Daily Market Report April 18, 2016

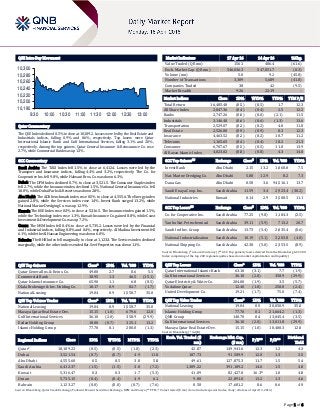

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.5% to close at 10,189.2. Losses were led by the Real Estate and Industrials indices, falling 0.9% and 0.6%, respectively. Top losers were Qatar International Islamic Bank and Gulf International Services, falling 3.1% and 2.0%, respectively. Among the top gainers, Qatar General Insurance & Reinsurance Co. rose 2.7%, while Commercial Bank was up 1.3%. GCC Commentary Saudi Arabia: The TASI Index fell 1.5% to close at 6,412.4. Losses were led by the Transport and Insurance indices, falling 4.4% and 3.2%, respectively. The Co. for Cooperative Ins. fell 9.8%, while Halwani Bros. Co. was down 6.3%. Dubai: The DFM Index declined 0.7% to close at 3,521.5. The Consumer Staples index fell 2.7%, while the Insurance index declined 1.5%. National General Insurance Co. fell 10.0%, while Dubai Parks & Resorts was down 2.8%. Abu Dhabi: The ADX benchmark index rose 0.5% to close at 4,555.6. The Energy index gained 2.8%, while the Services index rose 1.4%. Invest Bank surged 13.2%, while National Marine Dredging Co. was up 12.9%. Kuwait: The KSE Index rose 0.3% to close at 5,316.5. The Insurance index gained 1.5%, while the Technology index rose 1.3%. Kuwait Insurance Co. gained 8.8%, while Coast Investment & Development Co. was up 7.2%. Oman: The MSM Index fell 0.4% to close at 5,735.2. Losses were led by the Financial and Industrial indices, falling 0.8% and 0.4%, respectively. Al Madina Investment fell 6.1%, while the Al Hassan Engineering was down 6.0%. Bahrain: The BHB Index fell marginally to close at 1,123.3. The Services index declined marginally, while the other indices ended flat. Seef Properties was down 1.1%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 49.00 2.7 0.6 5.5 Commercial Bank 38.95 1.3 46.5 (15.1) Qatar Islamic Insurance Co. 65.90 1.1 6.8 (8.5) Dlala Brokerage & Inv. Holding Co. 18.17 0.9 82.7 (1.7) National Leasing 19.04 0.9 1,558.7 35.0 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% National Leasing 19.04 0.9 1,558.7 35.0 Mazaya Qatar Real Estate Dev. 15.15 (1.0) 679.6 12.0 Gulf International Services 36.10 (2.0) 358.9 (29.9) Ezdan Holding Group 18.00 (0.7) 325.1 13.2 Islamic Holding Group 77.70 0.1 280.0 (1.3) Market Indicators 17 Apr 16 14 Apr 16 %Chg. Value Traded (QR mn) 156.1 406.4 (61.6) Exch. Market Cap. (QR mn) 546,036.3 547,851.7 (0.3) Volume (mn) 5.0 9.2 (45.8) Number of Transactions 3,309 5,689 (41.8) Companies Traded 38 42 (9.5) Market Breadth 9:26 22:19 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,485.48 (0.5) (0.5) 1.7 12.3 All Share Index 2,847.36 (0.4) (0.4) 2.5 12.2 Banks 2,747.26 (0.0) (0.0) (2.1) 11.5 Industrials 3,146.40 (0.6) (0.6) (1.3) 13.6 Transportation 2,529.07 (0.2) (0.2) 4.0 11.8 Real Estate 2,526.80 (0.9) (0.9) 8.3 12.3 Insurance 4,463.52 (0.2) (0.2) 10.7 11.2 Telecoms 1,165.65 (0.4) (0.4) 18.2 21.3 Consumer 6,707.67 (0.5) (0.5) 11.8 13.9 Al Rayan Islamic Index 4,023.02 (0.8) (0.8) 4.3 14.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Invest Bank Abu Dhabi 2.15 13.2 1,060.0 7.5 Nat. Marine Dredging Co. Abu Dhabi 5.88 12.9 8.2 7.3 Dana Gas Abu Dhabi 0.58 3.6 94,516.1 13.7 Saudi Enaya Coop. Ins. Saudi Arabia 11.59 3.4 2,923.4 (30.2) National Industries Kuwait 0.14 2.9 3,508.5 11.1 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Co. for Cooperative Ins. Saudi Arabia 77.25 (9.8) 1,184.3 (2.5) Yanbu Nat. Petrochemical Saudi Arabia 39.11 (5.9) 713.2 20.7 Saudi Ind Inv. Group Saudi Arabia 13.73 (5.4) 2,035.4 (0.6) National Industrialization Saudi Arabia 10.19 (5.1) 3,203.8 (4.0) National Shipping Co. Saudi Arabia 42.38 (5.0) 2,353.5 (8.9) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar International Islamic Bank 63.10 (3.1) 7.7 (1.9) Gulf International Services 36.10 (2.0) 358.9 (29.9) Qatar Electricity & Water Co. 204.00 (1.9) 3.5 (5.7) Vodafone Qatar 12.40 (1.8) 258.0 (2.4) United Development Co. 19.21 (1.7) 75.0 (7.