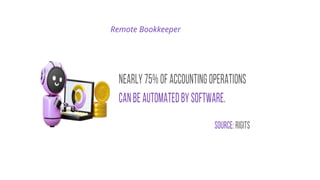

The document provides a comprehensive guide on hiring a remote bookkeeper, emphasizing the cost-effectiveness and efficiency of remote bookkeeping services for businesses. It outlines the process of remote bookkeeping, the tasks performed by remote bookkeepers, and the software commonly used in the industry. Additionally, it includes best practices for setting up and managing remote bookkeeping to ensure financial operations run smoothly.