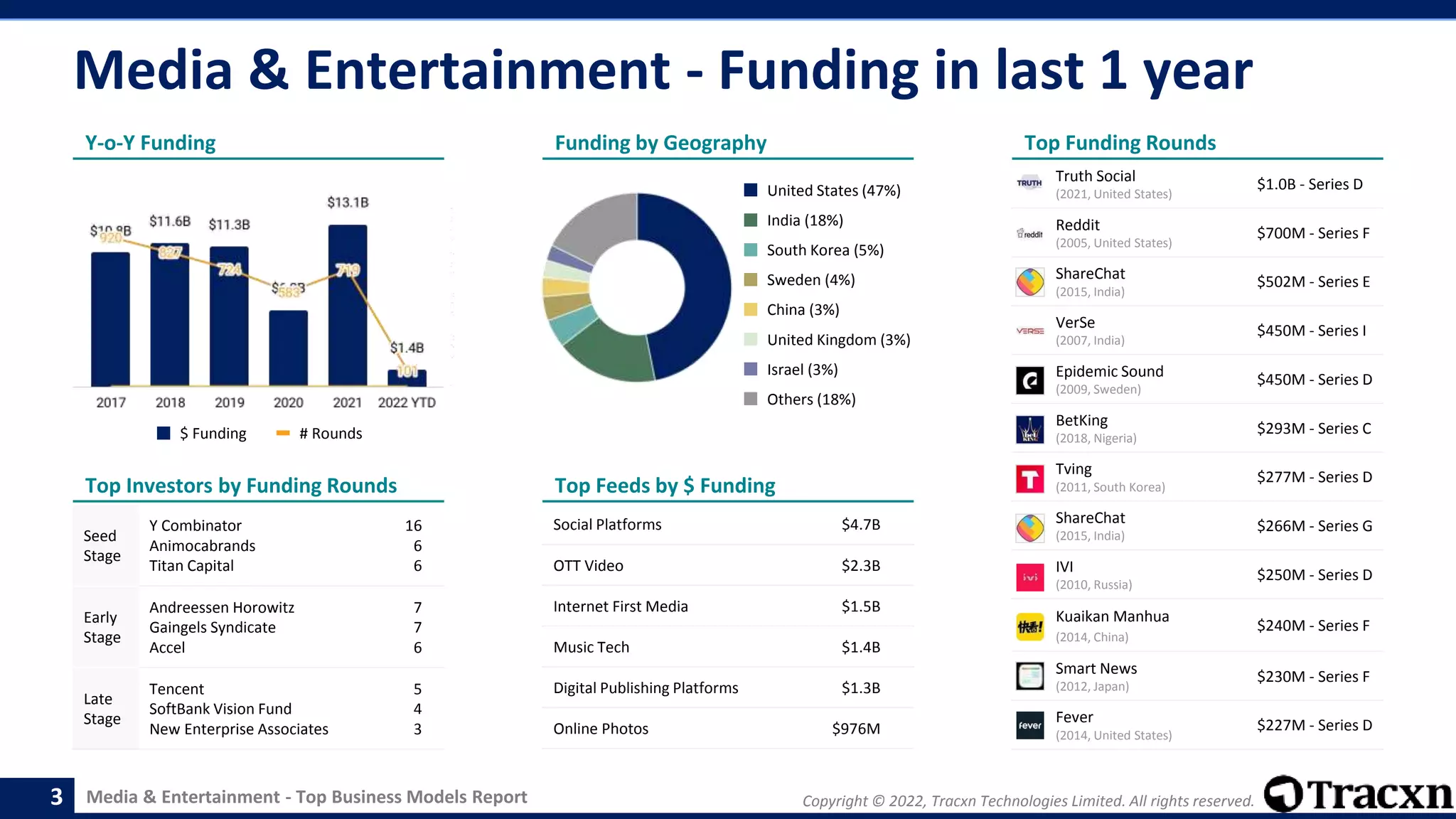