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% National Leasing 19.04 0.9 30,050.9 35.0 Islamic Holding Group 77.70 0.1 21,664.2 (1.3) QNB Group 140.70 0.4 13,045.4 (3.5) Gulf International Services 36.10 (2.0) 13,011.8 (29.9) Mazaya Qatar Real Estate Dev. 15.15 (1.0) 10,400.3 12.0 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,189.22 (0.5) (0.5) (1.8) (2.3) 42.87 149,941.6 12.3 1.2 4.3 Dubai 3,521.54 (0.7) (0.7) 4.9 11.8 107.73 91,589.9 12.0 1.3 3.5 Abu Dhabi 4,555.60 0.5 0.5 3.8 5.8 49.61 127,875.3 11.7 1.5 5.4 Saudi Arabia 6,412.37 (1.5) (1.5) 3.0 (7.2) 1,389.22 391,109.2 14.6 1.5 4.0 Kuwait 5,316.47 0.3 0.3 1.7 (5.3) 41.09 82,427.8 16.3# 1.0 4.8 Oman 5,735.15 (0.4) (0.4) 4.9 6.1 9.80 22,891.0 13.2 1.3 4.6 Bahrain 1,123.27 (0.0) (0.0) (0.7) (7.6) 0.58 17,681.2 8.6 0.6 4.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, DFM and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any; #Data as of April 13, 2016) 10,180 10,200 10,220 10,240 10,260 10,280 10,300 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.5% to close at 10,189.2. The Real Estate and Industrials indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari and GCC shareholders. Qatar International Islamic Bank and Gulf International Services were the top losers, falling 3.1% and 2.0%, respectively. Among the top gainers, Qatar General Insurance & Reinsurance Co. rose 2.7%, while Commercial Bank was up 1.3%. Volume of shares traded on Sunday fell by 45.8% to 5.0mn from 9.2mn on Thursday. Further, as compared to the 30-day moving average of 11.4mn, volume for the day was 56.6% lower. National Leasing and Mazaya Qatar Real Estate Development were the most active stocks, contributing 31.4% and 13.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2016 % Change YoY Operating Profit (mn) 1Q2016 % Change YoY Net Profit (mn) 1Q2016 % Change YoY Takween Advanced Industries Co. Saudi Arabia SR – – 20.3 NA 5.0 NA Halwani Bros. Co. Saudi Arabia SR – – 40.5 3.6% 13.9 -46.3% Saudi Transport & Investment Co. Saudi Arabia SR – – 12.4 NA 14.8 3,567.3% Aldrees Petroleum & Transport Saudi Arabia SR – – 31.7 -19.5% 28.2 -32.9% Jazan Development Co. Saudi Arabia SR – – 1.2 NA 1.2 1,622.9% Saudi Arabian Mining Co. Saudi Arabia SR – – 302.6 -21.8% 168.9 -35.3% Saudi Arabia Fertilizers Co. Saudi Arabia SR – – 256.0 -56.1% 286.0 -51.5% Najran Cement Co. Saudi Arabia SR – – 72.3 -31.1% 61.1 -33.6% Filing & Packing Materials Co. Saudi Arabia SR – – 4.9 73.8% 4.7 87.6% Dur Hospitality Co. Saudi Arabia SR – – 32.7 -25.2% 31.5 -29.9% The Company for Coop. Insurance Saudi Arabia SR 1.6 26.7% 0.0 NA 61.5 -36.1% AlAhli Takaful Co. Saudi Arabia SR 28.0 12.5% 0.0 NA 7.7 -45.0% Hail Cement Co. Saudi Arabia SR – – 39.3 1.4% 33.1 -11.7% Al Sharqiya Investment Holding Co. Oman OMR 1.1 20.9% – – -0.1 NA Oman Hotels & Tourism Co. Oman OMR 1.6 -19.1% – – 11.7 1,275.9% Oman Investment & Finance Co. Oman OMR 4.5 5.6% – – 1.5 -22.4% Al Hassan Engineering Co. Oman OMR 26.0 15.6% – – 0.1 NA National Hotels Co. Bahrain BHD 2.4 -9.8% – – 1.1 4.6% Esterad Investment Co. Bahrain BHD 0.8 -35.4% – – 0.0 NA Source: Company data, DFM, ADX, MSM Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 50.15% 58.21% (12,581,993.09) Qatari Institutions 10.97% 15.16% (6,547,145.85) Qatari 61.12% 73.37% (19,129,138.94) GCC Individuals 1.29% 1.00% 448,145.89 GCC Institutions 2.33% 2.37% (72,527.00) GCC 3.62% 3.37% 375,618.89 Non-Qatari Individuals 20.60% 21.77% (1,821,046.65) Non-Qatari Institutions 14.66% 1.48% 20,574,566.70 Non-Qatari 35.26% 23.25% 18,753,520.05

