Embed presentation

Download to read offline

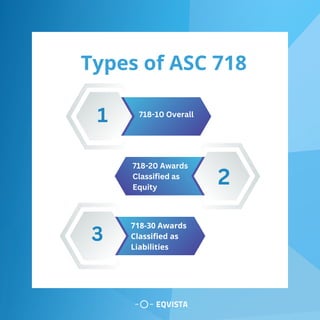

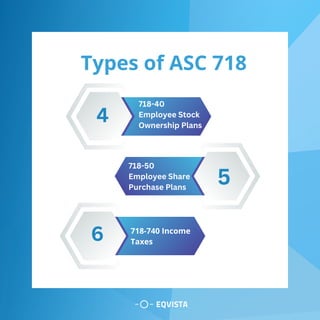

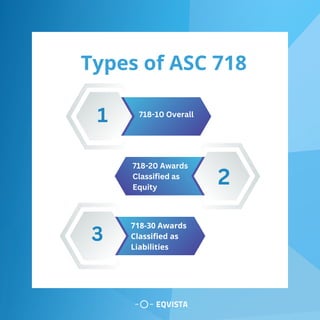

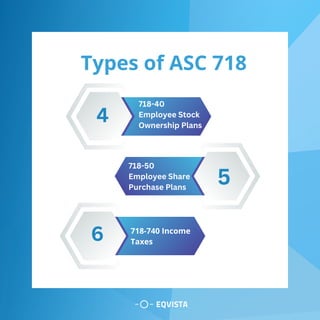

ASC 718 is the standard accounting method for expensing options, which involves recognizing the transfer of value in awarding stock options and equity compensation to employees. It includes various classifications such as awards classified as equity or liabilities, and encompasses employee stock ownership plans and share purchase plans. Additionally, it addresses the implications for income taxes related to these awards.