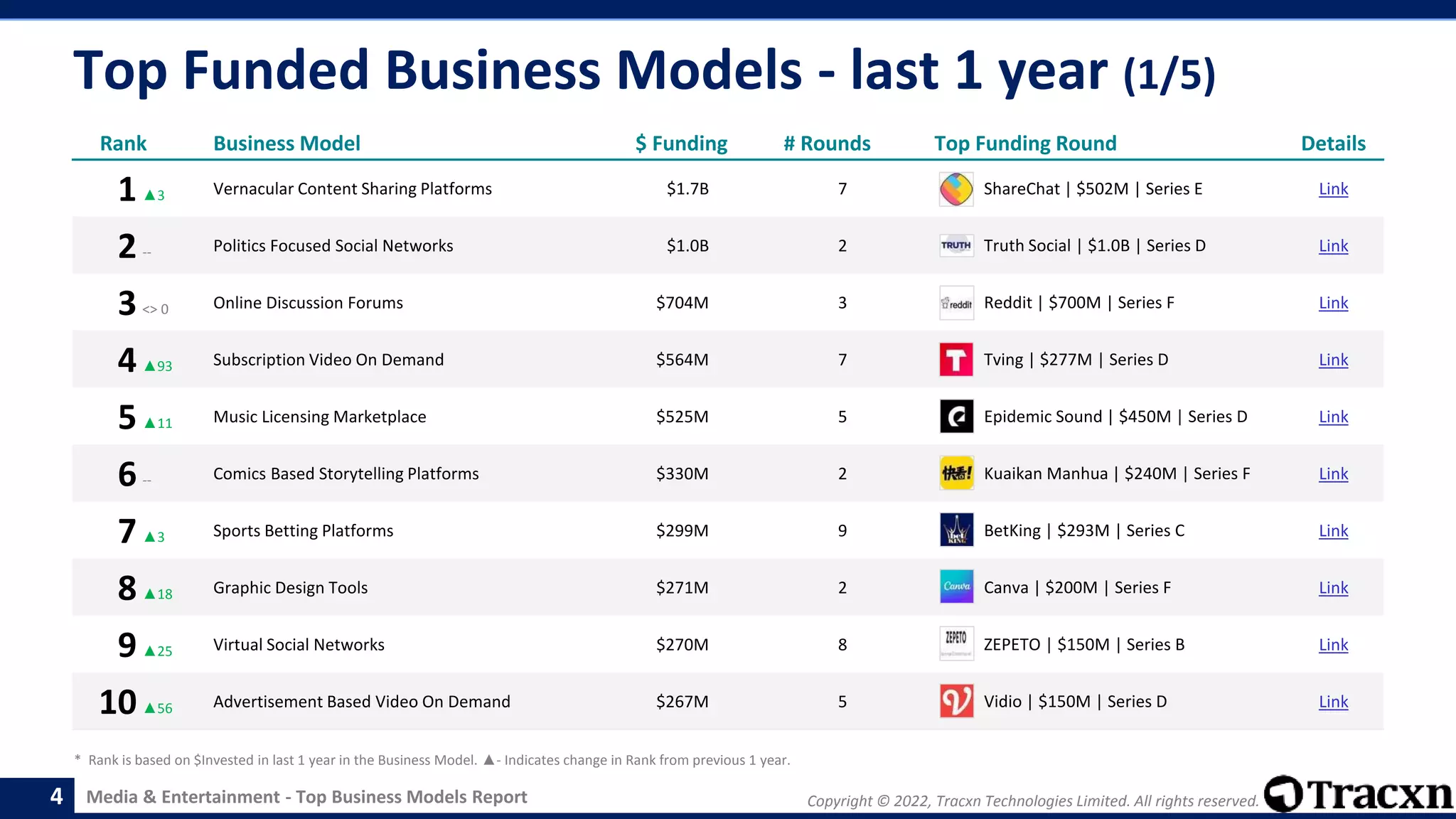

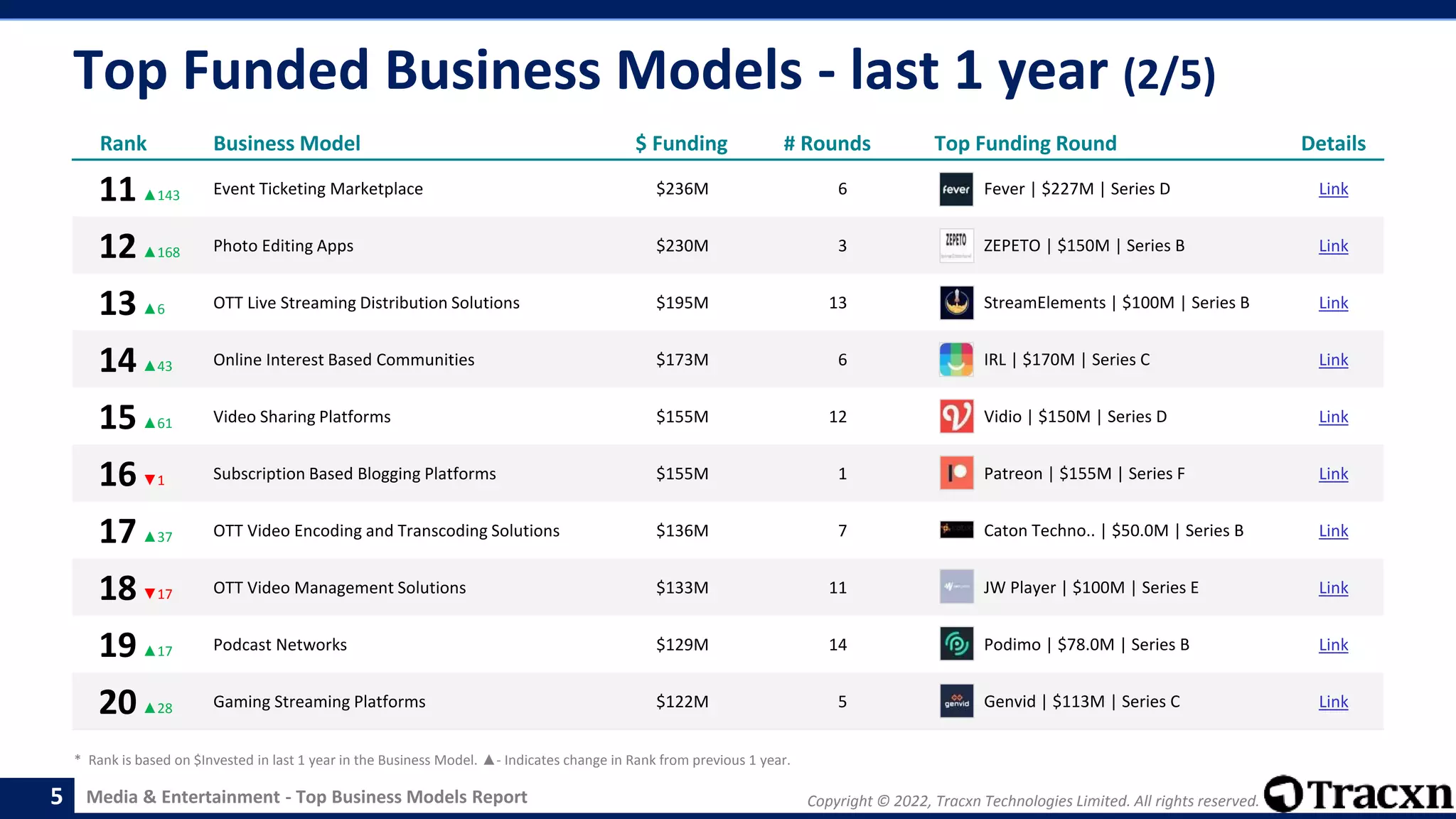

