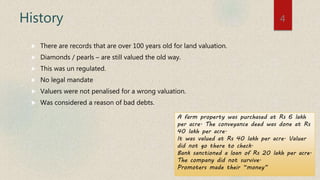

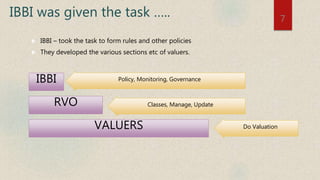

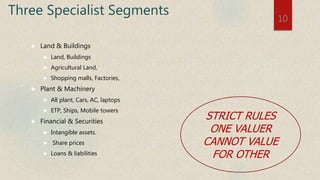

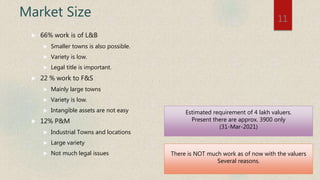

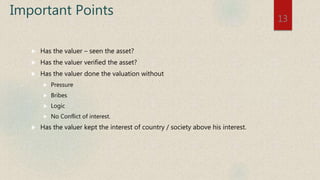

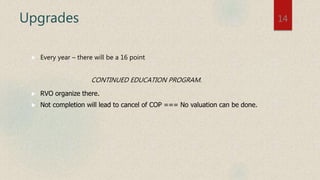

This document provides an overview of valuers and the valuation profession in India. It discusses how the profession was previously unregulated but the government passed new laws in 2017 to regulate valuers. The Insolvency and Bankruptcy Board of India (IBBI) was tasked with creating rules for valuers and establishing Registered Valuer Organizations (RVOs) to register and monitor valuers. Valuers must now have certain qualifications, complete training programs, pass exams, and obtain certification numbers from the IBBI to legally practice valuations. The document outlines regulations for different types of valuations and asset classes, continuing education requirements, monitoring of valuers, and expectations for the future of the profession as the regulatory framework