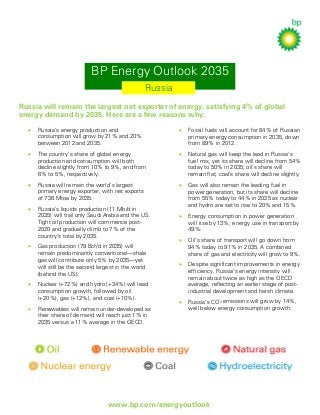

BP Energy Outlook 2035 - Russia country insights 2014

- 1. BP Energy Outlook 2035 Russia Russia will remain the largest net exporter of energy, satisfying 4% of global energy demand by 2035. Here are a few reasons why: • Russia’s energy production and consumption will grow by 21% and 20% between 2012 and 2035. • Fossil fuels will account for 84% of Russian primary energy consumption in 2035, down from 89% in 2012. • The country’s share of global energy production and consumption will both decline slightly from 10% to 9%, and from 6% to 5%, respectively. • Natural gas will keep the lead in Russia’s fuel mix, yet its share will decline from 54% today to 50% in 2035; oil’s share will remain flat, coal’s share will decline slightly. • Russia will remain the world’s largest primary energy exporter, with net exports of 736 Mtoe by 2035. • • Russia’s liquids production (11 Mb/d in 2035) will trail only Saudi Arabia and the US. Tight oil production will commence post2020 and gradually climb to 7% of the country’s total by 2035. Gas will also remain the leading fuel in power generation, but its share will decline from 55% today to 44% in 2035 as nuclear and hydro are set to rise to 20% and 15%. • Energy consumption in power generation will rise by 13%; energy use in transport by 49%. • Oil’s share of transport will go down from 94% today to 91% in 2035. A combined share of gas and electricity will grow to 9%. • Despite significant improvements in energy efficiency, Russia’s energy intensity will remain about twice as high as the OECD average, reflecting an earlier stage of postindustrial development and harsh climate. • Russia’s CO2 emissions will grow by 14%, well below energy consumption growth. • Gas production (79 Bcf/d in 2035) will remain predominantly conventional—shale gas will contribute only 5% by 2035—yet will still be the second largest in the world (behind the US). • Nuclear (+72%) and hydro (+34%) will lead consumption growth, followed by oil (+20%), gas (+12%), and coal (+10%). • Renewables will remain under-developed as their share of demand will reach just 1% in 2035 versus a 11% average in the OECD. www.bp.com/energyoutlook