Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Viewers also liked

Viewers also liked (20)

Similar to state.ia.us tax forms 0841132

Similar to state.ia.us tax forms 0841132 (20)

IN-152 - Underpayment of 2007 Estimated Individual Income Tax

IN-152 - Underpayment of 2007 Estimated Individual Income Tax

Request for Extension of Time to File South Carolina Tax Return (File on-line...

Request for Extension of Time to File South Carolina Tax Return (File on-line...

Nonresident and Part-year resident Computation of Illinois Tax

Nonresident and Part-year resident Computation of Illinois Tax

More from taxman taxman

More from taxman taxman (20)

Recently uploaded

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investorsFalcon Invoice Discounting

VIP Call Girls Napur Anamika Call Now: 8617697112 Napur Escorts Booking Contact Details WhatsApp Chat: +91-8617697112 Napur Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable. Independent Escorts Napur understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together. We provide –(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7Call Girls in Nagpur High Profile Call Girls

Recently uploaded (20)

Insurers' journeys to build a mastery in the IoT usage

Insurers' journeys to build a mastery in the IoT usage

Value Proposition canvas- Customer needs and pains

Value Proposition canvas- Customer needs and pains

Call Girls In Panjim North Goa 9971646499 Genuine Service

Call Girls In Panjim North Goa 9971646499 Genuine Service

How to Get Started in Social Media for Art League City

How to Get Started in Social Media for Art League City

Uneak White's Personal Brand Exploration Presentation

Uneak White's Personal Brand Exploration Presentation

Falcon Invoice Discounting: The best investment platform in india for investors

Falcon Invoice Discounting: The best investment platform in india for investors

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls In Noida 959961⊹3876 Independent Escort Service Noida

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

Call Girls Electronic City Just Call 👗 7737669865 👗 Top Class Call Girl Servi...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

The Path to Product Excellence: Avoiding Common Pitfalls and Enhancing Commun...

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

Mysore Call Girls 8617370543 WhatsApp Number 24x7 Best Services

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

FULL ENJOY Call Girls In Majnu Ka Tilla, Delhi Contact Us 8377877756

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

👉Chandigarh Call Girls 👉9878799926👉Just Call👉Chandigarh Call Girl In Chandiga...

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Hebbal Just Call 👗 7737669865 👗 Top Class Call Girl Service Bangalore

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

Call Girls Jp Nagar Just Call 👗 7737669865 👗 Top Class Call Girl Service Bang...

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

(Anamika) VIP Call Girls Napur Call Now 8617697112 Napur Escorts 24x7

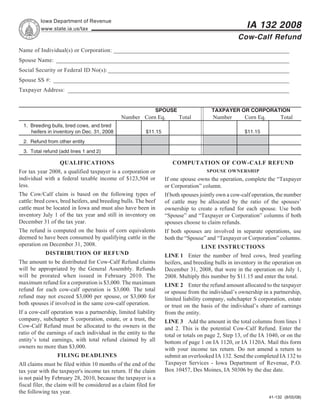

state.ia.us tax forms 0841132

- 1. Reset Form Print Form Iowa Department of Revenue IA 132 2008 www.state.ia.us/tax Cow-Calf Refund Name of Individual(s) or Corporation: _____________________________________________________________ Spouse Name: _________________________________________________________________________________ Social Security or Federal ID No(s): _______________________________________________________________ Spouse SS #: __________________________________________________________________________________ Taxpayer Address: _____________________________________________________________________________ SPOUSE TAXPAYER OR CORPORATION Number Corn Eq. Total Number Corn Eq. Total 1. Breeding bulls, bred cows, and bred heifers in inventory on Dec. 31, 2008 $11.15 $11.15 2. Refund from other entity 3. Total refund (add lines 1 and 2) QUALIFICATIONS COMPUTATION OF COW-CALF REFUND For tax year 2008, a qualified taxpayer is a corporation or SPOUSE OWNERSHIP individual with a federal taxable income of $123,504 or If one spouse owns the operation, complete the “Taxpayer less. or Corporation” column. The Cow/Calf claim is based on the following types of If both spouses jointly own a cow-calf operation, the number cattle: bred cows, bred heifers, and breeding bulls. The beef of cattle may be allocated by the ratio of the spouses’ cattle must be located in Iowa and must also have been in ownership to create a refund for each spouse. Use both inventory July 1 of the tax year and still in inventory on “Spouse” and “Taxpayer or Corporation” columns if both December 31 of the tax year. spouses choose to claim refunds. The refund is computed on the basis of corn equivalents If both spouses are involved in separate operations, use deemed to have been consumed by qualifying cattle in the both the “Spouse” and “Taxpayer or Corporation” columns. operation on December 31, 2008. LINE INSTRUCTIONS DISTRIBUTION OF REFUND LINE 1 Enter the number of bred cows, bred yearling The amount to be distributed for Cow-Calf Refund claims heifers, and breeding bulls in inventory in the operation on will be appropriated by the General Assembly. Refunds December 31, 2008, that were in the operation on July 1, will be prorated when issued in February 2010. The 2008. Multiply this number by $11.15 and enter the total. maximum refund for a corporation is $3,000. The maximum LINE 2 Enter the refund amount allocated to the taxpayer refund for each cow-calf operation is $3,000. The total or spouse from the individual’s ownership in a partnership, refund may not exceed $3,000 per spouse, or $3,000 for limited liability company, subchapter S corporation, estate both spouses if involved in the same cow-calf operation. or trust on the basis of the individual’s share of earnings If a cow-calf operation was a partnership, limited liability from the entity. company, subchapter S corporation, estate, or a trust, the LINE 3 Add the amount in the total columns from lines 1 Cow-Calf Refund must be allocated to the owners in the and 2. This is the potential Cow-Calf Refund. Enter the ratio of the earnings of each individual in the entity to the total or totals on page 2, Step 13, of the IA 1040, or on the entity’s total earnings, with total refund claimed by all bottom of page 1 on IA 1120, or IA 1120A. Mail this form owners no more than $3,000. with your income tax return. Do not amend a return to FILING DEADLINES submit an overlooked IA 132. Send the completed IA 132 to Taxpayer Services - Iowa Department of Revenue, P.O. All claims must be filed within 10 months of the end of the Box 10457, Des Moines, IA 50306 by the due date. tax year with the taxpayer's income tax return. If the claim is not paid by February 28, 2010, because the taxpayer is a fiscal filer, the claim will be considered as a claim filed for the following tax year. 41-132 (8/05/08)