Reclaiming VAT on pension scheme costs – what should you be thinking about?

•

0 likes•233 views

Following the judgment of the Court of Justice of the European Union (CJEU) in the case of PPG Holdings, the VAT incurred on administration and investment management expenses was ruled to be reclaimable, in certain circumstances. This ruling prompted a change of policy by HMRC which has left advisors and businesses somewhat confused on the VAT treatment of such expenses.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Olimpo Exclusive Living

(21) 3021-0040 http://www.imobiliariadorio.com.br/imoveis/detalhes/olimpo-exclusive-livingOlimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...

Olimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...www.imobiliariadorio.com.br (21) 3021-0040

More Related Content

What's hot

What's hot (20)

Business Financials in Plain English: a Focused Overview

Business Financials in Plain English: a Focused Overview

preparation of profit and loss account, and balance sheet of sole propritor

preparation of profit and loss account, and balance sheet of sole propritor

Guide to Profit and Loss, Balance Sheet & Cash flow statements

Guide to Profit and Loss, Balance Sheet & Cash flow statements

Profit and Loss, Balance Sheets and RATIO ANALYSIS

Profit and Loss, Balance Sheets and RATIO ANALYSIS

Viewers also liked

Olimpo Exclusive Living

(21) 3021-0040 http://www.imobiliariadorio.com.br/imoveis/detalhes/olimpo-exclusive-livingOlimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...

Olimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...www.imobiliariadorio.com.br (21) 3021-0040

PDF software. Social media. Tablets and smartphones. And of course, that ubiquitous term: cloud computing. See how modern firms are using new technology to store and share information efficiently—and stop your office from drowning in paperwork.Ernie Svenson - Practice Law, Not Paper Pushing: The Paperless Firm

Ernie Svenson - Practice Law, Not Paper Pushing: The Paperless FirmClio - Cloud-Based Legal Technology

Viewers also liked (15)

Olimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...

Olimpo Exclusive Living - (21) 3021-0040 - http://www.imobiliariadorio.com.br...

The International Journal of Engineering and Science (The IJES)

The International Journal of Engineering and Science (The IJES)

Ernie Svenson - Practice Law, Not Paper Pushing: The Paperless Firm

Ernie Svenson - Practice Law, Not Paper Pushing: The Paperless Firm

Analysis of User Submission Behavior on HPC and HTC

Analysis of User Submission Behavior on HPC and HTC

Similar to Reclaiming VAT on pension scheme costs – what should you be thinking about?

International Best Tax practices in India || An Article by CA. Sudha G. BhushanInternational Best Tax practices in India || An Article by CA. Sudha G. Bhushan

International Best Tax practices in India || An Article by CA. Sudha G. BhushanTAXPERT PROFESSIONALS

Similar to Reclaiming VAT on pension scheme costs – what should you be thinking about? (20)

VAT & Occupational Pension Schemes – HMRC issues guidance

VAT & Occupational Pension Schemes – HMRC issues guidance

Off Payroll Working In Private Sector | Makesworth Accountants in Harrow

Off Payroll Working In Private Sector | Makesworth Accountants in Harrow

Horner Downey & Company- Tax & Financial Strategies

Horner Downey & Company- Tax & Financial Strategies

Plymouth - Essential 6-monthly Finance Directors' Update - June 2019

Plymouth - Essential 6-monthly Finance Directors' Update - June 2019

Bournemouth - Essential 6-monthly Finance Directors' Update - June 2019

Bournemouth - Essential 6-monthly Finance Directors' Update - June 2019

Truro - Essential 6-monthly Finance Directors' Update - June 2019

Truro - Essential 6-monthly Finance Directors' Update - June 2019

Taunton - Essential 6-monthly Finance Directors' Update - June 2019

Taunton - Essential 6-monthly Finance Directors' Update - June 2019

Exeter - Essential 6-monthly Finance Directors' Update - June 2019

Exeter - Essential 6-monthly Finance Directors' Update - June 2019

International Best Tax practices in India || An Article by CA. Sudha G. Bhushan

International Best Tax practices in India || An Article by CA. Sudha G. Bhushan

VIETNAM TAX ISSUES – OUTLOOK ON THE EUROPEAN UNION VIETNAM FREE TRADE AGREEME...

VIETNAM TAX ISSUES – OUTLOOK ON THE EUROPEAN UNION VIETNAM FREE TRADE AGREEME...

SMAC_Salient-Features-of-the-New-Income-Tax-Act-2023.pdf

SMAC_Salient-Features-of-the-New-Income-Tax-Act-2023.pdf

More from Alex Baulf

More from Alex Baulf (20)

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

UK: VAT alert - Government publicises VAT changes if there is “no-deal” on B...

International Indirect Tax - Global VAT/GST update (June 2018)

International Indirect Tax - Global VAT/GST update (June 2018)

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

USA: Georgia Enacts Legislation Imposing Bright-Line Nexus Collection or Repo...

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

U.S. Supreme Court Holds Hearing in South Dakota v. Wayfair

International Indirect Tax - Global VAT/GST update (March 2018)

International Indirect Tax - Global VAT/GST update (March 2018)

China: Tax Bulletin-Latest update on VAT Regulations

China: Tax Bulletin-Latest update on VAT Regulations

India: Recommendations from GST Council in 25th meeting

India: Recommendations from GST Council in 25th meeting

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

Serbia: Tax Alert - Amendments of Serbian Tax Laws (Dec 2017)

USA: NY - New York Appellate Division Holds Certain Data Information Services...

