Weekly Indian Economy Newsletter

•

0 likes•369 views

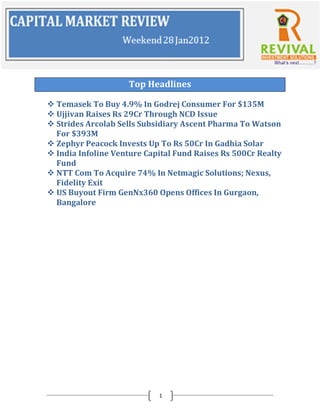

The document provides a summary of top business news headlines: - Temasek will buy a 4.9% stake in Godrej Consumer for $135 million. - Ujjivan raised Rs 29 crore through a bond issue. - Strides Arcolab sold its Ascent Pharma subsidiary to Watson for $393 million. - Other deals included investments in Gadhia Solar and Netmagic Solutions.

Report

Share

Report

Share

Download to read offline

Recommended

Weekly newsletter

The Reserve Bank of India kept its key repo rate unchanged at 8% as inflation continues to ease towards the bank's targeted level. The RBI expects growth in the current fiscal year to be in the range of 5-6% with downside risks. Several private equity deals were announced, including ChrysCapital leading a $53 million investment in LiquidHub and Everstone Capital investing $16.6 million in the fashion label Ritu Kumar. Temasek announced a $40 million investment in Star Agriwarehousing.

Weekly newsletter

Skype co-founders music streaming venture Rdio acquires Dhingana. Rdio acquires Indian social music streaming service Dhingana to enter the Indian market. Dhingana founders will join Rdio's executive team to help with expansion efforts.

Silk and jewellery retailer Kalyan Group is in talks with private equity firms Blackstone, TPG Capital and Temasek Holdings to sell a minority stake for $200-250 million.

India's wholesale price inflation eased to a 9-month low of 4.68% in February due to lower food and fuel prices, raising expectations that the RBI will keep interest rates unchanged at its next policy review.

Weekly Economic and Corporate Deals

1) Essel Finance has appointed Abhinav Bhushan as head of its real estate fund business following the exit of the previous head. It is also looking to appoint a new head for its investment banking unit.

2) SKS Microfinance has completed an eighth securitization deal worth $26.2 million this financial year, taking the total to $171.6 million.

3) Manipal Health plans to acquire a 250-300 bed hospital each in Mumbai and Delhi over the next six months, having allocated $193 million for expansion plans.

Weekly newsletter

The document summarizes several business news headlines:

- Lifestyle e-commerce venture Koovs is raising $37 million by floating on London's AIM exchange.

- Blackstone-backed FTIL has appointed JM Financial to sell 24% of its stake in MCX and find a strategic partner.

- KKR has expanded its energy and infrastructure investment team in Asia with two new hires in Australia and Singapore.

- Indian Oil Corp will acquire a 10% stake in Petronas' LNG export project in British Columbia.

Weekly Indian Economic Review

The document provides summaries of several business news stories:

1) Lightspeed is raising a $675M global fund and appointing an India principal. Morgan Stanley will trim fees and size for its $4.7B property fund. Canaan Partners raises $600M for tech and healthcare investments.

2) Kedaara Capital plans to invest in corporate spin-offs and pursue $75-100M deals. IL&FS invests $38.5M for a 9.4% stake in an IndiaBulls real estate project. PE-backed Dalmia Bharat will acquire up to 50% of Calcom Cement for $46M.

3) IEP is raising

Weekly newsletter

Key Indian stock indices fell for the first week in six as weak earnings from large companies and concerns over tapering of US stimulus weighed on sentiment. The benchmark BSE index fell 2.87% for the week, marking its biggest weekly fall since late March, while the broader NSE index dropped 3.29% as markets declined in four of five trading sessions. Several major corporate deals were also announced, including Yahoo's $1.1 billion acquisition of Tumblr, Kingfa Sci's purchase of a 66.5% stake in an Indian company for $1.9 million, and Mentor Graphics' acquisition of SoftJin's software business.

Weekly newsletter

1) Several Indian companies raised funding, including a payment systems company that raised over $5M from a Dutch development bank, and a microfinance firm that received $16M from the UK's CDC Group.

2) A road construction equipment maker will acquire a 26% stake in a mining company for $2.1M.

3) A private equity firm raised its stake in a restaurant chain, purchasing an additional 3.2% of shares.

Weekly newsletter 02 june2012

The document summarizes top business headlines and provides more context on some of the stories:

1. India's economic growth slowed to 5.3% for the last quarter and 6.5% for the full fiscal year, prompting downgrades from analysts.

2. The cabinet approved reforms to India's telecom policy that will separate licenses from spectrum and review the TRAI Act.

3. Tata Motors posted strong earnings growth for the last quarter but investors were disappointed by lower margins at Jaguar Land Rover.

Recommended

Weekly newsletter

The Reserve Bank of India kept its key repo rate unchanged at 8% as inflation continues to ease towards the bank's targeted level. The RBI expects growth in the current fiscal year to be in the range of 5-6% with downside risks. Several private equity deals were announced, including ChrysCapital leading a $53 million investment in LiquidHub and Everstone Capital investing $16.6 million in the fashion label Ritu Kumar. Temasek announced a $40 million investment in Star Agriwarehousing.

Weekly newsletter

Skype co-founders music streaming venture Rdio acquires Dhingana. Rdio acquires Indian social music streaming service Dhingana to enter the Indian market. Dhingana founders will join Rdio's executive team to help with expansion efforts.

Silk and jewellery retailer Kalyan Group is in talks with private equity firms Blackstone, TPG Capital and Temasek Holdings to sell a minority stake for $200-250 million.

India's wholesale price inflation eased to a 9-month low of 4.68% in February due to lower food and fuel prices, raising expectations that the RBI will keep interest rates unchanged at its next policy review.

Weekly Economic and Corporate Deals

1) Essel Finance has appointed Abhinav Bhushan as head of its real estate fund business following the exit of the previous head. It is also looking to appoint a new head for its investment banking unit.

2) SKS Microfinance has completed an eighth securitization deal worth $26.2 million this financial year, taking the total to $171.6 million.

3) Manipal Health plans to acquire a 250-300 bed hospital each in Mumbai and Delhi over the next six months, having allocated $193 million for expansion plans.

Weekly newsletter

The document summarizes several business news headlines:

- Lifestyle e-commerce venture Koovs is raising $37 million by floating on London's AIM exchange.

- Blackstone-backed FTIL has appointed JM Financial to sell 24% of its stake in MCX and find a strategic partner.

- KKR has expanded its energy and infrastructure investment team in Asia with two new hires in Australia and Singapore.

- Indian Oil Corp will acquire a 10% stake in Petronas' LNG export project in British Columbia.

