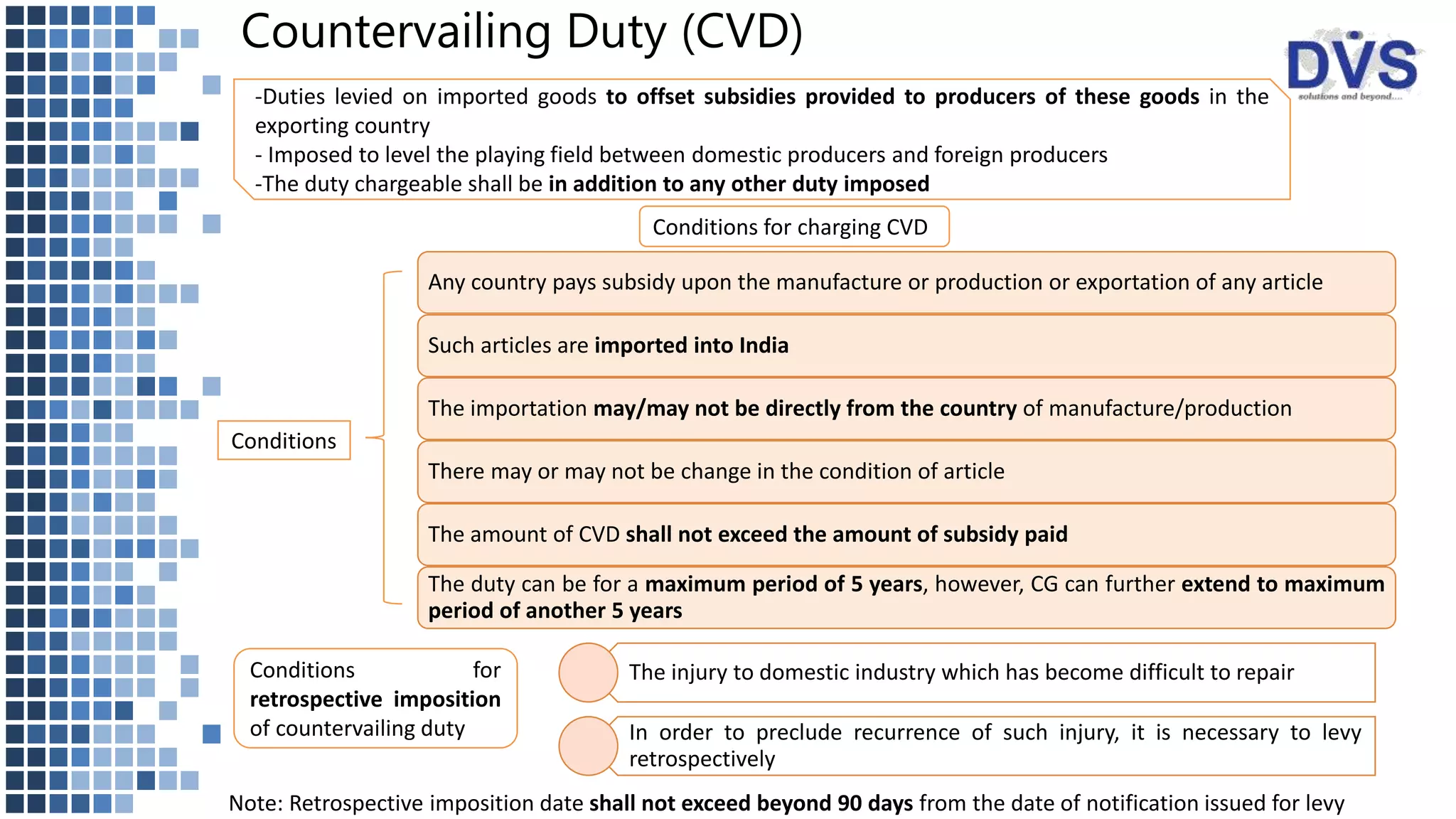

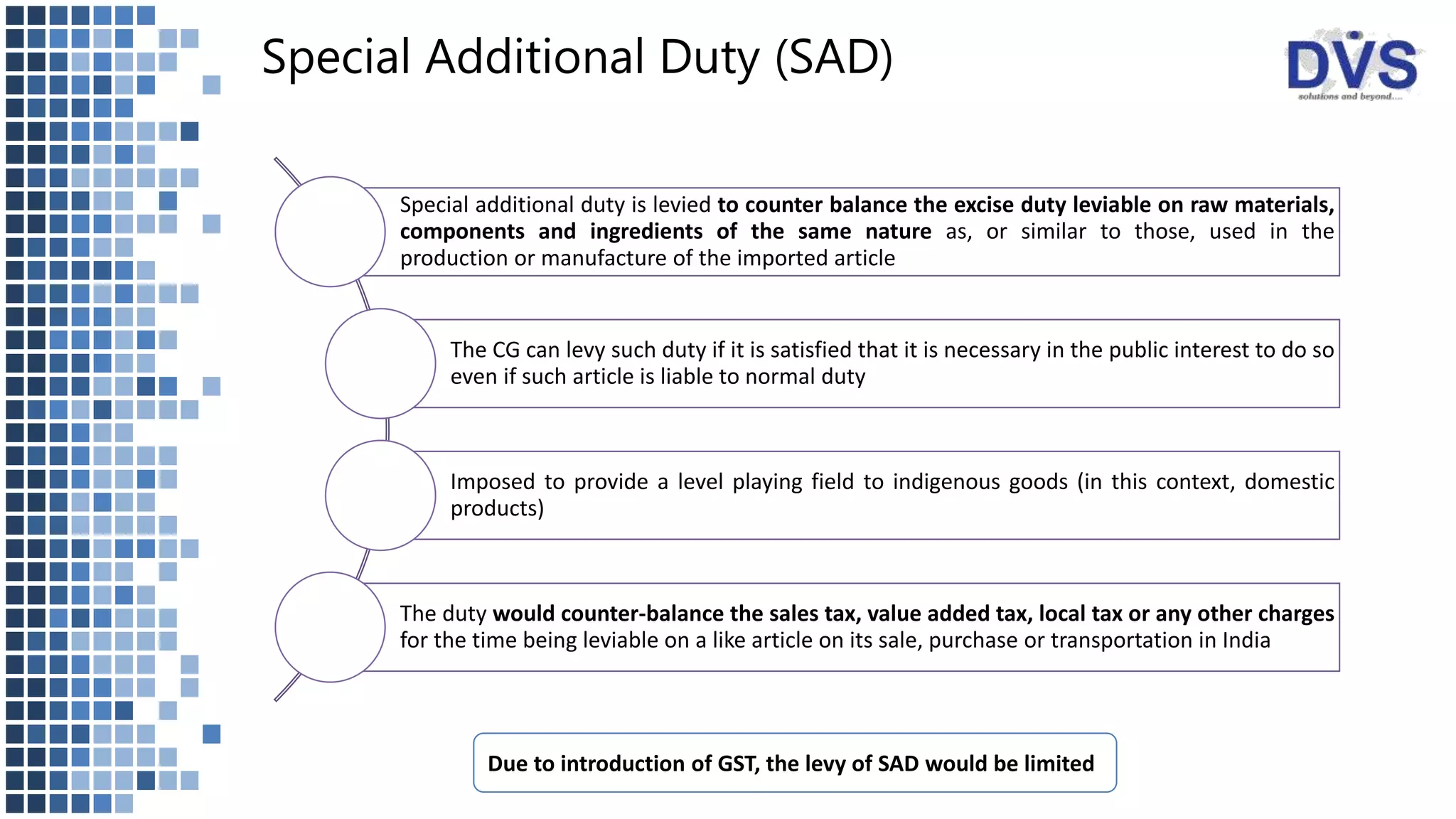

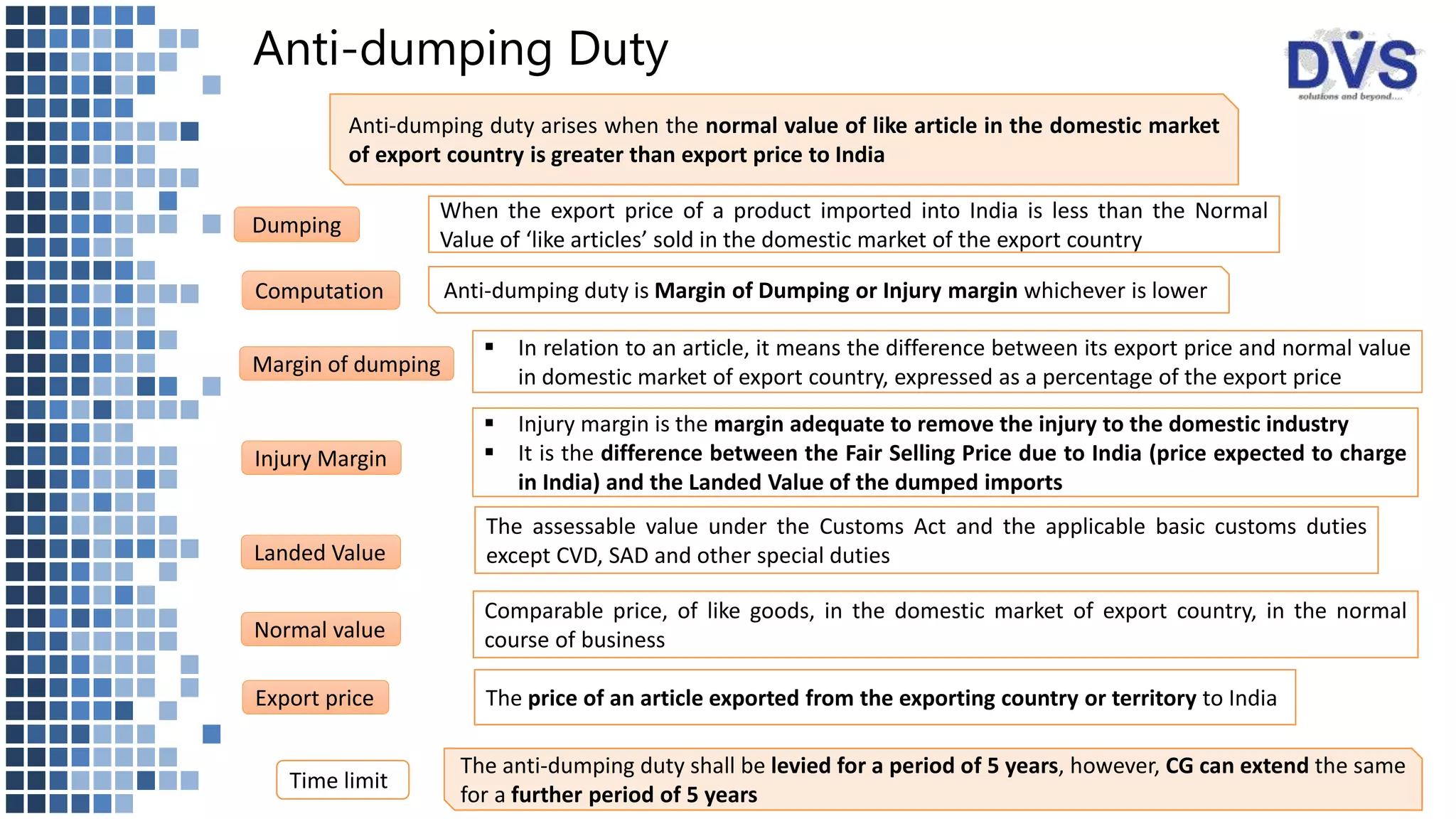

