Ideal educational facility

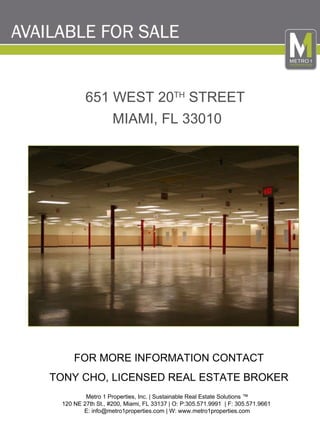

- 1. Metro 1 Properties, Inc. | Sustainable Real Estate Solutions ™ 120 NE 27th St., #200, Miami, FL 33137 | O: P:305.571.9991 | F: 305.571.9661 E: info@metro1properties.com | W: www.metro1properties.com FOR MORE INFORMATION CONTACT TONY CHO, LICENSED REAL ESTATE BROKER 651 WEST 20 TH STREET MIAMI, FL 33010

- 11. The Florida Enterprise Zone Program offers various tax incentives to businesses located within the designated enterprise zones. In addition, local governments may also offer their own incentives. Listed below are all of the Florida incentives for businesses located in an Enterprise Zone. Jobs Tax Credit (Sales Tax): Rural Enterprise Zones Allows a business located within a Rural Enterprise Zone to take a sales and use tax credit for 30 or 45 percent of wages paid to new employees who live within a Rural County. To be eligible, a business must create at least one new job. The Sales Tax Credit cannot be used in conjunction with the Corporate Tax Jobs Credit. Jobs Tax Credit (Sales Tax): Urban Enterprise Zones Allows a business located within an Urban Enterprise Zone to take a sales and use tax credit for 20 or 30 percent of wages paid to new employees who reside within an enterprise zone. To be eligible, a business must create at least one new job. The Sales Tax Credit cannot be used in conjunction with the Corporate Tax Jobs Credit). Jobs Tax Credit (Corporate Income Tax): Rural Enterprise Zones Allows a business located within a Rural Enterprise Zone to take a corporate income tax credit for 30 or 45 percent of wages paid to new employees who reside within a Rural County. To be eligible, a business must create at least one new job. The Corporate Tax Credit cannot be used in conjunction with the Sales Tax Credit. Jobs Tax Credit (Corporate Income Tax): Urban Enterprise Zones Allows a business located within an Urban Enterprise Zone to take a corporate income tax credit for 20 or 30 percent of wages paid to new employees who reside within an enterprise zone. The Corporate Tax Credit cannot be used in conjunction with the Sales Tax Credit. Business Equipment Sales Tax Refund: Rural and Urban Enterprise Zones A refund is available for sales taxes paid on the purchase of certain business property, which is used exclusively in an Enterprise Zone for at least 3 years. Building Materials Sales Tax Refund: Rural and Urban Enterprise Zones A refund is available for sales taxes paid on the purchase of building materials used to rehabilitate real property located in an Enterprise Zone. Property Tax Credit (Corporate Income Tax): Rural and Urban Enterprise Zones New or expanded businesses located within an enterprise zone are allowed a credit against Florida corporate income tax equal to 96% of ad valorem taxes paid on the new or improved property. Sales Tax Exemption for Electrical Energy: Rural and Urban Enterprise Zones A 50% sales tax exemption is available to qualified businesses located within an Enterprise Zone on the purchase of electrical energy, if the municipality has reduced the municipal utility tax by at least 50%. Community Contribution Tax Credit Program: Rural and Urban Enterprise Zones Allows businesses a 50% credit on Florida corporate income tax, insurance premium tax, or sales tax refund for donations made to local community development projects. Businesses are not required to be located in an enterprise zone to be eligible for this credit.

- 12. One of the most densely populated and developed regions of Florida, the Southeast Region offers a number of advantages to businesses, including large urban centers such as Miami and Ft. Lauderdale. Infrastructure: This region provides easy access to international markets via several international airports and deep-water seaports. Home to a Network Access Point, the AMPATH network, and numerous Internet-related companies, this region is considered to be one of the major telecom hubs in the world and offers many other technological advances in voice, video and data transmission. Industry: Companies that want to compete on the international level find that Southeast Florida is the perfect strategic location for their businesses. As a result, Latin American companies often locate their regional headquarters in the area. In fact, Miami is recognized as the business capital of Latin America. Furthermore, globally-bound innovative companies find the area’s talented, multi-cultural workforce, its high-tech environment and its international opportunities appealing. Workforce: Southeast Florida offers a large pool of highly skilled individuals, and is home to several research universities, such as the University of Miami, Florida International University and Florida Atlantic University , which continue to increase the knowledge base in the area. Additionally, the area’s culturally diverse population serves as an excellent resource for global corporations requiring a multi-lingual workforce. Quality of Life: Southeast Florida’s diverse ethnic and cultural environment and its year-round outdoor lifestyle are well-known. A variety of other attractions, such as major cultural institutions, shopping experiences, fine restaurants, and professional sports teams, also draw smart and sophisticated audiences. Add in a housing options in both urban and suburban locations, and it’s clear that the Southeast region offers a unique and rich quality of life. This region is home to the Miami-Fort Lauderdale-Pompano Beach, Sebastian-Vero Beach and Port St. Lucie metropolitan areas. Southeast Florida: Economic Indicators $252,750 Median Home Price, 2008 113.0 Cost of Living Index, 2008 (U.S. average=100) 1474 Number of Foreign-Affiliated Companies $43,480 Per Capita Personal Income, 2007 $260.7 Personal Income, 2007 ($billions) 6.0% Unemployment Rate, 2008 2,960,332 Total Employment, 2008 3,147,674 Labor Force, 2008 6,023,098 Population, 2008