Freight Out Analyses

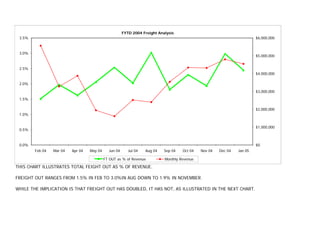

- 1. FYTD 2004 Freight Analysis 3.5% $6,000,000 3.0% $5,000,000 2.5% $4,000,000 2.0% $3,000,000 1.5% $2,000,000 1.0% $1,000,000 0.5% 0.0% $0 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 FT OUT as % of Revenue Monthly Revenue THIS CHART ILLUSTRATES TOTAL FEIGHT OUT AS % OF REVENUE. FREIGHT OUT RANGES FROM 1.5% IN FEB TO 3.0%IN AUG DOWN TO 1.9% IN NOVEMBER. WHILE THE IMPLICATION IS THAT FREIGHT OUT HAS DOUBLED, IT HAS NOT, AS ILLUSTRATED IN THE NEXT CHART.

- 2. FYTD 2004 Freight Analysis $1.20 $6,000,000 $1.00 $5,000,000 $0.80 $4,000,000 $0.60 $3,000,000 $0.40 $2,000,000 $0.20 $1,000,000 $0.00 $0 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 FT OUT Dollars/Unit Monthly Revenue AS ILLUSTRATED ABOVE, FREIGHT OUT, EXPRESSED AS $/UNIT, HAS NOT DOUBLED AS IMPLIED BY THE % OF REVENUE CHART. IN THIS CHART, FREIGHT OUT HAS INCREASED FROM $0.78/UNIT TO $0.91/UNIT. THE INCREMENT IN FREIGHT OUT, AS % OF REVENUE AND $/UNIT IS INVESTIGATED IN THE FOLLOWING CHARTS.

- 3. DC Shipments Freight Analysis $6,000,000 2.5% $5,000,000 2.0% $4,000,000 1.5% $3,000,000 1.0% $2,000,000 0.5% $1,000,000 $0 0.0% Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 DC Revenue Dollars DC FT OUT as % of Revenue DISTRIBUTION CENTER SHIPMENTS ARE ILLUSTRATED ABOVE AS % OF REVENUE. THE FREIGHT OUT IS FAIRLY CONSTANT BETWEEN 1.2% TO 1.5% AS % OF REVENUE. CLEARLY, THE VARIABILITY IN COST IS DUE TO THE VARIABILITY IN VOLUME. THAT IS, AS VOLUME GOES DOWN, FREIGHT COST GOES UP.

- 4. DC Shipments Freight Analysis $6,000,000 $1.20 $5,000,000 $1.00 $4,000,000 $0.80 $3,000,000 $0.60 $2,000,000 $0.40 $1,000,000 $0.20 $0 $0.00 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 DC Revenue Dollars DC FT OUT Dollars/Unit THIS CHART ILLUSTRATES FREIGHT OUT AS COST/UNIT. AS ILLUSTRATED, COST/UNIT HAS VARIED FROM $0.69 TO $1.05. THE COST/UNIT DROPPED IN MARCH AND APRIL, ALONG WITH OUR VOLUME, THAT IS INDICATIVE OF THE REDUCTION IN FREIGHT BY VIRTUE OF THE FAK 72 RATE.

- 5. Store Direct Shipments Freight Analysis $2,000,000 10.0% $1,800,000 9.0% $1,600,000 8.0% $1,400,000 7.0% $1,200,000 6.0% $1,000,000 5.0% $800,000 4.0% $600,000 3.0% $400,000 2.0% $200,000 1.0% $0 0.0% Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 Store Direct Revenue Dollars Store Direct FT OUT as % of Revenue ITEMIZING THE STORE-DIRECT SHIPMENTS YIELDED VERY INTERSTING INFORMATION AS ILLUSTRATED ABOVE. ON A % OF REVENUE, STORE DIRECT SHIPMENTS ARE VERY HIGH. FROM 6.5% IN FEBRUARY TO 9.0% IN JULY. THE COST DROP IN SEPTEMBER IS A DIRECT RESULT OF INCREASED VOLUME. STORE DIRECT SHIPMENTS ARE THE BIGGEST FACTOR IN FREIGHT OUT COSTS.