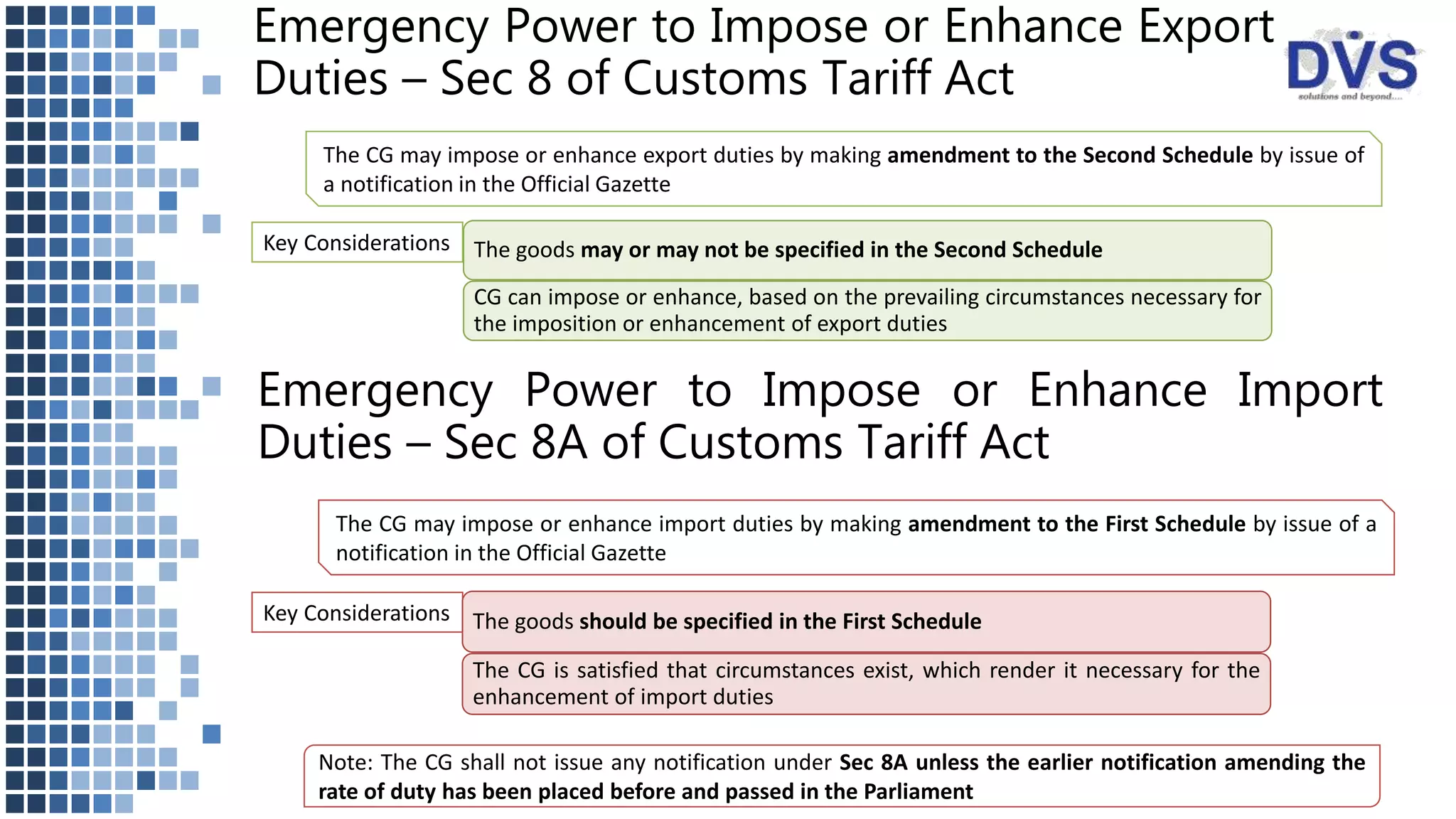

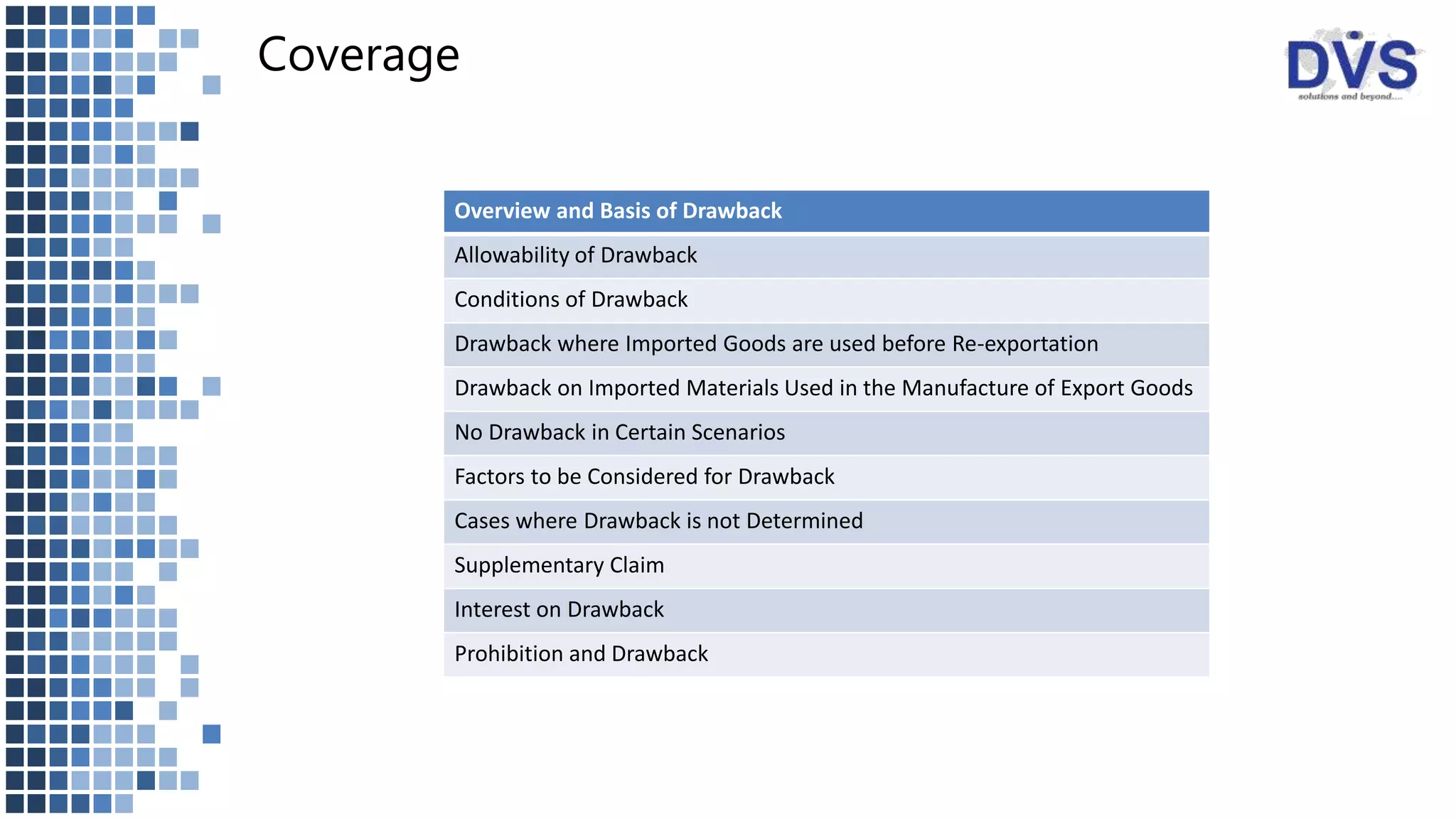

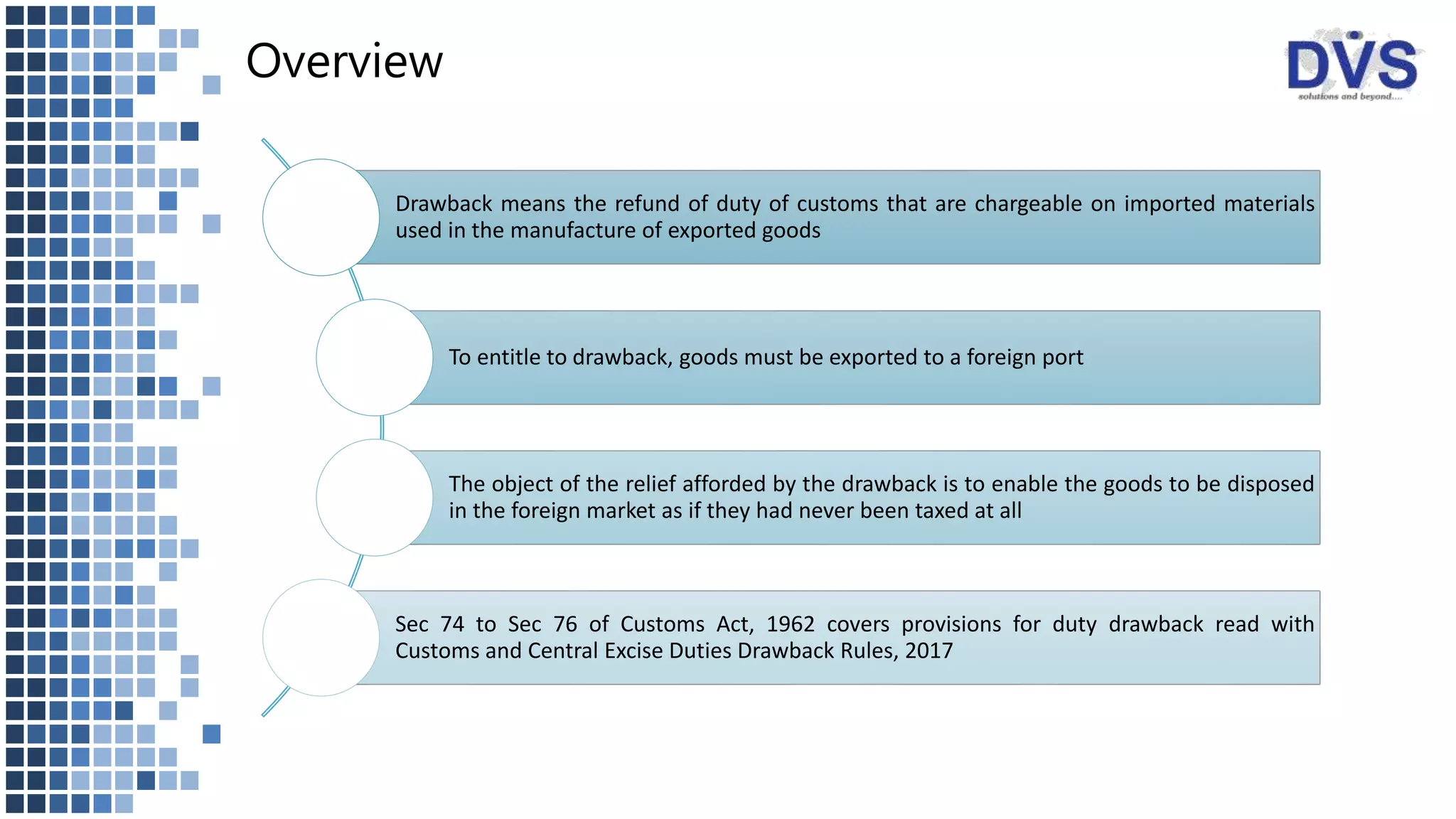

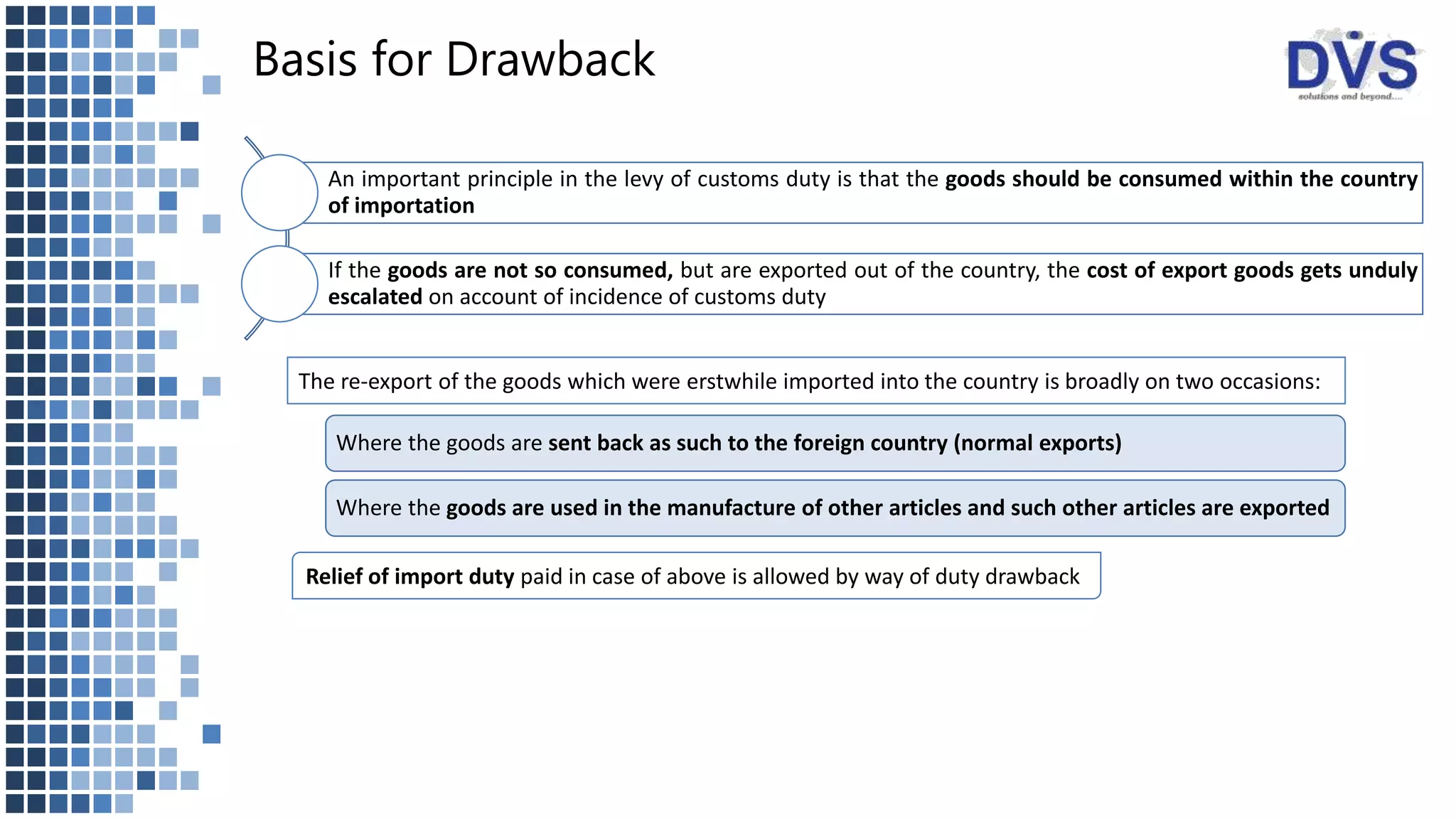

