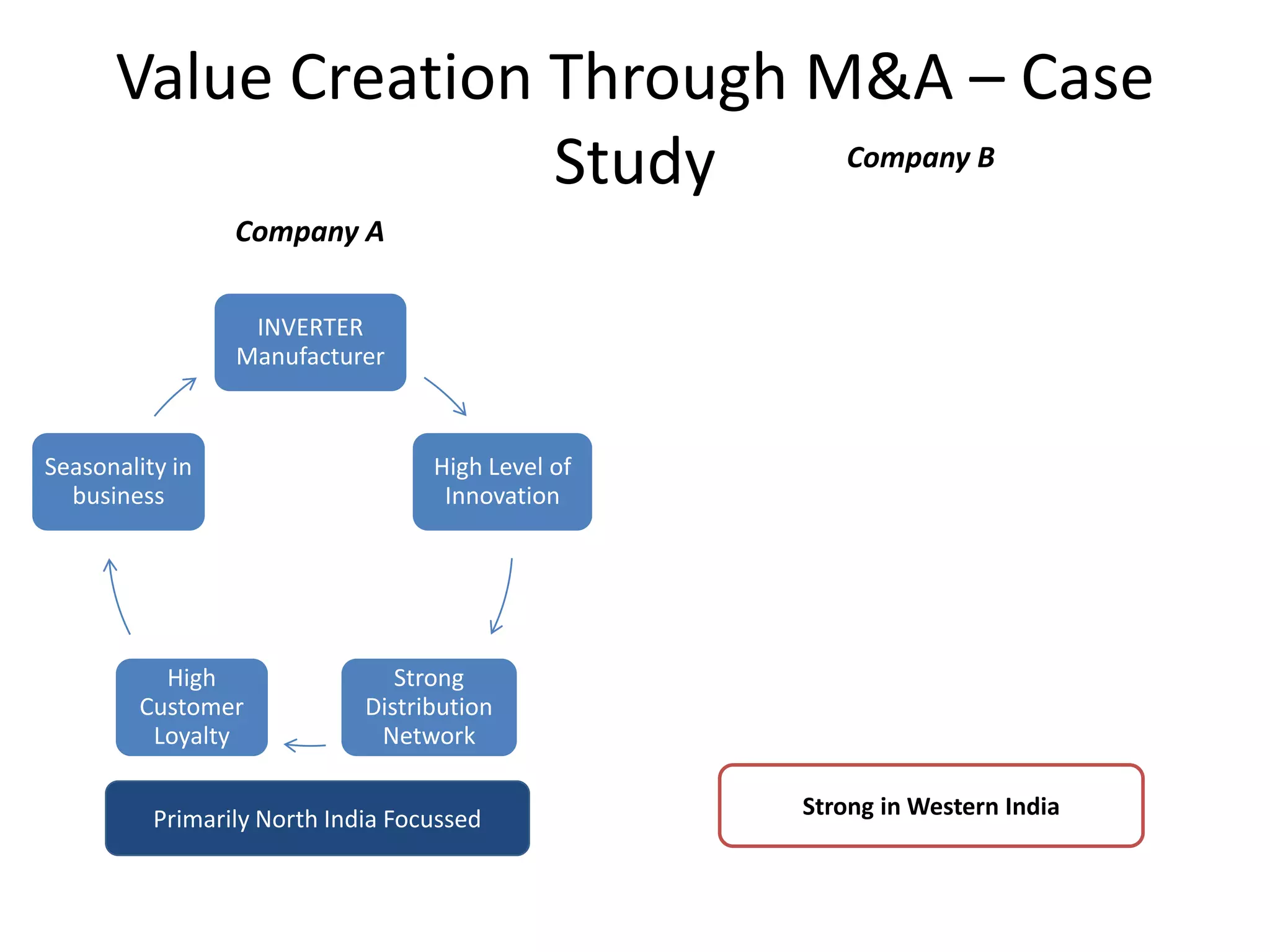

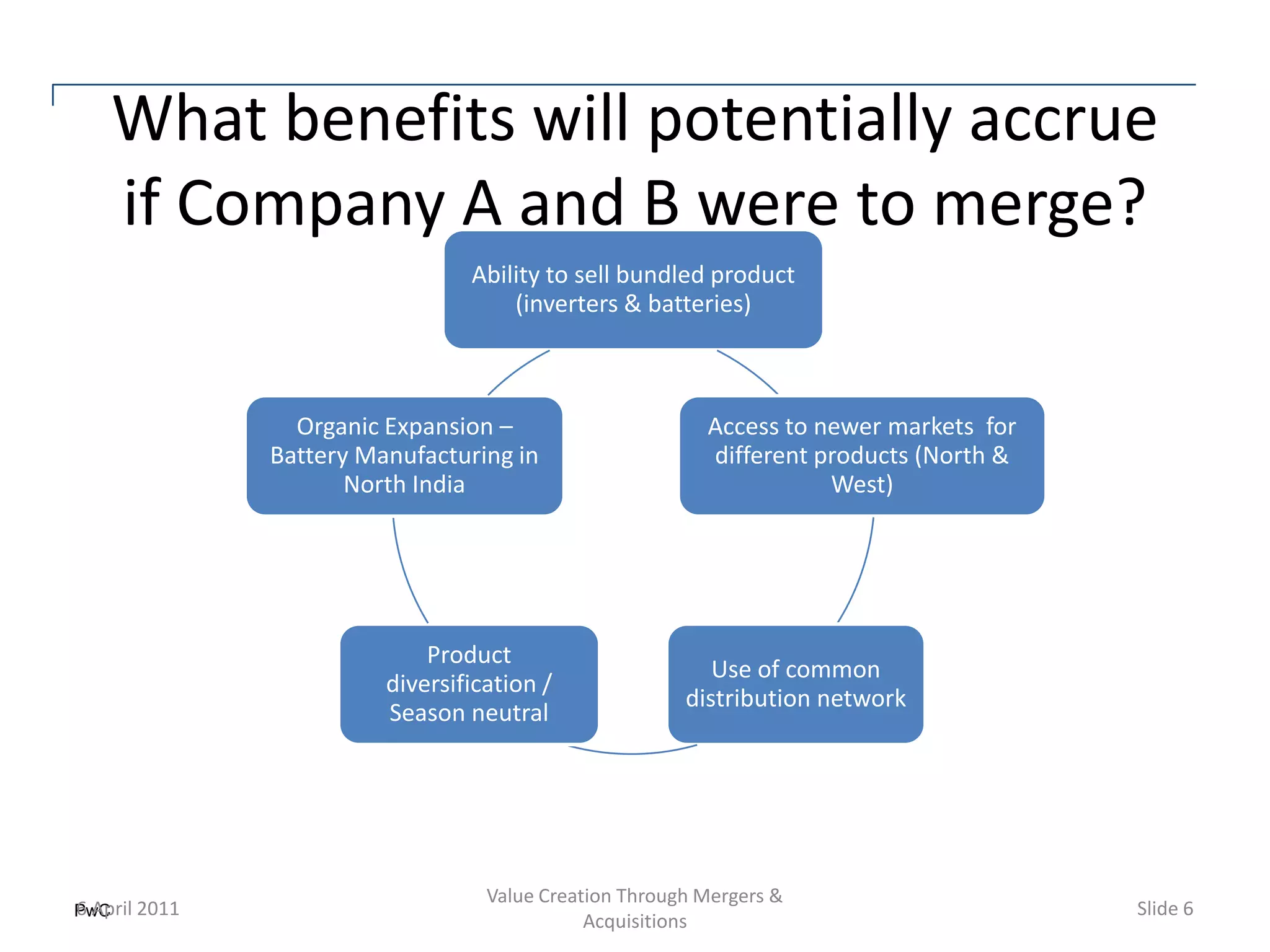

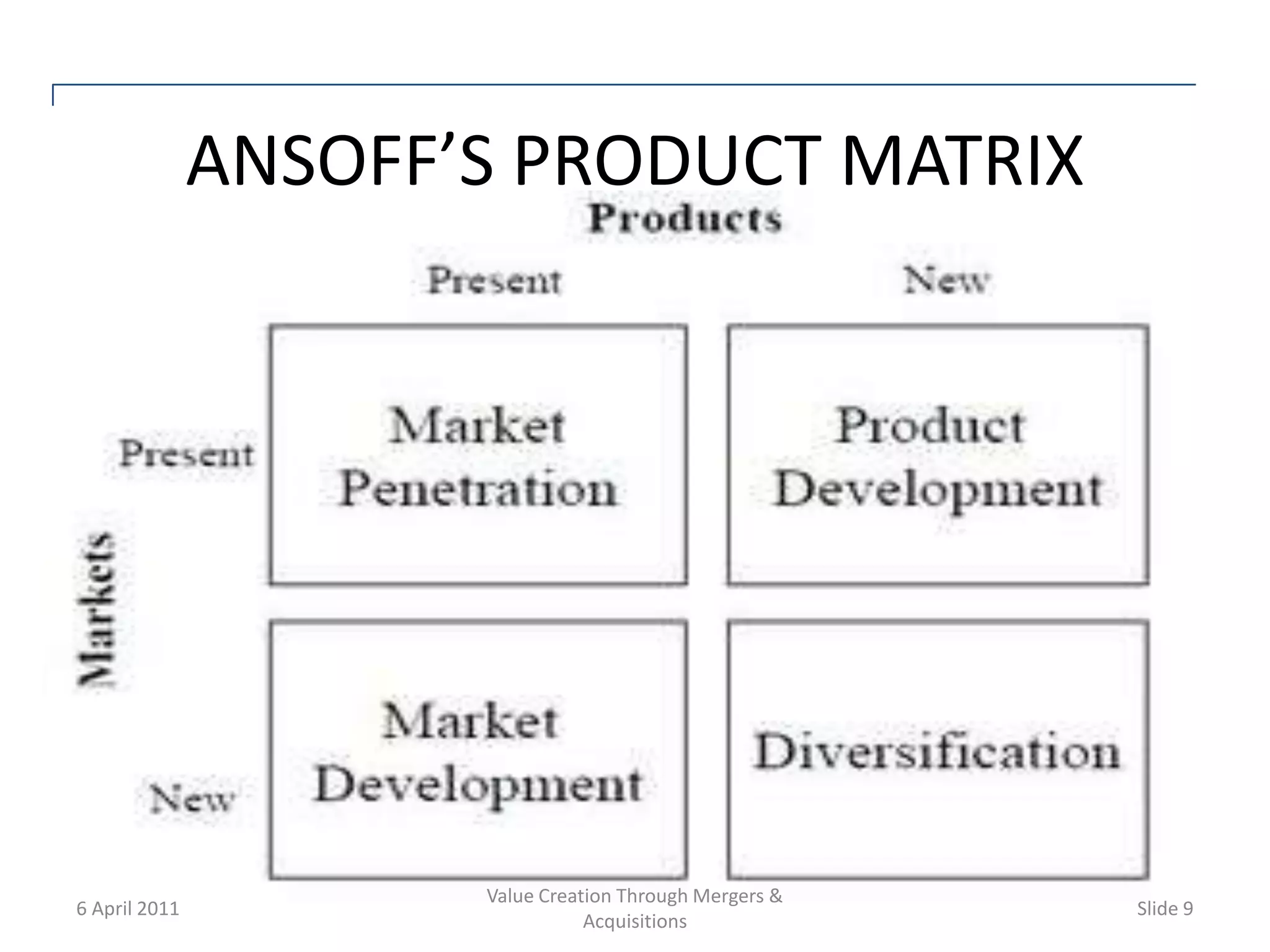

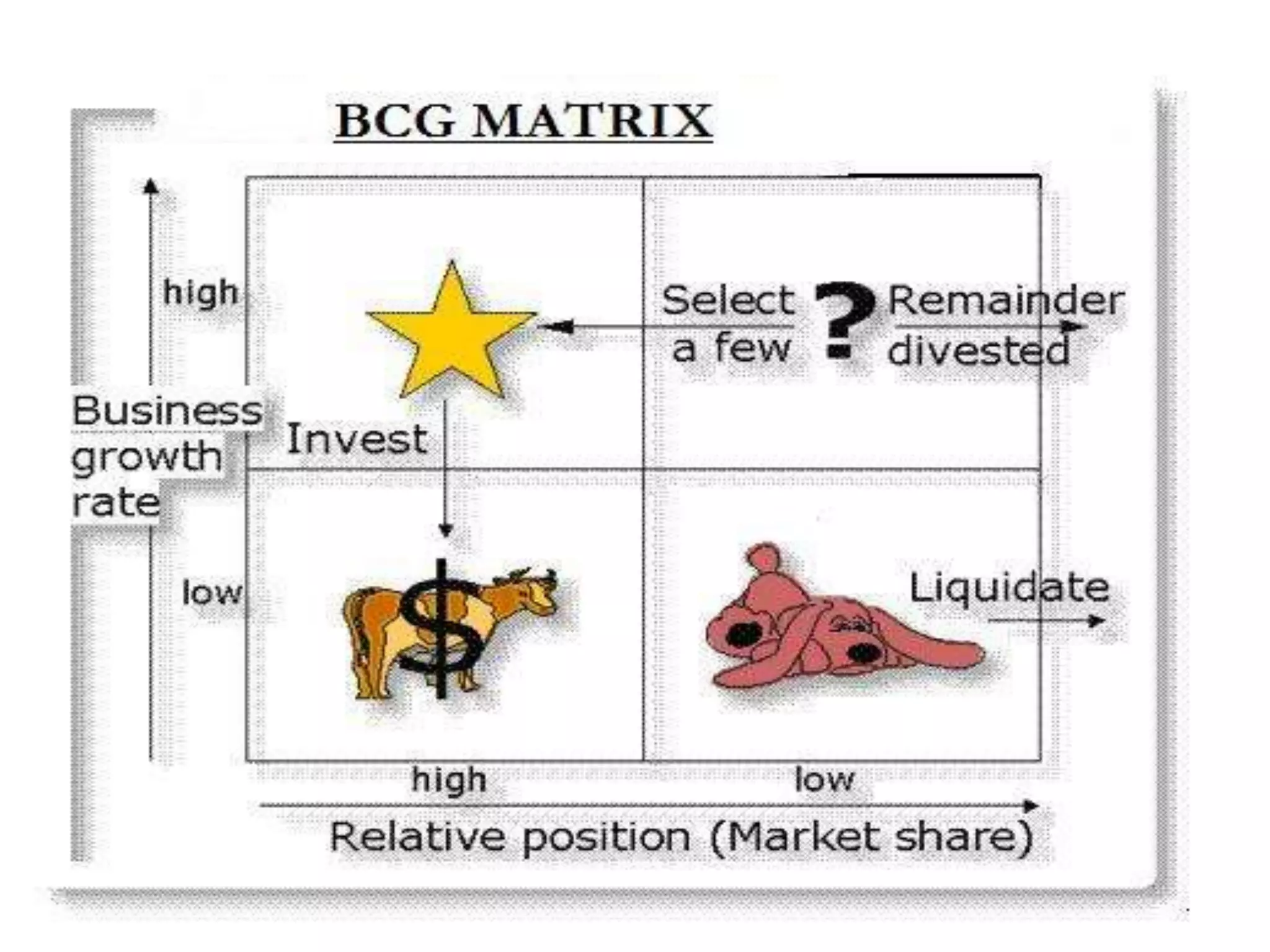

