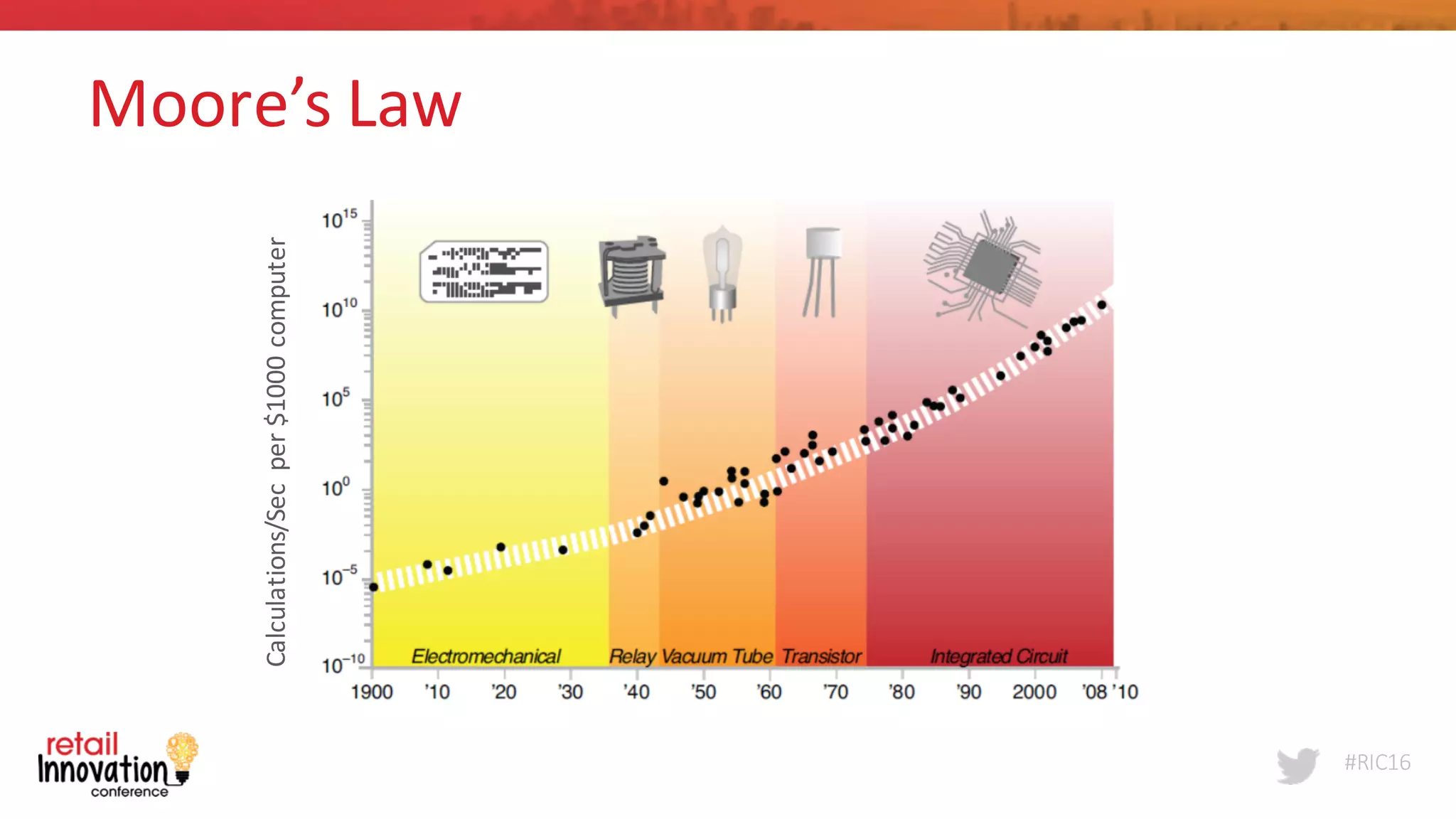

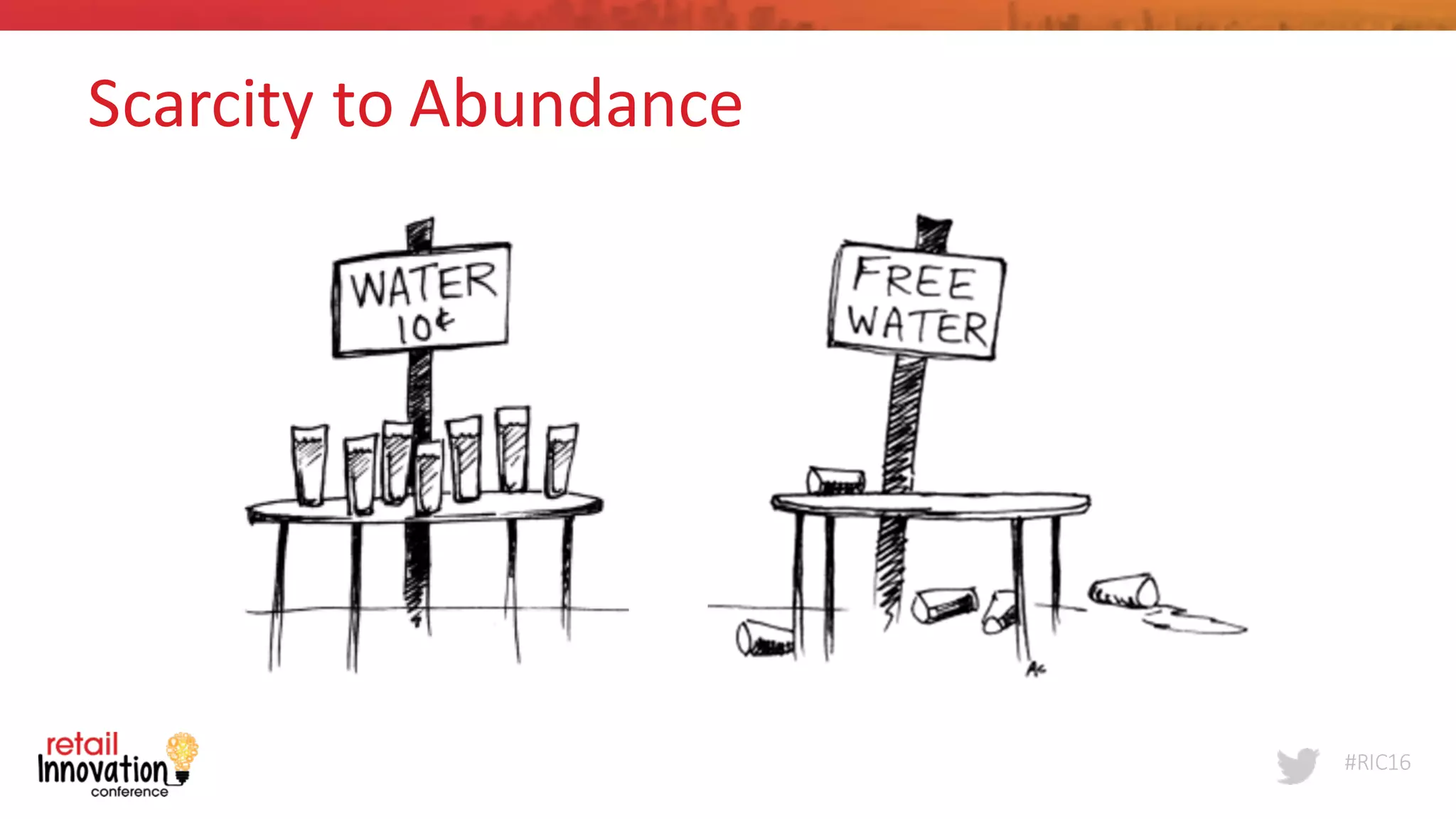