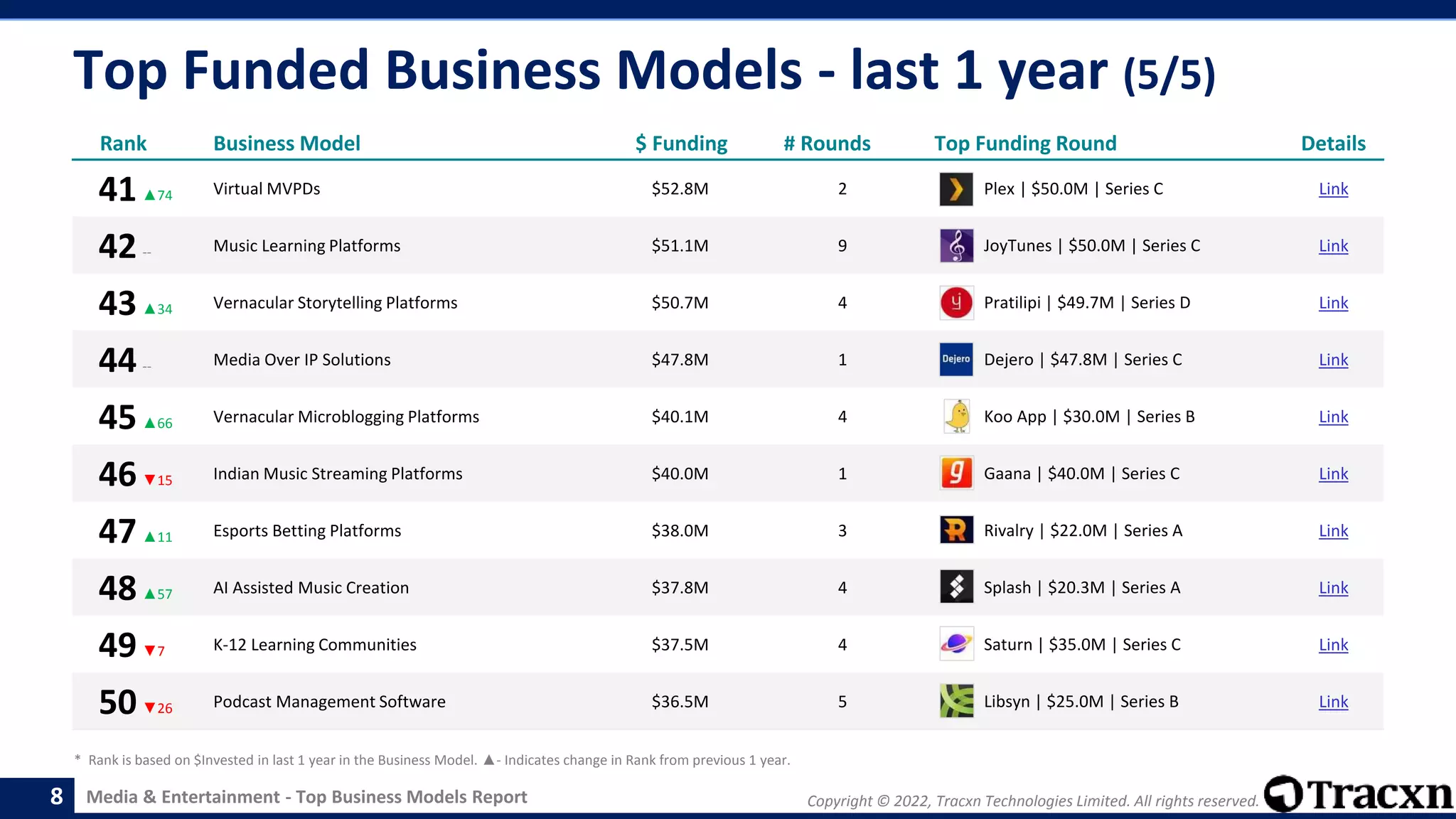