- 3. Page 3 of 6 Earnings Calendar Tickers Company Name Date of reporting 1Q2016 results No. of days remaining Status DHBK Doha Bank 18-Apr-16 0 Due CBQK Commercial Bank 19-Apr-16 1 Due KCBK Al Khalij Commercial Bank 19-Apr-16 1 Due QEWS Qatar Electricity & Water Company 19-Apr-16 1 Due QATI Qatar Insurance Company 19-Apr-16 1 Due MARK Masraf Al Rayan 19-Apr-16 1 Due MRDS Mazaya Qatar 19-Apr-16 1 Due QGTS Qatar Gas Transport Company (Nakilat) 19-Apr-16 1 Due IHGS Islamic Holding Group 19-Apr-16 1 Due QIIK Qatar International Islamic Bank 19-Apr-16 1 Due DOHI Doha Insurance 20-Apr-16 2 Due QIMD Qatar Industrial Manufacturing Company 20-Apr-16 2 Due ABQK Al Ahli Bank 20-Apr-16 2 Due MCCS Mannai Corp. 20-Apr-16 2 Due GWCS Gulf Warehousing Company 20-Apr-16 2 Due MCGS Medicare Group 20-Apr-16 2 Due QNNS Qatar Navigation (Milaha) 23-Apr-16 5 Due QCFS Qatar Cinema & Film Distribution Company 24-Apr-16 6 Due UDCD United Development Company 25-Apr-16 7 Due QOIS Qatar & Oman Investment 25-Apr-16 7 Due QFLS Qatar Fuel Company 26-Apr-16 8 Due DBIS Dlala Brokerage & Investment Holding Company 26-Apr-16 8 Due ORDS Ooredoo 27-Apr-16 9 Due QGRI Qatar General Insurance & Reinsurance 27-Apr-16 9 Due MERS Al Meera Consumer Goods Company 27-Apr-16 9 Due AHCS Aamal Company 28-Apr-16 10 Due ERES Ezdan Real Estate Company 28-Apr-16 10 Due NLCS National Leasing (Alijarah) 28-Apr-16 10 Due ZHCD Zad Holding Company 30-Apr-16 12 Due Source: QSE

- 4. Page 4 of 6 News Qatar WDAM net profit rises 11.5% QoQ in 1Q2016 – Widam Food Company’s (WDAM) net profit rose 11.5% QoQ to QR19.8mn in 1Q2016 vs. QR17.7mn in 4Q2015. Further, on a YoY basis net profit surged 76.6%. Earnings per Share (EPS) increased to QR1.1 in 1Q2016 from QR1.0 in 4Q2015. (QSE, QNBFS Research) AHCS is on track to finish first phase of its City Center redevelopment by 2016-end – According to Aamal Company (AHCS) Vice Chairman Sheikh Mohamed bin Faisal bin Qassim al- Thani, the first phase of the redevelopment project of the City Center Mall will be completed by 2016-end. Speaking to reporters on the sidelines of the company’s annual general meeting, Sheikh Mohamed said AHCS began phase 2 of the redevelopment project in 2015. He said the project, which is expected to be completed in 2018, would provide 5,000 square meters to 7,000 square meters of additional space for new amenities and strong brand names. He said, “We are creating more retail space, entertainment facilities, and there is construction work being done to redesign the façade, which will host café shops for outdoor seating to make the façade livelier.” Sheikh Mohamed said one of the strengths of the 16-year- old City Center Mall is its location, which is at the heart of the West Bay area, where many corporate offices and government ministries are based. (Gulf-Times.com) Boston marks QA’s new service – Boston’s Logan International Airport marked Qatar Airways’ (QA) new route to the city with an exclusive flag-raising ceremony in honor of QA’s recently launched daily, non-stop service. (Peninsula