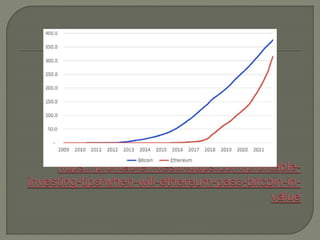

Bitcoin remains the most valuable cryptocurrency despite losing two-thirds of its value over the past nine months, while Ethereum has gained against it, leading to speculation about a potential 'flip' in value. Factors contributing to this shift include Ethereum's upcoming software upgrade and its practical applications in decentralized finance and smart contracts, which give it a competitive edge. Economic conditions, such as rising interest rates and a looming recession, are expected to impact both cryptocurrencies, but Ethereum's broader utility may help it maintain a stronger position.