Weekly Indian Economic Review

The document provides summaries of several business news stories:

1) Lightspeed is raising a $675M global fund and appointing an India principal. Morgan Stanley will trim fees and size for its $4.7B property fund. Canaan Partners raises $600M for tech and healthcare investments.

2) Kedaara Capital plans to invest in corporate spin-offs and pursue $75-100M deals. IL&FS invests $38.5M for a 9.4% stake in an IndiaBulls real estate project. PE-backed Dalmia Bharat will acquire up to 50% of Calcom Cement for $46M.

3) IEP is raising

Weekly newsletter

Key Indian stock indices fell for the first week in six as weak earnings from large companies and concerns over tapering of US stimulus weighed on sentiment. The benchmark BSE index fell 2.87% for the week, marking its biggest weekly fall since late March, while the broader NSE index dropped 3.29% as markets declined in four of five trading sessions. Several major corporate deals were also announced, including Yahoo's $1.1 billion acquisition of Tumblr, Kingfa Sci's purchase of a 66.5% stake in an Indian company for $1.9 million, and Mentor Graphics' acquisition of SoftJin's software business.

Weekly newsletter

1) Several Indian companies raised funding, including a payment systems company that raised over $5M from a Dutch development bank, and a microfinance firm that received $16M from the UK's CDC Group.

2) A road construction equipment maker will acquire a 26% stake in a mining company for $2.1M.

3) A private equity firm raised its stake in a restaurant chain, purchasing an additional 3.2% of shares.

Weekly newsletter 02 june2012

The document summarizes top business headlines and provides more context on some of the stories:

1. India's economic growth slowed to 5.3% for the last quarter and 6.5% for the full fiscal year, prompting downgrades from analysts.

2. The cabinet approved reforms to India's telecom policy that will separate licenses from spectrum and review the TRAI Act.

3. Tata Motors posted strong earnings growth for the last quarter but investors were disappointed by lower margins at Jaguar Land Rover.

Weekly newsletter

The Indian stock market fell sharply, with the Sensex losing 1.12% and Nifty falling 1.24%, tracking losses in Asian markets after China reported its slowest GDP growth in 14 years. The rupee also declined sharply against the dollar due to heavy demand from oil firms. Consumer inflation eased to a 3-month low of 9.87% in December due to moderation in vegetable and fruit prices. Meanwhile, the US FDA banned another plant of Ranbaxy Laboratories from selling products in the US due to manufacturing violations, and Japan's ARKRAY agreed to acquire the IVD business of Span Diagnostics for $16 million.

Weeky newsletter 26th may 2012

The rupee hit a record low against the dollar, dropping to 56 rupees to the dollar due to concerns about the eurozone. Reebok India filed a police complaint accusing two former executives of fraud totaling 8.7 billion rupees. Jyothy Laboratories appointed a new CEO with 20 years of experience in sales, marketing, and strategic planning. ValueFirst acquired Way2sms.com and 160by2.com in one of India's largest internet industry acquisitions totaling around 200 crores.

Sector updates for the week ending 7th Nov'14

The document provides sector updates for the banking, FMCG, pharma, and power sectors from November 1-8, 2014. In the banking sector, the BSE sensex touched 28,000 due to Japanese quantitative easing and gains in bank stocks. ICICI Bank and HDFC Bank saw increased investment from mutual funds. Axis Bank signed an MOU with a South Korean bank and China UnionPay will start operating in India. In FMCG, stock prices increased for companies like ITC and Dabur. ITC received clearance for a new hotel and Dabur launched a new product. Pharma companies received FDA approvals and faced regulatory issues. The power minister discussed plans to increase power capacity and production in India

Weekly newsletter

The Sensex rose to a new record high on foreign inflows of $3.5 billion since the US Federal Reserve delayed tapering monetary stimulus. However, the Indian market remains the fourth worst performer in Asia due to a weak rupee and mixed economic signals like contracting manufacturing. Several companies saw investment deals, including Sanofi investing $122 million in Shantha Biotech, Avenue Ventures investing $6.5 million in a Pune real estate project, and Carlyle in talks to buy 24% of Medanta for $160 million.

Weekly newsletter

The document summarizes recent economic and business news headlines from India. It discusses Loop Telecom's plans to wind down operations in areas where it lost licenses, the resolution of a legal battle between SEBI and MCX exchange, and Mahindra & Mahindra's plans to develop a hybrid vehicle for the Indian market. It also mentions the financial restructuring approved for Air India and recent industrial production numbers, which showed sluggish growth.

Weekly newsletter

Getit Infoservices received approval to raise $36.4 million in funding from Helion Venture Capital. RPG Life Sciences sold 14,149 square meters of land in Navi Mumbai to Maruti Suzuki for $13.5 million. Snapdeal closed a $50 million funding round with new investors including eBay and Intel Capital.

Cmr 24 apr'11 revival investments

he weekly review by Revival Investments – Revival CMR dated 25 April 2011. Highlights of the week are –

• Facor Alloys has acquired controlling interest in BEC Power by paying a total consideration of INR 160 million…

• iProf Learning Solutions India, offering personal education tablet and chain of Wi-Fienabled e-learning centres, has secured INR 22 Crore in series A funding from Norwest Venture Partners (NVP) and IDG Ventures India (IDGVI)…

• Sensex gained 1.1% and the S&P CNX Nifty index 1% over the week. The 30-share BSE Sensex rose 215 points or 1.11%, to close at 19,602…

Weelynewsletter

- Reliance Industries reported better-than-expected quarterly earnings, though profits fell 21% year-over-year. Net profits were Rs4,473crore with sales rising 13.4% to Rs94,926crore.

- The IMF cut its growth projections for India's economy in 2012 to 6.1% from 6.8%, citing weak global markets and domestic demand.

- The Indian government approved import duties of up to 21% on foreign power generation equipment to boost domestic power engineering companies like BHEL and L&T.

Weekly newsletter

The document provides a summary of various business news headlines and stories:

- HT Media will invest up to Rs 1.95Cr in Hyderabad-based software firm Comp-U-Learn. CloudByte raised $2.1M from Nexus Venture to expand sales and hiring. OneAssist raised $3.5M from Sequoia Capital for its mobile security and financial management products. FINO acquired Nokia's Indian prepaid payment business for an undisclosed amount. Cairn Energy sold an additional 3.5% stake in Cairn India for $365M. Yatra will acquire Travelguru from Travelocity. ERP provider Valgen raised Rs 2.25Cr in angel funding

Weekly newsletter

Bharti Airtel acquired Qualcomm's Indian wireless broadband venture. PVR sold its Anupam multiplex property in Delhi for $8.5 million while entering a long-term lease agreement to continue operating on the property. Education startup K2 Learning raised $1.3 million in angel funding to develop content and set up tablet labs in colleges. Real estate marketplace HomeShikari.com is in talks to raise $5 million to expand to more cities. Online trip planner mygola raised $1.5 million in funding led by Helion Venture Partners. ONGC Videsh agreed to acquire a 12% stake in a Brazilian offshore block for $529 million. Vodacom is

Biocon FY12 full year results Press Release + Fact Sheet

- Biocon reported a 16% year-over-year increase in revenues for fiscal year 2012 to Rs 2,148 Crores. Net profit was sustained at Rs 338 Crores despite lower licensing income.