Qatar) Qatargas, UASC, Shell sign deal to explore use of LNG as marine fuel – Qatargas, United Arab Shipping Company (UASC), and Shell signed a tripartite Memorandum of Understanding (MoU) to explore the development of LNG (liquefied natural gas) as a marine fuel in the Middle East region. This is the second such agreement signed by Qatargas and Shell in as many months and establishes another core partnership within the shipping industry. The MoU was signed by Qatargas Chief Executive Khalid bin Khalifa al-Thani, UASC Chief Executive Jorn Hinge, and Qatar Shell Company’s Managing Director and Chairman Michiel Kool. The partners will continue to work diligently to develop and supply LNG as marine fuel for the merchant fleet before the end of the current decade. Through this agreement, the partners will explore the development of new markets for LNG to be used as propulsion fuel within the Middle East and the conversion of UASC’s existing vessels providing the opportunity to use a cleaner fuel. The MoU envisages LNG supplies to be made available from Qatargas 4, a joint venture between Qatar Petroleum and Shell Gas, with the UASC line potentially using the fuel for its recently-built container ships. (Gulf-Times.com) ORDS launches video clips mobile portal – Ooredoo (ORDS) launched its newest service, the Ooredoo Video Clips mobile portal, as it expands its entertainment offerings for Qatar’s growing online population. Ooredoo Video Clips, which has been designed to enable Qatar’s smartphone users to watch videos online and on the go, offers subscribers the ability to access unlimited video clips on a daily basis. Once subscribed, customers will be able to watch as many videos as they like on their mobiles, with the portal offering more than 1.7mn videos across genres such as sports, action, Bollywood, Pinoy, shows, and more. (Gulf- Times.com) International US Treasury readies new tax rules as G20 vows to fight evasion – The US Treasury Secretary Jack Lew said that the Treasury Department is finalizing new tax rules aimed at combating the use of shell companies to evade taxes, amid increased pledges by global finance leaders to cooperate on tax issues. In a statement to the International Monetary Fund's steering committee, Lew said the Treasury was finalizing a rule that would require banks to identify the beneficial owners of new customers that are companies. (Reuters) Osborne: UK economy faces permanent hit with Brexit – British Finance Minister George Osborne said that a vote to leave the European Union in a referendum in June would do permanent damage to the country's economy, which he warned would be 6% smaller by 2030 than if it stayed in the bloc. The government is due to present on April 18 a "serious, sober analysis" of the long- term economic impact of a so-called Brexit. Osborne was quoted as saying the loss to the economy would be the equivalent to each household of $6,100 a year by 2030. (Reuters) NBS: China March home prices rise at fastest rate in two years, top cities boom – According to the data released by the National Statistics Bureau (NBS) China's home prices in March gained at the fastest pace in almost two years but that growth may slow as local authorities tighten home purchase requirements in the two top performing cities on fears of a bubble forming. The southern city of Shenzhen continued to be the top performer, with home prices surging 61.6% from a year ago, followed by Shanghai with a 25% gain. Prices in the two cities were up 