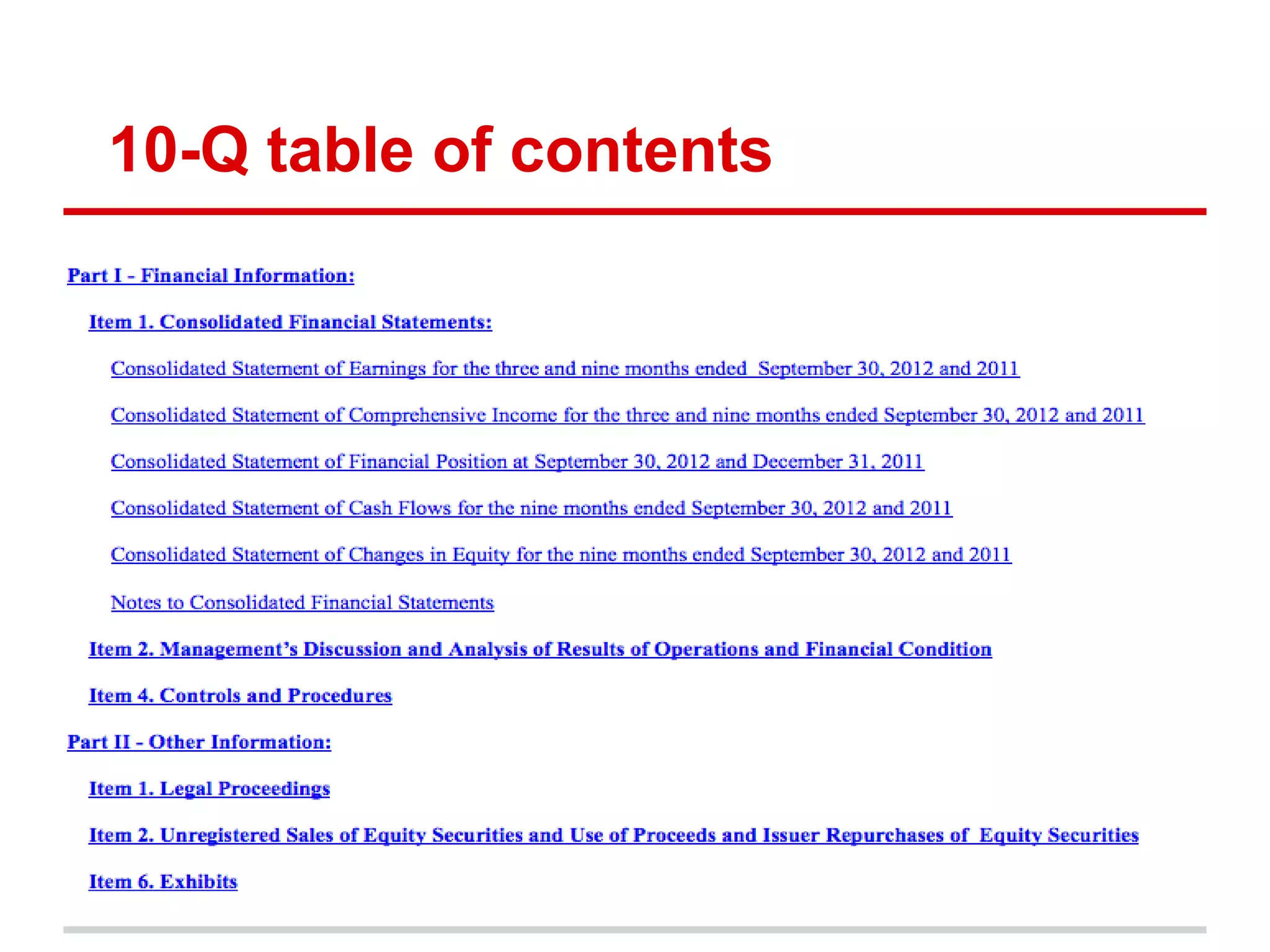

The document discusses the importance of 10-Q filings, which provide quarterly earnings and can reveal information hidden from earnings releases. It highlights the differences between 10-Q and 10-K filings, outlines what to look for in 8-K filings, and provides context on other key financial filings related to ownership and mergers. Additionally, it notes the significance of the timing of these filings, particularly concerning investor awareness.