Embed presentation

Download to read offline

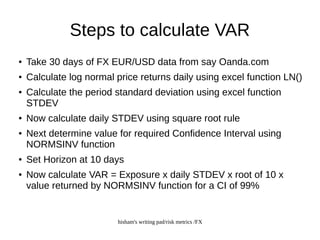

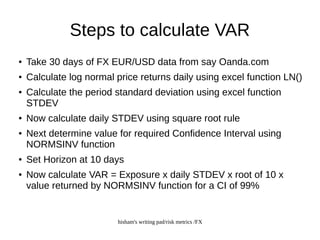

The document outlines the steps to calculate the Value at Risk (VaR) for a single currency pair according to Basel III requirements. It specifies calculating a stressed VaR at a 99% confidence interval over a 10 day time horizon. The steps include taking 30 days of FX data, calculating log normal returns and standard deviation, determining the confidence interval value, and using the exposure, standard deviation, time horizon, and confidence interval value in the VaR calculation formula.