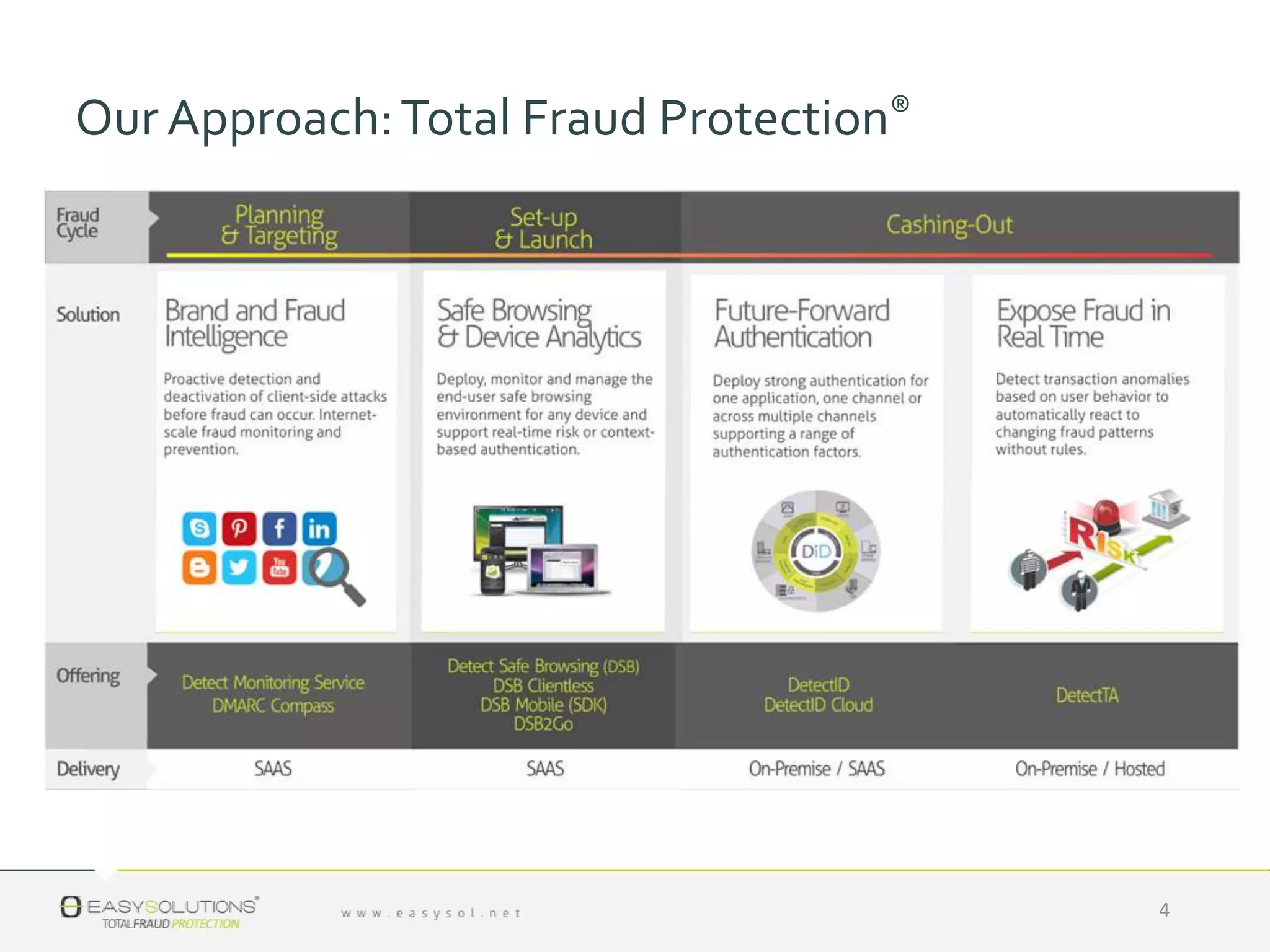

1. Easy Solutions is a leading global provider of electronic fraud prevention for financial institutions and enterprise customers, protecting over 75 million users and monitoring over 22 billion online connections in the last 12 months.

2. Alejandro Correa Bahnsen is a data scientist at Easy Solutions who has over 8 years of experience in data science and works on fraud detection and prevention.

