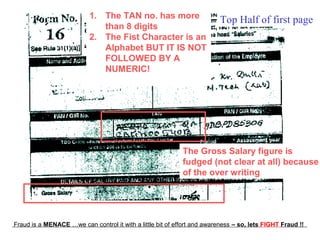

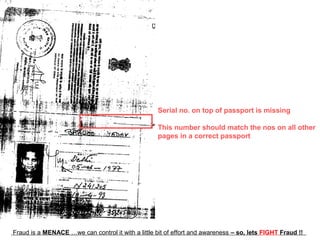

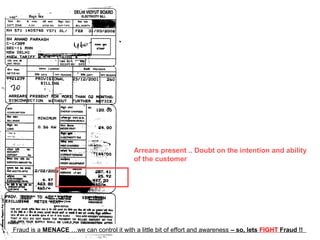

This document provides information on how to spot fraudulent documents. It discusses red flags for various common documents like bank statements, Form 16, income tax returns, and others. For each document type, it lists disconnects or inconsistencies to watch out for that could indicate fraud, such as transactions on bank holidays, inconsistent formatting or handwriting on forms, or incorrect dates. The goal is to educate people on fraud awareness by teaching them to examine documents closely for errors or anomalies.