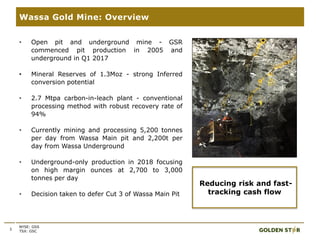

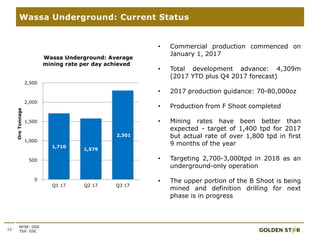

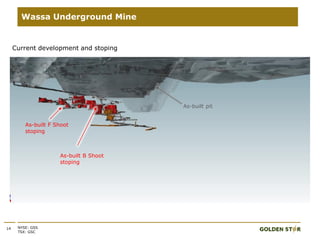

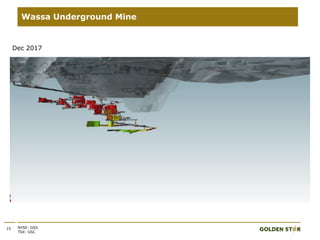

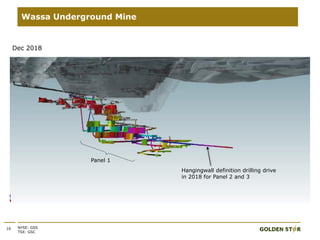

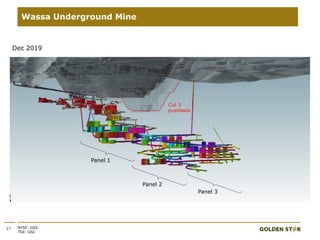

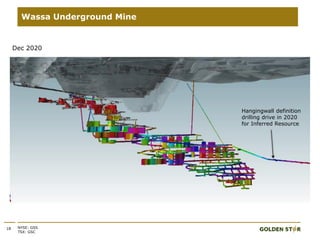

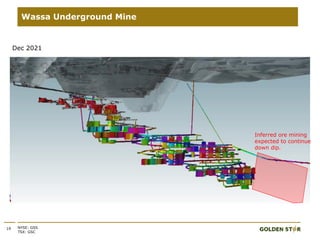

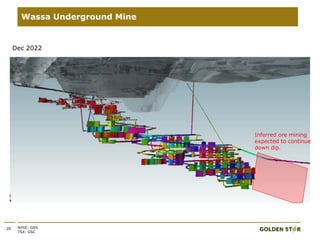

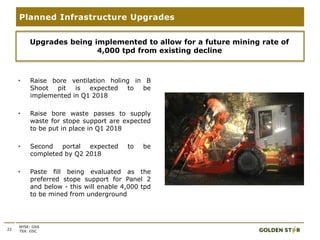

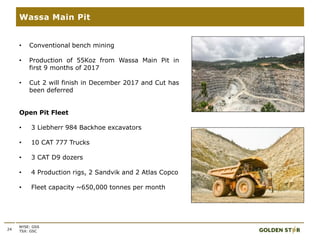

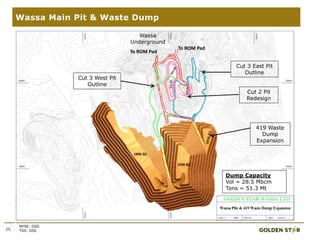

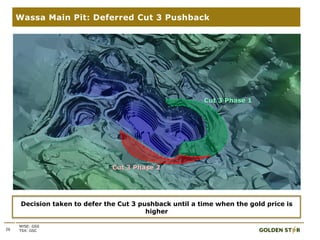

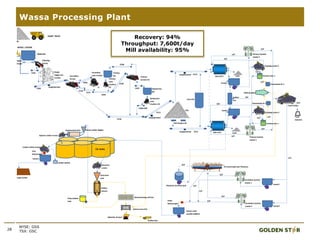

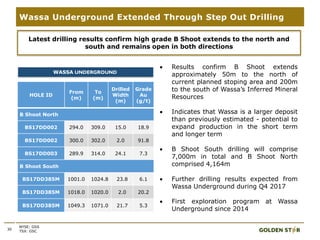

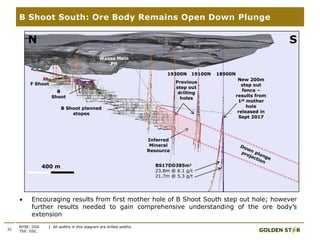

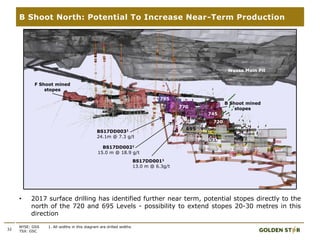

Golden Star's Wassa Gold Mine in Ghana includes an open pit mine and underground mine. In Q3 2017, production from the Wassa Underground mine increased to 15,877 ounces, accounting for 50% of Wassa's total gold production. Golden Star plans to transition Wassa to an underground-only operation in 2018 in order to focus on higher grade ounces from underground at a target rate of 2,700 to 3,000 tonnes per day. Exploration and infrastructure expansion at the Wassa Underground mine has the potential to further increase production beyond 2020.