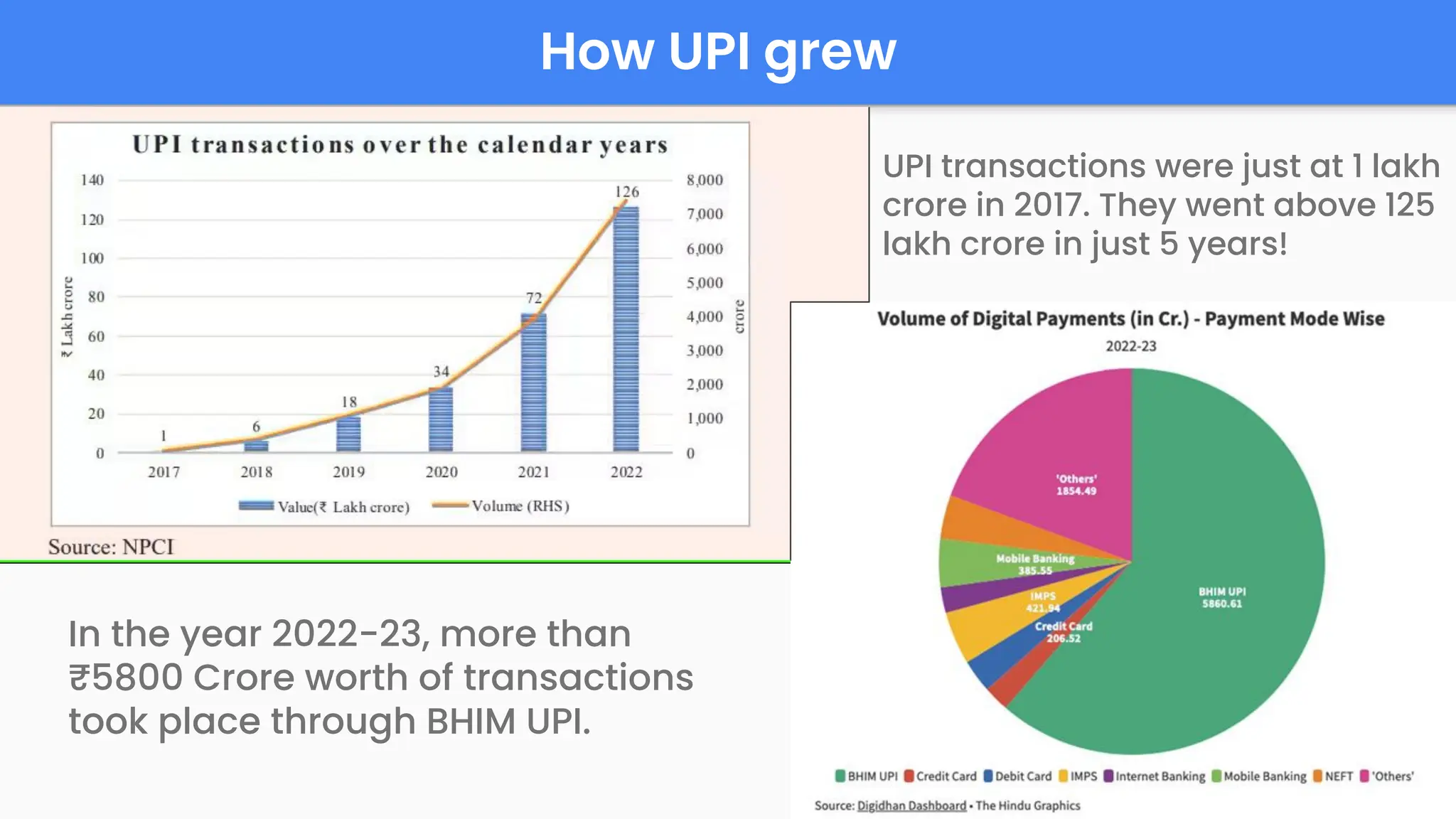

The Unified Payments Interface (UPI) is a real-time payment system launched in India in 2016, allowing instant money transfers between bank accounts via mobile devices, including 24/7 accessibility. UPI was introduced to simplify digital payments and reduce reliance on cash, experiencing rapid growth attributed to factors like demonetization and increased smartphone usage. Its features include easy navigation, security enhancements, and innovations like autopay and offline transactions, demonstrating its evolution and potential for the future.