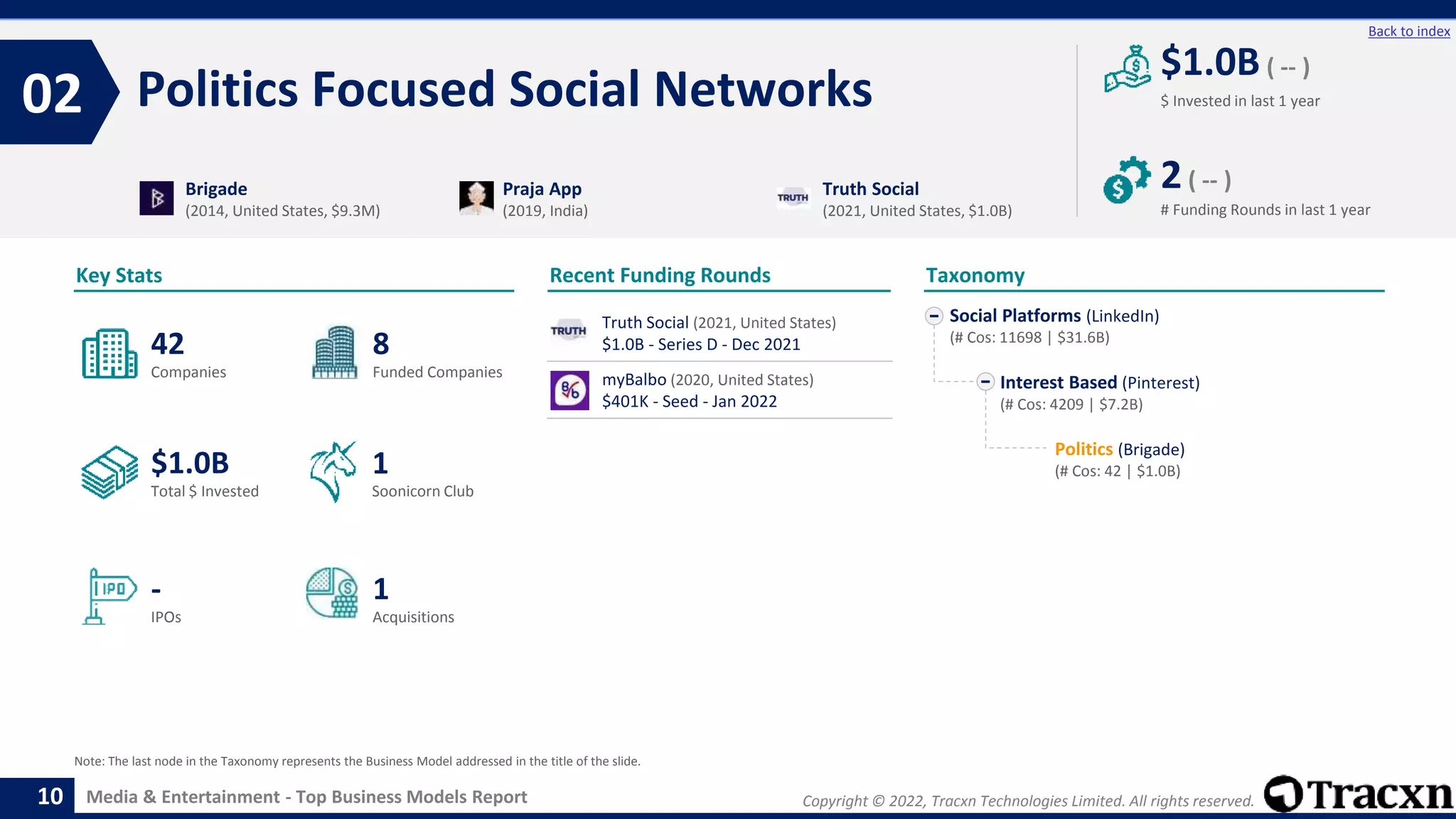