- 6. Store Direct Shipments Freight Analysis $2,000,000 $1.40 $1,800,000 $1.20 $1,600,000 $1,400,000 $1.00 $1,200,000 $0.80 $1,000,000 $0.60 $800,000 $600,000 $0.40 $400,000 $0.20 $200,000 $0 $0.00 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 Store Direct Revenue Dollars Store Direct FT OUT Dollars/Unit LOOKING AT STORE DIRECT SHIPMENTS AS COST/UNIT EVOKES THE SAME CONCLUSION. THE COST/UNIT GOES FROM $1.11 IN FREB TO $1.33 IN AUG AND DOWN TO $0.79 IN NOV. COMPARED TO DC SHIPMENTS, THE DIFFERENCES IN % OF REVENUE AND $/UNIT ARE SIGNIFICANT.

- 7. Store Direct vs DC Shipments 10.0% $6,000,000 9.0% $5,000,000 8.0% 7.0% $4,000,000 6.0% 5.0% $3,000,000 4.0% $2,000,000 3.0% 2.0% $1,000,000 1.0% 0.0% $0 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 Store Direct FT OUT as % of Revenue DC FT OUT as % of Revenue Monthly Revenue WHEN COMPARED AGAINST STORE DIRECT SHIPMENTS, DC SHIPMENTS ARE VERY STABLE AND PREDICTABLE. CLEARLY, THE PROBLEM IS IN THE STORE DIRECT SHIPMENTS AND THEIR SIGNIFICANT VARIABILITY.

- 8. Impact of Non-Ttoyz Store-Direct Shipments 10,000 $60,000 9,000 $50,000 8,000 7,000 $40,000 6,000 5,000 $30,000 4,000 $20,000 3,000 2,000 $10,000 1,000 0 $0 Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Jan 05 Store Direct Non-Ttoyz Store Direct Ttoyz Store Direct FT OUT FURTHER DRILL-DOWN INTO STORE DIRECT SHIPMENTS REVEAL THAT SIGNIFICANT VOLUMES OF NON-TTOYZ ARE SHIPPED STORE DIRECT. APPROX 80% OF THE NON-TTOYZ SHIPPED STORE DIRECT ARE EXTERNAL OPTICAL DRIVES. ANOTHER FACTOR IS THE HIGH COST OF FREIGHT INCLUDE STAND-ALONE POWER SUPPLY SHIPMENTS. AS EVIDENCED BY THE CHART ABOVE, NON-TTOYZ SHIPMENTS HAVE SIGNIFICANTLYINCREASED SINCE JULY AND LITERALLY SKYROCKETED IN OCTOBER.

- 9. YTD Average Sales Price $90.00 10.0% $80.00 9.0% 8.0% $70.00 7.0% $60.00 6.0% $50.00 5.0% $40.00 4.0% $30.00 3.0% $20.00 2.0% $10.00 1.0% $0.00 0.0% Feb 04 Mar 04 Apr 04 May 04 Jun 04 Jul 04 Aug 04 Sep 04 Oct 04 Nov 04 Dec 04 Non-Ttoyz ASP Store Direct FT OUT as % of Rev THIS CHART ILLUSTRATES THE IMPACT OF NON-TTOYZ ASP ON FREIGHT OUT AS A % OF REVENUE. NON-TTOYZ ASP, FROM OPTICAL DRIVES, ETC., ADDS SIGNIFICANT VARIABILITY TO FREIGHT OUT. NON-TOYZ AVERAGE NEARLY $59/UNIT WHILE TTOYZ AVERAGE NEARLY $13/UNIT. THIS DISPARITY IN ASP HAS A DETRIMENTAL EFFECT ON TTOYZ FT OUT % DUE TO THE MUCH HIGHER ASP OF NON-TTOYZ (OPTICAL SOTRAGE, GRAPHICS, ETC.). TTOYZ METRIC SHOULD BE ON A $/UNIT BASIS.

- 10. SUMMARY AND ACTION ITEMS DC SHIPMENTS ARE IN LINE WITH ESTABLISHED METRIC(S). STORE DIRECT SHIPMENTS ARE OUT OF METRIC AND ARE A SIGNIFICANT FACTOR IN FREIGHT OUT COSTS. STORE DIRECT SHIPMENTS OF NON-TTOYZ ARE A SIGNIFICANT COST-ADDER TO THE FREIGHT OUT METRIC. ACTION ITEMS STOP SHIPPING NON-TTOYZ STORE DIRECT. STOP SHIPPING NON-TTOYZ EXPRESS (3-DAY) STORE DIRECT (OBVIOUS). SHIP TTOYZ IN 10-PACKS TO LOWER FT COST/UNIT. GET CUSTOMER(S) TO ORDER POWER SUPPLIES WITH TTOYZ (UNDER THE SAME PO). CHANGE TTOYZ FT OUT METRIC FROM % OF REVENUE TO $/UNIT