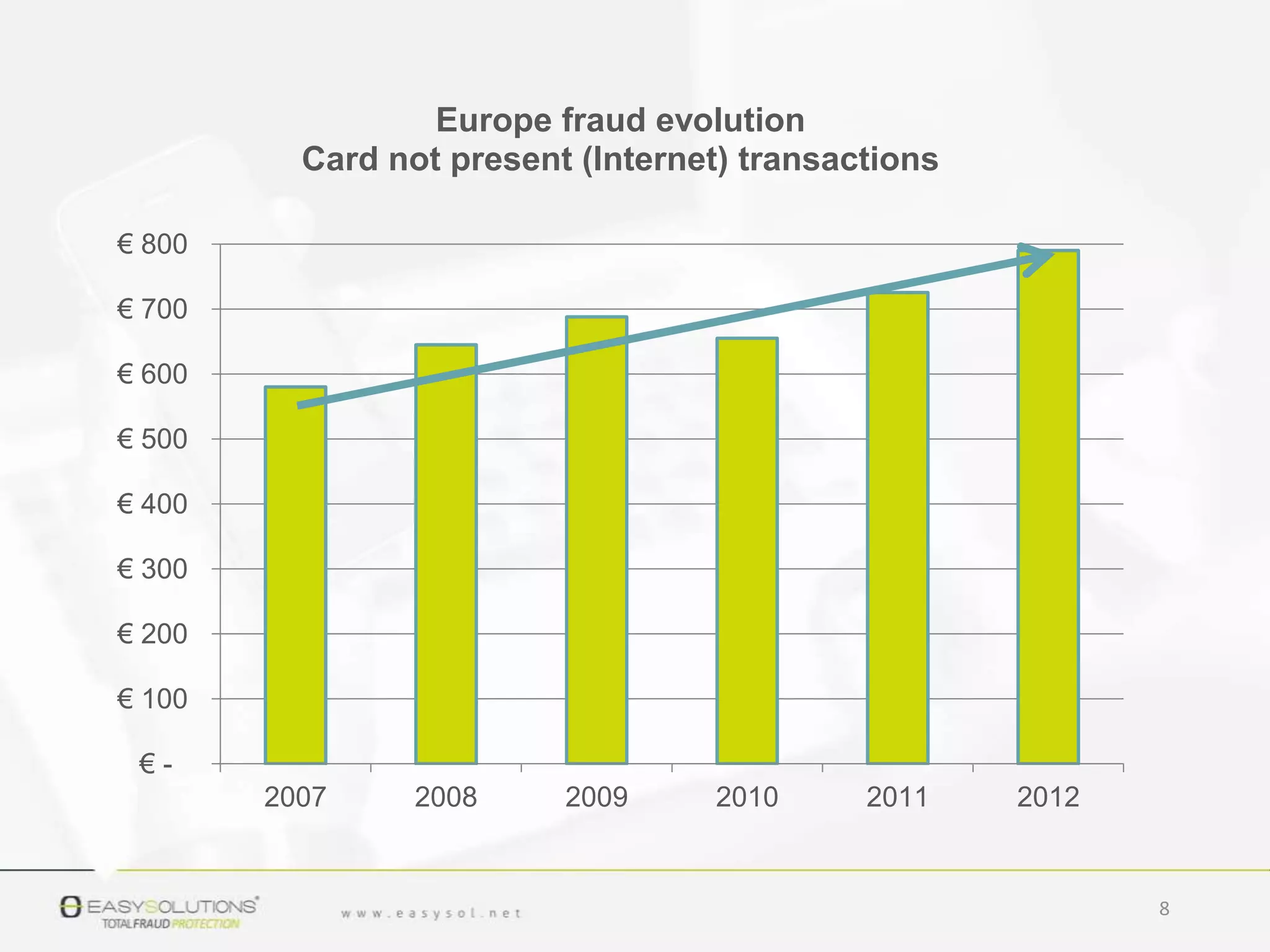

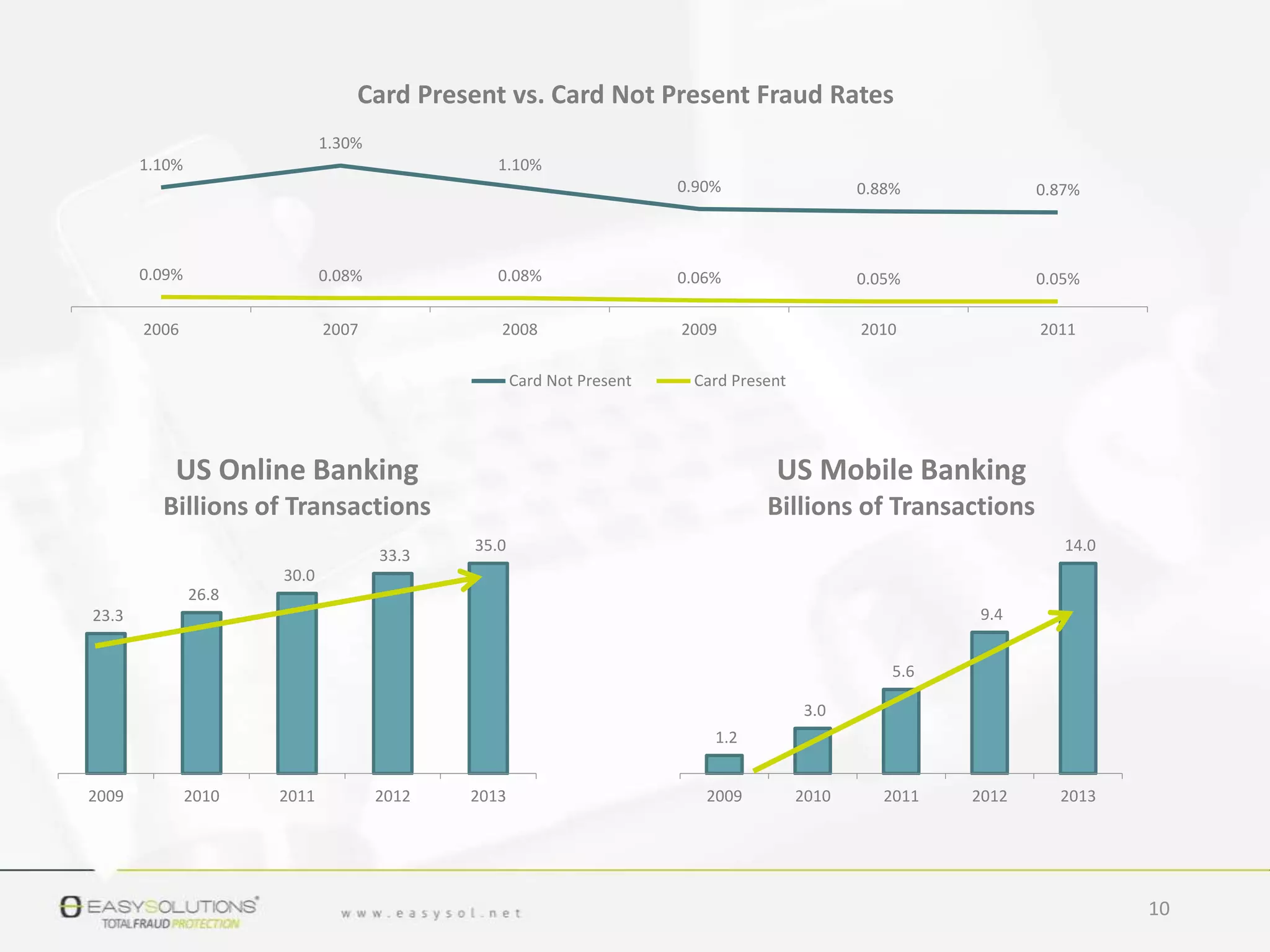

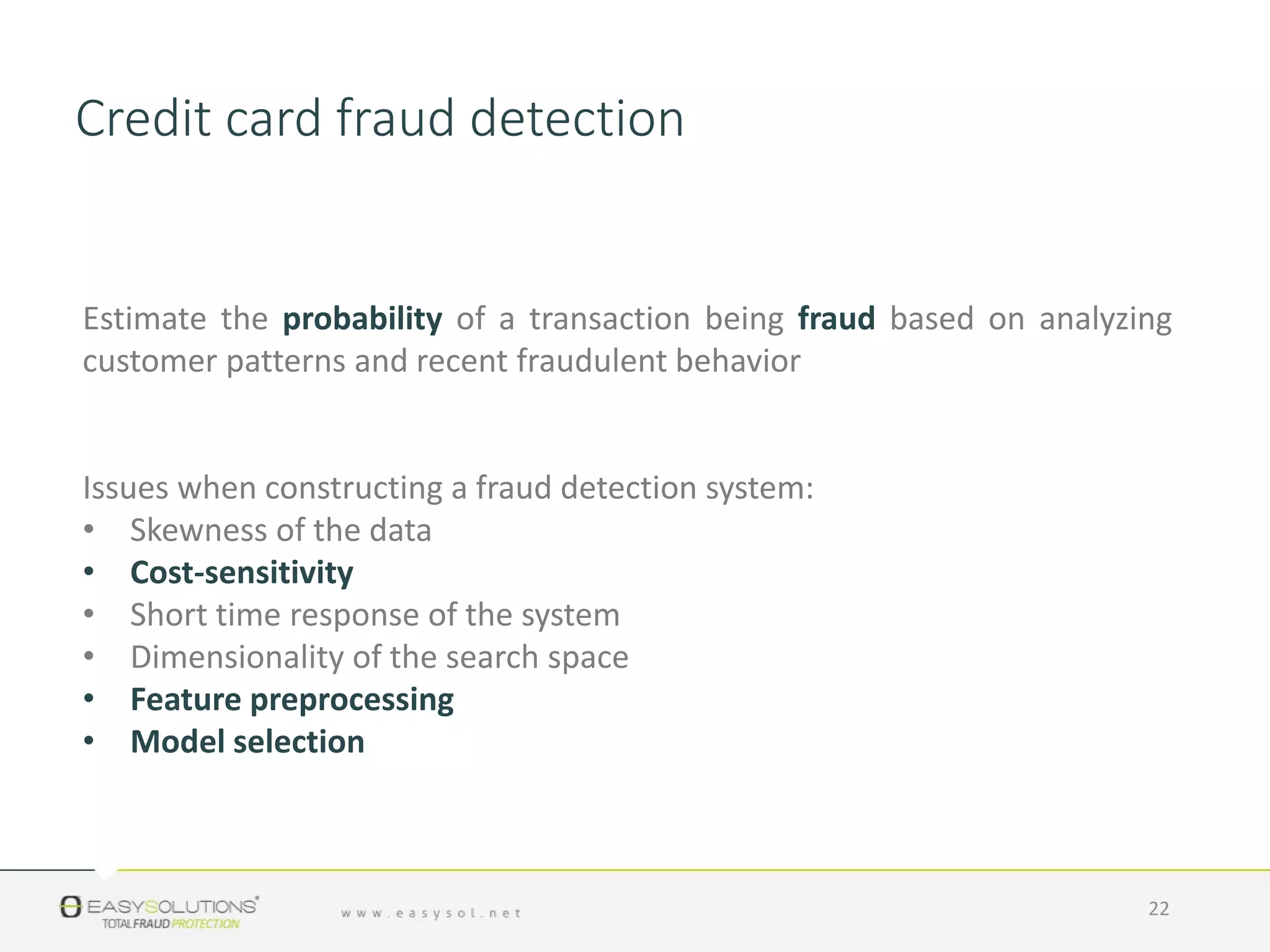

