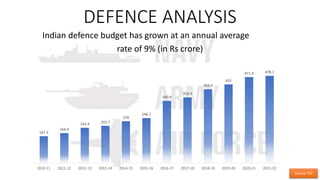

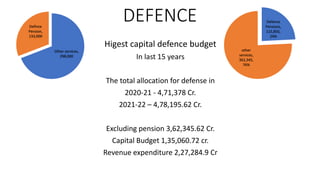

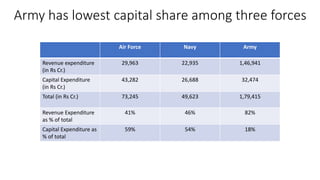

The document discusses the Indian Union Budget for 2021-22, emphasizing key aspects such as defense allocation, agricultural initiatives, and fiscal estimates. It highlights Nirmala Sitharaman as the first female finance minister, detailed expenditure categories, and growth in the defense budget. Moreover, it outlines improvements in agricultural credit and infrastructure investments to enhance economic activities in the sector.