- For the fourth quarter of fiscal year 2012, Biocon's revenues increased 30% year-over-year to Rs 6,102 Crores. Net profit increased 15% to Rs 978 Crores.

- Branded formulations grew 39% for the full year and research services grew 29%, driven by new contracts and expansions.

Vedanta Acquired Cairn

Vedanta acquired a controlling stake in Cairn India Ltd. Specifically:

- Vedanta bought an 11% stake in Cairn India from Petronas for $1.5 billion in 2011.

- In December 2011, Vedanta acquired 30% of Cairn India from Cairn Energy for a total of $8.67 billion, giving it a 58.5% controlling stake.

- The acquisition provided Vedanta access to Cairn India's significant oil reserves in India and was expected to be immediately earnings accretive for Vedanta.

THE NOTABLE CONTRIBUTIONS MADE BY CORPORATE GIANTS DURING THE OUTBREAK OF THI...

Tata Trusts and Tata Sons have combined committed Rs 1,500 crore towards coronavirus relief work. Chairman of Tata Trusts, Ratan Tata committed Rs 500 crore towards manufacturing of personal protective equipment, respiratory systems, testing kits and setting up modular treatment facilities and training of health workers. Following which, Tata Sons announced an additional Rs 1,000 crore support towards coronavirus fund. This is by far the biggest contribution by a business group in India. Out of the total fund, Rs 500 crore has been contributed towards PM-CARES fund.

Philanthropist Azim Premji's companies Wipro Ltd, Wipro Enterprises Ltd and Azim Premji Foundation, have together committed Rs 1,125 crore. Of the Rs 1,125 crore, Wipro Ltd's commitment is Rs 100 crore, Wipro Enterprises Ltd's is Rs 25 crore, and that of the Azim Premji Foundation is Rs 1,000 crore. These sums are in addition to the annual CSR activities of Wipro, and the usual philanthropic spends of the Azim Premji Foundation.

Mukesh Ambani-led Reliance Industries (RIL) has donated Rs 510 crore to the coronavirus relief work. This includes contribution of Rs 500 crore to the PM-CARES Fund and Rs. 5 crore each to the Chief Minister's Relief Fund of Maharashtra and Gujarat. RIL has also setup a 100-bed centre for COVID-19 patients at a hospital in Mumbai.

Nl healthcare oct 3 - oct 9, 2015

The CDSCO of India and the MHRA of the UK signed an MoU to improve public safety in both countries by promoting each other's regulatory frameworks and processes. Apollo Hospitals launched home healthcare services in major cities to provide integrated care for patients recovering from surgery or with chronic illnesses. The DHR plans to establish 150 viral diagnostic labs across India to study outbreaks of diseases like dengue and malaria.

Newsletter dated 11th April, 2015

The document provides information about Dr. Anand Burman, the chairman of Dabur India Limited. It discusses his educational background and career journey. After earning a PhD in pharmaceutical chemistry from the University of Kansas, he joined Dabur in 1980. Under his leadership, Dabur has grown significantly from revenues of Rs. 20 crores to over Rs. 100 crores. His focus on research and development in biotechnology and attracting talented professionals helped professionalize the company and fuel its growth. Today Dabur generates over $1.2 billion in annual revenues and remains majority owned by the Burman family.

Equity fact sheet_june2011

This document provides portfolio information for the Fidelity Equity Fund as of June 30, 2011. Some of the top holdings include Reliance Industries, ICICI Bank, ITC, and HDFC Bank. The document also includes performance metrics such as returns over various periods compared to the BSE 200 index, as well as risk-adjusted measures. Charts show the growth of investments in the fund over time through SIP compared to the index.

Fidelity equity fact sheet_july2011

The document is a portfolio statement for a mutual fund as of July 29, 2011. It lists the fund's top 20 holdings by market value, which make up over 50% of the total assets. The portfolio has significant exposure to banks, software, consumer non-durables, pharmaceuticals, and petroleum products. It also provides industry diversification breakdown and notes a portfolio turnover ratio of 0.26 times for the past year.

22 nov.

The government approved splitting ONGC shares to make them more affordable for retail investors ahead of an FPO where it will divest 5% of its holding. SBI is likely to announce pricing this week for its 500 million Eurobond issue with help from 6 European banks. Future Group's promoter directed family members to move from direct operational roles to help professionals hired recently. Bank of Baroda increased interest rates on certain retail term deposits by up to 75 basis points. Emami is prepared to spend up to Rs. 1,000 crore on an overseas acquisition in personal care and has approval to raise Rs. 2,000 crore in long-term resources.

Weekly newsletter

Nalanda Capital buys a 2.2% stake in Cera Sanitaryware Ltd, an Indian sanitaryware company backed by WestBridge Capital Partners. BSNL and MTNL will receive refunds of $1.8 billion for returning 4G spectrum they acquired in 2010. The RBI raises the loan-to-value ratio for gold loan non-banking financial companies to 75% from 60% to boost gold monetization and loan growth.

Weekly newsletter

The document provides a summary of various business news headlines and articles:

1) IDG Ventures and SAIF Partners invested $14 million in Brainbees Solutions, which owns FirstCry.com and GoodLife.com, to fund marketing and expansion.

2) Warburg Pincus will invest $50 million in AU Financiers, a Jaipur-based non-banking finance company involved in commercial vehicles and SME loans.

3) French company Legrand acquired the UPS business of Numeric Power Systems for Rs 837 crore to expand its industrial infrastructure portfolio in India.

Weekly newsletter

The document provides a summary of economic news from India during the given week. It discusses comments from an RBI deputy governor about the potential for future interest rate cuts. It also mentions major deals, such as CRISIL acquiring a UK analytics firm, and expansion plans from companies like Hero MotoCorp and RIL. Key economic indicators like inflation rates and the value of the rupee against the dollar are also addressed.

Weekly newsletter

The document provides a summary of top business headlines and stories from India. Some of the key points include:

- Max India is in talks to sell its polypropylene business. SBI will cut rates on vehicle and SME loans.

- TCS reported quarterly revenues of over $10 billion but its shares dropped over 2% on the same day.

- The Reserve Bank of India cut the cash reserve ratio but banks have been reluctant to lower loan rates.

- Standard & Poor's downgraded India's outlook to negative from stable, citing fiscal challenges and slow growth.