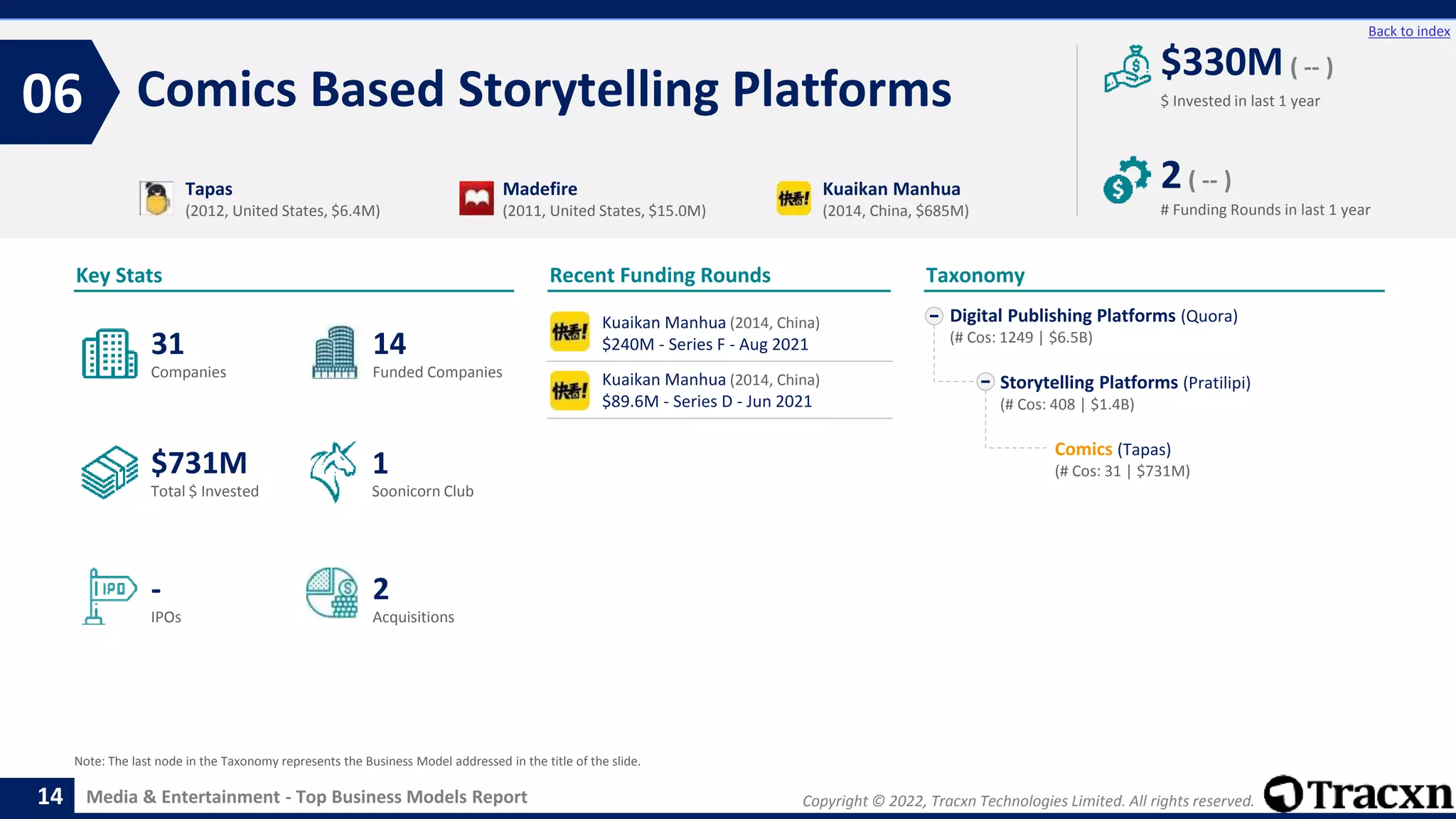