3.7% and 3.6% MoM. Average new home prices in 70 major cities rose 4.9% last month from a year ago, picking up from February's 3.6% rise. March prices were up 1.1% compared to a month ago. (Reuters) Regional Oil output freeze talks to resume in June – High-stake talks in Doha between OPEC and non-OPEC oil producers on an agreement to freeze output ran into last-minute confusion and concluded without an output cap deal. The parties would meet again in June for further talks. Minister of Energy and Industry HE Dr. Mohammed bin Saleh Al Sada, also current President of OPEC, said, “OPEC needed more time for consultations to reach an output freeze deal.” (Peninsula Qatar) Deputy Crown Prince: KSA to announce reform plan on April 25 – Saudi Arabia Deputy Crown Prince Mohammed bin Salman said KSA will announce a comprehensive plan on April 25 to prepare the Kingdom for an era in which it does not rely heavily on oil. Prince Mohammed said the vision for the Kingdom of Saudi Arabia will include developmental, economic, social and other programs. He also said part of the vision, a package of economic reforms known as the National Transformation Plan (NTP), will be launched within a month or 45 days after this month’s announcement. The NTP includes asset sales, tax increases, spending cuts, changes to the way the state manages its financial reserves, an efficiency drive, and a much bigger role for the private sector. (Reuters) ACE Arabia shareholders approve dividend freeze – ACE Arabia Cooperative Insurance Company’s ordinary general assembly meeting has approved the board of directors’ recommendation of non-distribution of dividends for the fiscal year 2015. (Tadawul) Almarai expresses interest to acquire controlling stake in NFPC – Almarai Company has expressed its interest to acquire a controlling stake in National Food Products Company (NFPC) in the UAE. NFPC has officially initiated a competitive sale process for part of its share capital and has invited Almarai to proceed with due diligence. (Tadawul) Al Rajhi Bank net profit surges 32.78% YoY in 1Q2016 – Al Rajhi Bank reported a net profit of SR2.02bn in 1Q2016 as compared to SR1.52bn in 1Q2015, representing an increase of 32.78% YoY. The bank’s total assets stood at SR323.3bn at the end of March 31, 2016 as compared to SR320.43bn on March 31, 2015. Loans &

- 5. Page 5 of 6 advances reached SR216.39bn, while customer deposits stood at SR264.78bn. EPS amounted to SR1.24 in 1Q2016 versus SR0.93 in 1Q2015. (Tadawul) Arab National Bank reports SR749.2mn net profit in 1Q2016 – Arab National Bank reported a net profit of SR749.2mn in 1Q2016 as compared to SR770.6mn in 1Q2015, representing a decline of 2.78% YoY. The bank’s total assets stood at SR166.59bn at the end of March 31, 2016 as compared to SR164.79bn on March 31, 2015. Loans & advances reached SR116.04bn, while customer deposits stood at SR132.03bn. EPS amounted to SR0.75 in 1Q2016 versus SR0.77 in 1Q2015. (Tadawul) Dallah Healthcare announces development regarding use of IPO proceeds – Dallah Healthcare Holding has announced developments regarding the use of its IPO proceeds, which took place in 2012. The gross proceeds amounted to SR539.6mn and net of SR513.1mn after deducting the IPO costs of SR26.5mn. The company paid a total amount of SR38mn representing the acquisition price of Pharmaceuticals, Herbal and Cosmetics factory. The company paid an amount of SR35.5mn against part of what is paid for the subscription in Dr. Mohamed Alfaqeeh Co., targeting to set up a