More Related Content

What's hot

Weekly newsletter

The Indian stock market fell sharply, with the Sensex losing 1.12% and Nifty falling 1.24%, tracking losses in Asian markets after China reported its slowest GDP growth in 14 years. The rupee also declined sharply against the dollar due to heavy demand from oil firms. Consumer inflation eased to a 3-month low of 9.87% in December due to moderation in vegetable and fruit prices. Meanwhile, the US FDA banned another plant of Ranbaxy Laboratories from selling products in the US due to manufacturing violations, and Japan's ARKRAY agreed to acquire the IVD business of Span Diagnostics for $16 million.

Weeky newsletter 26th may 2012

The rupee hit a record low against the dollar, dropping to 56 rupees to the dollar due to concerns about the eurozone. Reebok India filed a police complaint accusing two former executives of fraud totaling 8.7 billion rupees. Jyothy Laboratories appointed a new CEO with 20 years of experience in sales, marketing, and strategic planning. ValueFirst acquired Way2sms.com and 160by2.com in one of India's largest internet industry acquisitions totaling around 200 crores.

Sector updates for the week ending 7th Nov'14

The document provides sector updates for the banking, FMCG, pharma, and power sectors from November 1-8, 2014. In the banking sector, the BSE sensex touched 28,000 due to Japanese quantitative easing and gains in bank stocks. ICICI Bank and HDFC Bank saw increased investment from mutual funds. Axis Bank signed an MOU with a South Korean bank and China UnionPay will start operating in India. In FMCG, stock prices increased for companies like ITC and Dabur. ITC received clearance for a new hotel and Dabur launched a new product. Pharma companies received FDA approvals and faced regulatory issues. The power minister discussed plans to increase power capacity and production in India

Weekly newsletter

The Sensex rose to a new record high on foreign inflows of $3.5 billion since the US Federal Reserve delayed tapering monetary stimulus. However, the Indian market remains the fourth worst performer in Asia due to a weak rupee and mixed economic signals like contracting manufacturing. Several companies saw investment deals, including Sanofi investing $122 million in Shantha Biotech, Avenue Ventures investing $6.5 million in a Pune real estate project, and Carlyle in talks to buy 24% of Medanta for $160 million.

Weekly newsletter

The document summarizes recent economic and business news headlines from India. It discusses Loop Telecom's plans to wind down operations in areas where it lost licenses, the resolution of a legal battle between SEBI and MCX exchange, and Mahindra & Mahindra's plans to develop a hybrid vehicle for the Indian market. It also mentions the financial restructuring approved for Air India and recent industrial production numbers, which showed sluggish growth.

Weekly newsletter

Getit Infoservices received approval to raise $36.4 million in funding from Helion Venture Capital. RPG Life Sciences sold 14,149 square meters of land in Navi Mumbai to Maruti Suzuki for $13.5 million. Snapdeal closed a $50 million funding round with new investors including eBay and Intel Capital.

Cmr 24 apr'11 revival investments

he weekly review by Revival Investments – Revival CMR dated 25 April 2011. Highlights of the week are –

• Facor Alloys has acquired controlling interest in BEC Power by paying a total consideration of INR 160 million…

• iProf Learning Solutions India, offering personal education tablet and chain of Wi-Fienabled e-learning centres, has secured INR 22 Crore in series A funding from Norwest Venture Partners (NVP) and IDG Ventures India (IDGVI)…

• Sensex gained 1.1% and the S&P CNX Nifty index 1% over the week. The 30-share BSE Sensex rose 215 points or 1.11%, to close at 19,602…

Weelynewsletter

- Reliance Industries reported better-than-expected quarterly earnings, though profits fell 21% year-over-year. Net profits were Rs4,473crore with sales rising 13.4% to Rs94,926crore.

- The IMF cut its growth projections for India's economy in 2012 to 6.1% from 6.8%, citing weak global markets and domestic demand.

- The Indian government approved import duties of up to 21% on foreign power generation equipment to boost domestic power engineering companies like BHEL and L&T.

Weekly newsletter

The document provides a summary of various business news headlines and stories:

- HT Media will invest up to Rs 1.95Cr in Hyderabad-based software firm Comp-U-Learn. CloudByte raised $2.1M from Nexus Venture to expand sales and hiring. OneAssist raised $3.5M from Sequoia Capital for its mobile security and financial management products. FINO acquired Nokia's Indian prepaid payment business for an undisclosed amount. Cairn Energy sold an additional 3.5% stake in Cairn India for $365M. Yatra will acquire Travelguru from Travelocity. ERP provider Valgen raised Rs 2.25Cr in angel funding

Weekly newsletter

Bharti Airtel acquired Qualcomm's Indian wireless broadband venture. PVR sold its Anupam multiplex property in Delhi for $8.5 million while entering a long-term lease agreement to continue operating on the property. Education startup K2 Learning raised $1.3 million in angel funding to develop content and set up tablet labs in colleges. Real estate marketplace HomeShikari.com is in talks to raise $5 million to expand to more cities. Online trip planner mygola raised $1.5 million in funding led by Helion Venture Partners. ONGC Videsh agreed to acquire a 12% stake in a Brazilian offshore block for $529 million. Vodacom is

Biocon FY12 full year results Press Release + Fact Sheet

- Biocon reported a 16% year-over-year increase in revenues for fiscal year 2012 to Rs 2,148 Crores. Net profit was sustained at Rs 338 Crores despite lower licensing income.

- For the fourth quarter of fiscal year 2012, Biocon's revenues increased 30% year-over-year to Rs 6,102 Crores. Net profit increased 15% to Rs 978 Crores.

- Branded formulations grew 39% for the full year and research services grew 29%, driven by new contracts and expansions.

Vedanta Acquired Cairn

Vedanta acquired a controlling stake in Cairn India Ltd. Specifically:

- Vedanta bought an 11% stake in Cairn India from Petronas for $1.5 billion in 2011.

- In December 2011, Vedanta acquired 30% of Cairn India from Cairn Energy for a total of $8.67 billion, giving it a 58.5% controlling stake.

- The acquisition provided Vedanta access to Cairn India's significant oil reserves in India and was expected to be immediately earnings accretive for Vedanta.

THE NOTABLE CONTRIBUTIONS MADE BY CORPORATE GIANTS DURING THE OUTBREAK OF THI...

Tata Trusts and Tata Sons have combined committed Rs 1,500 crore towards coronavirus relief work. Chairman of Tata Trusts, Ratan Tata committed Rs 500 crore towards manufacturing of personal protective equipment, respiratory systems, testing kits and setting up modular treatment facilities and training of health workers. Following which, Tata Sons announced an additional Rs 1,000 crore support towards coronavirus fund. This is by far the biggest contribution by a business group in India. Out of the total fund, Rs 500 crore has been contributed towards PM-CARES fund.

Philanthropist Azim Premji's companies Wipro Ltd, Wipro Enterprises Ltd and Azim Premji Foundation, have together committed Rs 1,125 crore. Of the Rs 1,125 crore, Wipro Ltd's commitment is Rs 100 crore, Wipro Enterprises Ltd's is Rs 25 crore, and that of the Azim Premji Foundation is Rs 1,000 crore. These sums are in addition to the annual CSR activities of Wipro, and the usual philanthropic spends of the Azim Premji Foundation.