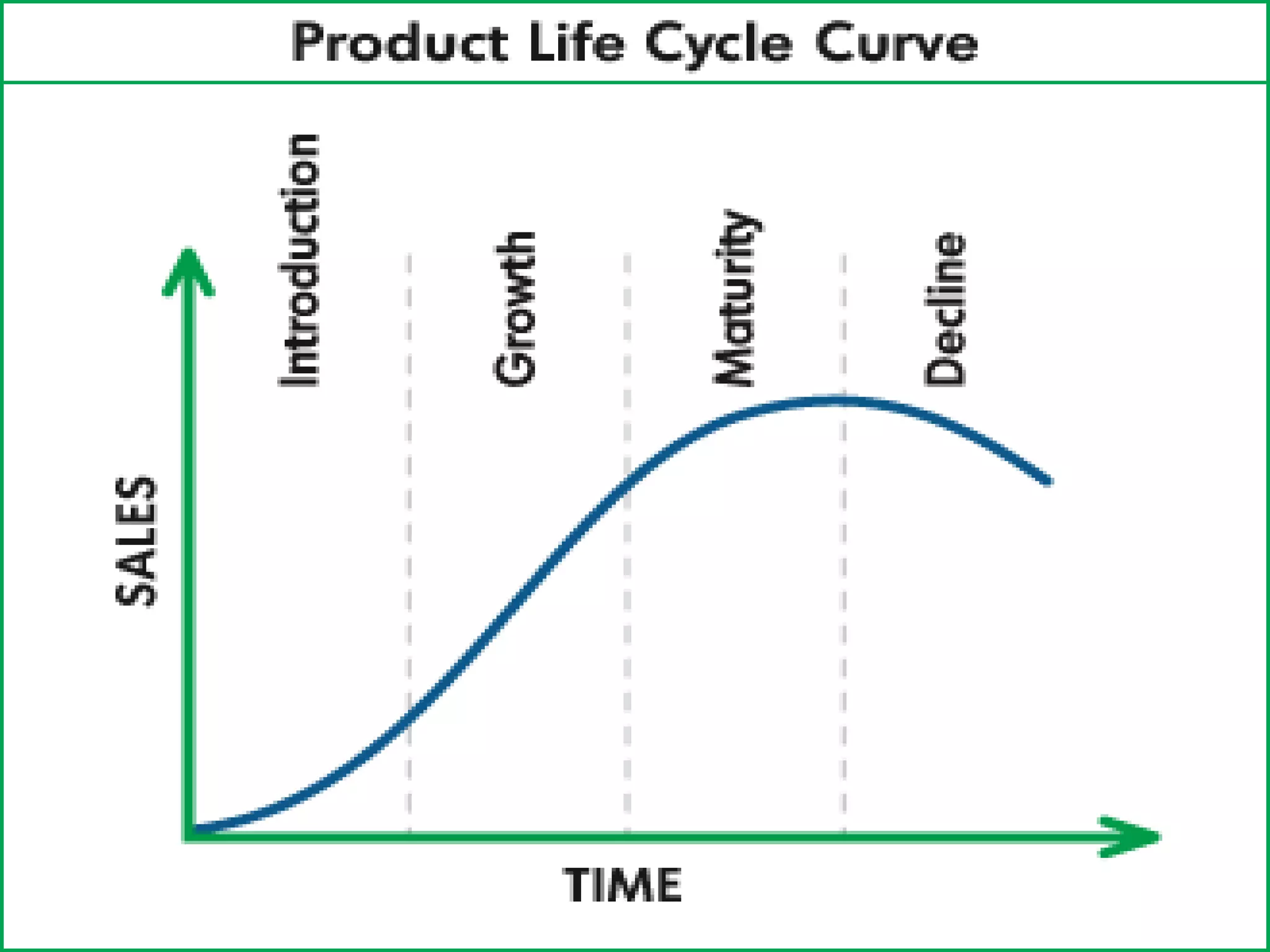

The document discusses sources of value creation through mergers and acquisitions (M&A). It outlines four main models: Ansoff's Product Market Matrix, BCG Matrix, Grand Matrix, and Industry/Product Life Cycle. These models identify strategies like market penetration, integration, diversification and divestment that can generate value at different stages of a product or industry's development. Case studies demonstrate how merging two companies can provide benefits like increased revenues and markets through synergies, cost savings, and access to new technologies. Overall, the document argues that M&A can be an important part of long-term value creation for companies when the right strategic rationale is applied.