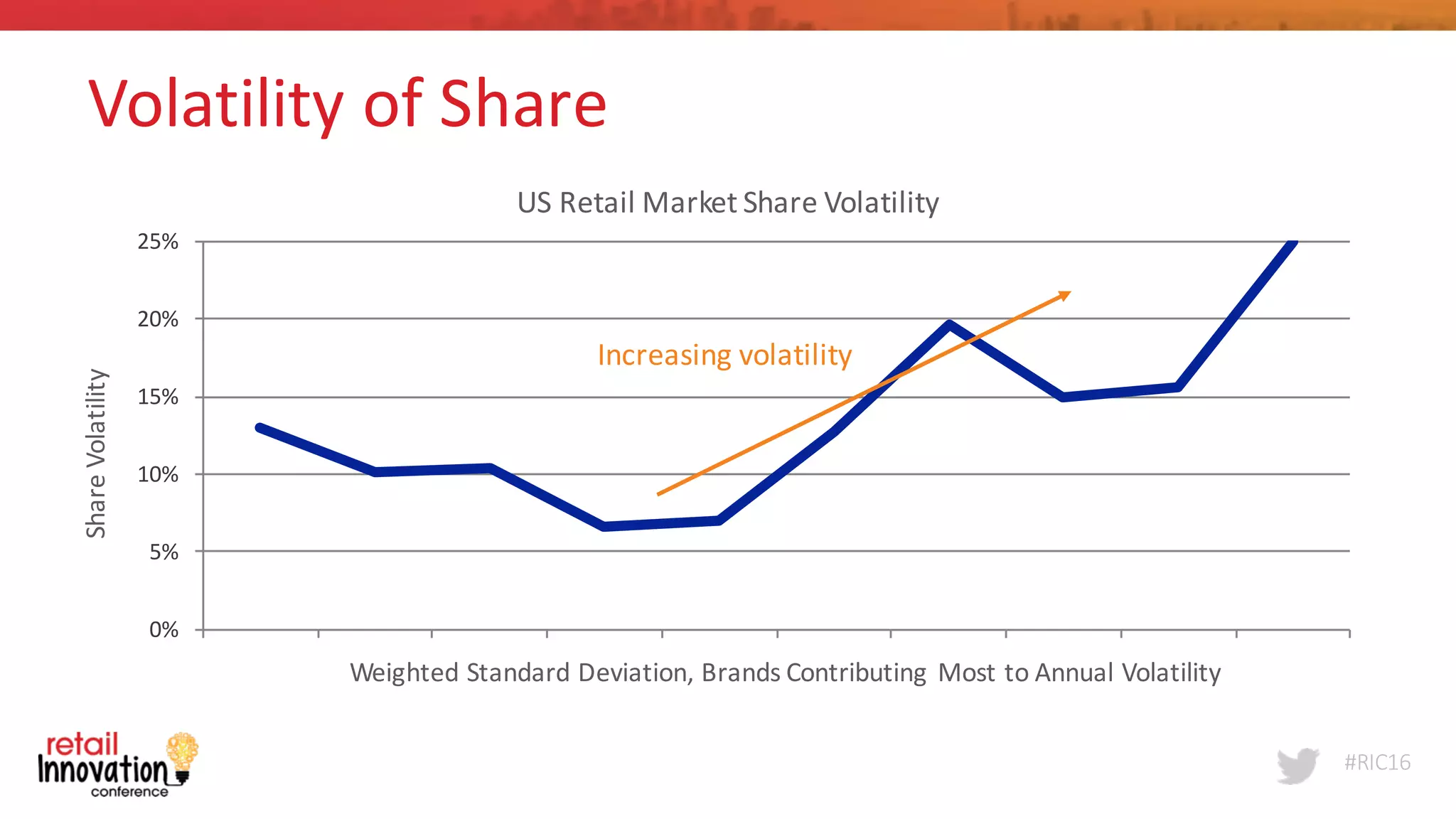

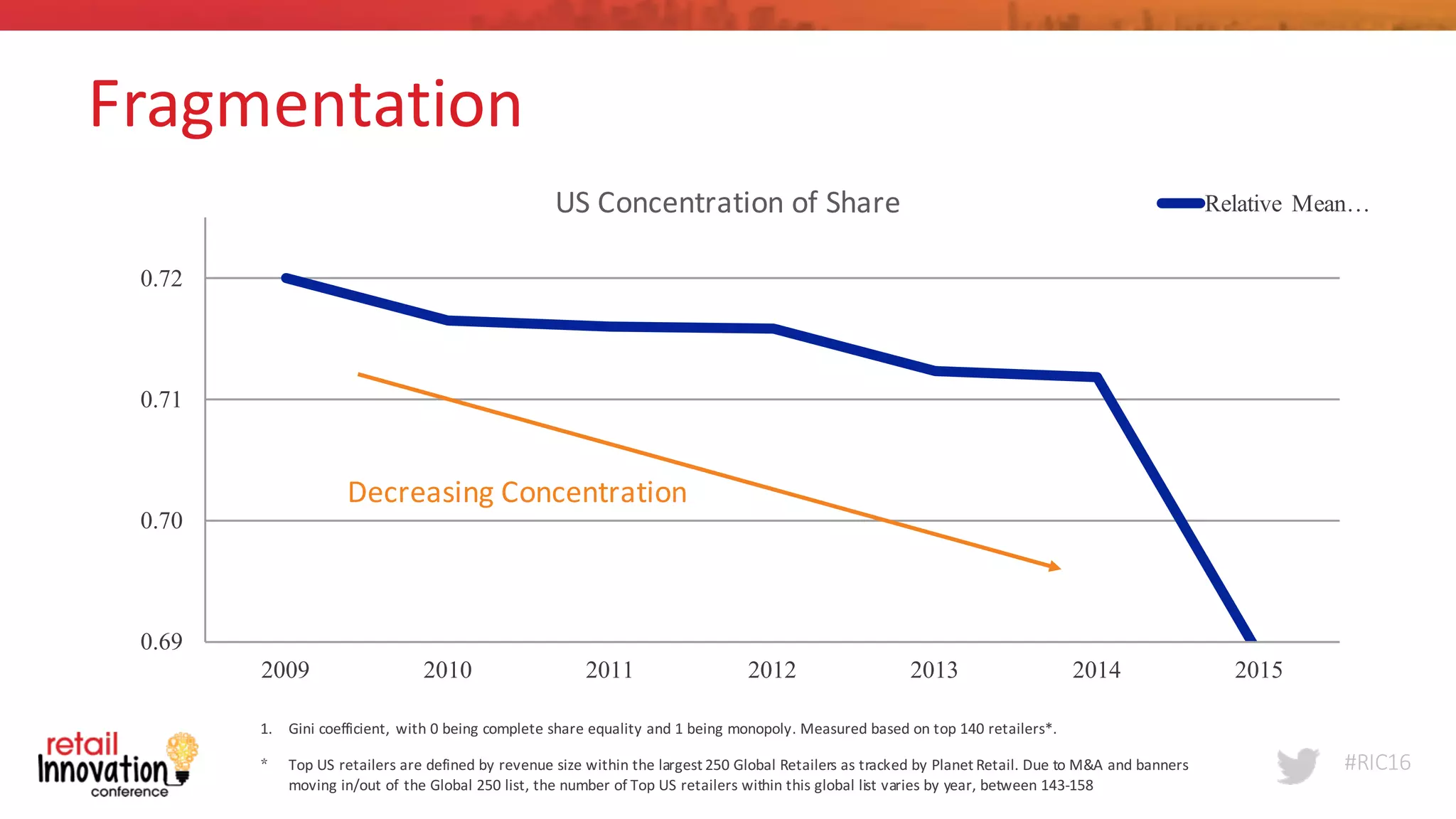

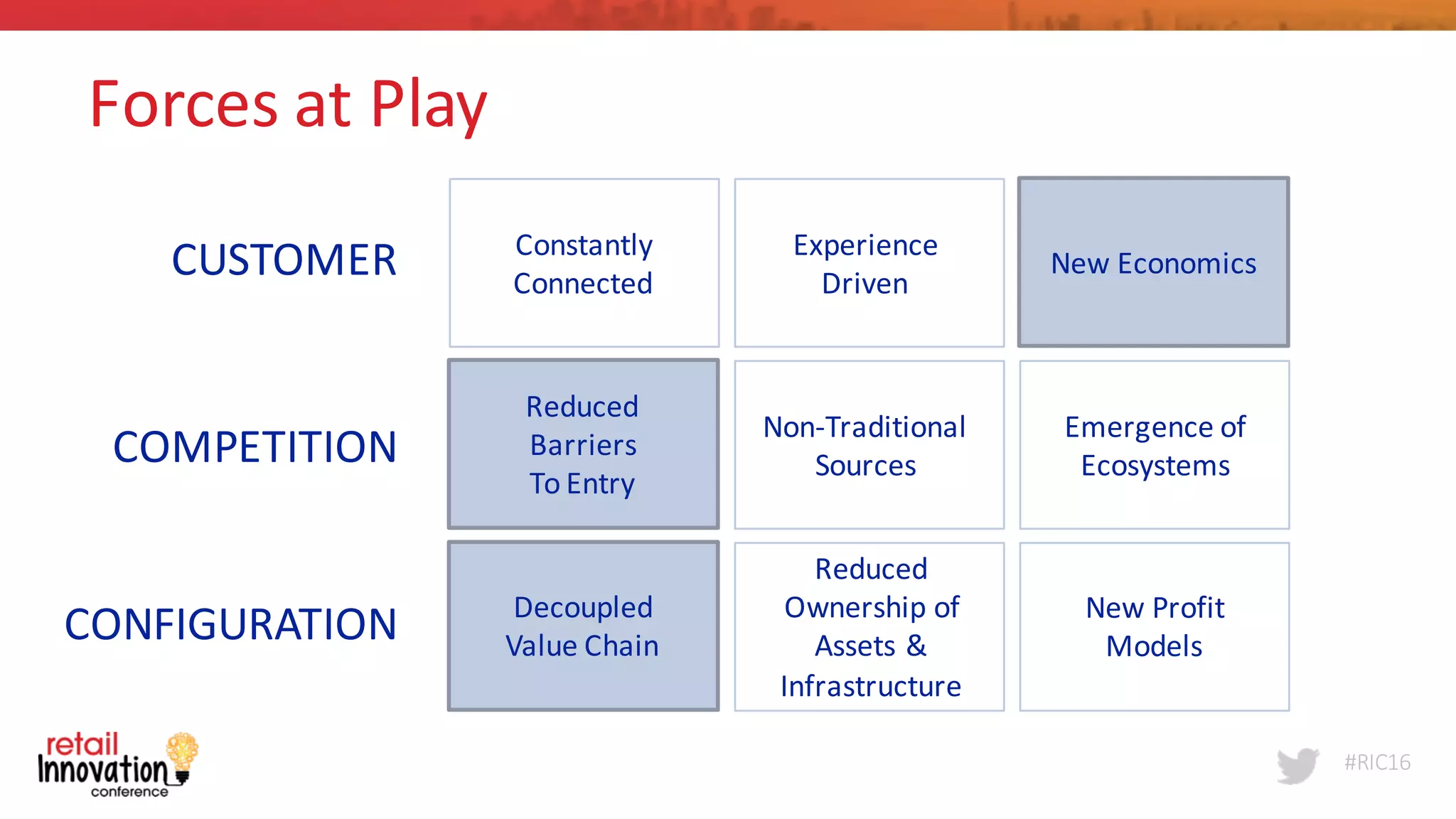