Mukesh Ambani-led Reliance Industries (RIL) has donated Rs 510 crore to the coronavirus relief work. This includes contribution of Rs 500 crore to the PM-CARES Fund and Rs. 5 crore each to the Chief Minister's Relief Fund of Maharashtra and Gujarat. RIL has also setup a 100-bed centre for COVID-19 patients at a hospital in Mumbai.

Nl healthcare oct 3 - oct 9, 2015

The CDSCO of India and the MHRA of the UK signed an MoU to improve public safety in both countries by promoting each other's regulatory frameworks and processes. Apollo Hospitals launched home healthcare services in major cities to provide integrated care for patients recovering from surgery or with chronic illnesses. The DHR plans to establish 150 viral diagnostic labs across India to study outbreaks of diseases like dengue and malaria.

Newsletter dated 11th April, 2015

The document provides information about Dr. Anand Burman, the chairman of Dabur India Limited. It discusses his educational background and career journey. After earning a PhD in pharmaceutical chemistry from the University of Kansas, he joined Dabur in 1980. Under his leadership, Dabur has grown significantly from revenues of Rs. 20 crores to over Rs. 100 crores. His focus on research and development in biotechnology and attracting talented professionals helped professionalize the company and fuel its growth. Today Dabur generates over $1.2 billion in annual revenues and remains majority owned by the Burman family.

Equity fact sheet_june2011

This document provides portfolio information for the Fidelity Equity Fund as of June 30, 2011. Some of the top holdings include Reliance Industries, ICICI Bank, ITC, and HDFC Bank. The document also includes performance metrics such as returns over various periods compared to the BSE 200 index, as well as risk-adjusted measures. Charts show the growth of investments in the fund over time through SIP compared to the index.

Fidelity equity fact sheet_july2011

The document is a portfolio statement for a mutual fund as of July 29, 2011. It lists the fund's top 20 holdings by market value, which make up over 50% of the total assets. The portfolio has significant exposure to banks, software, consumer non-durables, pharmaceuticals, and petroleum products. It also provides industry diversification breakdown and notes a portfolio turnover ratio of 0.26 times for the past year.

22 nov.

The government approved splitting ONGC shares to make them more affordable for retail investors ahead of an FPO where it will divest 5% of its holding. SBI is likely to announce pricing this week for its 500 million Eurobond issue with help from 6 European banks. Future Group's promoter directed family members to move from direct operational roles to help professionals hired recently. Bank of Baroda increased interest rates on certain retail term deposits by up to 75 basis points. Emami is prepared to spend up to Rs. 1,000 crore on an overseas acquisition in personal care and has approval to raise Rs. 2,000 crore in long-term resources.

Weekly newsletter

Nalanda Capital buys a 2.2% stake in Cera Sanitaryware Ltd, an Indian sanitaryware company backed by WestBridge Capital Partners. BSNL and MTNL will receive refunds of $1.8 billion for returning 4G spectrum they acquired in 2010. The RBI raises the loan-to-value ratio for gold loan non-banking financial companies to 75% from 60% to boost gold monetization and loan growth.

What's hot (19)

Biocon FY12 full year results Press Release + Fact Sheet

Biocon FY12 full year results Press Release + Fact Sheet

THE NOTABLE CONTRIBUTIONS MADE BY CORPORATE GIANTS DURING THE OUTBREAK OF THI...

THE NOTABLE CONTRIBUTIONS MADE BY CORPORATE GIANTS DURING THE OUTBREAK OF THI...

Similar to Weekly Indian Economy Newsletter

Weekly newsletter

The document provides a summary of various business news headlines and articles:

1) IDG Ventures and SAIF Partners invested $14 million in Brainbees Solutions, which owns FirstCry.com and GoodLife.com, to fund marketing and expansion.

2) Warburg Pincus will invest $50 million in AU Financiers, a Jaipur-based non-banking finance company involved in commercial vehicles and SME loans.

3) French company Legrand acquired the UPS business of Numeric Power Systems for Rs 837 crore to expand its industrial infrastructure portfolio in India.

Weekly newsletter

The document provides a summary of economic news from India during the given week. It discusses comments from an RBI deputy governor about the potential for future interest rate cuts. It also mentions major deals, such as CRISIL acquiring a UK analytics firm, and expansion plans from companies like Hero MotoCorp and RIL. Key economic indicators like inflation rates and the value of the rupee against the dollar are also addressed.

Weekly newsletter

The document provides a summary of top business headlines and stories from India. Some of the key points include:

- Max India is in talks to sell its polypropylene business. SBI will cut rates on vehicle and SME loans.

- TCS reported quarterly revenues of over $10 billion but its shares dropped over 2% on the same day.

- The Reserve Bank of India cut the cash reserve ratio but banks have been reluctant to lower loan rates.

- Standard & Poor's downgraded India's outlook to negative from stable, citing fiscal challenges and slow growth.

Weekly newsletter

The document provides a summary of various business news stories:

- Piramal buys an additional stake in Vodafone India while Essar exits completely.

- India Homes, a property services startup, raises $4 million in funding with plans to raise another $6 million.

- SBI waives fees on loans to small and medium businesses guaranteed under a government credit guarantee scheme.

- Halcyon Finance acquires the management rights to a Delhi hospital for $77 million.

Weekly newsletter

1. Fairfax-led consortium offers to buy BlackBerry for $4.7B, with Fairfax owning 10% of BlackBerry and contributing its shares.

2. Celebrity Fashions allots shares worth 24% stake to SBI in lieu of debt from a restructuring exercise.

3. Germany's Brenntag acquires chemical distribution arm of Zytex for $14M to strengthen its nutrition and health business in India.

Weekly newsletter

The document provides top business headlines and summaries of key stories. It discusses Vedanta Aluminium acquiring bauxite mines, Samara Capital investing in Monte Carlo Fashions, and DLF selling hotel assets. It also mentions Komli Media raising funds, Zicom acquiring a stake in a Qatar company, and Jyothy Labs merging with Henkel. The weekly economic review discusses a warning by S&P about India's credit rating and slow GDP growth, as well as inflation and industrial production figures.

Daily equity report

- The Indian equity benchmarks ended lower for the second straight session due to profit taking in large companies, while weakness in global markets also weighed on the markets.

- Moody's revised its outlook on India's corporate sector from negative to stable, expecting economic recovery.

- Several companies saw share price movements, with Apar Industries and IL&FS Engineering rising, while Jindal Steel and Tata Steel fell.