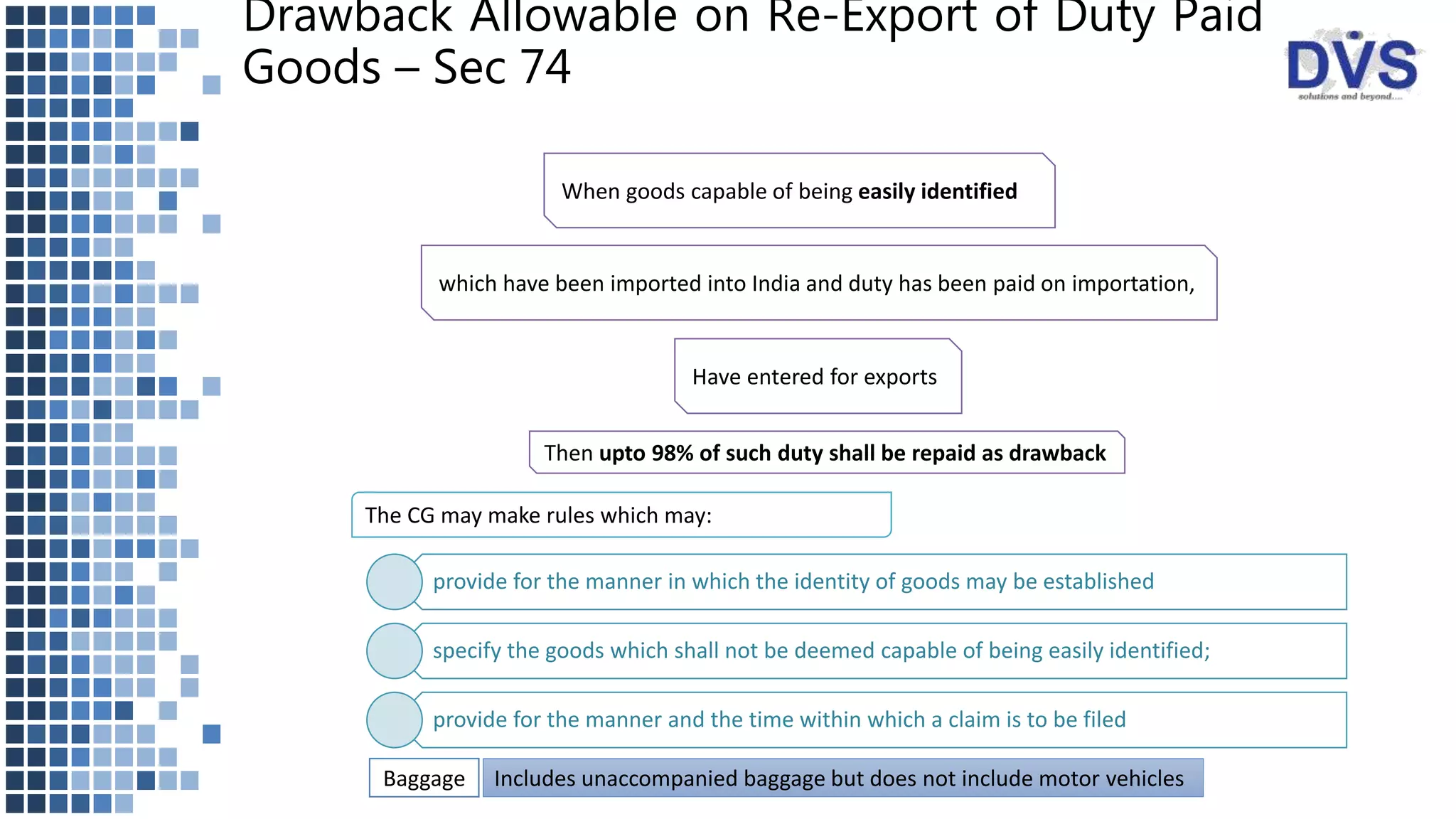

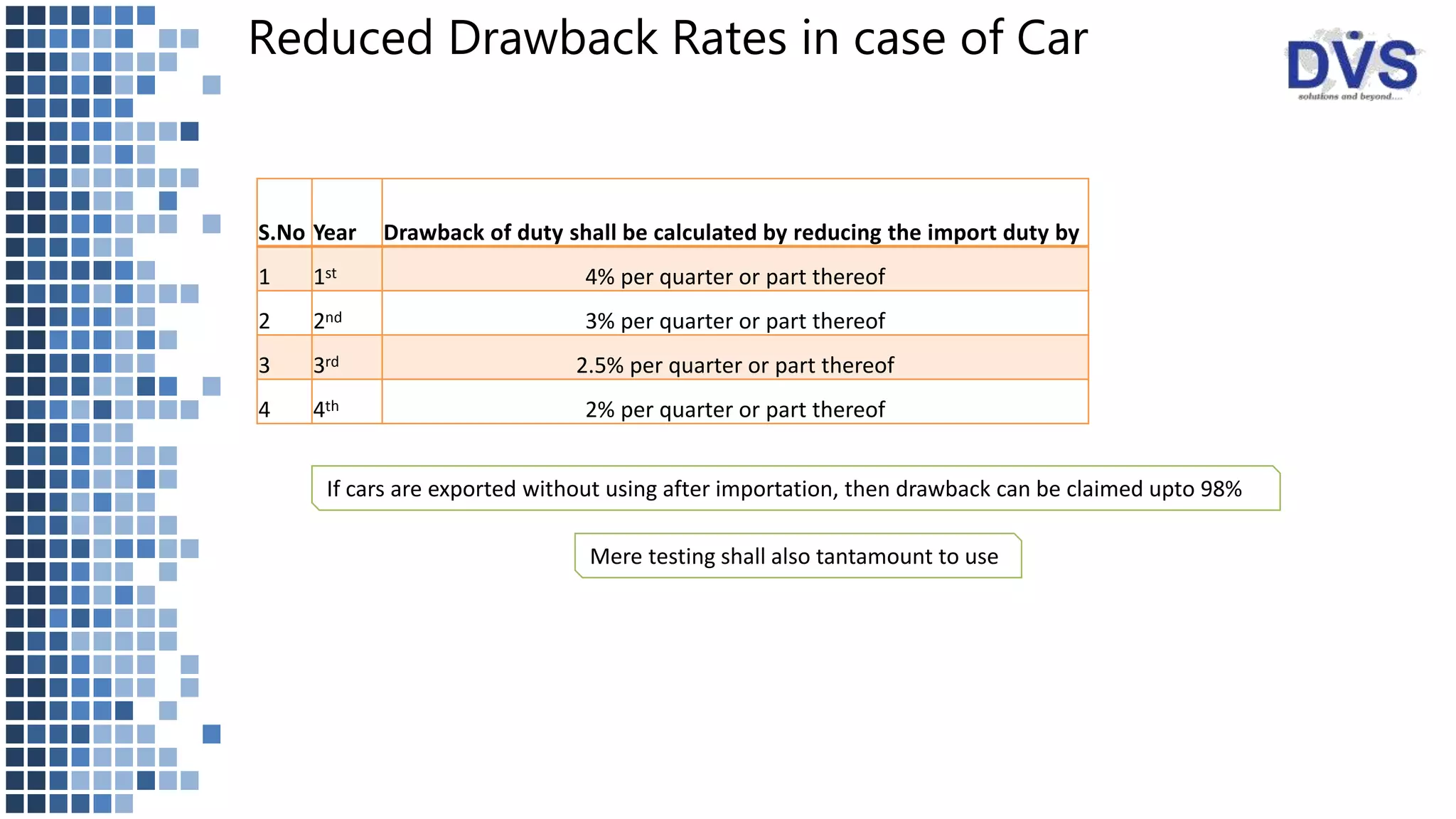

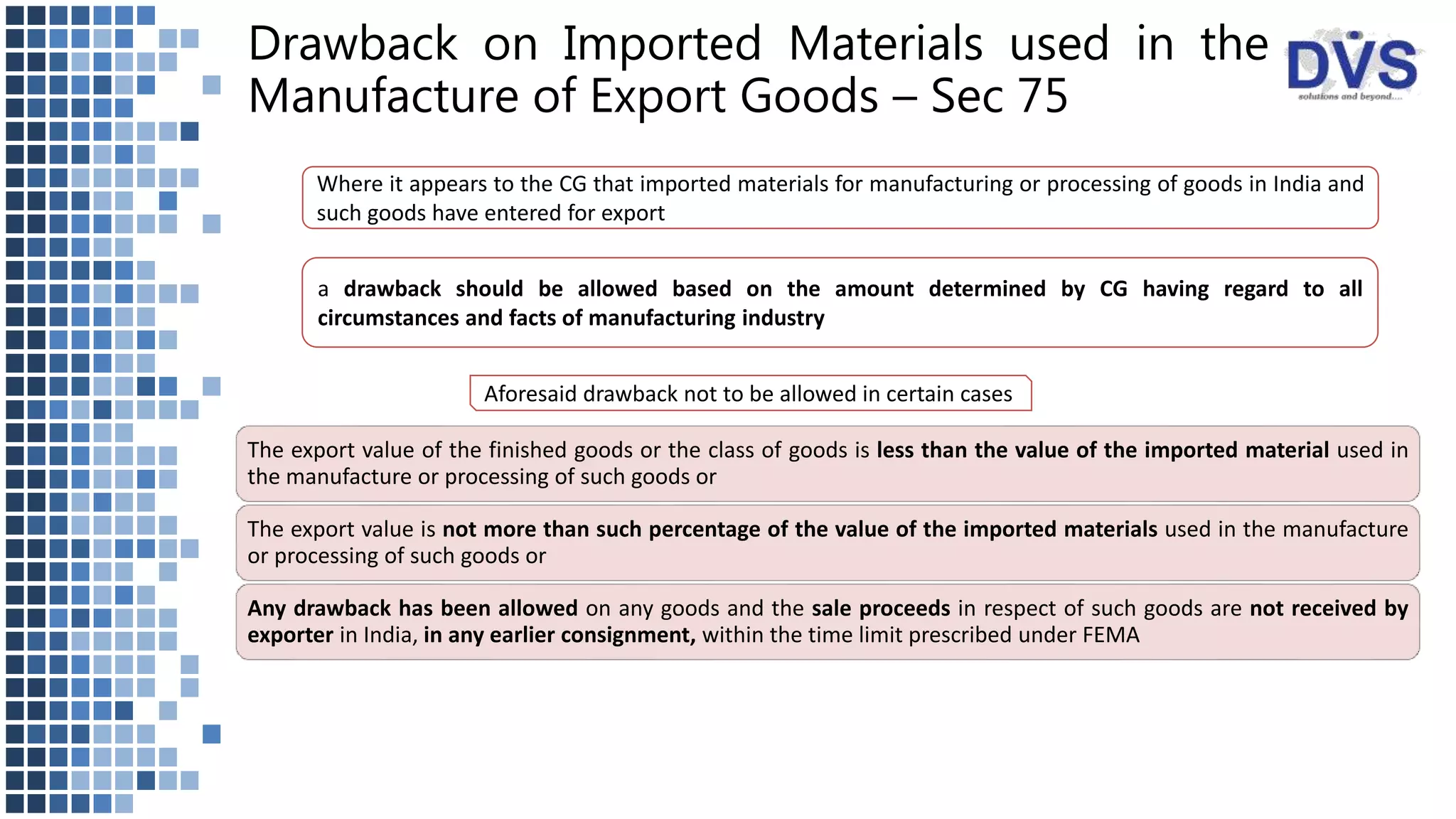

