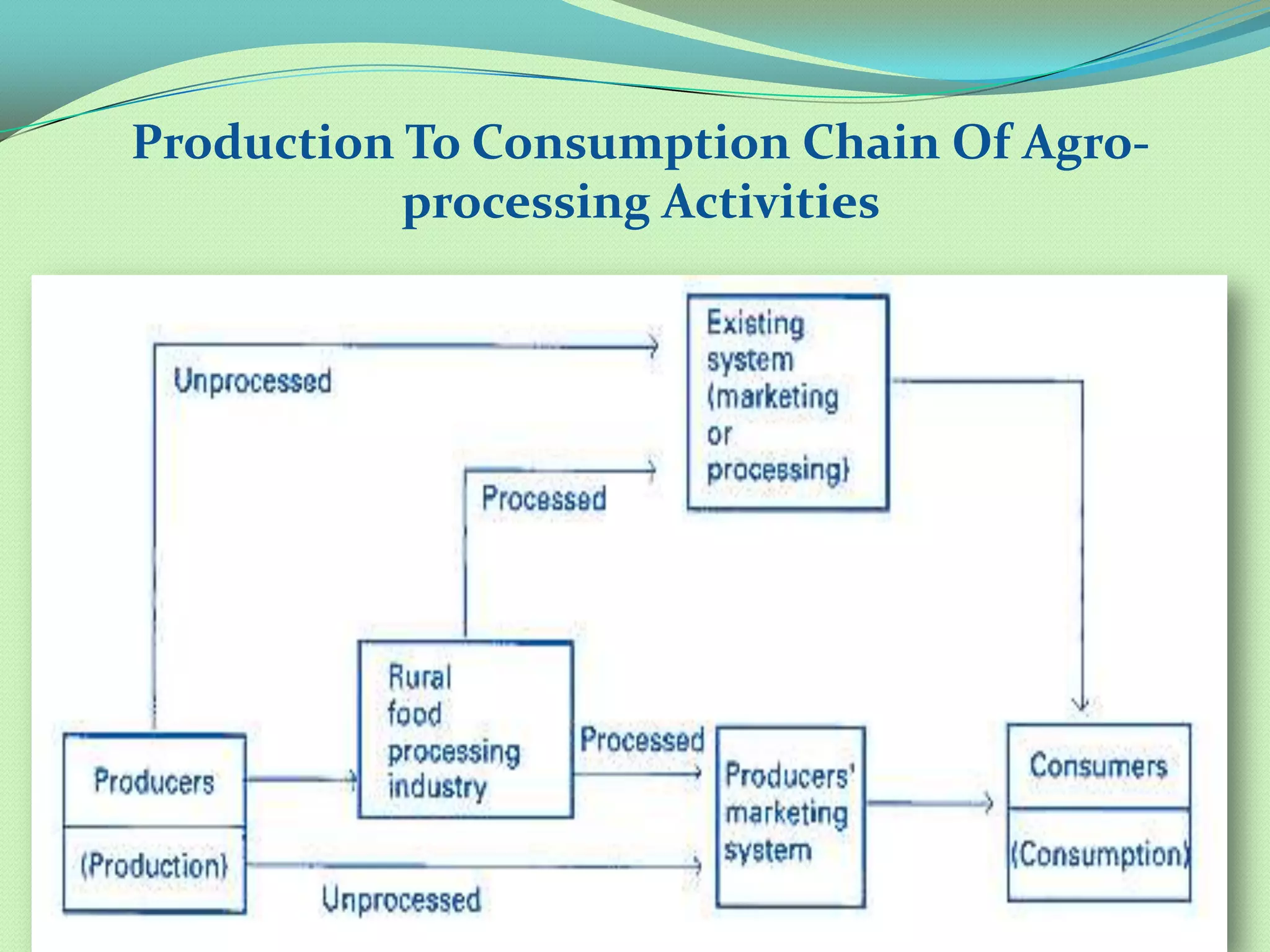

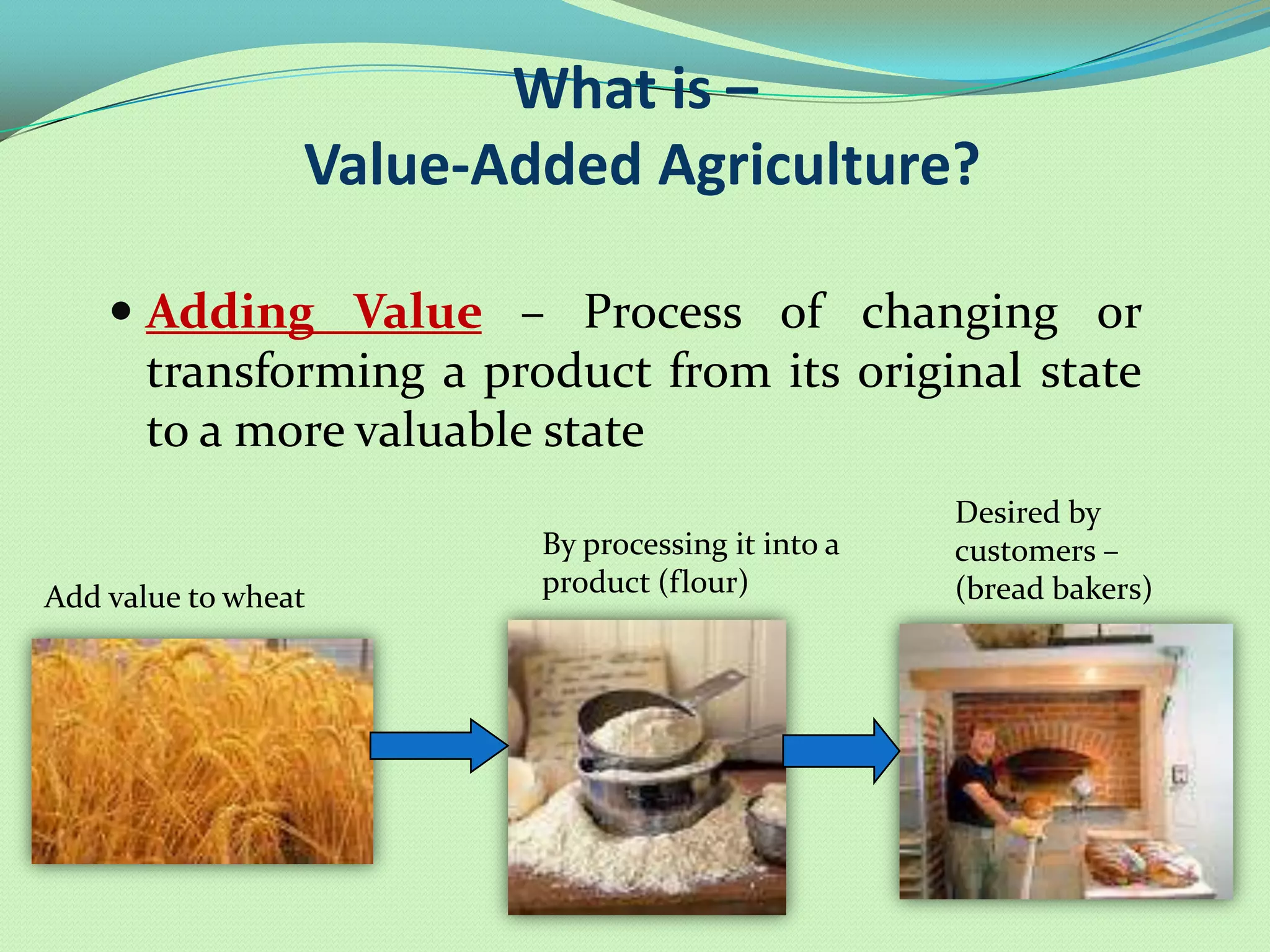

- The document discusses opportunities and challenges for value addition and processing of agricultural products in India.

