Embed presentation

Download to read offline

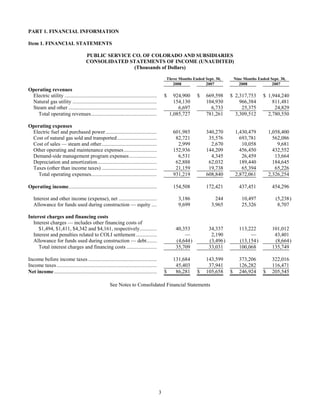

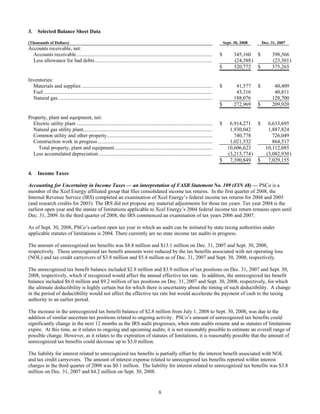

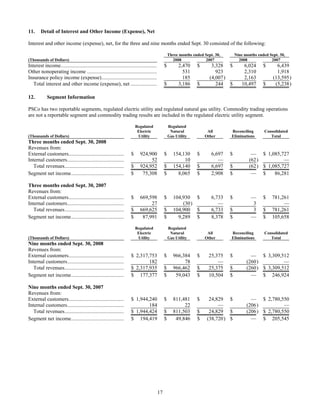

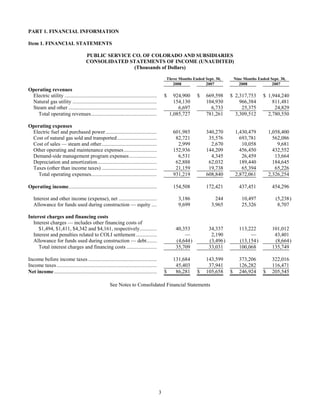

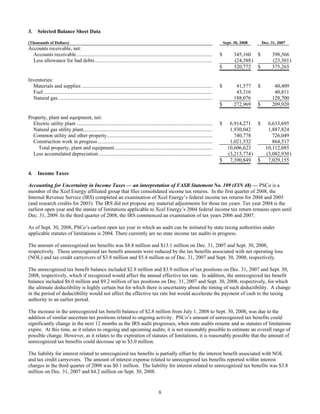

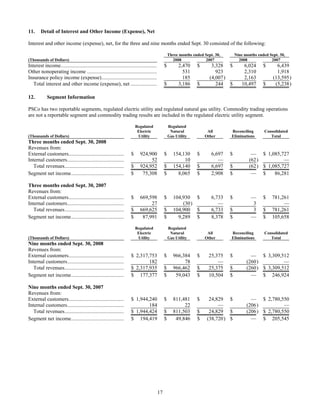

- Public Service Company of Colorado (PSCo) filed a quarterly report on Form 10-Q with the SEC for the quarter ended Sept. 30, 2008. - PSCo is a wholly owned subsidiary of Xcel Energy Inc. that operates regulated electric and natural gas utilities in Colorado. - For the quarter, PSCo reported net income of $86.3 million on operating revenues of $1.1 billion, compared to net income of $105.7 million on operating revenues of $781.3 million for the same quarter last year.