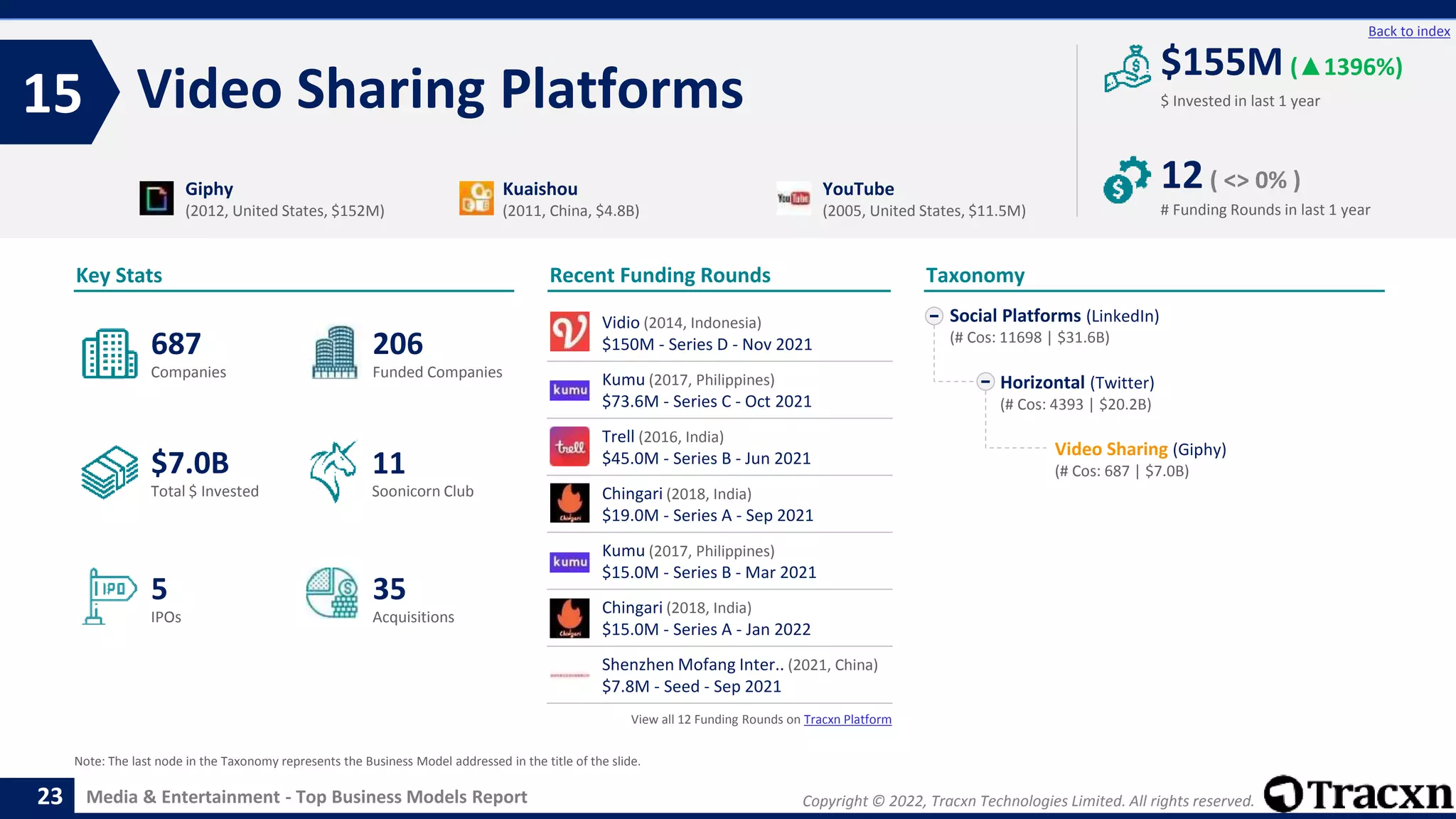

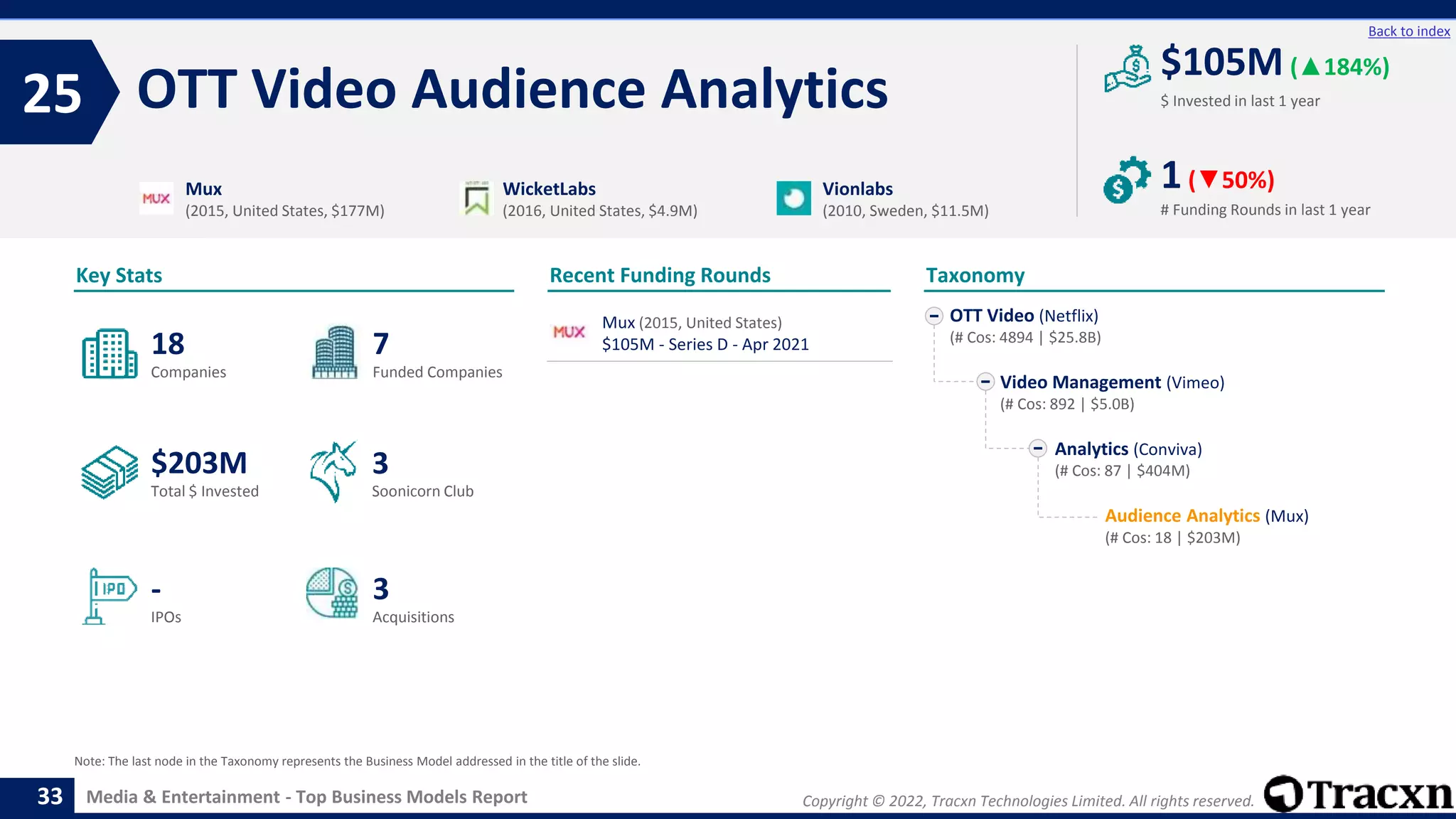

