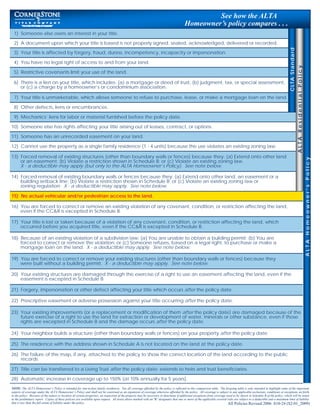

The document discusses the benefits of the ALTA Homeowners Title Policy over other policies. It provides greater security and peace of mind by clearly defining existing right of access coverage to include both pedestrian and vehicular access. For example, a homeowner may purchase a property with pedestrian access but no vehicular access. Other policies may deny claims for such issues, but the ALTA Homeowners Title Policy provides coverage. It offers more comprehensive coverage than other available policies.