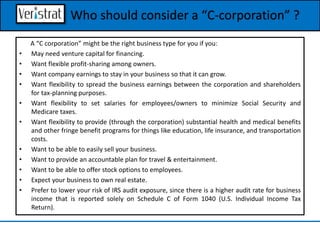

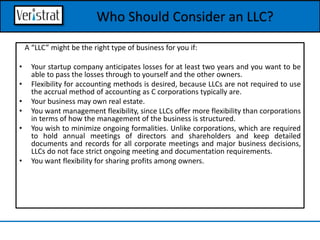

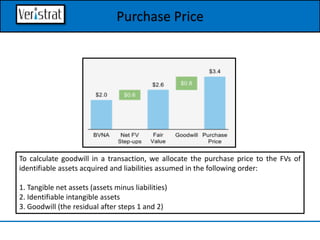

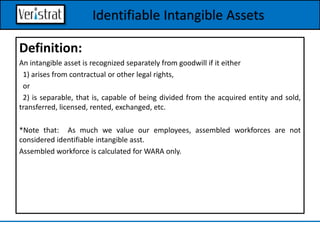

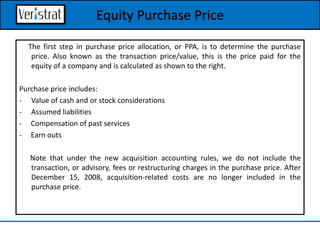

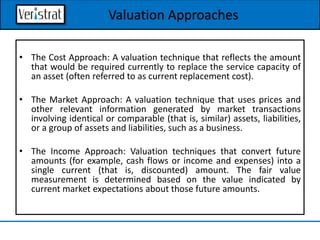

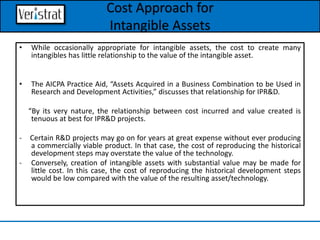

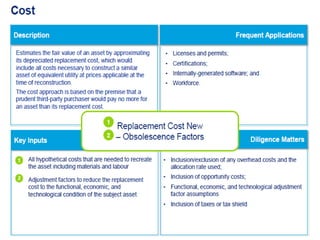

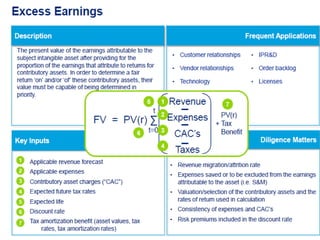

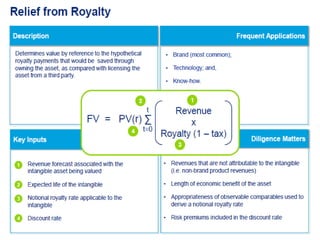

The document outlines the various types of corporations, specifically c-corporations and s-corporations, detailing their formation, taxation structures, and targeted business scenarios. It also introduces limited liability companies (LLCs), highlighting their advantages, such as pass-through taxation and reduced formalities. Additionally, the document explains purchase price allocation (PPA) for business acquisitions, focusing on asset valuation methods and the distinction between tangible and intangible assets.