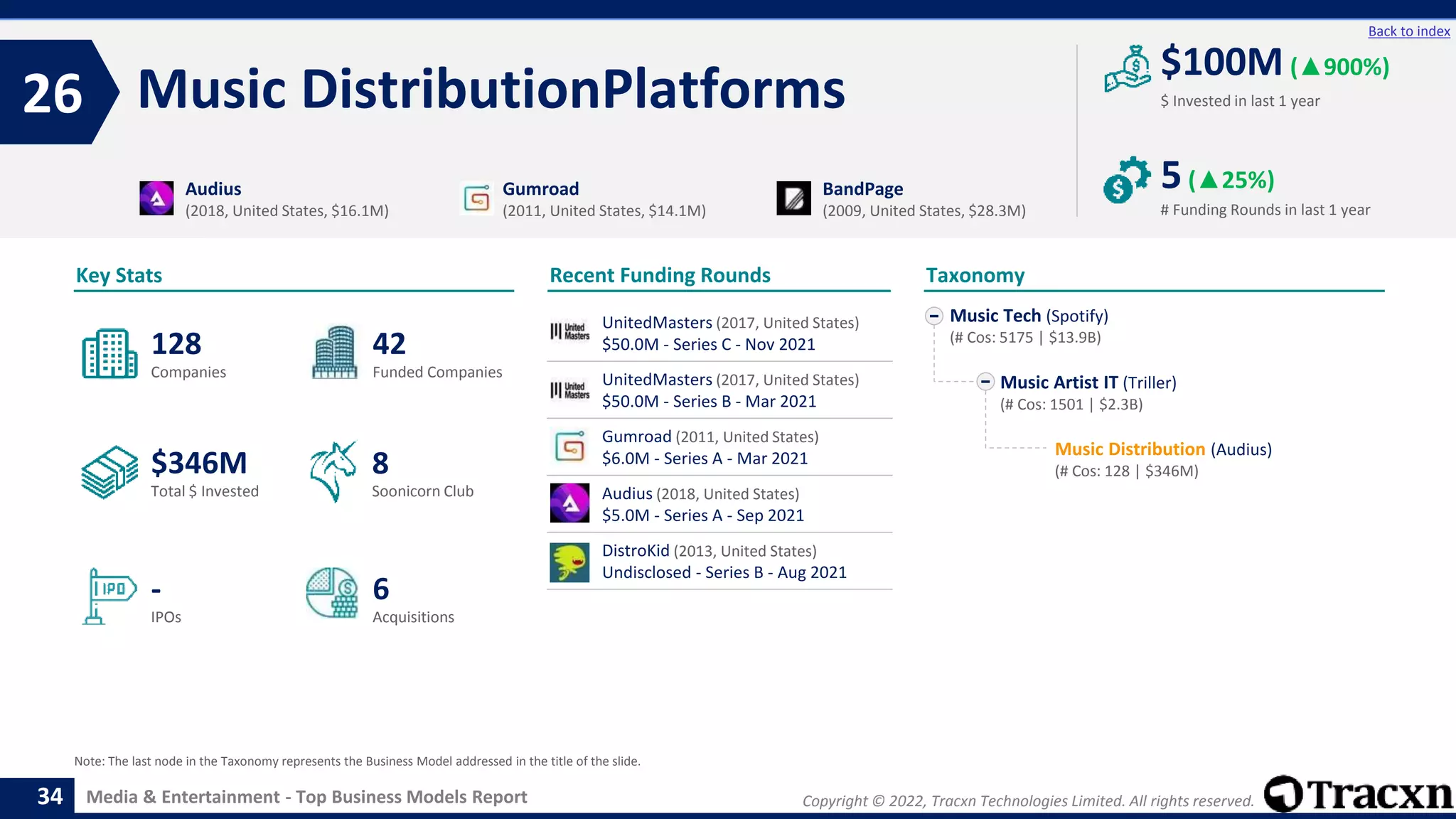