hospital in east Riyadh. Dallah Healthcare spent SR133.8mn against buying of land in west Riyadh area and SR173.7mn against payments for engineering works, consultation, land survey, digging and designs. (Tadawul) Tadawul to hire investment bank for flotation – The Saudi Stock Exchange (Tadawul) is in the process of hiring an investment bank to advice on its flotation. The Kingdom is expected to privatize and float a number of state-owned assets in the next few years, part of efforts to raise cash to help bridge a budget shortfall caused by lower oil prices. The aim is also to improve the efficiency of the economy by the reform of state companies and by bringing in professional investors. According to Thomson Reuters data, the stock market is the largest exchange in the Middle East with a total market capitalization of SR1.48tn. (Reuters) Emirates Refreshment AGM approves 5% cash dividend – Emirates Refreshment’s ordinary annual general meeting (AGM) has approved the board of directors’ recommendation to distribute 5% cash dividend amounting to AED1.5mn. (DFM) Aldar appoints Chief Asset Management Officer – Aldar Properties has appointed Jassem Saleh Busaibe as the Chief Asset Management Officer. (ADX) ADSB AGM approves 10% cash dividend – Abu Dhabi Ship Building’s (ADSB) ordinary general assembly meeting (AGM) has approved the board of directors’ recommendation to distribute 10% cash dividend of the company’s capital for the financial year ended December 31, 2015. (ADX) RAKBANK AGM approves 50% cash dividend for 2015 – National Bank of Ras Al Khaimah’s (RAKBANK) annual general assembly meeting (AGM) has approved the board of directors (BoD) recommendation to distribute 50% of cash dividend for the year ended December 31, 2015. (ADX) RAK Properties to release Bermuda Villas' Phase II – RAK Properties is all set to commence the release of phase II of its Bermuda Villas being developed under its flagship Mina Al Arab waterfront community. The residential complex will span 157 two-to six-bedroom villas and townhouses catering to the high standards of living embodied by the Mina Al Arab master development. (GulfBase.com) Kuwait crude output drops 60% as oil workers’ strike over pay hike – Kuwait’s crude production tumbled by 60% and its refineries scaled back operations as the state oil company took emergency measures to cope with the first day of an open-ended labor strike. Kuwait Oil Company’s (KOC) Deputy Chief Executive for Finance said that the OPEC member’s production dropped to 1.1mn barrels a day. He said that Kuwait Petroleum Corporation, the parent company for KOC and other operating units, will continue providing fuel to the local market and can meet demand from international customers for exports. (Bloomberg) NBK reports 18.2% fall in 1Q2016 net profit – National Bank of Kuwait (NBK) has reported an 18.2% fall in 1Q2016 net profit, as it failed to repeat a one-off gain from an asset sale. The bank made a net profit of KD78.9mn in 1Q2016 as compared to KD96.5mn in 1Q2015. Net interest income and net income from Islamic financing and fees both increased during 1Q2016. NBK’s total assets were KD24.67bn, up 5.8% from the same time a year ago. In March 2016, the bank said the board of directors had agreed to raise the bank’s capital by 6.5% through a rights issue involving issuing 343.96mn shares at KD0.4 per share. The bank said the move was aimed at maintaining a healthy capitalization ratio after the launch in Kuwait of Basel III capital rules, as well as funding