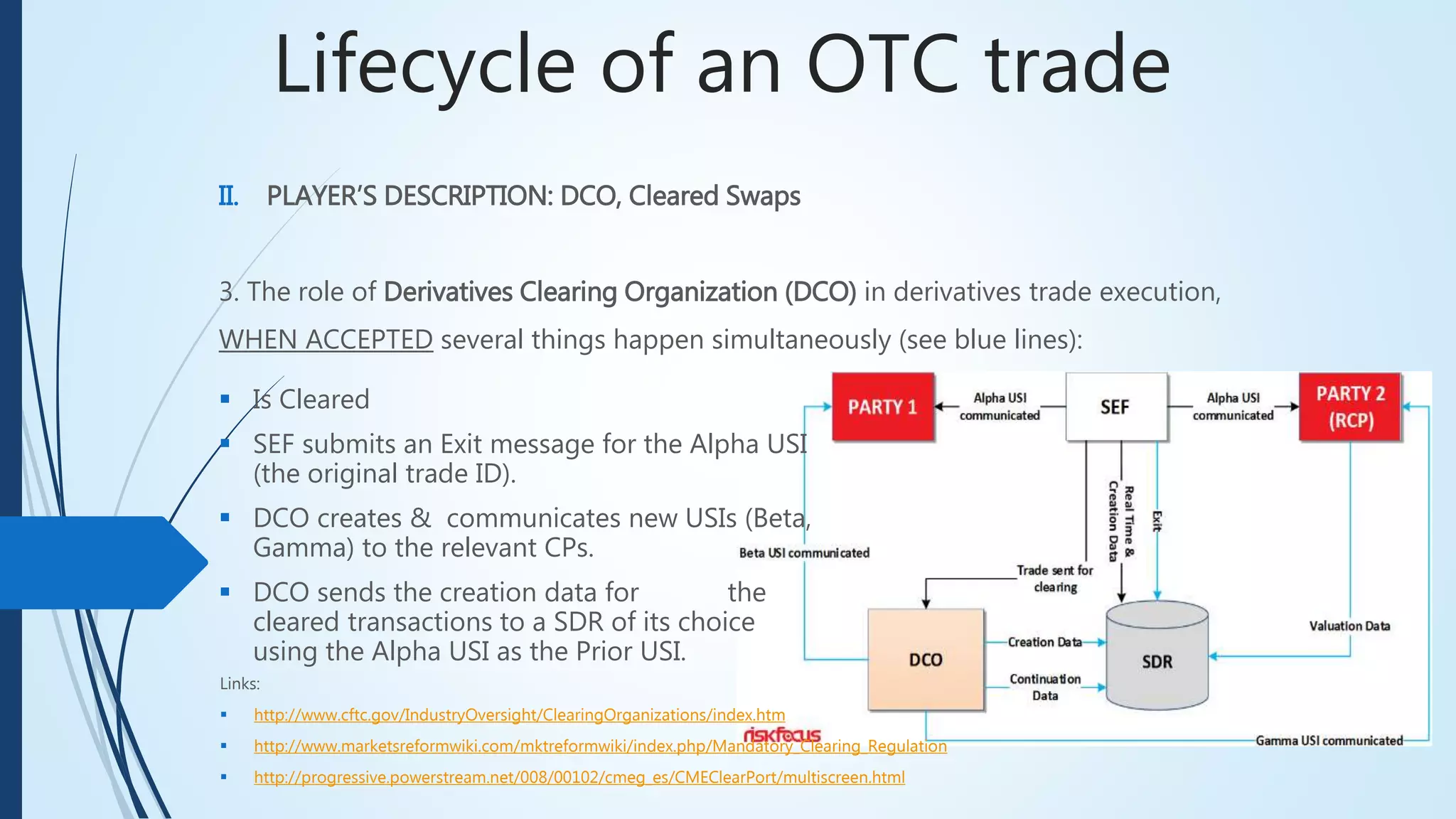

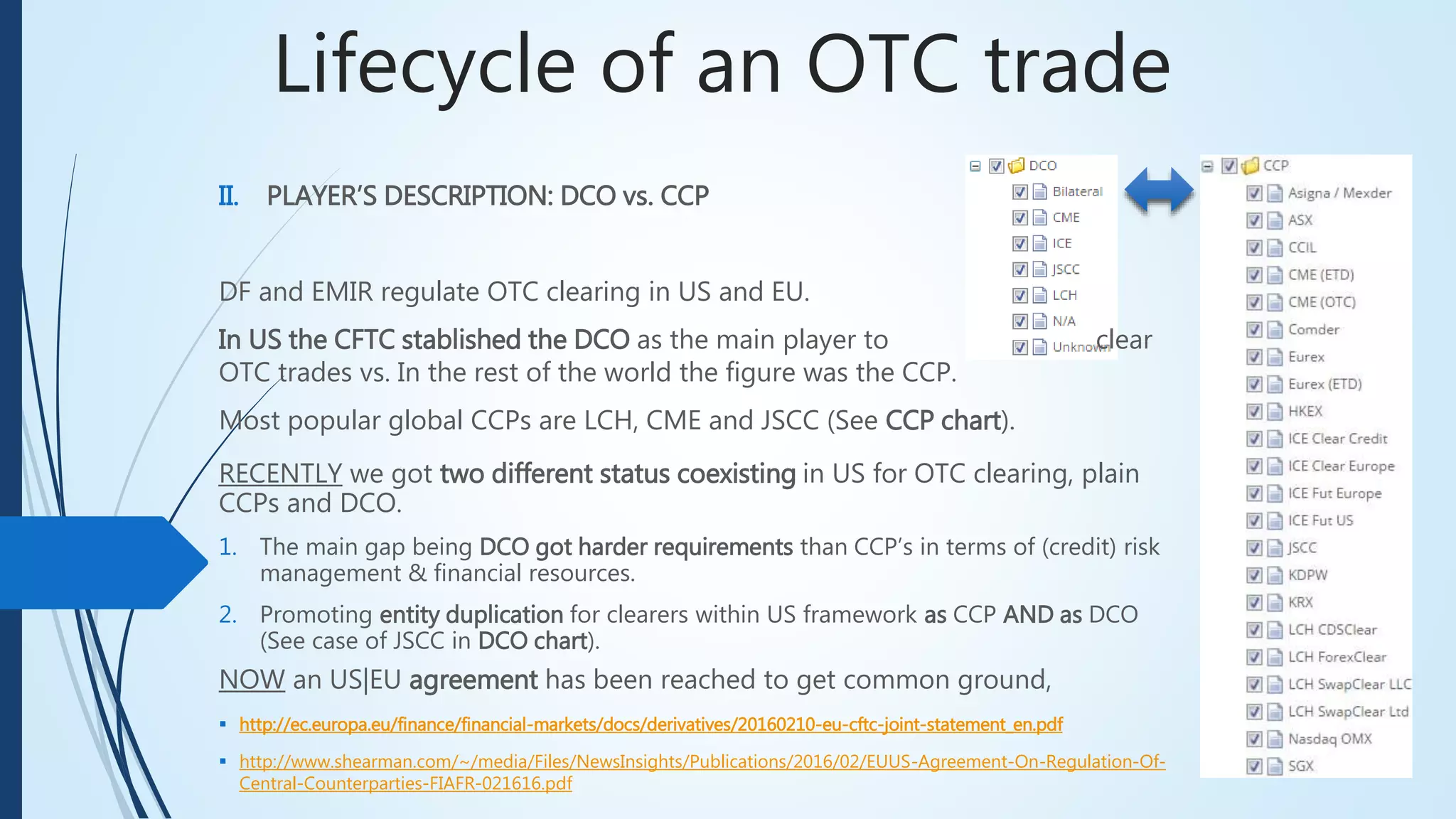

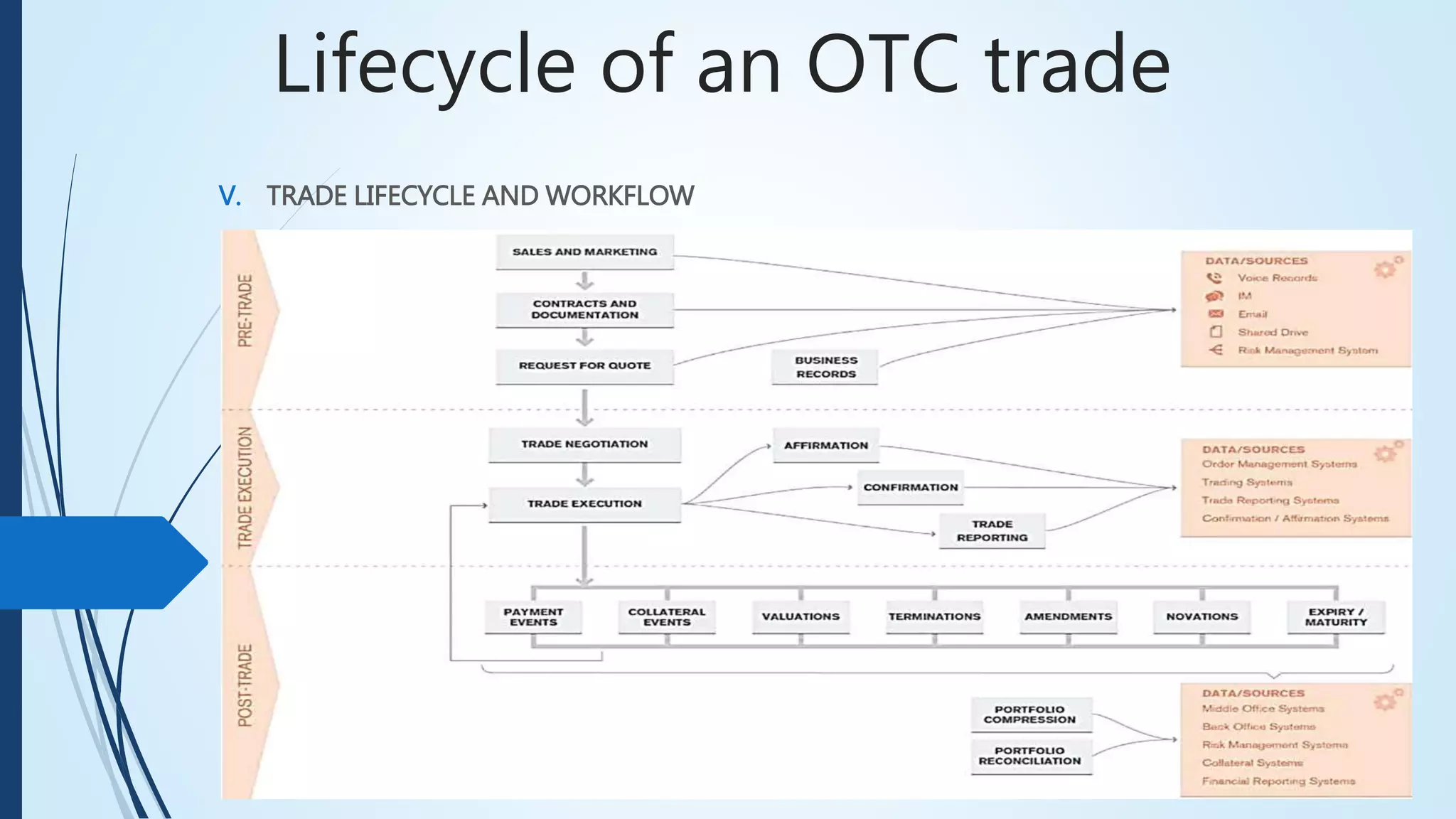

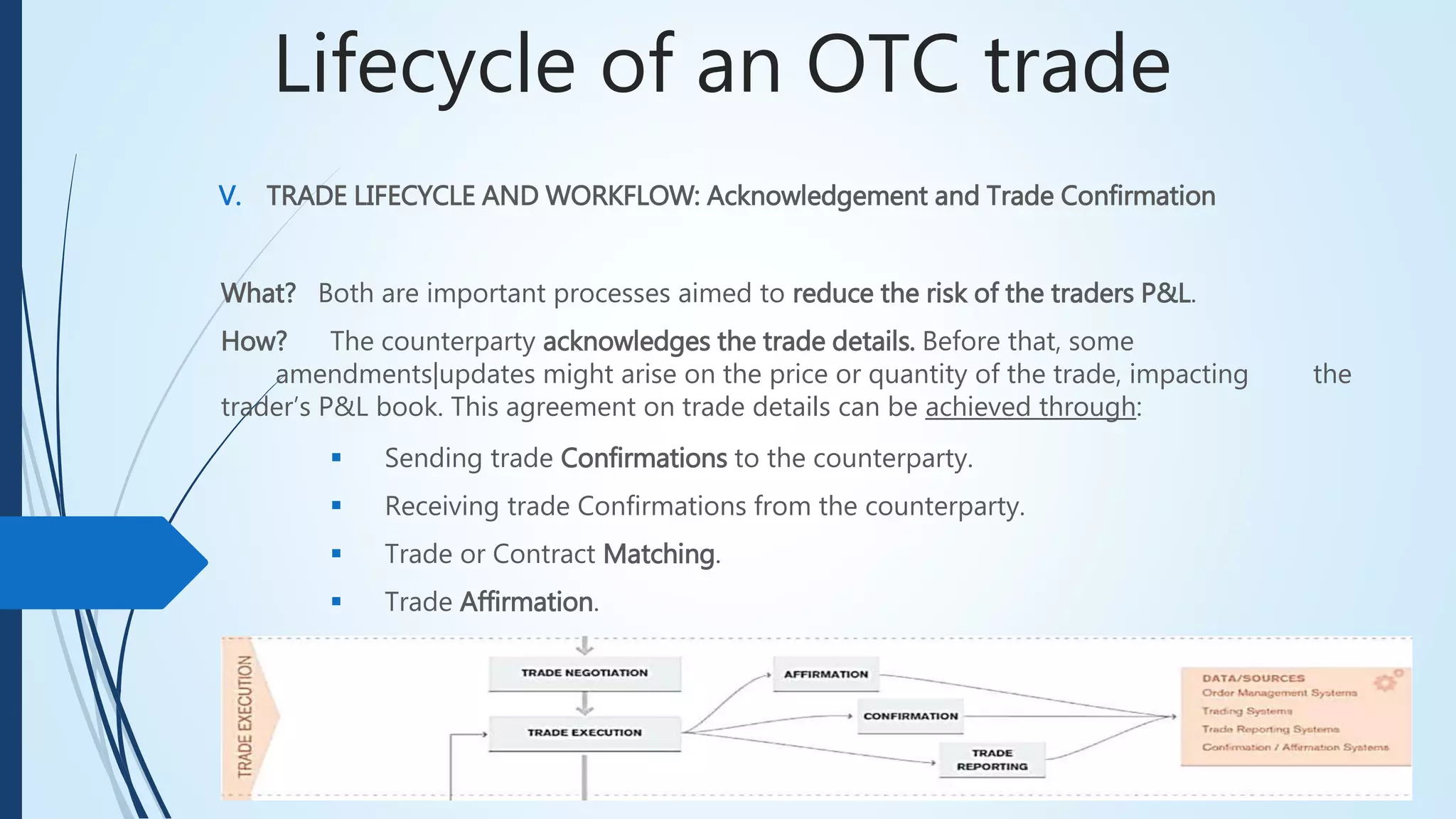