Weekly newsletter

The document provides a summary of various business and economic news headlines from India. Some of the key stories include LinkedIn acquiring SlideShare for $118.7 million, an Indian IPO failing with only 23% subscription, and industrial output in India plunging 3.5% in March. The Reserve Bank also announced new measures to support the struggling rupee, including requiring exporters to sell half their foreign currency holdings.

Weekly newsletter

1. Tata Realty aims to raise up to Rs 800 crore by selling its 780,000 sq ft IT park in Mumbai's Goregaon suburb which it acquired in 2011 for Rs 525 crore. Tata Realty's fund is also considering selling four other assets.

2. Janalakshmi Financial Services, an NBFC focused on lending to the urban poor, is looking to raise Rs 300 crore through private equity investors to expand its lending business.

3. The Indian government agreed to reduce its planned stake sale in Coal India from 10% to 5% to raise Rs 10,000 crore, half of the original target, to narrow the fiscal deficit.

Weekly newsletter

The Reserve Bank of India decided not to cut interest rates and maintained the repo rate at 8%. RBI lowered the statutory liquidity ratio but this is unlikely to significantly impact banks. RBI increased its inflation forecast to 7% and lowered growth forecast to 6.5%. Power grids collapsed in India, leaving 700 million people without electricity for hours on two separate occasions. The monsoon forecast indicates India may face a drought this year. Two major Indian airlines reported profits in the first quarter after five consecutive quarters of losses.

Weekly newsletter

The document contains headlines about various mergers and acquisitions in India, including Nalanda Capital increasing its stake in Ahluwalia Contracts, Providence and Macquarie acquiring Star India's stake in Hathway Cable for $72 million, and Everstone Capital in talks to buy a majority stake in salon chain YLG. It also discusses Varroc Group acquiring Visteon's auto lighting business for $92 million, the Indian government raising rail fares for the first time in eight years in its rail budget, and Reliance Equity Advisors investing $20 million in appliance maker Butterfly Gandhimathi. The second part of the document provides more details on these deals.

Daily equity report

- Indian stock indices edged up, led by gains in blue chip stocks on hopes the central bank would ease monetary policy to boost economic growth.

- Financial Technologies and Reliance Capital shares increased after announcements about transactions involving increasing ownership stakes in their companies.

- Asian stocks rose after US economic growth data reduced concerns about slowing global growth, while European shares also climbed on expectations of more eurozone monetary stimulus.

Weekly newsletter

1) Apollo Tyres is acquiring Cooper Tire, a NYSE-listed company, for $2.5 billion, making it the largest M&A deal this year involving an Indian company.

2) Twilight Litika is selling its manufacturing unit in Himachal Pradesh to Herbalife International for $3.5 million as part of plans to reduce debt by selling non-core assets.

3) The Securities and Exchange Board of India is seeking details from Infosys about a board meeting where N.R. Narayana Murthy was reappointed as executive chairman, but Infosys did not disclose the nature of the information sought.

Weekly newsletter

1) Apollo Tyres is acquiring Cooper Tire, a NYSE-listed company, for $2.5 billion, making it the largest M&A deal this year involving an Indian company.

2) Twilight Litika is selling its manufacturing unit in Himachal Pradesh to Herbalife International for $3.5 million as part of plans to reduce debt by selling non-core assets.

3) The Securities and Exchange Board of India is seeking details from Infosys about a board meeting where N.R. Narayana Murthy was reappointed as executive chairman, but Infosys did not disclose the nature of the information sought.

Newsletter weekly

The document discusses several business news headlines from India, including Indiabulls merging its NBFC arm with its housing finance unit, Forum Synergies making its debut investment of $3 million in Captronic Systems, and Nagpur Automotive buying Adhunik Metaliks' forging arm for $44 million. It also provides more details on some of these deals, discusses India's trade deficit increasing and services sector slowing, and covers other economic news like Hindustan Unilever's earnings growth and beer consumption falling in Australia.

Weekly newsletter

The Indian stock market fell for the fourth consecutive day due to concerns over the declining rupee and rising inflation, with the Sensex closing down 156 points. Vodafone sought approval to buy out minority shareholders in its Indian unit for $1.7 billion following rule changes allowing 100% foreign ownership of telecom companies. Espresso Logic raised $1.6 million led by Inventus Capital to develop database services for mobile and web applications. Aditya Birla Real Estate Fund invested $20.3 million in a residential project developed through a Tata Housing and Sidhartha Group joint venture.

Weekly newsletter

Reliance Industries reported an 18.9% rise in standalone net profit for the quarter ended June 30, 2013, despite a 4.6% fall in revenues. WPI inflation in India increased to 4.86% in June, driven by higher food prices. Abu Dhabi's Al Dahra Holdings will acquire a 20% stake in Kohinoor Foods for $18.8 million. Tata Global Beverages will monetize a land parcel in Bangalore through a deal worth $32.5 million. Texmaco Rail and Engineering will acquire a 24.9% stake in Kalindee Rail Nirman Engineers for $4.45 million.

Weekly newsletter

Getit Infoservices received approval to raise $36.4 million in funding from Helion Venture Capital. RPG Life Sciences sold 14,149 square meters of land in Navi Mumbai to Maruti Suzuki for $13.5 million. Snapdeal closed a $50 million funding round with new investors including eBay and Intel Capital.

Indian Finance Weekly newsletter

The document provides an overview of recent business and economic news in India. Industrial output rose significantly in November after falling the previous month. While Infosys reported quarterly results in line with estimates, it lowered its revenue growth forecast due to global uncertainty. HDFC also reported quarterly profits but fell short of expectations. Several mergers, acquisitions, and funding deals were also announced, including Praj Industries acquiring a majority stake in Neela Systems, and Healthkart raising funds from Sequoia Capital and Omidyar Network.

Unified Vision Capital Newsletter - November 2023 Highlights

Dive into our complete analysis of the global outlook, domestic triumphs, latest deal activities in India, business buzz, and industry insights. Stay informed and stay ahead by accessing the full newsletter.

Similar to Weekly Indian Economy Newsletter (20)

Unified Vision Capital Newsletter - November 2023 Highlights

Unified Vision Capital Newsletter - November 2023 Highlights

More from Revival Investment Solution Pvt.Ltd

Weekly newsletter

1. The government of India sold around 9% of its stake in Axis Bank for $912 million to buyers including LIC and Goldman Sachs. LIC and SUUTI each now hold around 11% stakes in Axis Bank.

2. IFCI will buy IDBI Bank's 18.95% stake in Stock Holding Corporation of India, increasing IFCI's equity participation in the company to 52.86% from 33.91%.

3. Starbucks opened its first store in India in 2012 and has seen the fastest global rollout of stores in its history, now operating 40 stores across 4 Indian cities.

Weekly newsletter

Moody's is making a voluntary open offer to increase its stake in ICRA, India's second largest rating agency, from 28.5% to up to 55% at a cost of up to $85 million. RBS plans to cut up to 30,000 jobs and shrink its investment bank. Reliance Group has increased its stake in radio and broadcasting firm Reliance Broadcast Network to over 90% to delist the company. UD Group is acquiring around 10% stake in Uttam Value Steels for $32 million.

