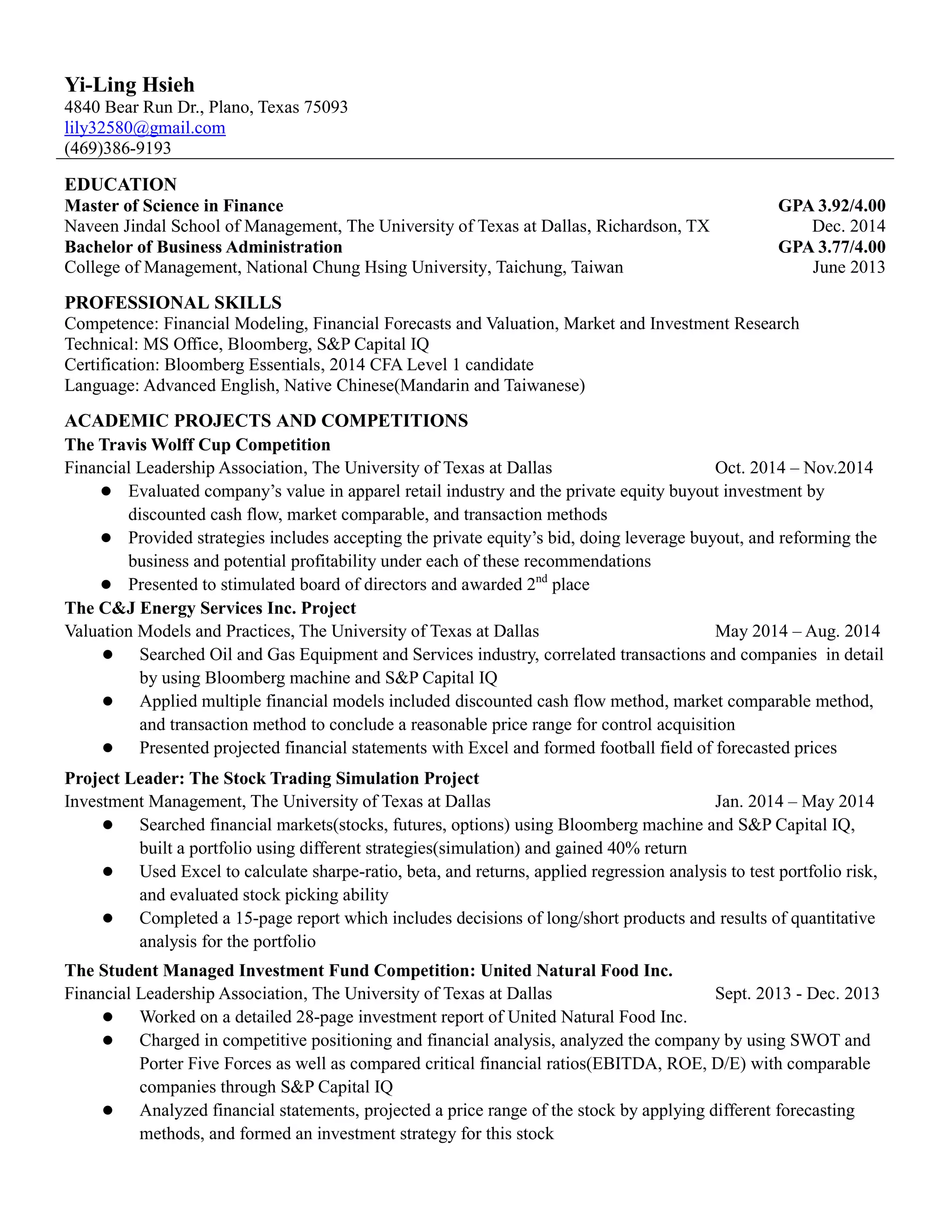

Yi-Ling Hsieh is seeking a position in finance. She received a Master of Science in Finance from UT Dallas in 2014 and a Bachelor of Business Administration from National Chung Hsing University in Taiwan in 2013. Her skills include financial modeling, valuation, market research, and fluency in English and Chinese. During her graduate studies, she participated in competitions evaluating private equity investments, modeling oil and gas company valuations, managing a stock portfolio simulation, and analyzing a natural foods company. She is a 2014 CFA Level 1 candidate.