USA: NY - New York Appellate Division Holds Certain Data Information Services...

UK: Briefing Paper - Are you ready for Making Tax Digital?

UK: Briefing Paper - Are you ready for Making Tax Digital?

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Cyprus: VAT Alert - VAT on building land, leasing of commercial immovable pro...

Recently uploaded

Recently uploaded (20)

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

abortion pills in Riyadh Saudi Arabia (+919707899604)cytotec pills in dammam

abortion pills in Riyadh Saudi Arabia (+919707899604)cytotec pills in dammam

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

abortion pills in Jeddah Saudi Arabia (+919707899604)cytotec pills in Riyadh

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Explore Dual Citizenship in Africa | Citizenship Benefits & Requirements

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

Significant AI Trends for the Financial Industry in 2024 and How to Utilize Them

fundamentals of corporate finance 11th canadian edition test bank.docx

fundamentals of corporate finance 11th canadian edition test bank.docx

+971565801893>>SAFE ORIGINAL ABORTION PILLS FOR SALE IN DUBAI,RAK CITY,ABUDHA...

+971565801893>>SAFE ORIGINAL ABORTION PILLS FOR SALE IN DUBAI,RAK CITY,ABUDHA...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

Famous Kala Jadu, Black magic expert in Faisalabad and Kala ilam specialist i...

cost-volume-profit analysis.ppt(managerial accounting).pptx

cost-volume-profit analysis.ppt(managerial accounting).pptx

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Black magic specialist in Canada (Kala ilam specialist in UK) Bangali Amil ba...

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Mahendragarh Escorts 🥰 8617370543 Call Girls Offer VIP Hot Girls

Test bank for advanced assessment interpreting findings and formulating diffe...

Test bank for advanced assessment interpreting findings and formulating diffe...

Reclaiming VAT on pension scheme costs – what should you be thinking about?

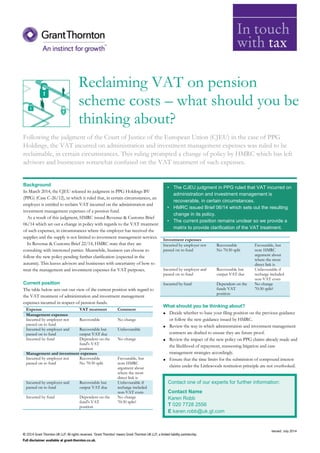

- 1. Following the judgment of the Court of Justice of the European Union (CJEU) in the case of PPG Holdings, the VAT incurred on administration and investment management expenses was ruled to be reclaimable, in certain circumstances. This ruling prompted a change of policy by HMRC which has left advisors and businesses somewhat confused on the VAT treatment of such expenses. Reclaiming VAT on pension scheme costs – what should you be thinking about? Background In March 2014, the CJEU released its judgment in PPG Holdings BV (PPG) (Case C-26/12), in which it ruled that, in certain circumstances, an employer is entitled to reclaim VAT incurred on the administration and investment management expenses of a pension fund. As a result of this judgment, HMRC issued Revenue & Customs Brief 06/14 which set out a change in policy with regards to the VAT treatment of such expenses, in circumstances where the employer has received the supplies and the supply is not limited to investment management services. In Revenue & Customs Brief 22/14, HMRC state that they are consulting with interested parties. Meanwhile, business can choose to follow the new policy pending further clarification (expected in the autumn). This leaves advisors and businesses with uncertainty of how to treat the management and investment expenses for VAT purposes. Current position The table below sets out our view of the current position with regard to the VAT treatment of administration and investment management expenses incurred in respect of pension funds. Expense VAT treatment Comment Management expenses Incurred by employer not passed on to fund Recoverable No change Incurred by employer and passed on to fund Recoverable but output VAT due Unfavourable Incurred by fund Dependent on the fund's VAT position No change Management and investment expenses Incurred by employer not passed on to fund Recoverable No 70:30 split Favourable, but note HMRC argument about where the most direct link is Incurred by employer and passed on to fund Recoverable but output VAT due Unfavourable if recharge included non-VAT costs Incurred by fund Dependent on the fund's VAT position No change 70:30 split? Investment expenses Incurred by employer not passed on to fund Recoverable No 70:30 split Favourable, but note HMRC argument about where the most direct link is Incurred by employer and passed on to fund Recoverable but output VAT due Unfavourable if recharge included non-VAT costs Incurred by fund Dependent on the funds VAT position No change 70:30 split? What should you be thinking about? Decide whether to base your filing position on the previous guidance or follow the new guidance issued by HMRC. Review the way in which administration and investment management contracts are drafted to ensure they are future proof. Review the impact of the new policy on PPG claims already made and the likelihood of repayment, reassessing litigation and case management strategies accordingly. Ensure that the time limits for the submission of compound interest claims under the Littlewoods restitution principle are not overlooked. Contact one of our experts for further information: Contact Name Karen Robb T 020 7728 2556 E karen.robb@uk.gt.com Issued: July 2014 • The CJEU judgment in PPG ruled that VAT incurred on administration and investment management is recoverable, in certain circumstances. • HMRC issued Brief 06/14 which sets out the resulting change in its policy. • The current position remains unclear so we provide a matrix to provide clarification of the VAT treatment.