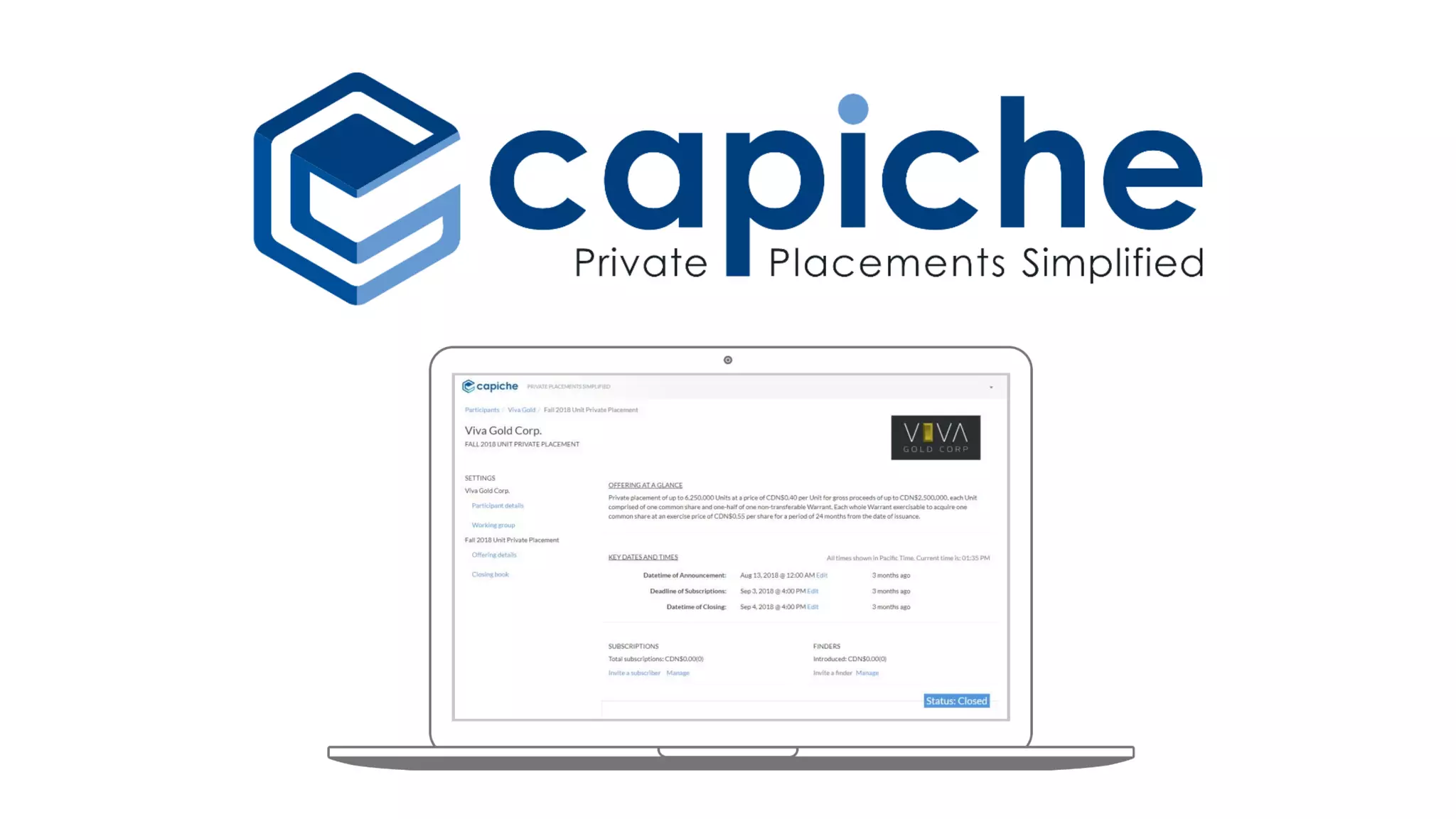

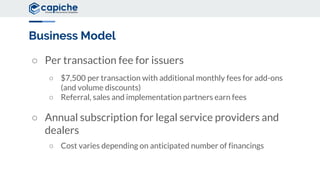

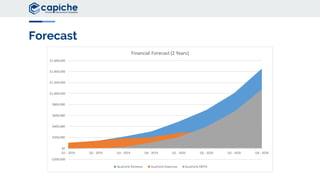

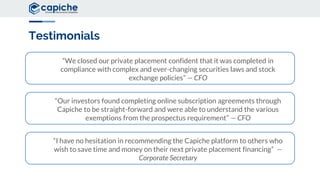

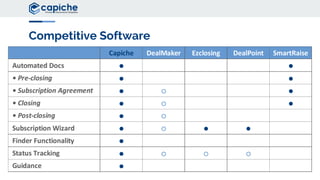

Capiche is a disruptive platform aimed at streamlining the capital raising process for legal services, with $849 billion in costs and $784 billion allocated specifically for compliance. The platform has raised $25 million and is currently processing subscriptions while exploring various growth opportunities and offering types. Led by a strong team, Capiche offers a user-friendly online experience with a per-transaction fee structure, aimed at making private placements more efficient and cost-effective.