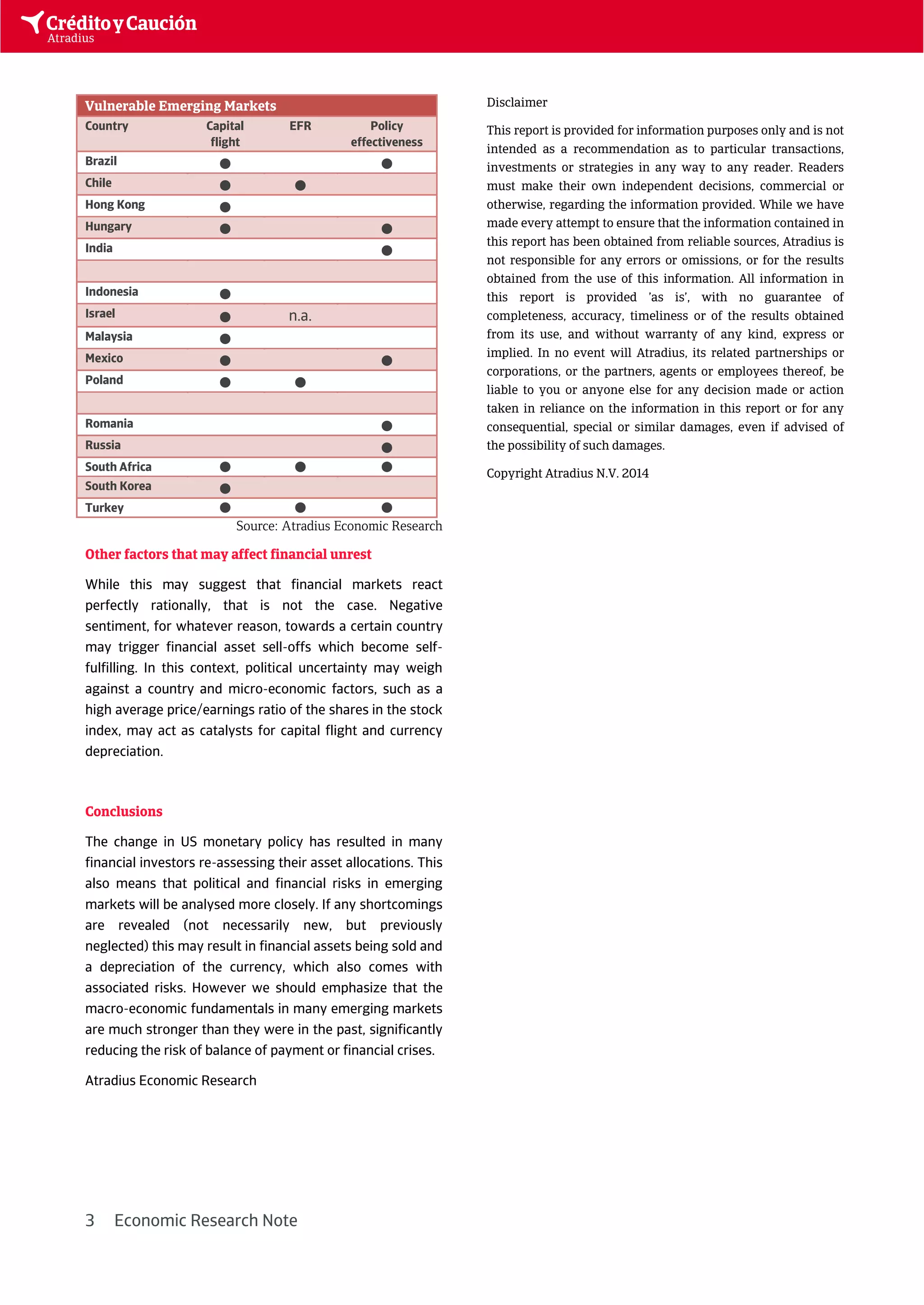

The document discusses the impact of changes in US monetary policy, specifically tapering, on emerging markets, which experienced significant capital outflows and currency depreciation in 2013. It identifies vulnerable emerging markets based on their foreign capital exposure, external financing requirements, and economic policy effectiveness, highlighting countries like Brazil, Turkey, and South Africa. The report concludes that while vulnerabilities exist, many emerging markets have stronger macro-economic fundamentals now, reducing the risk of financial crises.