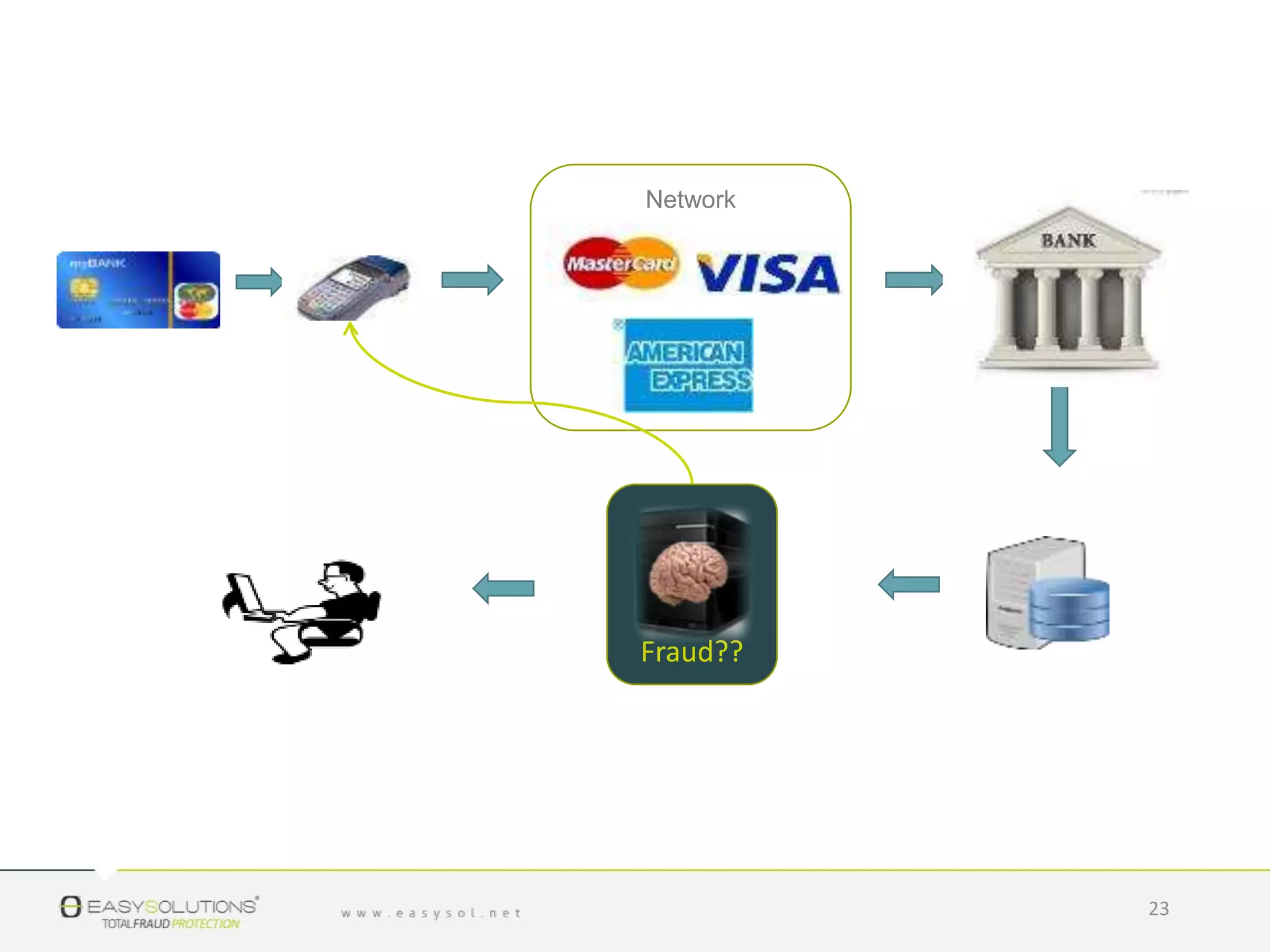

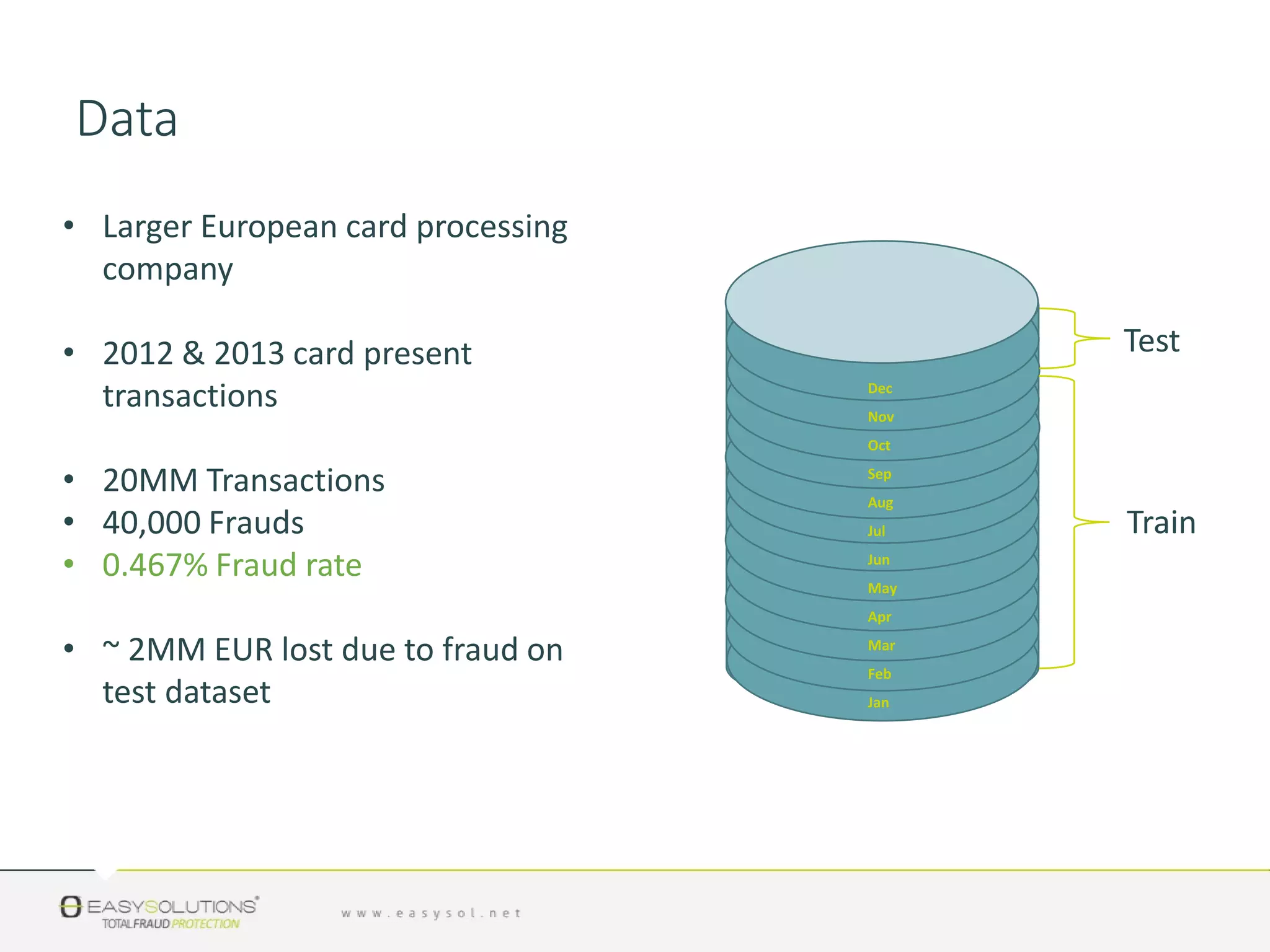

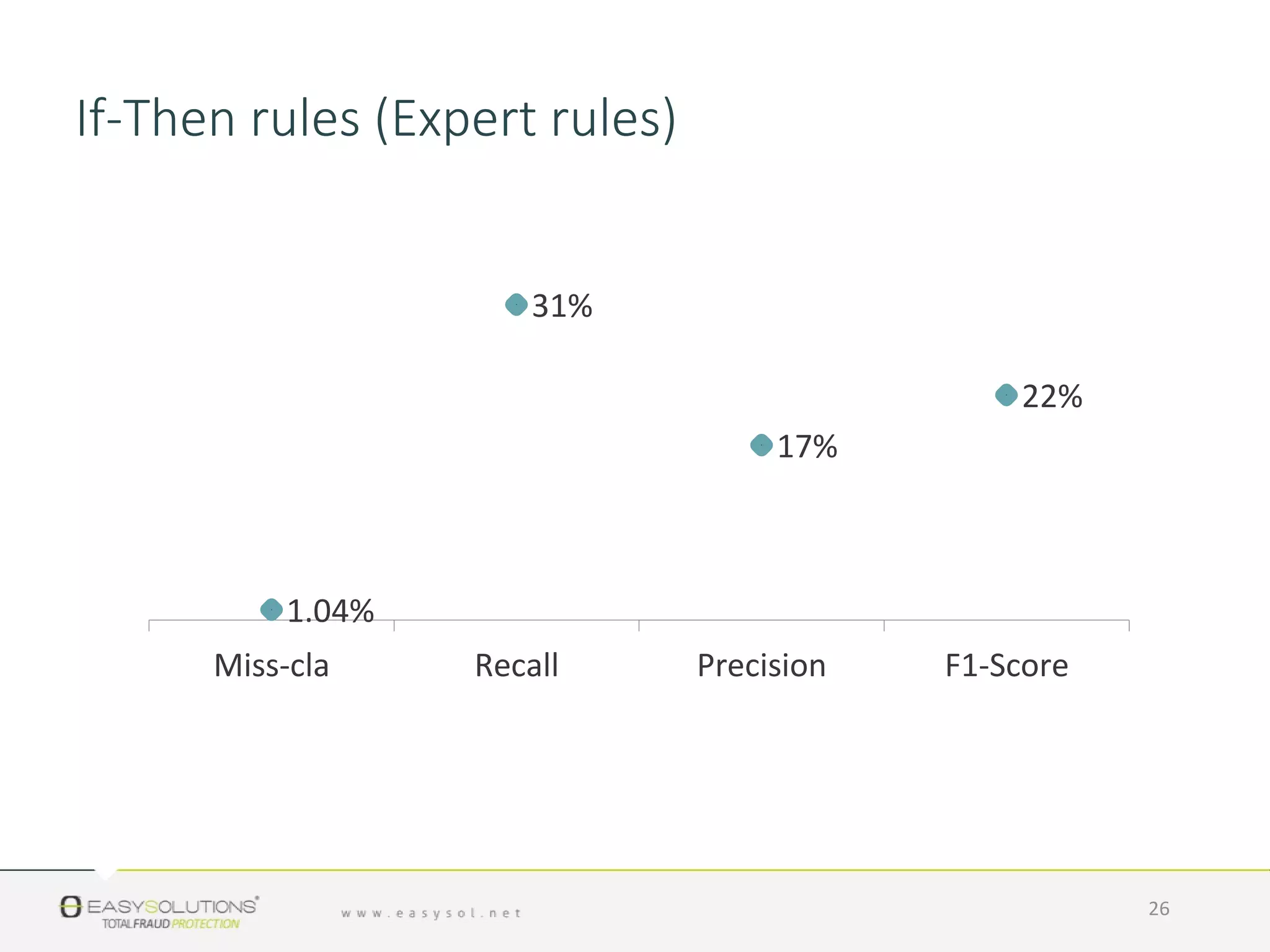