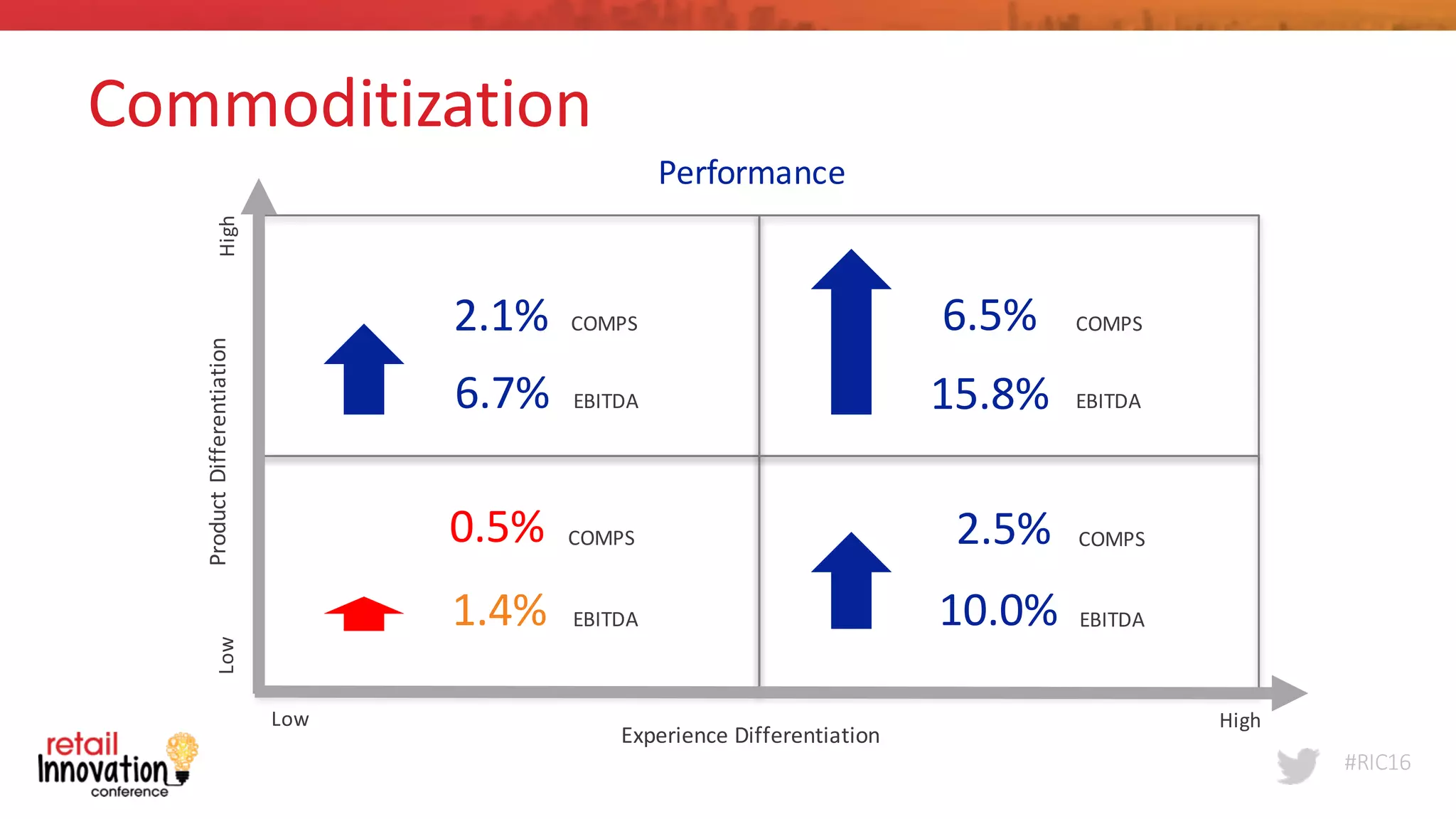

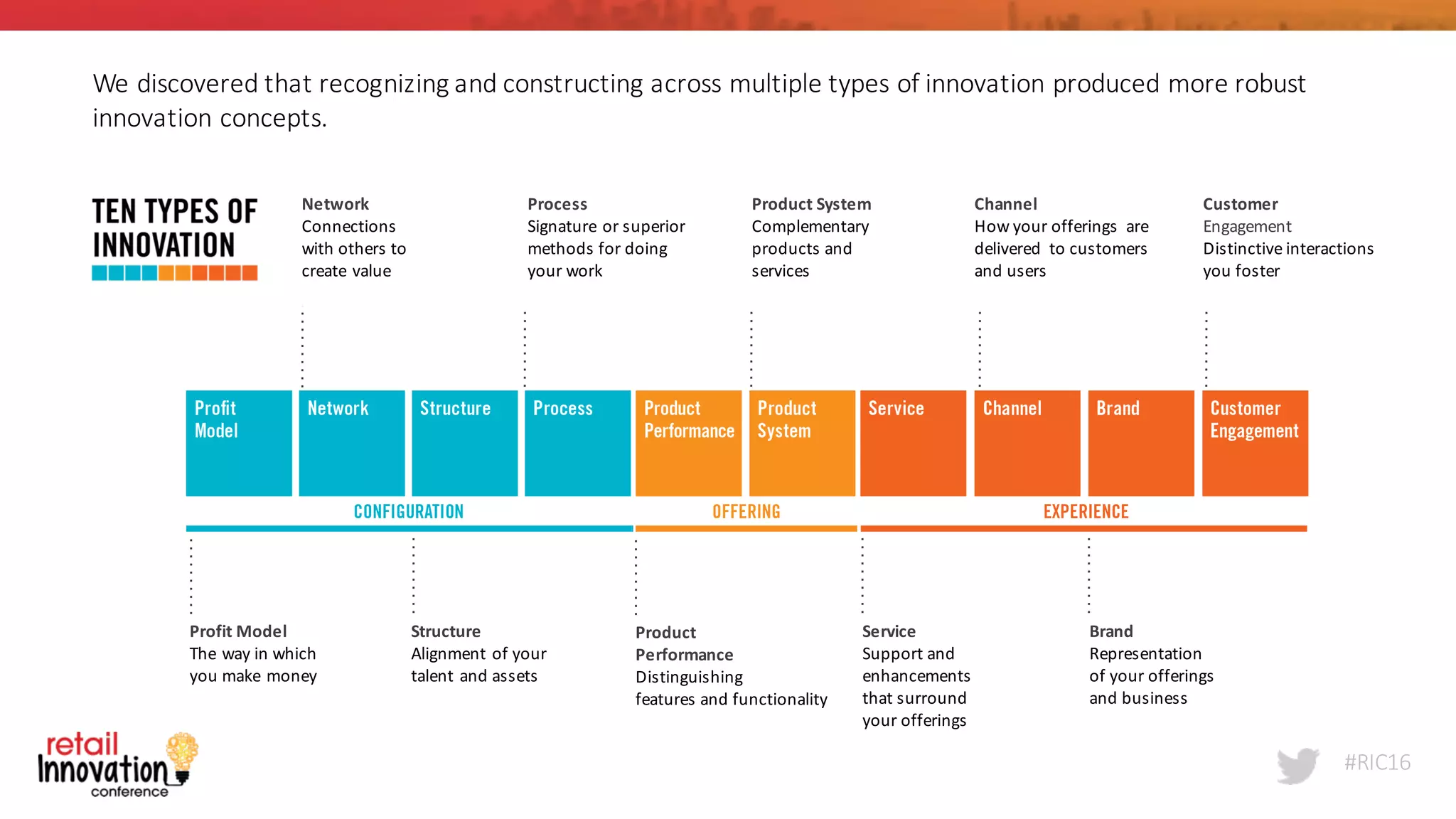