future growth. (Reuters) Sohar freezone to conduct study on global economic scenario for expansion – Sohar freezone is planning to carry out a study in 3Q2016 to assess the global market scenario and how to take advantage of the country’s strategic location for developing a major logistics and redistribution hub for the region. The free zone is evaluating cargo flows to device a marketing strategy for next expansion phases and chart out a way forward. (GulfBase.com) NCSI: Oman inflation rises marginally in March 2016 – According to the statistics released by the National Centre for Statistics and Information (NCSI), Oman’s inflation increased by 0.11% during March 2016 as compared to March 2015. The inflation rate also dropped by 0.31% as compared to February 2016. The YoY increase in the price index is attributed to the increasing prices of all main sets constituting the consumer basket. The housing, water, electricity, gas, and other fuel groups grew by 0.44% and the transport group increased by 1.31%. The general consumer price index (CPI) declined by 0.31% in March 2016 as compared to February 2016. Foodstuffs, non-alcoholic beverages, transport, and shoes & clothes groups declined by 0.46%, 1.02%, and 0.38%, respectively. (GulfBase.com) Alba appoints Bechtel as EPCM contractor for Line 6 – Aluminium Bahrain (Alba) has selected International Bechtel Co. Ltd. (Bechtel) as the engineering, procurement and construction management (EPCM) contractor for its landmark Line 6 Expansion Project. Under the terms of the contract, Bechtel will be responsible for the design and construction of the sixth pot line as well as support industrial services. Alba will be the world’s largest single-site aluminum smelter upon completion of the Line 6 Expansion Project, which will boost its production by 540,000 metric tons per annum (mtpa) bringing Alba’s total production capacity to 1,500,000 mtpa. Line 6 will have 424 pots that will use the proprietary EGA DX+ Ultra technology thus significantly increasing operating efficiencies. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (#Market closed on April 15, 2016) Source: Bloomberg (*$ adjusted returns: #Market closed on April 15, 2016) 80.0 100.0 120.0 140.0 160.0 180.0 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 QSE Index S&P Pan Arab S&P GCC (1.5%) (0.5%) 0.3% (0.0%) (0.4%) 0.5% (0.7%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD % YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,234.15 0.5 (0.4) 16.3 MSCI World Index 1,670.47 (0.1) 2.3 0.5 Silver/Ounce 16.24 0.4 5.7 17.2 DJ Industrial 17,897.46 (0.2) 1.8 2.7 Crude Oil (Brent)/Barrel (FM Future) 43.10 (1.7) 2.8 15.6 S&P 500 2,080.73 (0.1) 1.6 1.8 Crude Oil (WTI)/Barrel (FM Future) 40.36 (2.7) 1.6 9.0 NASDAQ 100 4,938.22 (0.2) 1.8 (1.4) Natural Gas (Henry Hub)/MMBtu 1.72 (10.6) (13.4) (25.7) STOXX 600 342.79 (0.1) 2.3 (2.6) LPG Propane (Arab Gulf)/Ton 45.00 (1.1) 1.1 15.0 DAX 10,051.57 (0.1) 3.5 (3.1) LPG Butane (Arab Gulf)/Ton# 53.25 0.0 1.4 (7.4) FTSE 100 6,343.75 0.2 3.0 (1.9) Euro 1.13 0.1 (1.0) 3.9 CAC 40 4,495.17 (0.1) 3.5 0.8 Yen 108.76 (0.6) 0.6 (9.5) Nikkei 16,848.03 0.1 6.2 (1.8) GBP 1.42 0.3 0.5 (3.6) MSCI EM 846.70 0.1 3.7 6.6 CHF 1.03 (0.1) (1.5) 3.6 SHANGHAI SE Composite 3,078.12 (0.1) 2.9 (12.9) AUD 0.77 0.4 2.2 6.0 HANG SENG 21,316.47 (0.1) 4.7 (2.8) USD Index 94.70 (0.2) 0.5 (4.0) BSE SENSEX# 25,626.75 0.0 4.3 (2.3) RUB 66.49 0.6 (0.9) (8.3) Bovespa 53,227.74 0.7 8.2 36.9 BRL 0.28 (1.4) 1.6 12.1 RTS 905.10 (1.0) 3.0 19.6 116.6 92.7 90.8