Bill Dallas, CEO of Skyline, discusses why he loves the company in a May 2016 document. In 3 sentences:

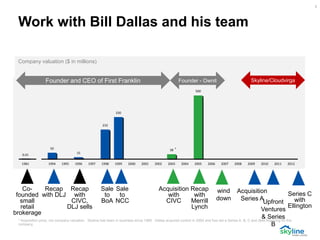

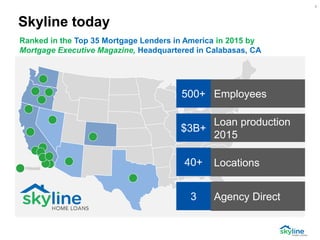

Skyline has advanced technology, loves helping people through home financing, and is always improving its mortgage origination platform to best serve consumers and be a top place for employees to work. Dallas acquired Skyline in 2009 and has since grown it to over 500 employees producing over $3 billion annually in home loans across multiple office locations.