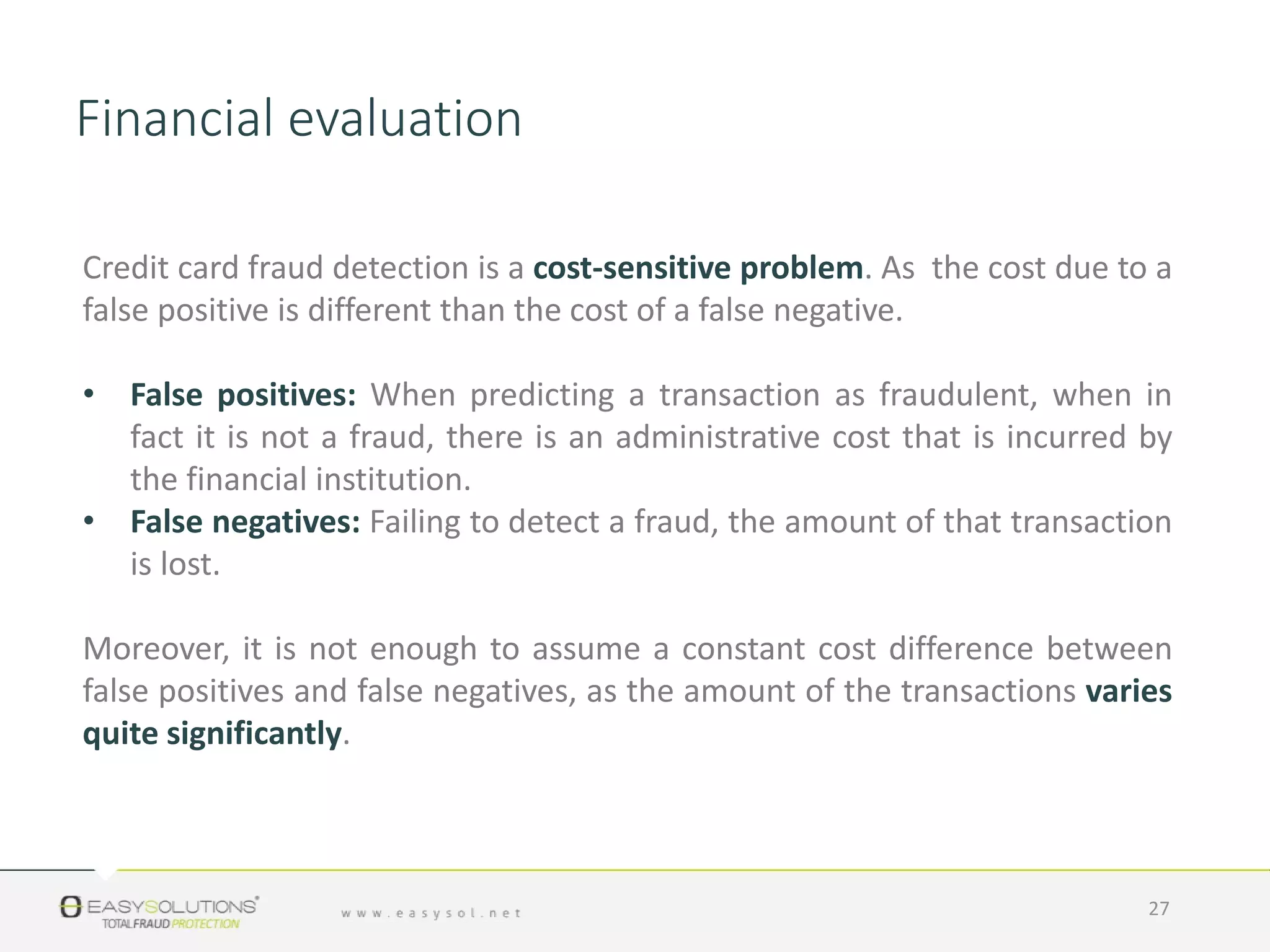

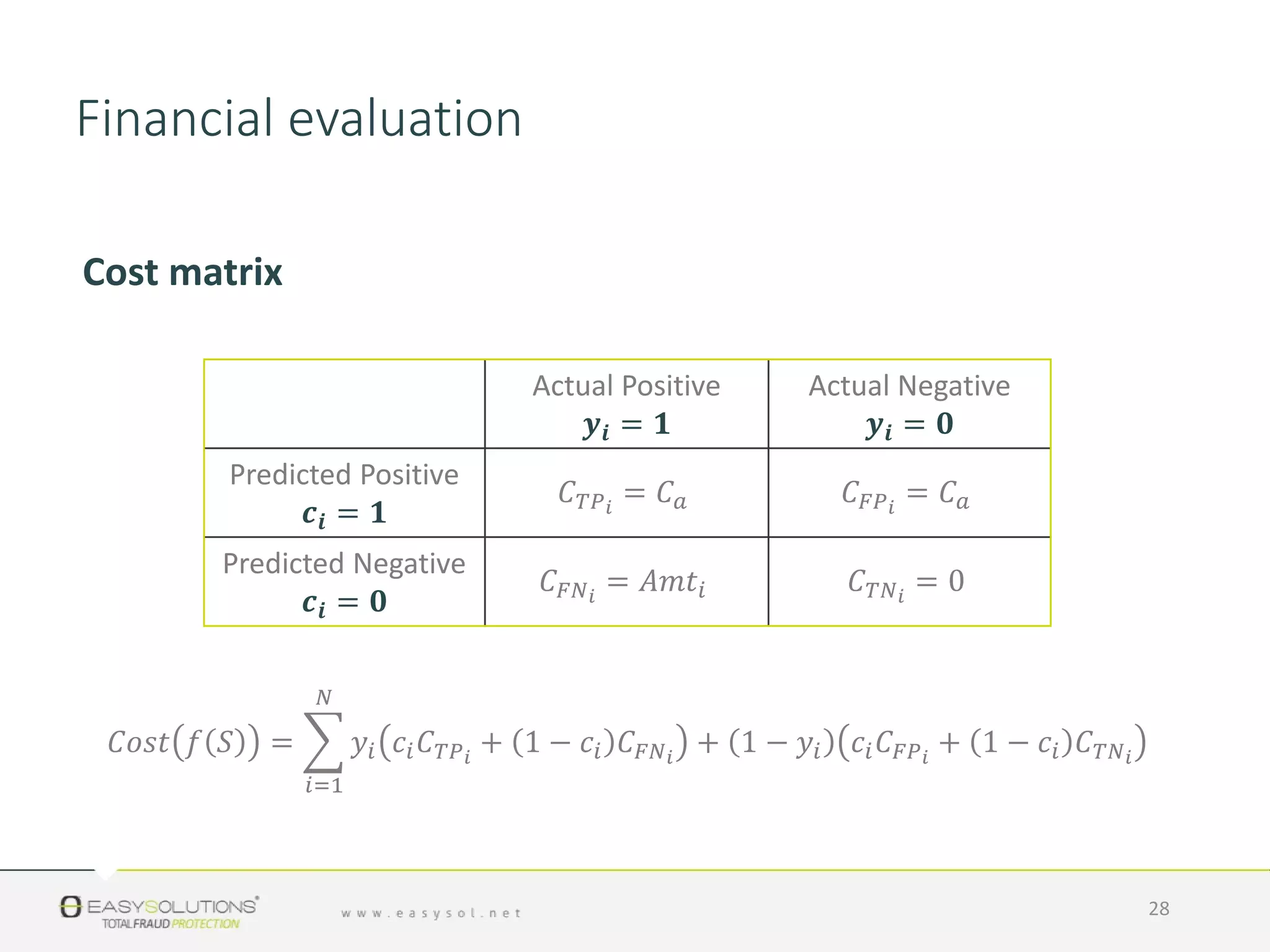

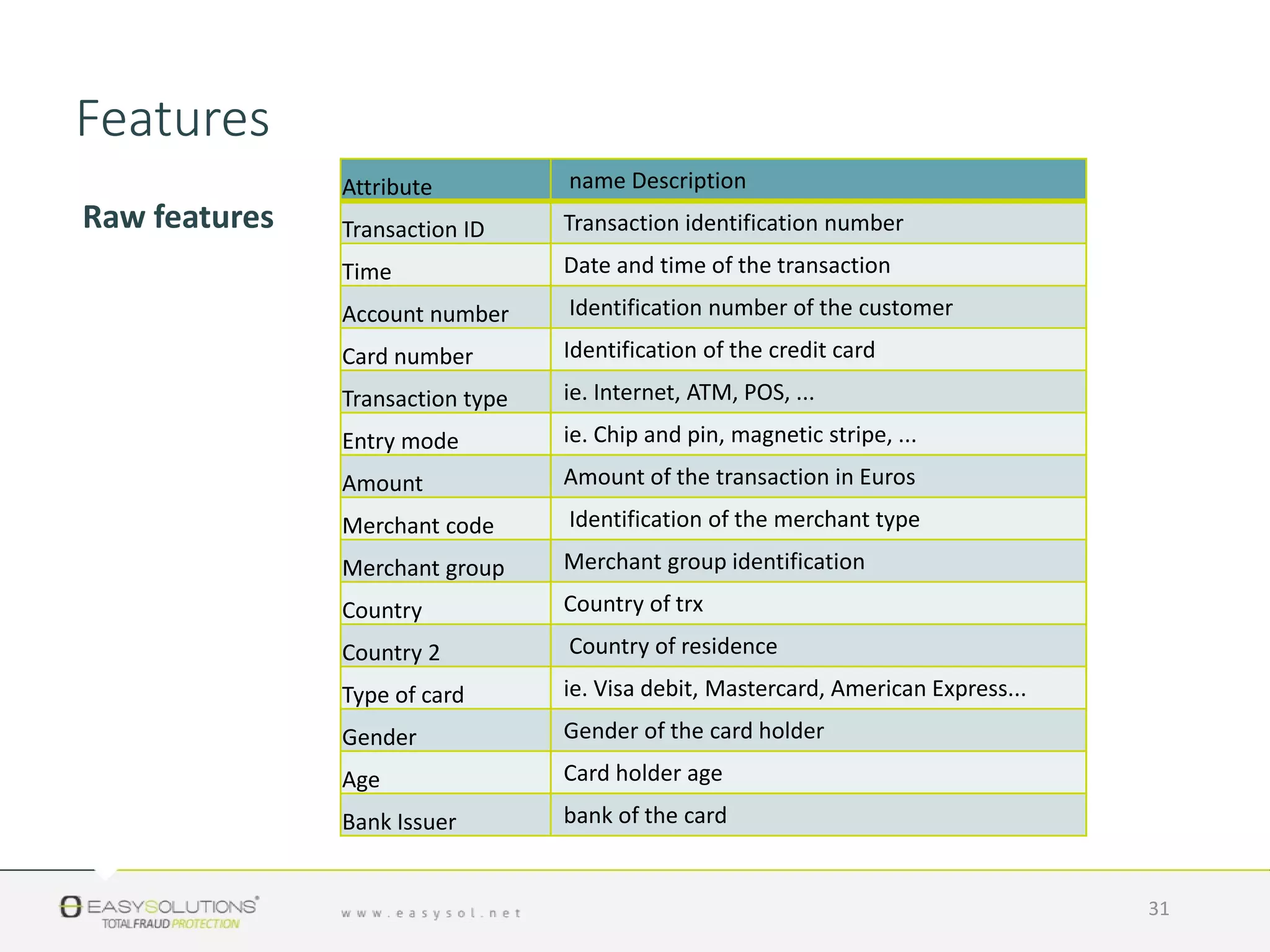