Weekly newsletter

IDBI-led consortium is looking to sell over 38% stake in domestic ratings agency CARE for more than $140 million. Wipro invests $19 million in two undisclosed tech startups. Piramal Enterprises and CPPIB form a $500 million JV to offer rupee debt funding to residential projects in major Indian cities. PubMatic raises $13 million in fresh funding and plans for a billion dollar IPO. WestBridge adds $325 million to its Crossover Fund, increasing its assets under management to over $1 billion.

Weekly newsletter

Carlyle is looking to offload its 80% stake in Cyberoam Technologies to Sophos Group for $70-80 million. Myntra raised $50 million led by Premji Invest to strengthen its technology and fund future growth. The government will allow FIIs and NRIs to invest in insurance under the 26% FDI cap. UK-based CDC Group invested $27.5 million in lifestyle e-tailer Jabong to drive business growth and supply chain development.

Weekly newsletter

Mayfield Fund has raised $86 million for its second India-focused fund, targeting $100 million total. Blume Ventures plans to launch a $50 million second fund in the second half of 2014. Nalanda Capital acquired an additional 3.73% stake in Lovable Lingerie for around $3.25 million. Explara.com is in talks to raise $2-3 million in its Series A round. Creador expects to commit 15% of its $250 million second PE fund in India, equivalent to around $37 million.

Weekly Newsletter

- India will release factory output data for November on January 10th, followed by consumer and wholesale inflation data in mid-January as these will influence the RBI's monetary policy decision on January 28th. Inflation is expected to be the key factor for RBI's future actions.

- IFC plans to raise up to $1.5 billion for investments in East Asia and Pacific through a new fund, committing $200 million of its own money.

- Future Lifestyle Fashions acquired a 27.5% stake in women's fashion brand Desi Belle but did not disclose the deal value.

Weekly newsletter

1) Nokia has offered $369 million to Indian authorities to unfreeze its assets in the country as part of an ongoing tax dispute. This comes after an earlier payment of $85 million.

2) India's industrial production contracted 1.8% in October, the first decline in four months, due to falling output in the manufacturing and infrastructure sectors.

3) Blackstone is sitting on an $8.5 billion paper profit from its 2007 acquisition and IPO of Hilton Worldwide, the world's largest hotel operator.

Weekly newsletter

Lodha Group acquires the Canadian embassy building in London for $530 million, their biggest overseas move. IL&FS Transportation Networks signs an agreement to form a joint venture in China with three Chinese firms focused on infrastructure projects. SEBI relaxes rules for infrastructure debt funds to allow more foreign investment. Tech Mahindra announces a merger with Mahindra Engineering Services. Quadria Capital may acquire ICICI Venture's majority stake in the healthcare firm Medica Synergie. Bafna Pharmaceuticals is looking to raise capital and is in talks with Mylan for an acquisition. Bharti Airtel plans to raise $1 billion through euro bonds. Three large dairy firms are bidding for a stake in Cream

Weekly newsletter

The Reserve Bank of India has provided $800 million in refinancing to the Small Industrial Development Bank of India to ease liquidity stress for small businesses. New merger and acquisition guidelines for telecom companies make it easier for large players to acquire smaller rivals. The Piramal Group and Canada Pension Plan may partner to create one of India's largest real estate finance companies with a $500 million investment. Accel-backed Trivone Digital has acquired Godot Media to expand its digital content services offerings.

Weekly newsletter

Reliance Jio receives a pan-India unified license, allowing it to offer all telecom services including voice. Unichem sells its Indore SEZ plant to Mylan for $26.3M. Burger King may partner with Everstone Capital to enter India. Micromax eyes expanding to other emerging markets like Russia and plans to acquire a software firm. Idea Cellular plans to raise Rs. 3,750 crore through a QIP issue.

Weekly newsletter

The document summarizes recent funding deals, acquisitions, and business developments in India:

- ASK Pravi invested $9.8 million in Omni Hospitals for expansion. IFC invested $2.3 million in education lender Avanse. Micromax co-founder Rajesh Agarwal was arrested by CBI for alleged bribery.

- Aavishkaar's second venture fund closed at $94 million to invest in underserved areas of India. Indiabulls Housing acquired a 42.5% stake in its subsidiary for $42.5 million. JSW Energy is looking to acquire distressed power assets after halting new projects.

- D

Weekly newsletter

1. Future Ventures India invested an undisclosed sum to acquire a 33% stake in KFC Shoemaker, a footwear company with brands like Trèsmode and Solovoga.

2. Joognu Technologies, which runs the parenting memoir portal Joognu.com, raised Rs 60 lakh ($110,000) in angel funding from investor Kishor Gokhru for product development and marketing.

3. Fortis Healthcare is raising $100 million from the International Finance Corporation through equity and bonds, and separately planning to raise up to $83 million through an institutional share placement.

More from Revival Investment Solution Pvt.Ltd (12)

Recently uploaded

在线办理(latrobe毕业证书)拉筹伯大学毕业证Offer一模一样

学校原件一模一样【微信:741003700 】《(latrobe毕业证书)拉筹伯大学毕业证》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Howard Fineman, Veteran Political Journalist and TV Pundit, Dies at 75

Howard Fineman, Veteran Political Journalist and TV Pundit, Dies at 75LUMINATIVE MEDIA/PROJECT COUNSEL MEDIA GROUP

From his beginnings with a daily newspaper, he moved easily through Newsweek magazine to cable news and, later, to the frontiers of online journalism.Youngest c m in India- Pema Khandu Biography

Pema Khandu, born on August 21, 1979, is an Indian politician and the Chief Minister of Arunachal Pradesh. He is the son of former Chief Minister of Arunachal Pradesh, Dorjee Khandu. Pema Khandu assumed office as the Chief Minister in July 2016, making him one of the youngest Chief Ministers in India at that time.

13062024_First India Newspaper Jaipur.pdf

Find Latest India News and Breaking News these days from India on Politics, Business, Entertainment, Technology, Sports, Lifestyle and Coronavirus News in India and the world over that you can't miss. For real time update Visit our social media handle. Read First India NewsPaper in your morning replace. Visit First India.

CLICK:- https://firstindia.co.in/

#First_India_NewsPaper

Essential Tools for Modern PR Business .pptx

Discover the essential tools and strategies for modern PR business success. Learn how to craft compelling news releases, leverage press release sites and news wires, stay updated with PR news, and integrate effective PR practices to enhance your brand's visibility and credibility. Elevate your PR efforts with our comprehensive guide.

Gabriel Whitley's Motion Summary Judgment

Here is Gabe Whitley's response to my defamation lawsuit for him calling me a rapist and perjurer in court documents.

