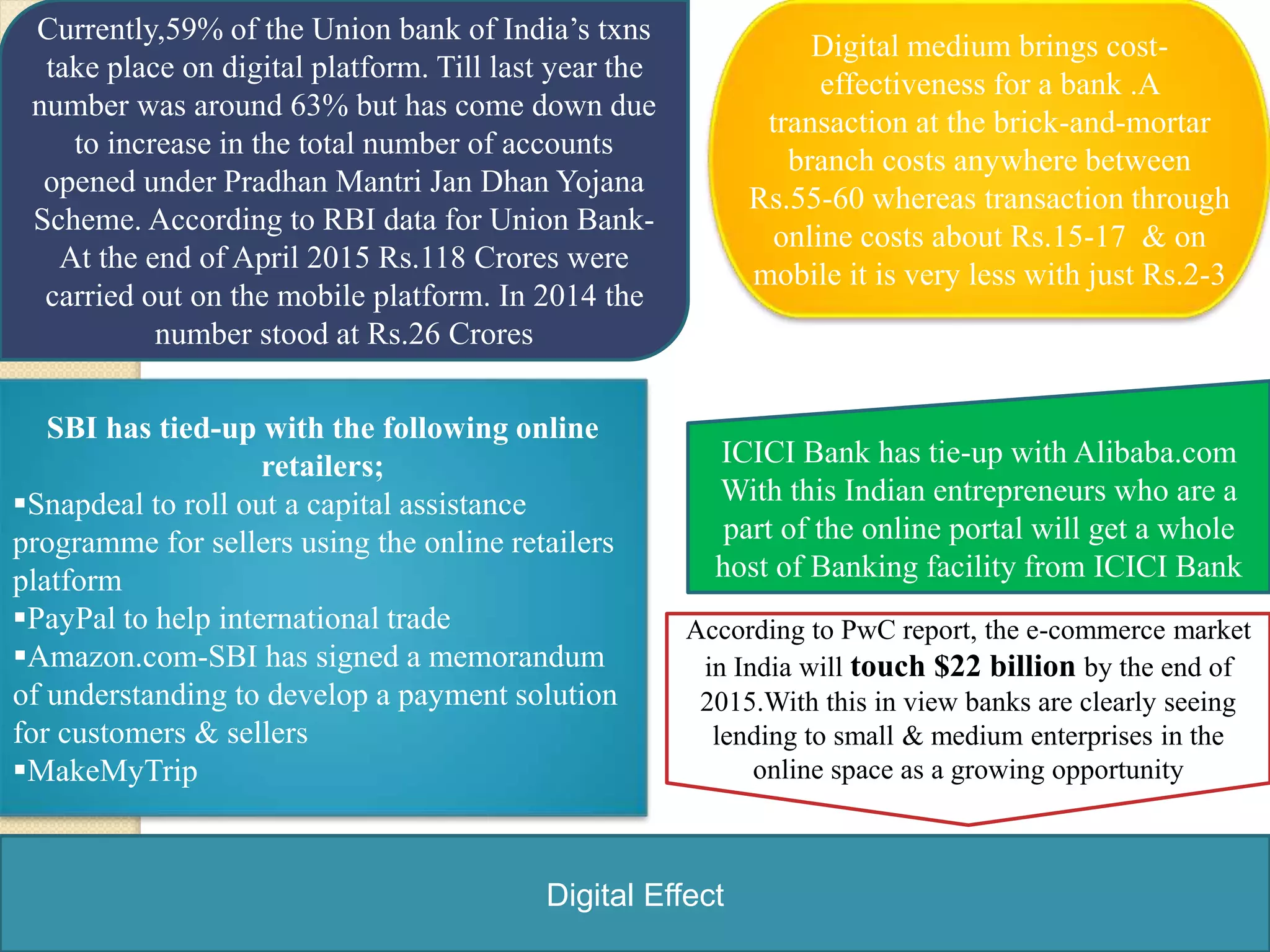

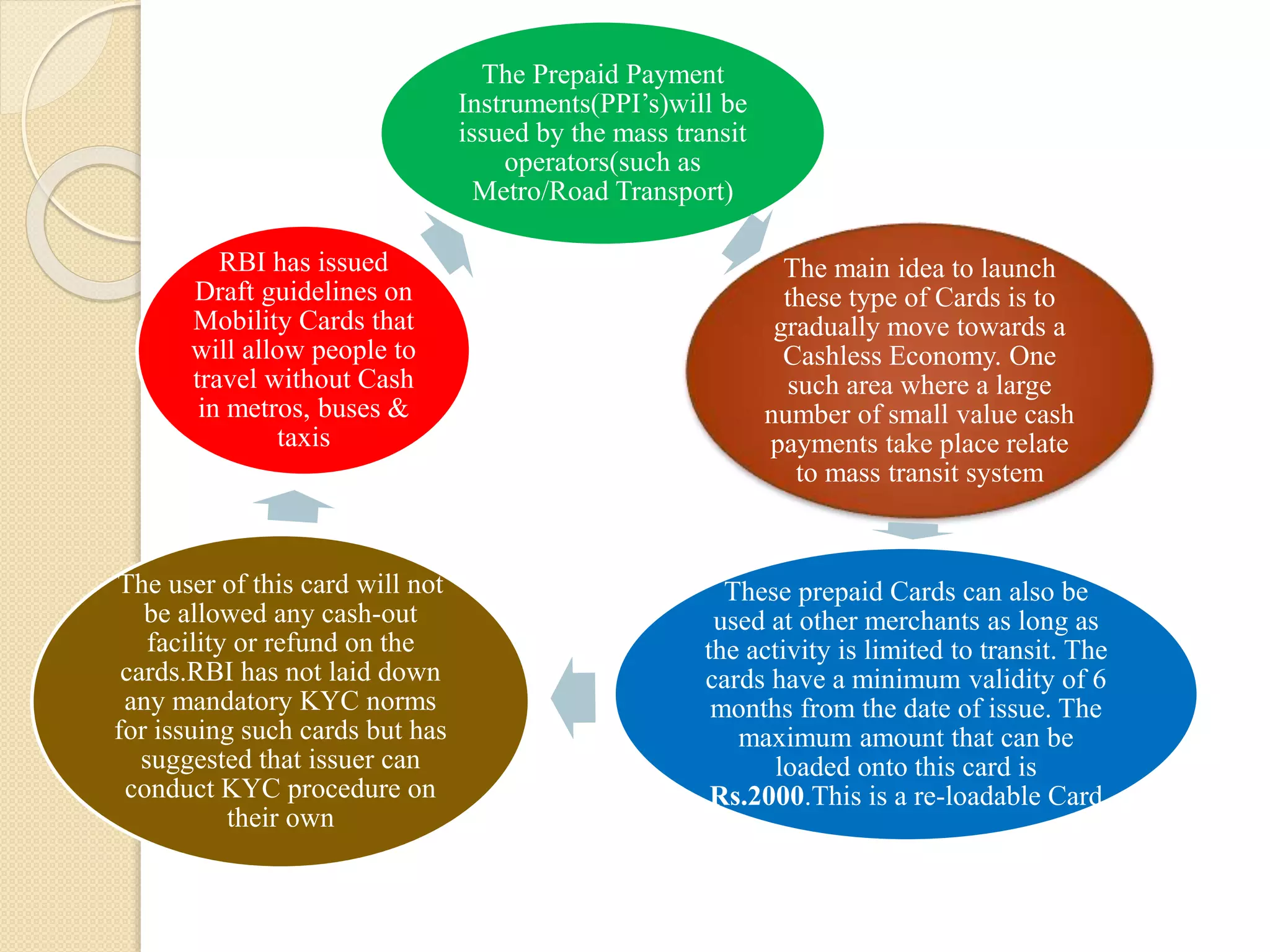

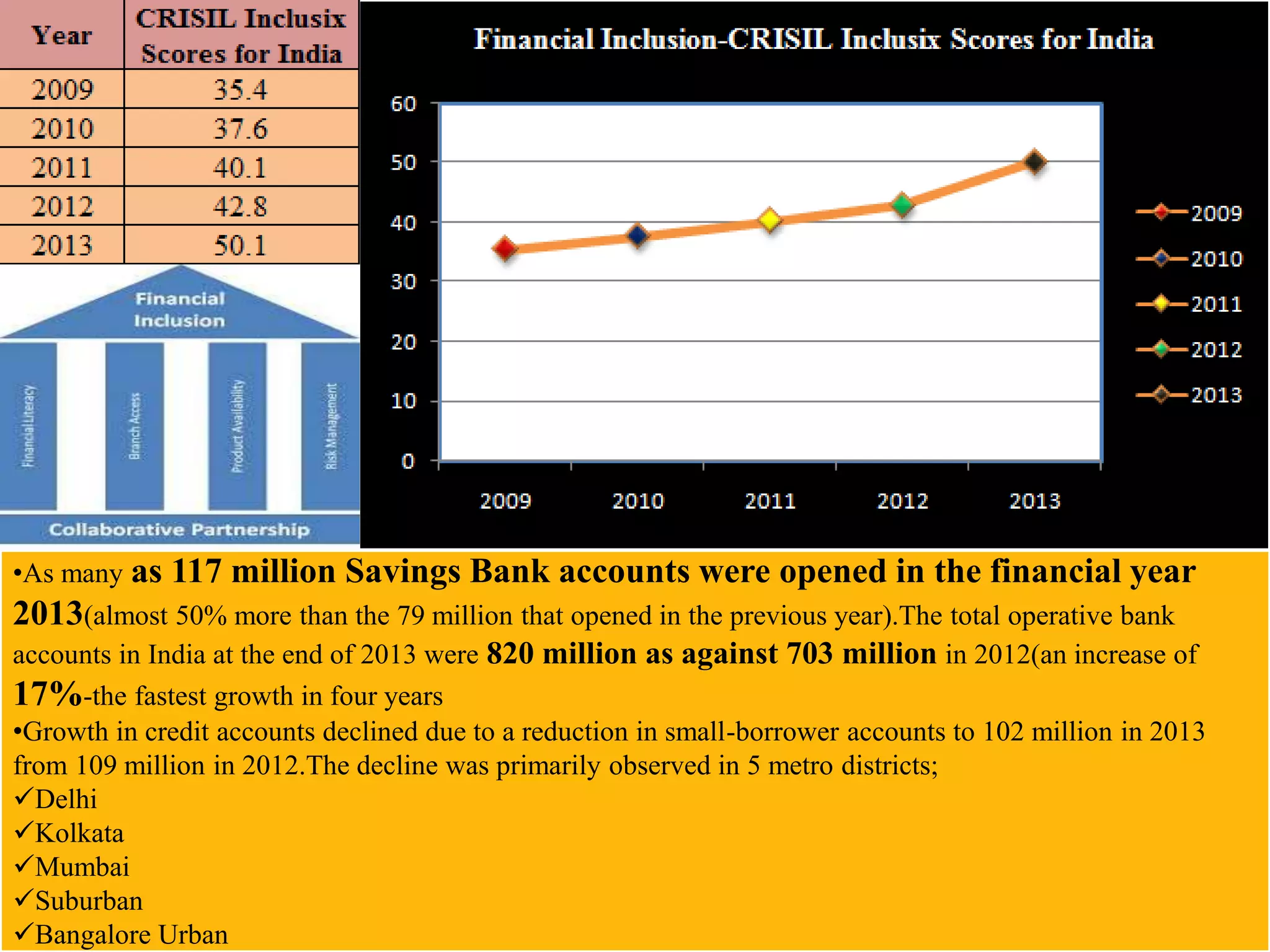

State Bank of India (SBI) plans to spend ₹4,000 crores on enhancing its digital services by March 2016, focusing on upgrading its IT infrastructure, expanding self-service branches, and training customers in digital transactions. In contrast, private banks like HDFC and ICICI are leading in mobile banking adoption, indicating a significant gap in digital transaction shares compared to peers. Additionally, RBI is introducing prepaid payment instruments for mass transit to promote a cashless economy, reflecting the ongoing digital transformation in Indian banking.