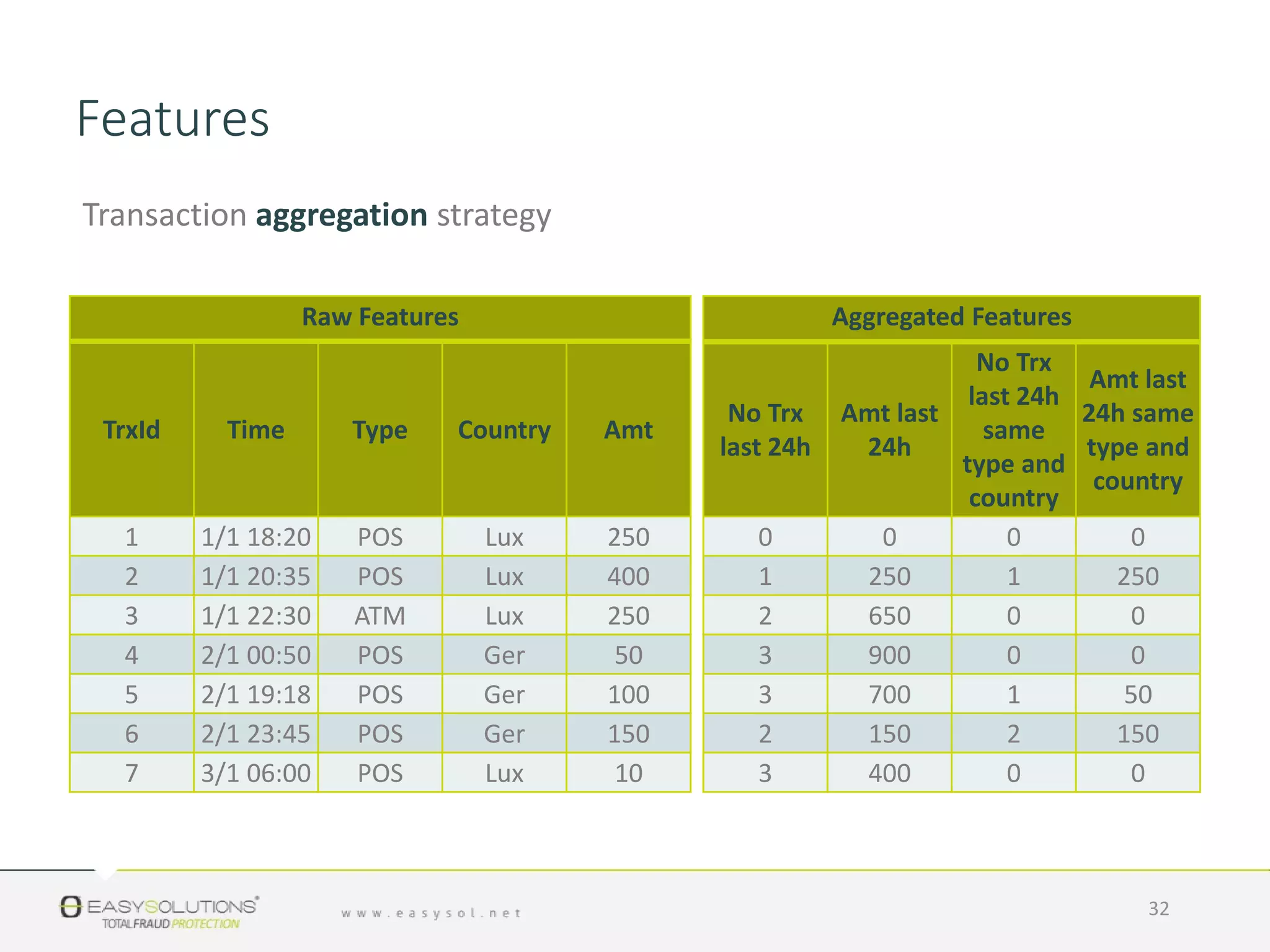

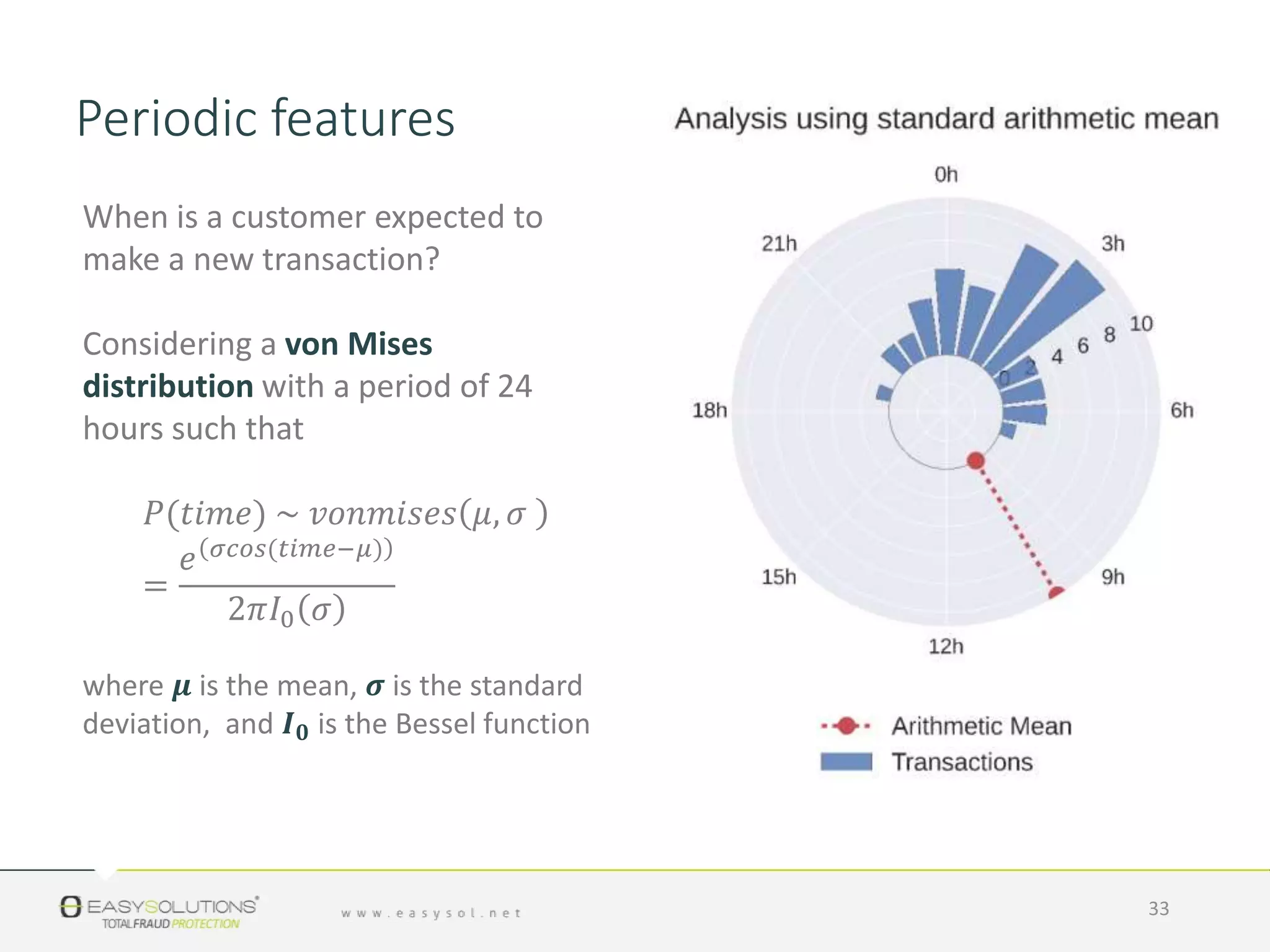

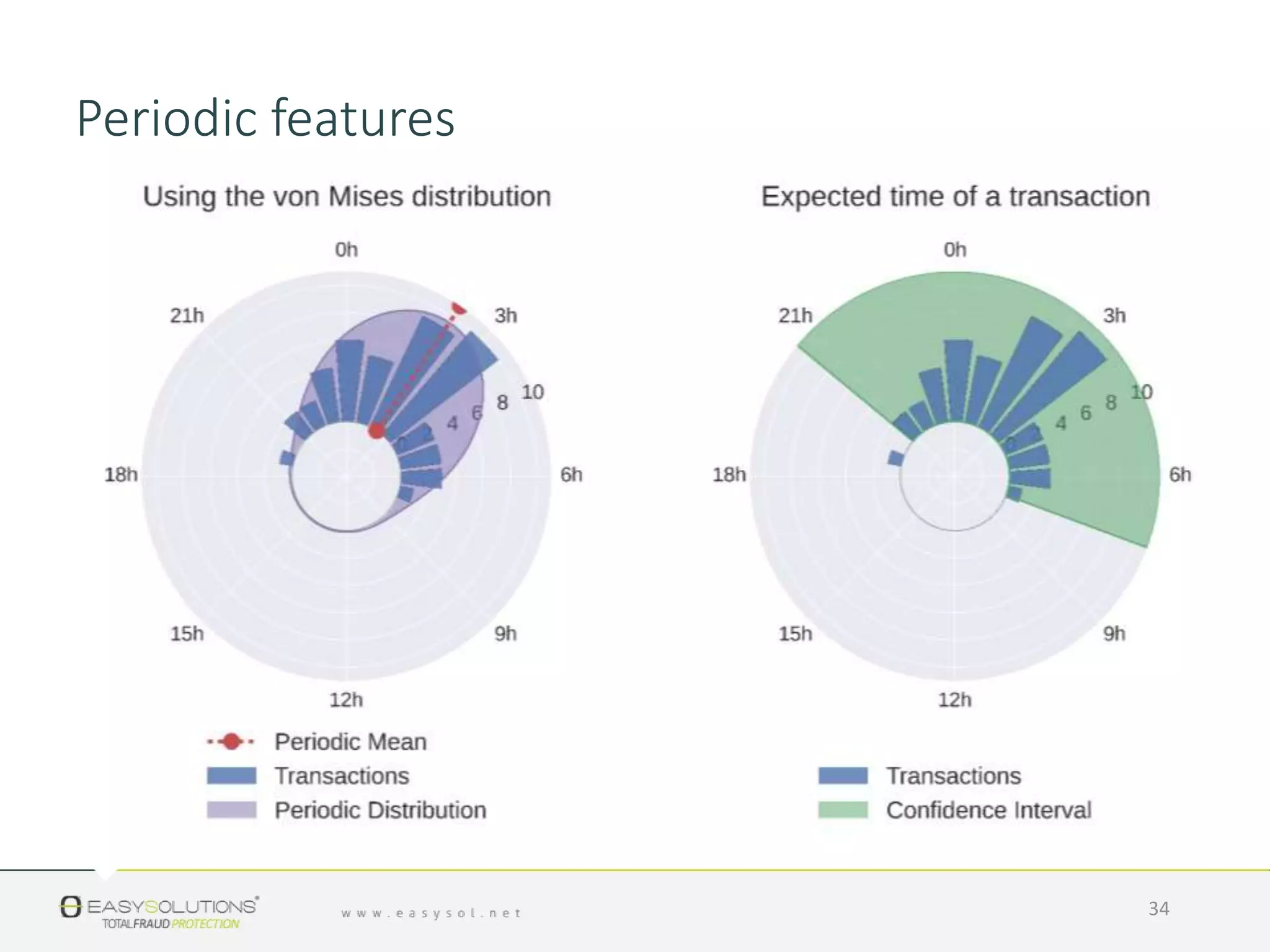