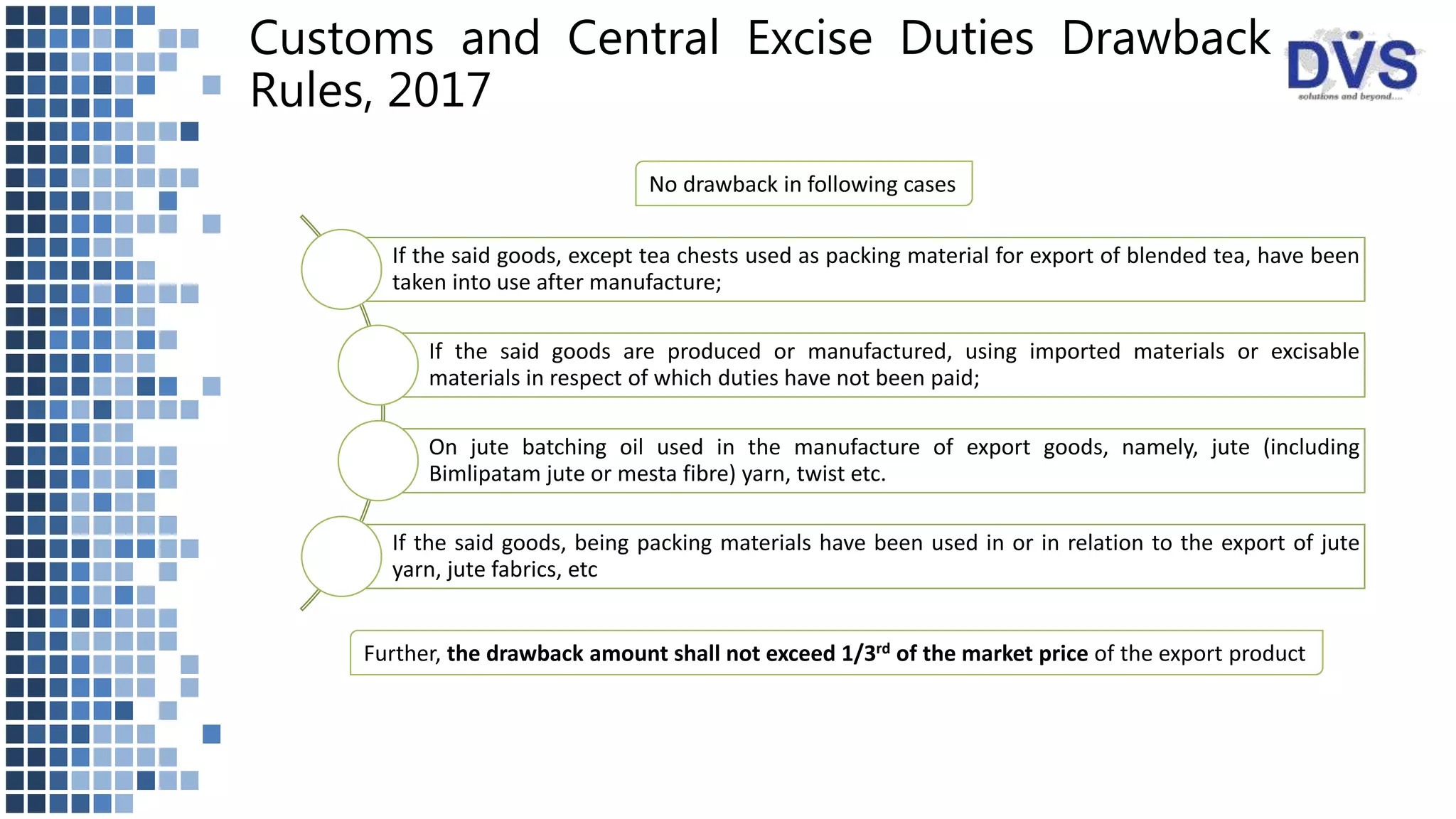

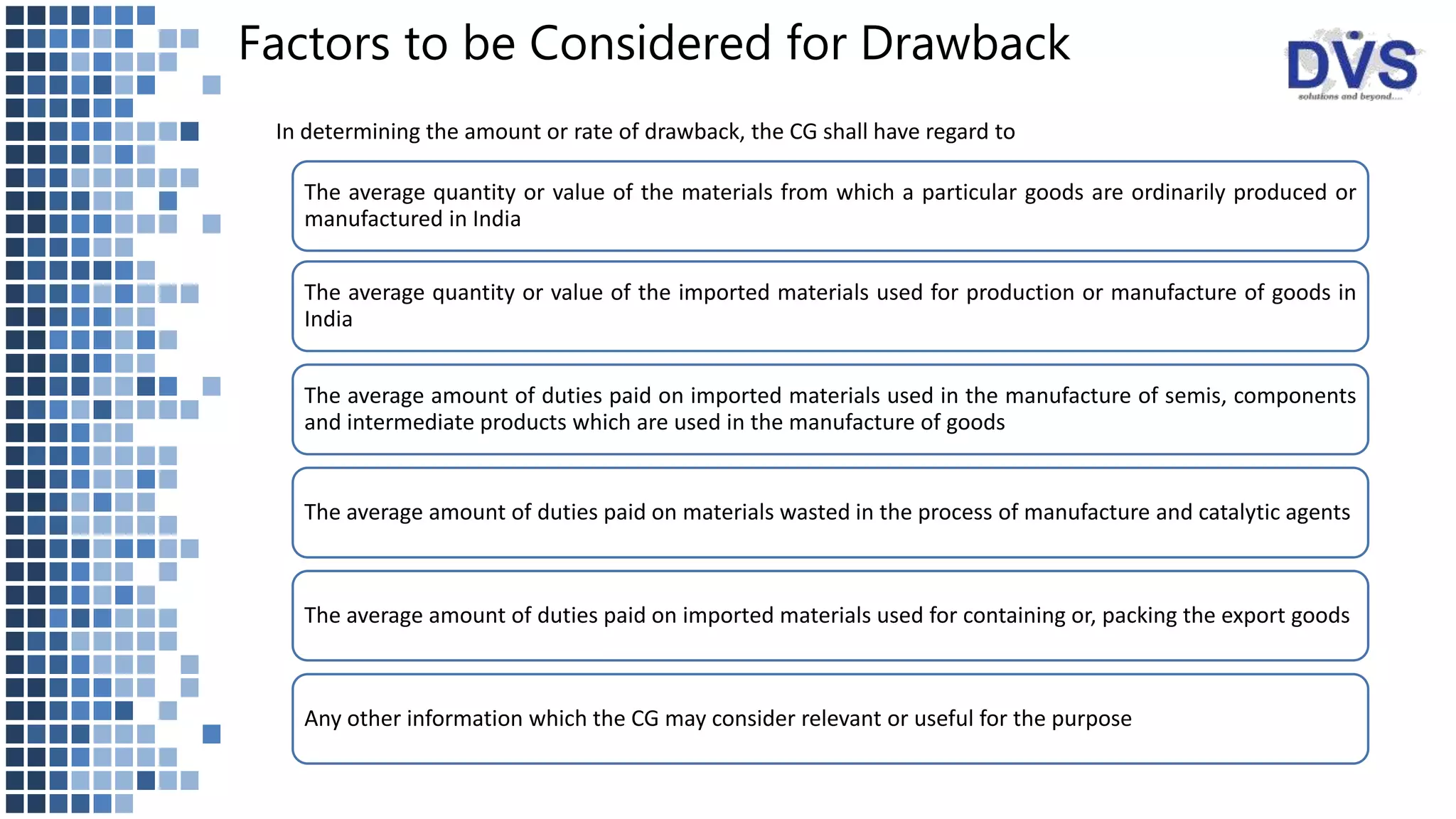

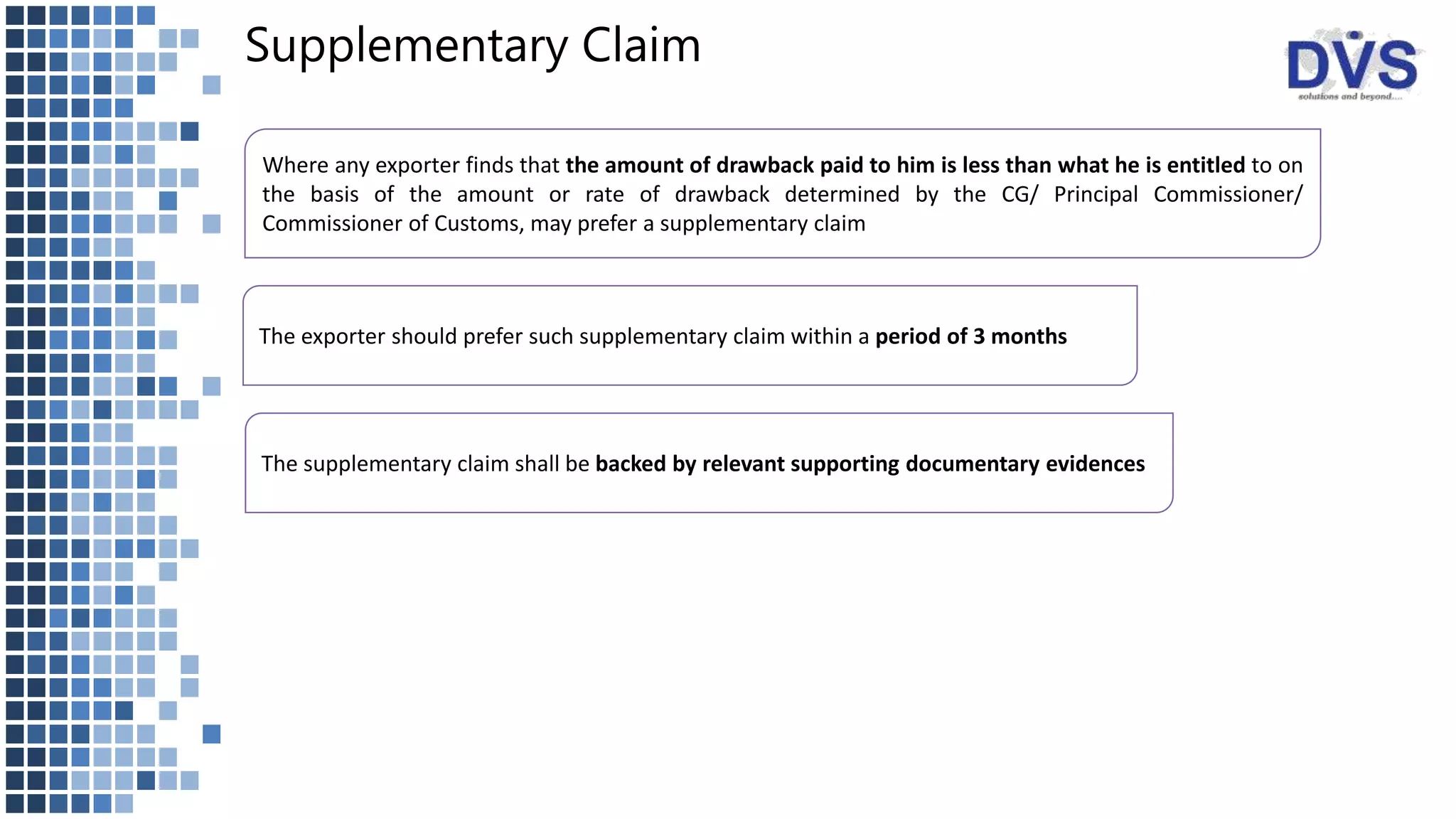

The document outlines various types of customs duties in India, including Basic Customs Duty (BCD), Countervailing Duty (CVD), Special Additional Duty (SAD), and others, explaining their purposes and conditions for imposition. It also details the provisions for duty drawback, which refund customs duty on imported materials used in manufacturing exported goods, while setting out the eligibility criteria and calculation methods. Furthermore, it discusses emergency powers of the Central Government to impose or enhance export and import duties as necessitated by circumstances.