Itemized Deductions - Homeowners

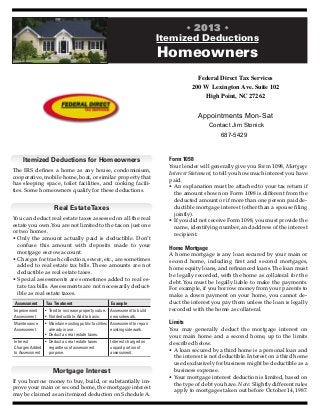

- 1. 2013 Itemized Deductions Homeowners Federal Direct Tax Services 200 W Lexington Ave. Suite 102 High Point, NC 27262 Appointments Mon-Sat Contact Jim Stonick 687-5429 Itemized Deductions for Homeowners Form 1098 Your lender will generally give you Form 1098, Mortgage The IRS defines a home as any house, condominium, Interest Statement, to tell you how much interest you have cooperative, mobile home, boat, or similar property that paid. has sleeping space, toilet facilities, and cooking facili- • An explanation must be attached to your tax return if ties. Some homeowners qualify for these deductions. the amount shown on Form 1098 is different from the deducted amount or if more than one person paid de- Real Estate Taxes ductible mortgage interest (other than a spouse filing jointly). You can deduct real estate taxes assessed on all the real • If you did not receive Form 1098, you must provide the estate you own. You are not limited to the tax on just one name, identifying number, and address of the interest or two homes. recipient. • Only the amount actually paid is deductible. Don’t confuse this amount with deposits made to your Home Mortgage mortgage escrow account. A home mortgage is any loan secured by your main or • Charges for trash collection, sewer, etc., are sometimes second home, including first and second mortgages, added to real estate tax bills. These amounts are not home equity loans, and refinanced loans. The loan must deductible as real estate taxes. be legally recorded, with the home as collateral for the • Special assessments are sometimes added to real es- debt. You must be legally liable to make the payments. tate tax bills. Assessments are not necessarily deduct- For example, if you borrow money from your parents to ible as real estate taxes. make a down payment on your home, you cannot de- Assessment Tax Treatment Example duct the interest you pay them unless the loan is legally Improvement • Tend to increase property value. Assessment to build recorded with the home as collateral. Assessment • Not deductible. Add to basis. new sidewalk. Maintenance • Maintain existing public facilities Assessment to repair Limits Assessment already in use. existing sidewalk. You may generally deduct the mortgage interest on • Deduct as real estate taxes. your main home and a second home, up to the limits Interest • Deduct as real estate taxes Interest charged on described below. Charges Added regardless of assessment unpaid portion of • A loan secured by a third home is a personal loan and to Assessment purpose. assessment. the interest is not deductible. Interest on a third home used exclusively for business might be deductible as a Mortgage Interest business expense. • Your mortgage interest deduction is limited, based on If you borrow money to buy, build, or substantially im- the type of debt you have. Note: Slightly different rules prove your main or second home, the mortgage interest apply to mortgages taken out before October 14, 1987. may be claimed as an itemized deduction on Schedule A.

- 2. pool for help with a specific medical condition, (3) bath- room or countertop modifications to accommodate a person who is disabled, (4) ramps, handrails, support or grab bars, (5) modifications to halls and doorways. An expense may generate a medical deduction to the extent the expense does not result in an increase to Debt Type and Limit Definition the home’s value. Not every expense results in such an • Acquisition debt: $1,000,000 Used to buy, build, or substantially increase. combined debt on main and improve a main or second home. second home ($500,000 MFS). Operation and Upkeep • Home equity debt: $100,000 Debt secured by a main or second Amounts you pay to operate and maintain a medically- combined debt on main and home that is not acquisition debt. second home ($50,000 MFS). related home improvement qualify as medical expens- es, if the main reason is for medical care. This is true even if only part or none of the asset cost qualified for Refinanced Loans a deduction. Debt that is refinanced generally retains its character as acquisition or home equity debt, up to the old loan balance. Other Itemized Deductions • Debt used to substantially improve your home is acqui- sition debt, even if it is refinanced home equity debt. As a homeowner, you may be eligible to claim the fol- • Refinanced acquisition debt that exceeds your old lowing additional deductions. Each is subject to special debt may qualify as home equity debt. rules and limitations. Points Casualty and Theft Losses Terms such as points, loan discount, loan origination If your home is damaged or destroyed due to an iden- fees, etc., refer to certain charges you might pay in order tifiable event that is sudden, unexpected, and unusual, to obtain a mortgage. If you pay points to borrow mon- you may have a casualty loss. Losses are calculated on ey, the points are deductible as prepaid interest. Form 4684, Casualties and Thefts, and carried to Sched- • Points are deductible ratably over the life of your loan. ule A, Itemized Deductions. Not every casualty results in Points you pay at the time of your home purchase are a deductible loss. deductible in full. • Points you pay to the lender in exchange for a lower Business Use of the Home interest rate are generally shown on your closing state- If you use a home office as an employee, you may be ment. Each point charged to obtain a loan is 1% of the able to claim a miscellaneous itemized deduction for loan amount. For example, 2.5 points charged on a the business use of your home. $100,000 loan equals $2,500 ($100,000 × 2.5%). • You must use your home office for the convenience of • Fees your lender charges for specific loan services are your employer. not deductible. Examples include appraisal, notary, • You may not rent your home office to your employer. and document fees. Mortgage Insurance Premiums You may have been able to deduct certain mortgage in- Contact Us surance premiums that you paid after 2006. As of the There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves sum- date of printing, this provision had not yet been extend- marizing transactions and events that occurred during the prior ed for the 2012 tax year. year. In most situations, treatment is firmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance Medical Expense Deductions if you have questions about the tax effects of a transaction or You may need to make home improvements in order to event, including the following: provide medical care for yourself, your spouse, or your • Pension or IRA distributions. • Retirement. dependent. Examples: (1) Lifts or elevators, (2) therapy • Significant change in income or • Notice from IRS or other deductions. revenue department. • Job change. • Divorce or separation. This brochure contains general information for taxpayers and • Marriage. • Self-employment. should not be relied upon as the only source of authority. • Attainment of age 59½ or 70½. • Charitable contributions Taxpayers should seek professional tax advice for more information. • Sale or purchase of a business. of property in excess of • Sale or purchase of a residence $5,000. Copyright © 2012 Tax Materials, Inc. or other real estate. All Rights Reserved