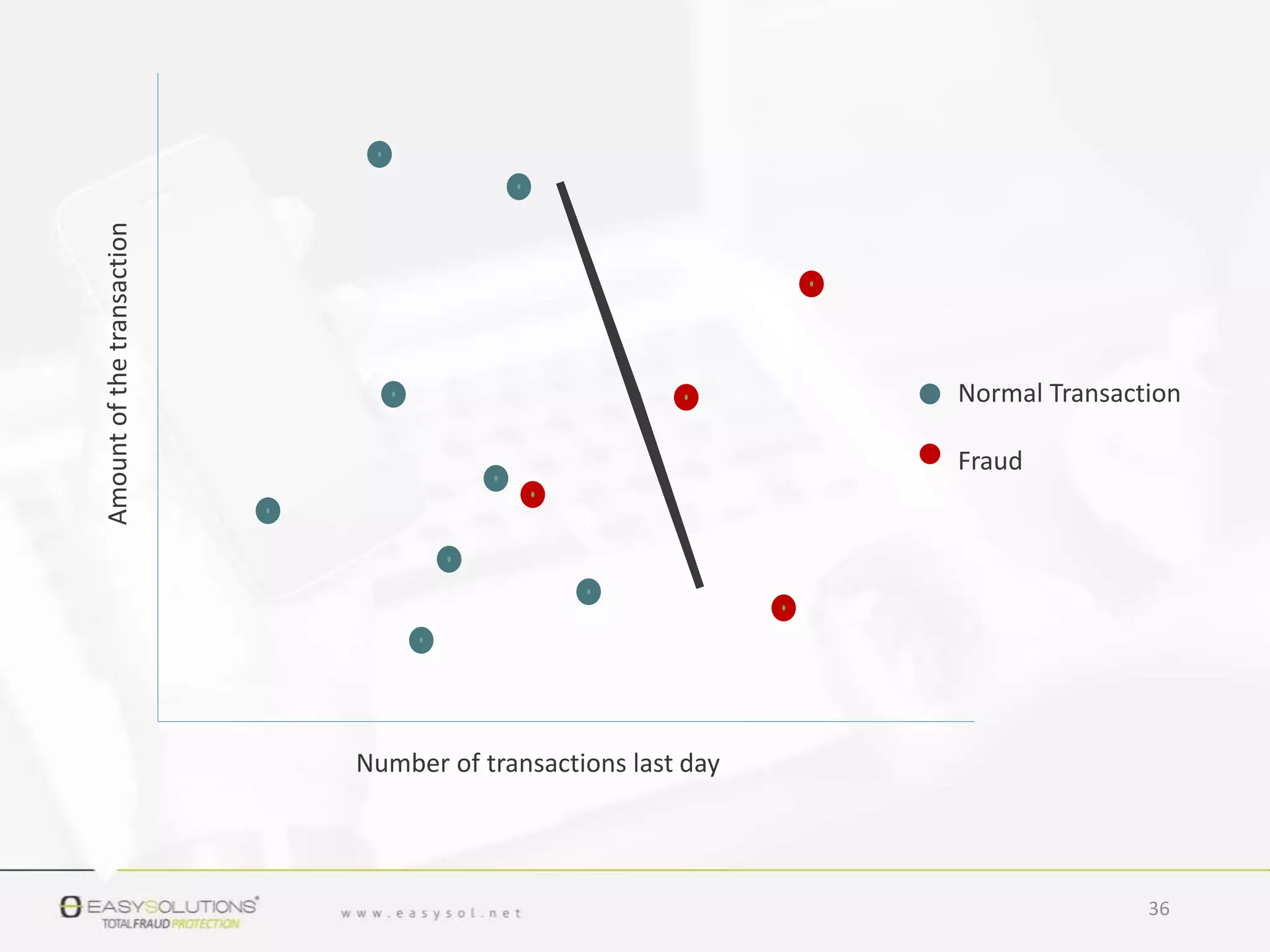

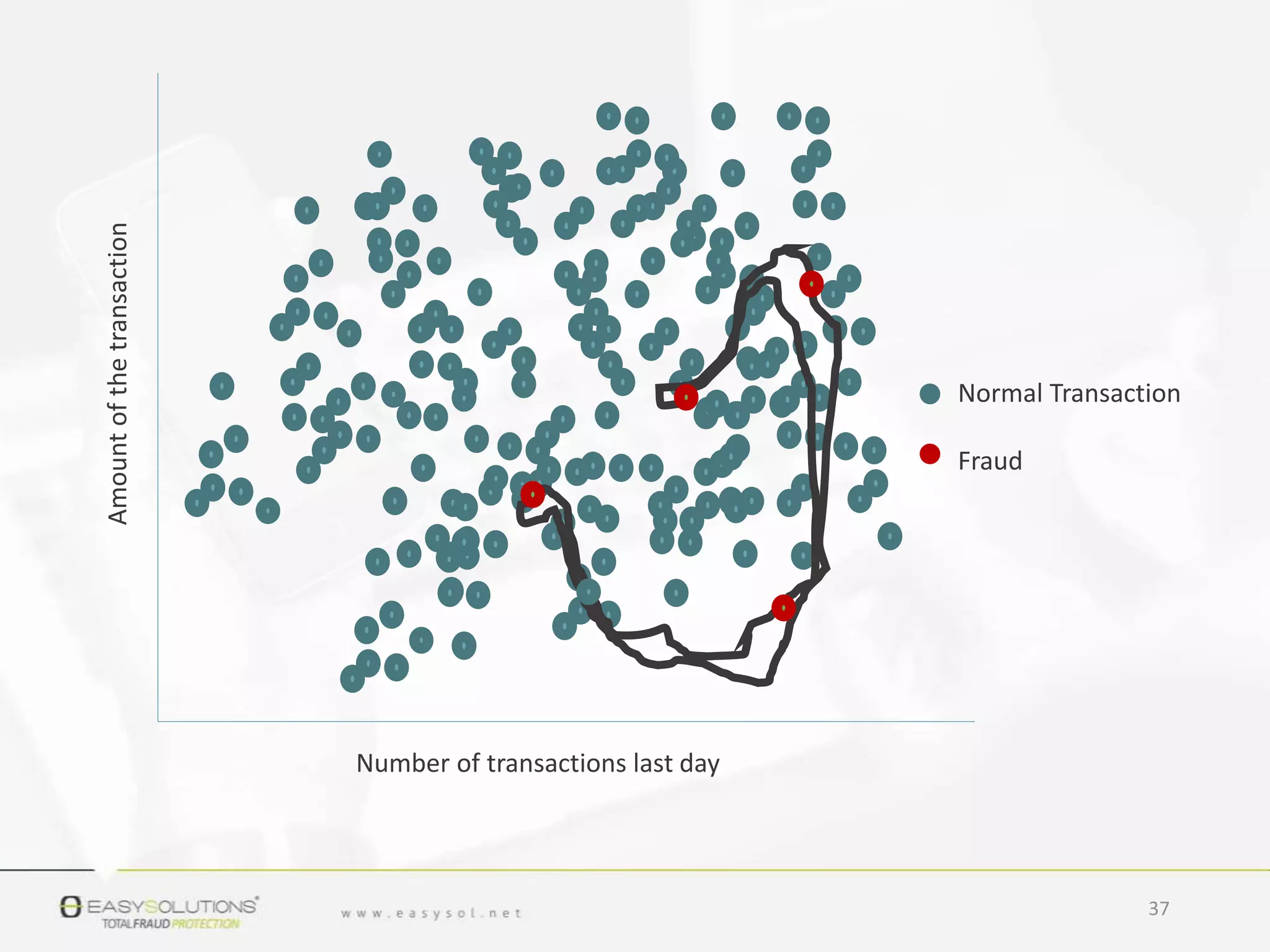

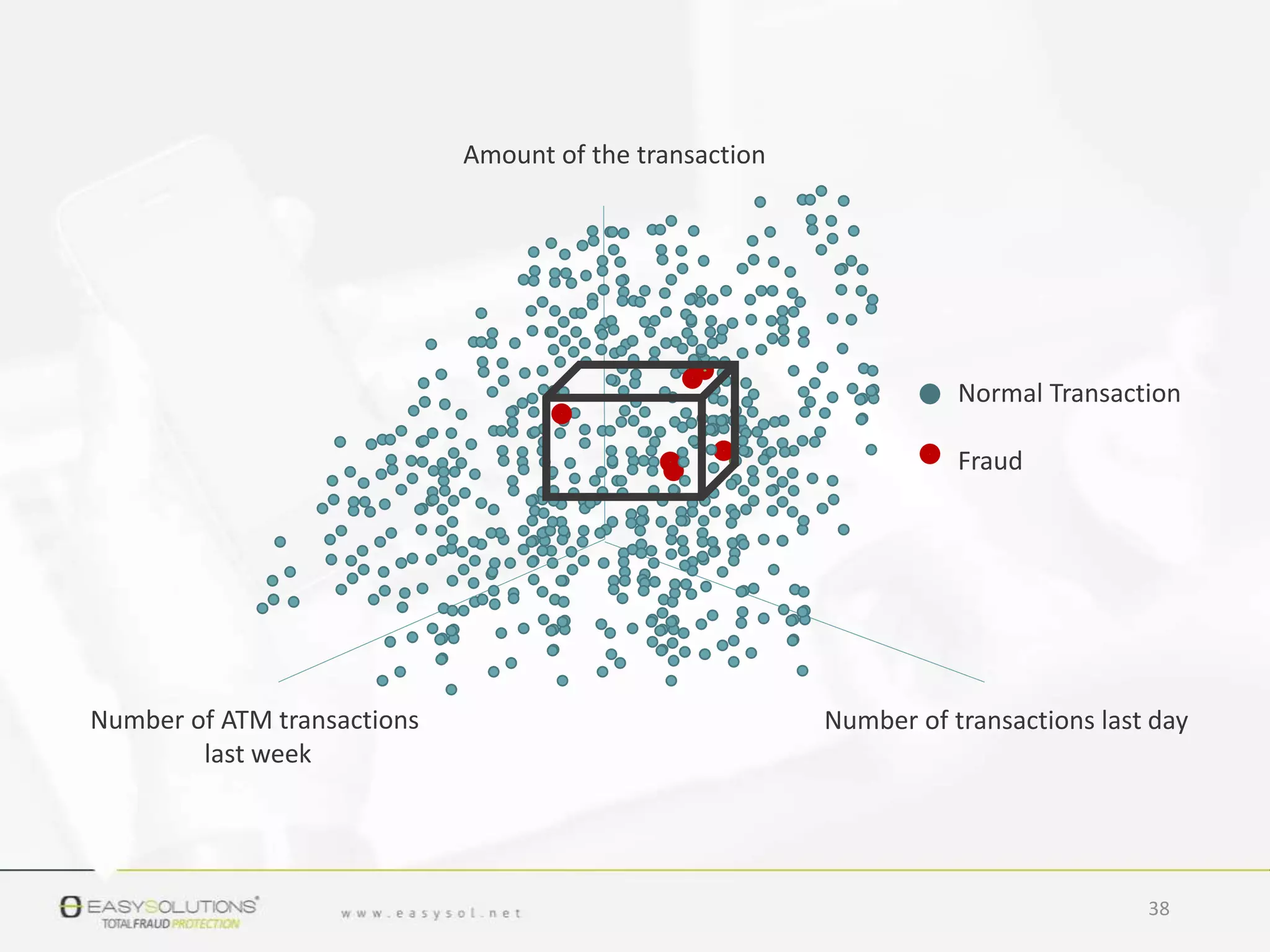