You have to read it to believe it, but after you read it, you won't believe it. And I included eight examples of defamatory statements/

Recently uploaded (8)

Howard Fineman, Veteran Political Journalist and TV Pundit, Dies at 75

Howard Fineman, Veteran Political Journalist and TV Pundit, Dies at 75

Weekly Indian Economy Newsletter

- 1. Top Headlines Temasek To Buy 4.9% In Godrej Consumer For $135M Ujjivan Raises Rs 29Cr Through NCD Issue Strides Arcolab Sells Subsidiary Ascent Pharma To Watson For $393M Zephyr Peacock Invests Up To Rs 50Cr In Gadhia Solar India Infoline Venture Capital Fund Raises Rs 500Cr Realty Fund NTT Com To Acquire 74% In Netmagic Solutions; Nexus, Fidelity Exit US Buyout Firm GenNx360 Opens Offices In Gurgaon, Bangalore 1

- 2. Weekly Executive Summary India's food inflation declined slightly to -1.03 per cent for the week ended January 14 as compared to -0.42 per cent for the previous week, staying in negative territory for the fourth straight week, as prices of essential items such as wheat, vegetables, potatoes and onions maintained a downtrend. The inflation rate for fuel, however, remained unchanged at the previous two weeks' level of 14.45 per cent, an official statement said here today, quoting provisional data. The Reserve Bank has sent a clear signal rates will be brought down in the coming months. Indeed, its monetary policy review on Tuesday emphasized growth rather than controlling inflation. RBI expects inflation to moderate to the targeted 7% by March--- even as growth falls to an estimated 7% from the old projection of 7.6%. But while RBI believes interest rate cuts can wait, it has moved quickly to inject some liquidity into the system. On Tuesday it cut the cash reserve ratio or CRR by 50 basis points to 5.5%. Moving on, Jet Airways is charting a new route towards reducing its debt. The airline plans to sell nine or ten of its Boeing 737s by April. It then plans to lease those aircraft back. The move will help it raise Rs666 crore. Jet has a debt of nearly Rs14, 000 crore. By leasing back its own aircraft, it’s following a path that other airlines have also used in the past to repair their balance sheets. Jet only owns 40 of the 101 planes it operates. Reliance Industries has set the dates for its planned buyback of some 120 million shares. The company said it would start the buyback on 1 February and end it on 19 January next year. RIL has set a maximum price of Rs870 per share and could spend 2.1 billion dollars on the buyback’s 2

- 3. Inside The Story Temasek to Buy 4.9% In Godrej Consumer For $135M Singapore’s sovereign wealth fund Temasek is investing Rs 685 crore($135 million) to buy 4.9 per cent stake in consumer products firm Godrej Consumer Products Ltd, in the single largest alternative investment deal in the Indian FMCG industry.Temasek is investing through a preferential allotment, making it the largest institutional shareholder in Godrej Consumer, the flagship of the $3.4- billion Godrej group. The Singapore government’s investment firm is picking up the stake through Baytree Investments (Mauritius) Pte Ltd, an indirect wholly-owned subsidiary. The fresh issue will be made at Rs 410 a share, a little over 2 per cent premium to the last traded share price of Godrej Consumer on Friday. The deal would help Godrej Consumer finance its aggressive inorganic strategy, wherein it has acquired seven companies across the world since 2010 and consolidated its holding in two joint ventures. Ujjivan Raises Rs 29Cr Through NCD Issue Bangalore-based microfinance firm Ujjivan Financial Services Pvt Ltd has raised Rs 29 crore ($5.8 million) through a private placement of non-convertible debentures (NCDs). The NCDs were subscribed by Developing World Markets (DWM) and listed on the Bombay Stock Exchange.The transaction comes a little over a year after Ujjivan raised Rs 40 crore through NCD placement with DWM only. The company followed that up with two issues with Standard Chartered Bank totalling Rs 55 crore. Ujjivan also raised over Rs 100 crore in debt funding from a set of public and private sector banks, including SIDBI, among others. 3

- 4. Strides Arcolab Sells Subsidiary Ascent Pharma to Watson For $393M Bangalore-based Strides Arcolab Ltd has sold its entire 94 per cent holding in Ascent Pharma Health Ltd, its subsidiary operating in Australia and South-east Asia, to NYSE-listed Watson Pharmaceuticals, Inc., at an enterprise value of AU$375 million ($393 million).Ascent is one of the top five generic pharmaceutical companies in Australia with presence across several South-east Asian countries like Singapore where it is the leading generic pharmaceutical company.As part of the transaction, Watson also acquired the remaining 6 per cent shareholding associated with Dennis Bastas, CEO of Ascent. The transaction was signed and closed simultaneously. Zephyr Peacock Invests Up To Rs 50Cr in Gadhia Solar Private equity firm Zephyr Peacock has invested up to Rs 50 crore in Mumbai-based Gadhia Solar. The solar energy company provides energy solutions by using parabolic concentrated technology and has implemented some of the world’s largest solar thermal systems during the past two decades. India Infoline Venture Capital Fund Raises Rs 500Cr Realty Fund India Infoline Venture Capital Fund, the private equity arm of the India Infoline group (IIFL), has completed raising a Rs 500 crore fund dubbed IIFL Real Estate Fund (Domestic) Series I, according to a company statement. The fund will mainly focus on the Indian real estate sector and invest in equity, debt and equity-linked instruments of promising real estate and construction companies, which are either involved in projects/ventures or have significant growth potential. 4

- 5. NTT Com to Acquire 74% in Netmagic Solutions; Nexus, Fidelity Exit NTT Communications Corporation (NTT Com), a wholly owned subsidiary of Nippon Telegraph and Telephone (NTT) Corporation, will acquire 74 per cent stake in data services firm Netmagic Solutions Pvt Ltd, the companies have jointly announced on Wednesday. According to Telecompaper, the acquisition price is around 10 billion Japanese yen (around $128 million).The addition of Netmagic Solutions’ datacentre services and sites will expand NTT Com’s capability to provide one-stop ICT solutions in the Indian market and also accelerate its global offering of seamless Cloud services. US Buyout Firm GenNx360 Opens Offices in Gurgaon, Bangalore US-based buyout firm GenNx360 Capital Partners has formed GenNx360 India Advisors Pvt Ltd, which will now operate out of two offices in Gurgaon and Bangalore. Launched in 2006, GenNx360 specializes in mid-market buyouts of industrial B2B companies. The firm focuses on opportunities in industrial water treatment, specialty chemicals & engineered materials, industrial machinery & equipment components, Global transportation component parts (auto, rail and infrastructure, aerospace & defense), oil & gas services (also, parts and equipment) and business services like logistics. It looks to invest in companies with revenues between $75 million and $500 million. GenNx360 is based in New York City, with additional offices in Seattle and Boston. This strategic initiative provides the firm with a truly global footprint, establishing a presence in both India and Asia 5

- 6. 6