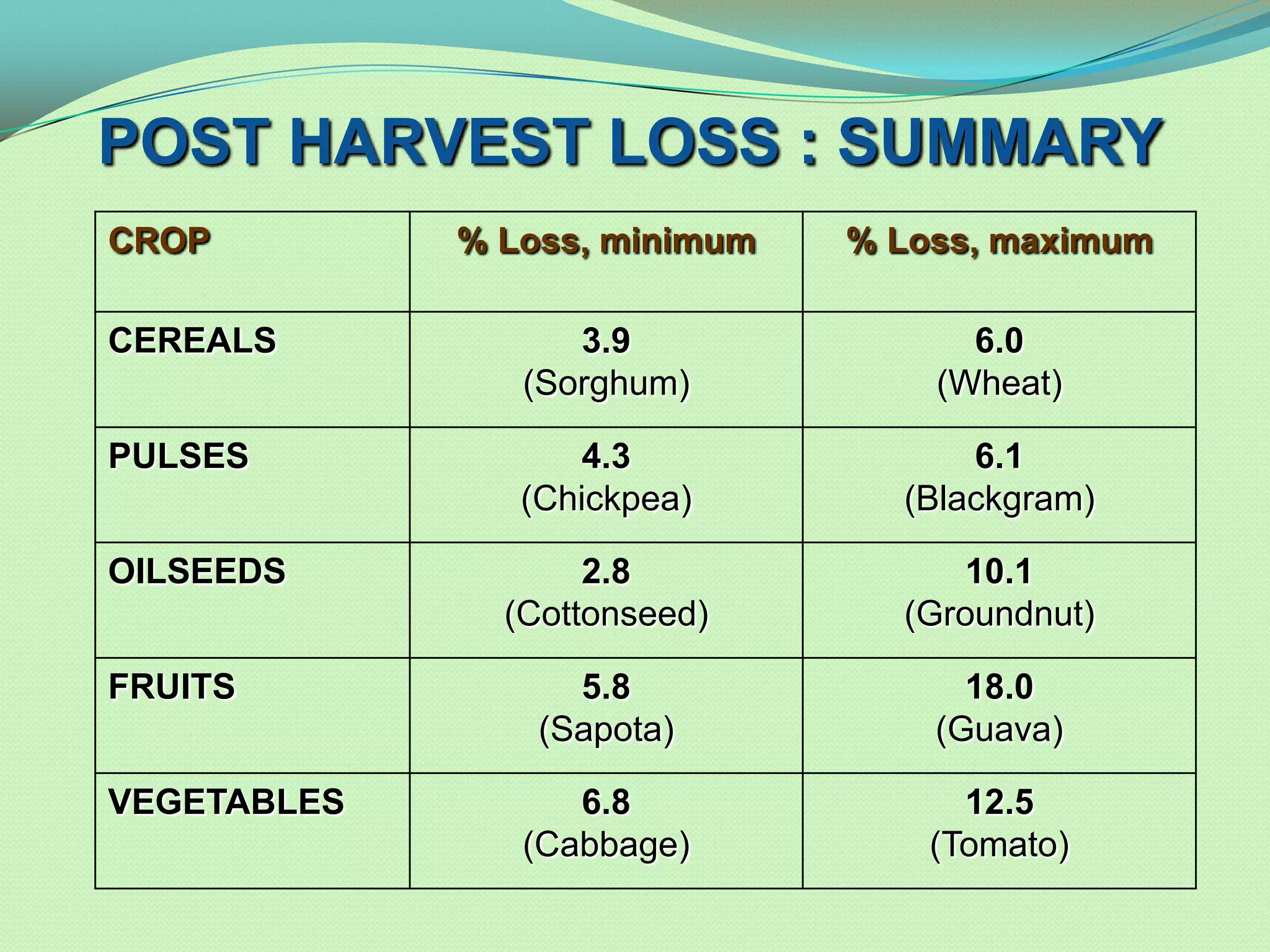

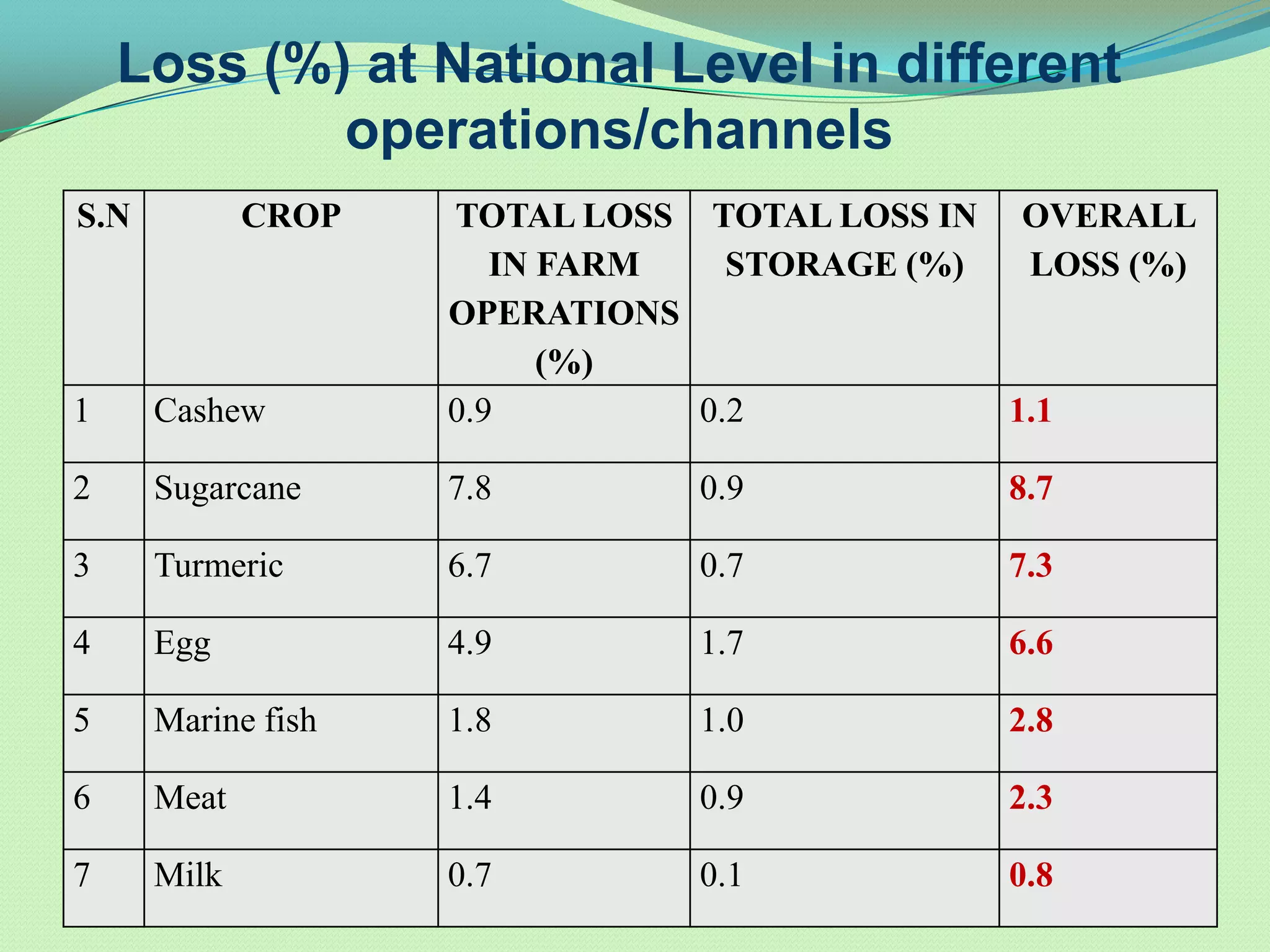

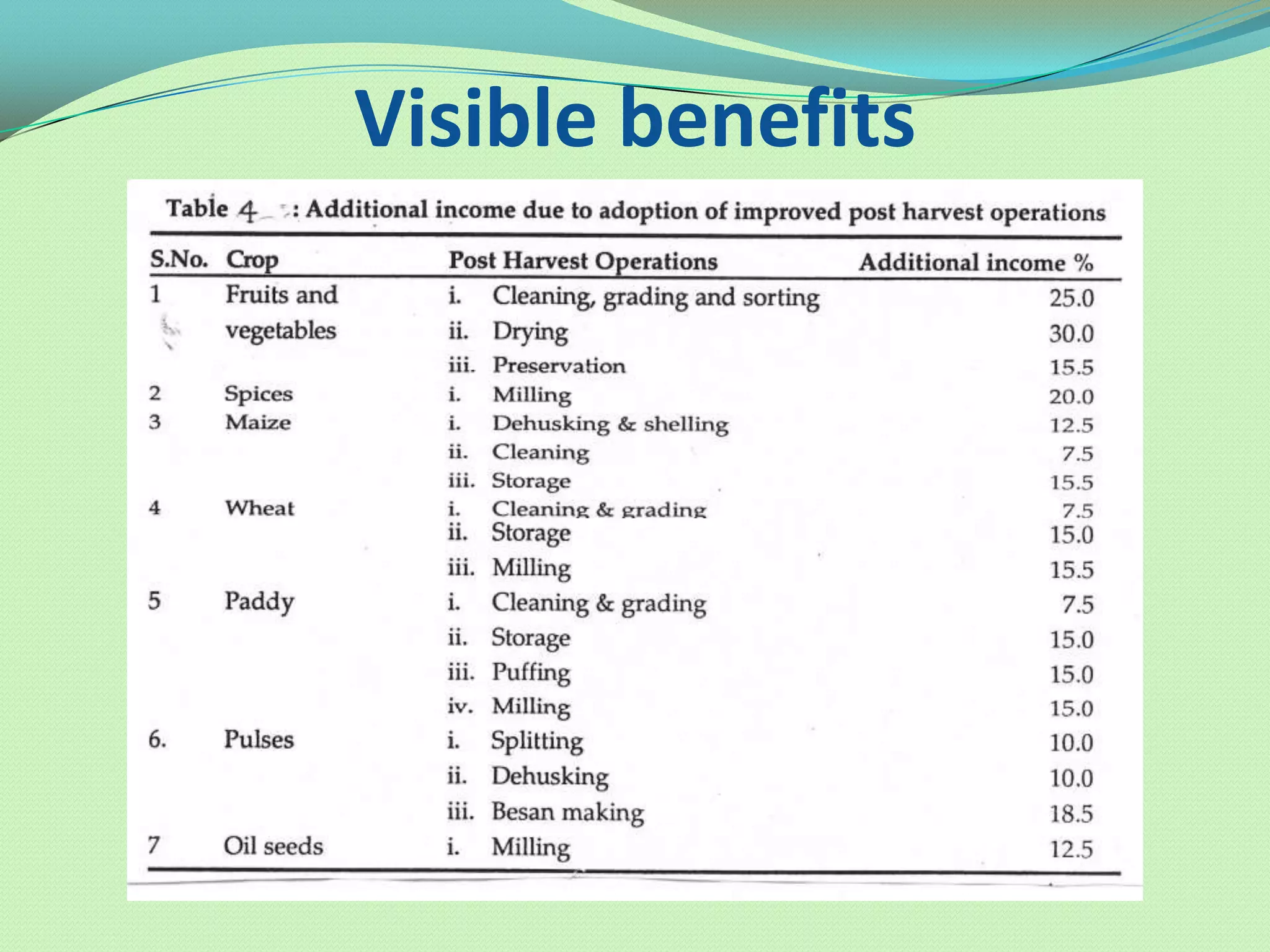

- It outlines high levels of post-harvest losses on farms and in supply chains, as well as low levels of agro-processing and value addition compared to other countries.

- The document advocates for strategies like expanding processing levels, modernizing food processing sectors, and promoting seamless value chains to reduce losses and add more value to agricultural commodities in India.