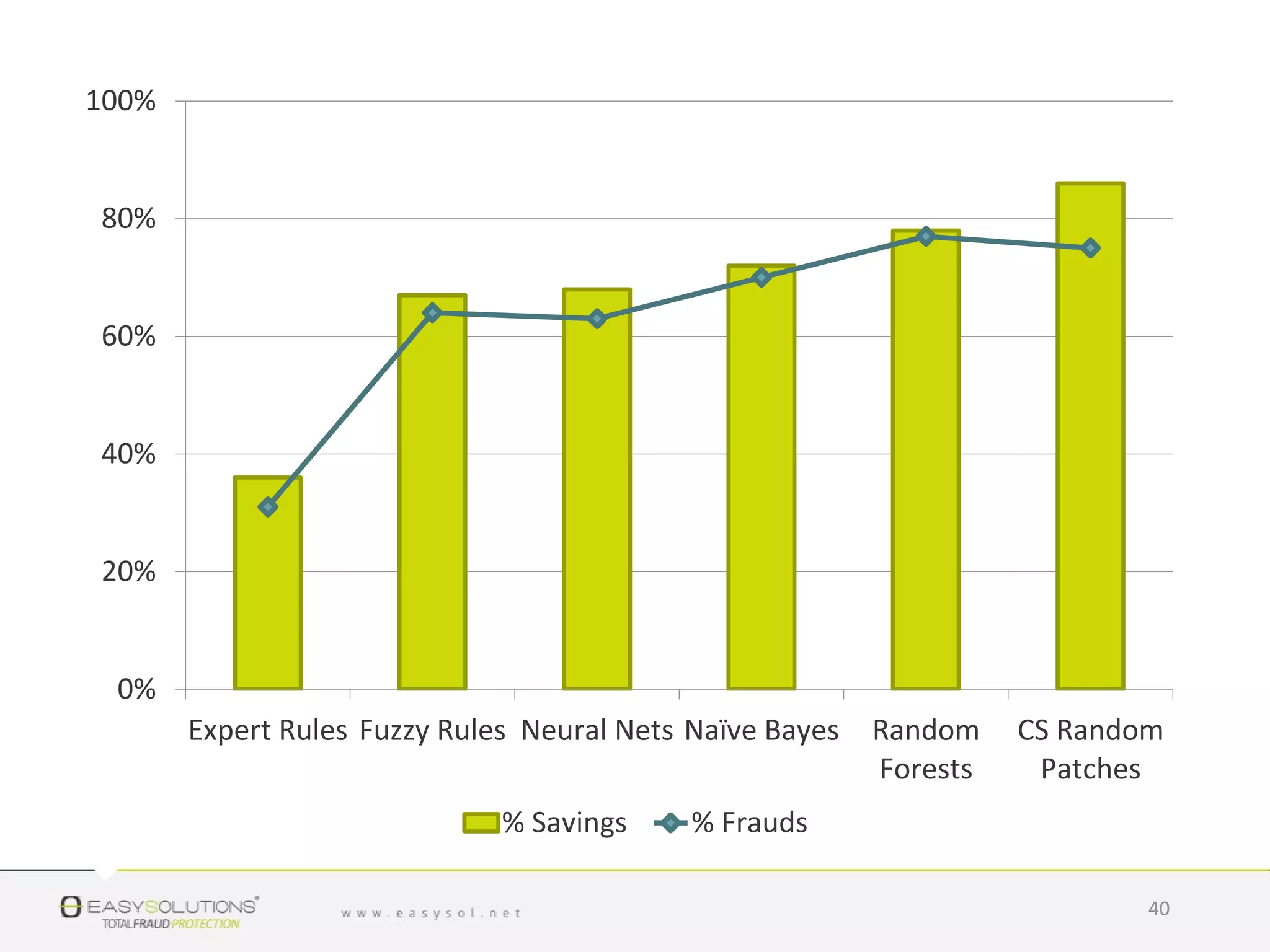

3. Fraud analytics uses machine learning and artificial intelligence techniques to analyze customer transaction data and detect patterns that can predict fraudulent transactions from legitimate ones.