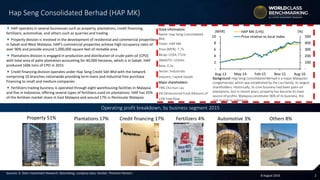

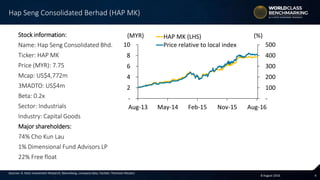

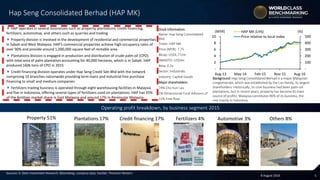

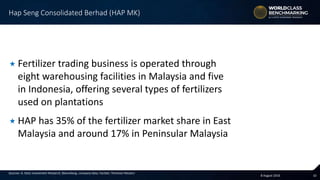

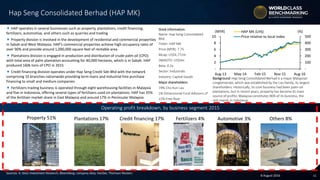

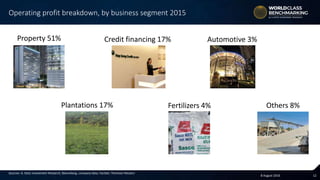

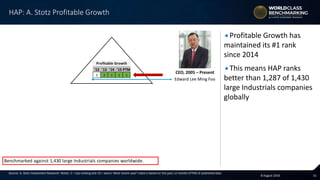

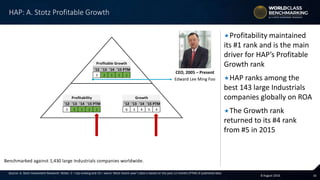

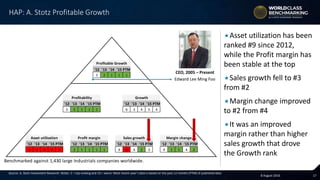

Hap Seng Consolidated Berhad is a major Malaysian conglomerate established by the Lau family, with significant operations in property development and palm oil production, contributing 96% of its business from Malaysia. The company manages diverse sectors including credit financing and fertilizers, holding substantial market shares in East Malaysia. As of August 2016, Hap Seng's market capitalization was approximately US$4.77 billion, and it has consistently ranked highly in profitability compared to global industrial companies.