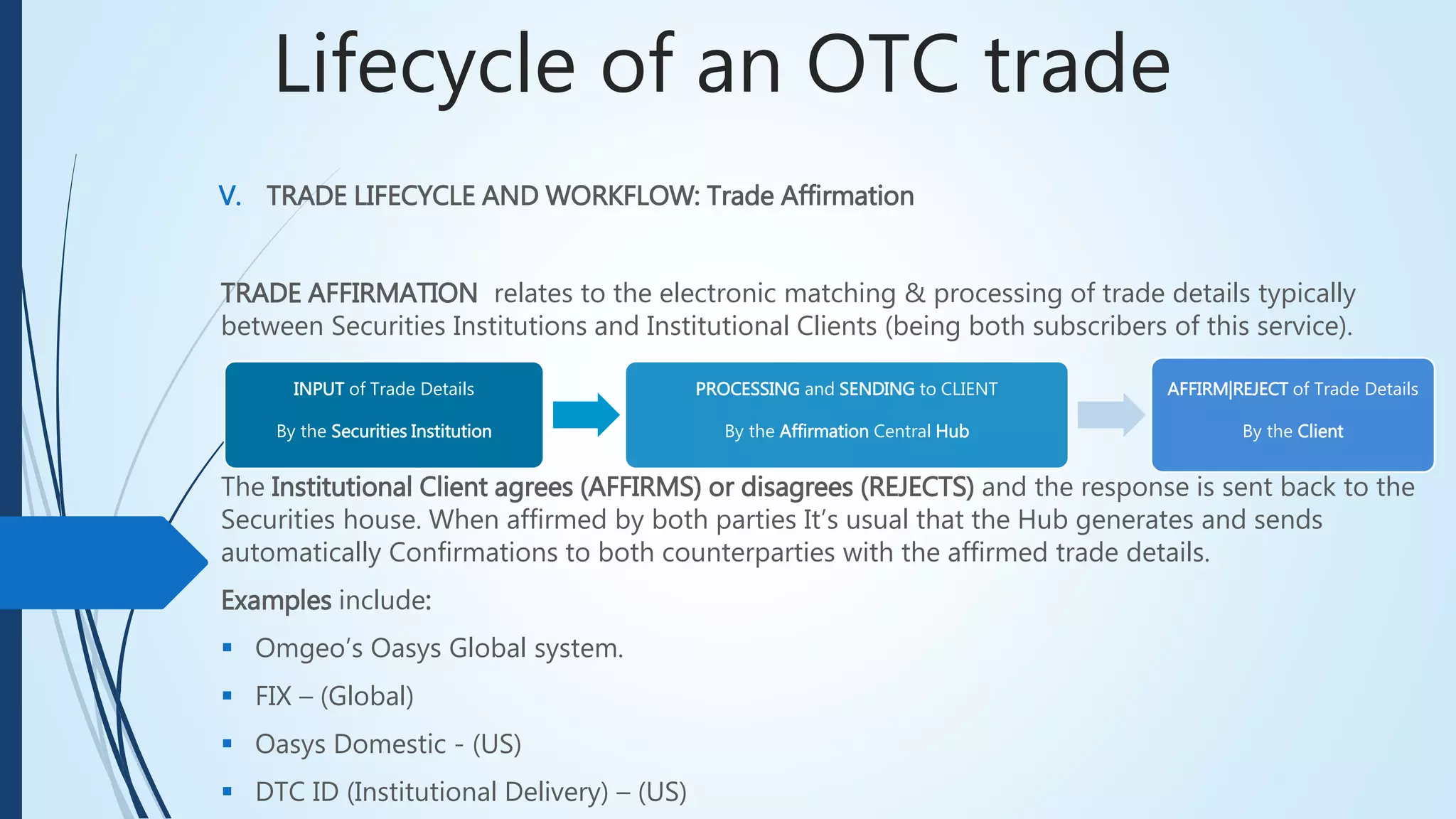

The document outlines the lifecycle of over-the-counter (OTC) derivatives trading, focusing particularly on interest rate swaps (IRS) and detailing the roles of various participants, including Swap Execution Facilities (SEFs), Swap Data Repositories (SDRs), and Derivatives Clearing Organizations (DCOs). It explains regulatory frameworks established by the Dodd-Frank Act aimed at ensuring transparency and proper reporting of OTC derivatives trades. Additionally, it discusses trade workflows, types of trades, and various trade events involved in the lifecycle of OTC trades.