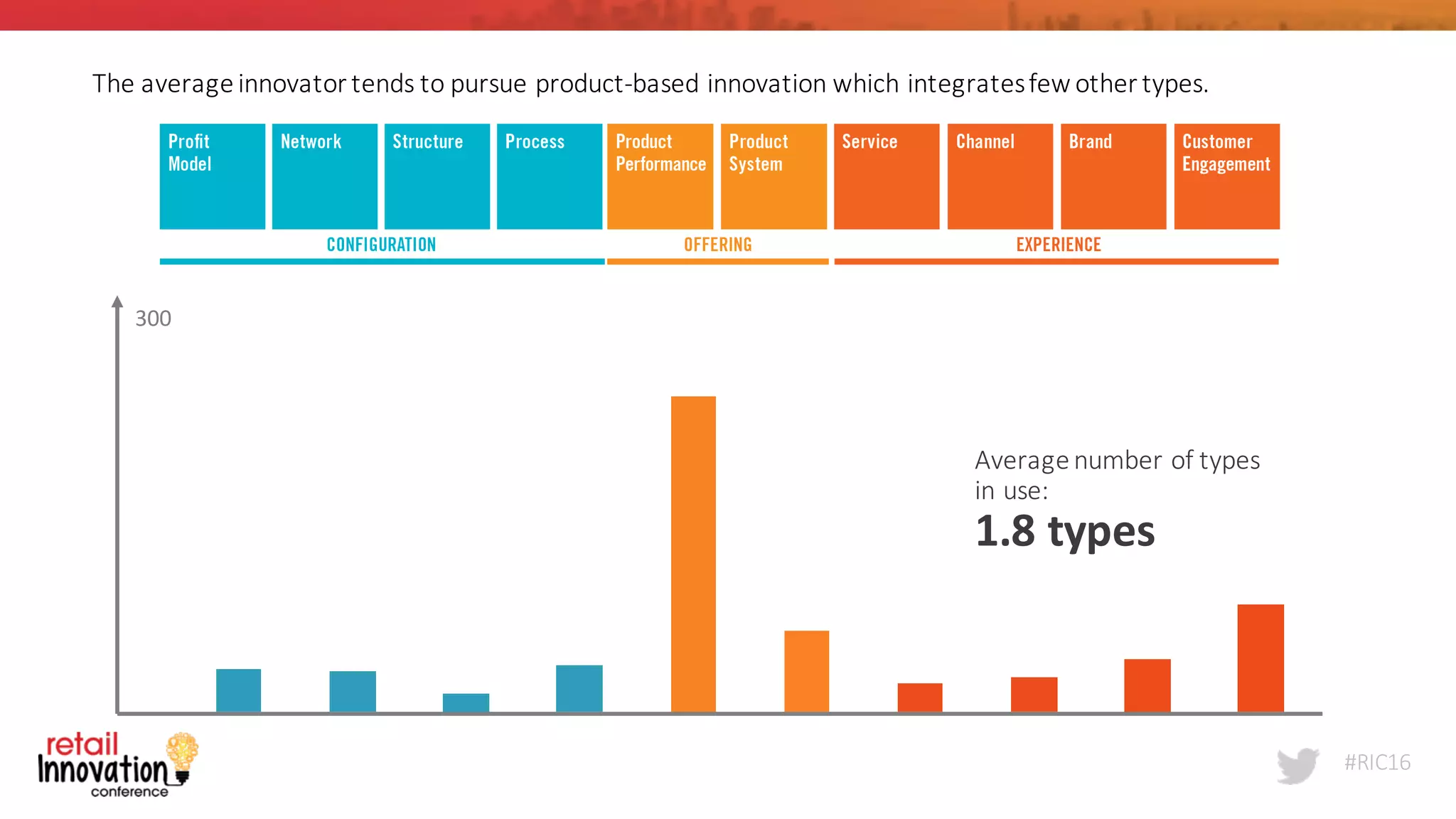

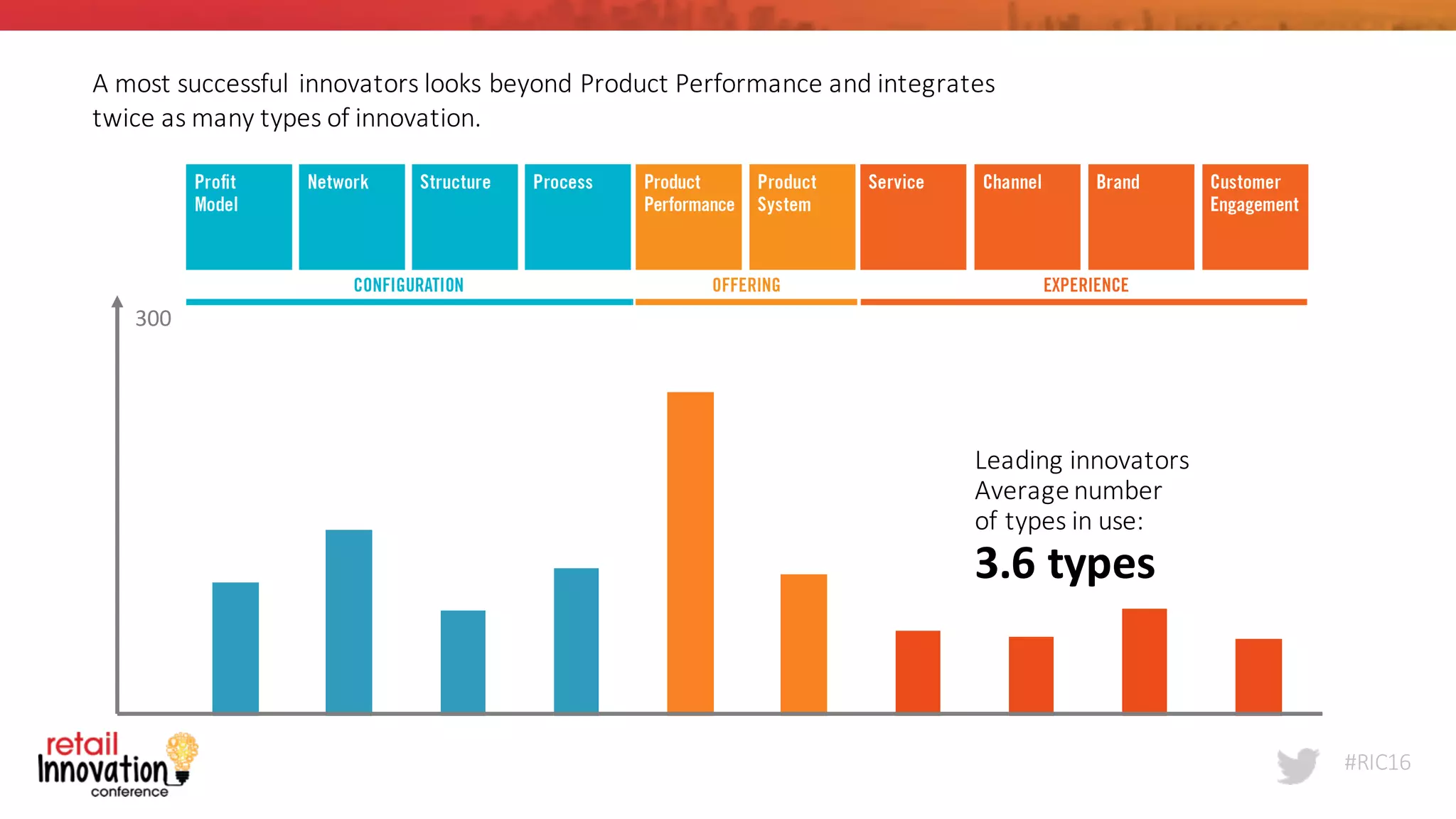

The document discusses the disruption in the retail industry, emphasizing market volatility and changing consumer behaviors. It highlights the importance of adapting innovation strategies beyond product-focused approaches to include various types of innovation for greater success. Key factors influencing this disruption include increased competition, technological advancements, and shifts toward experience-driven economic models.