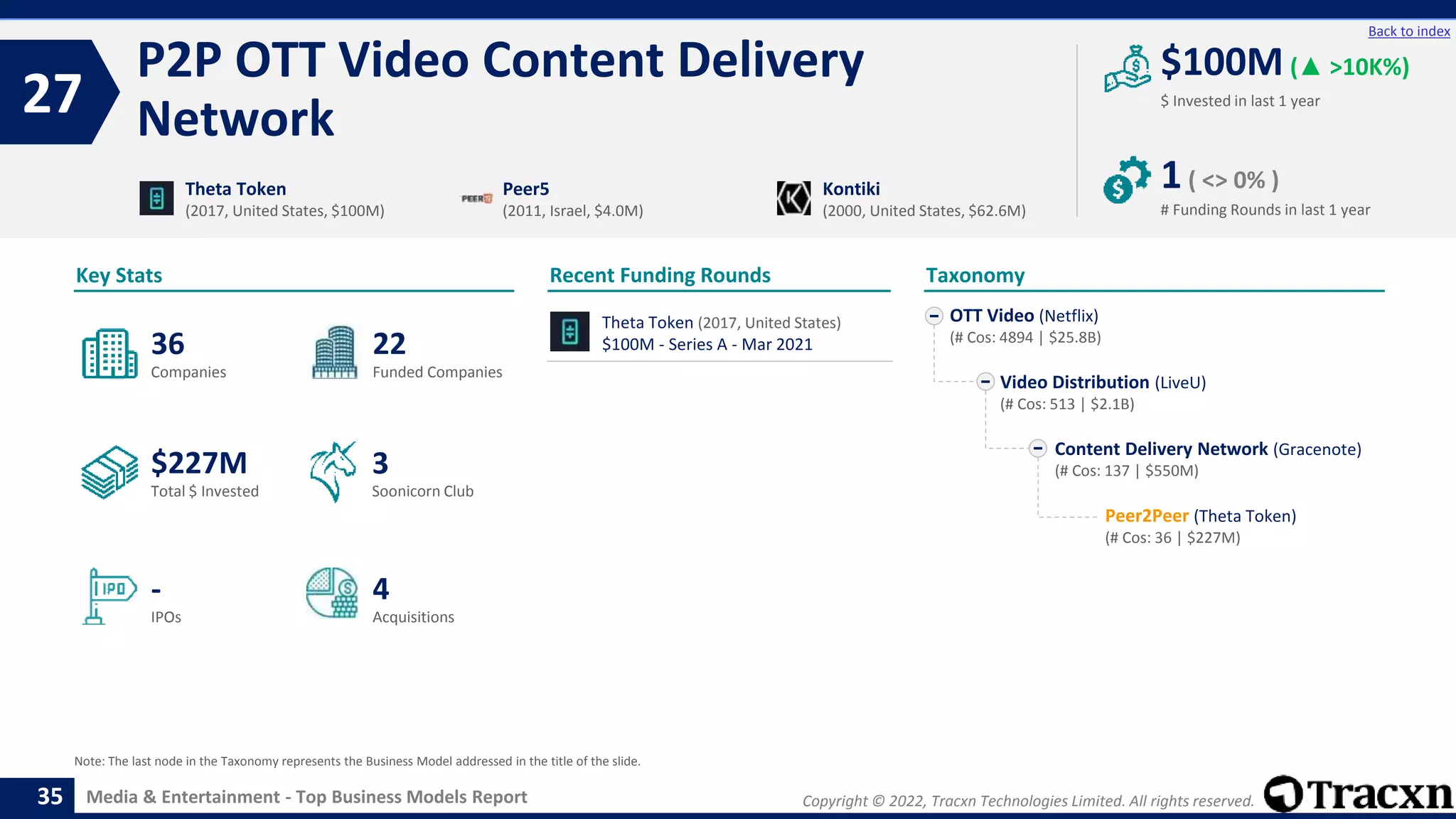

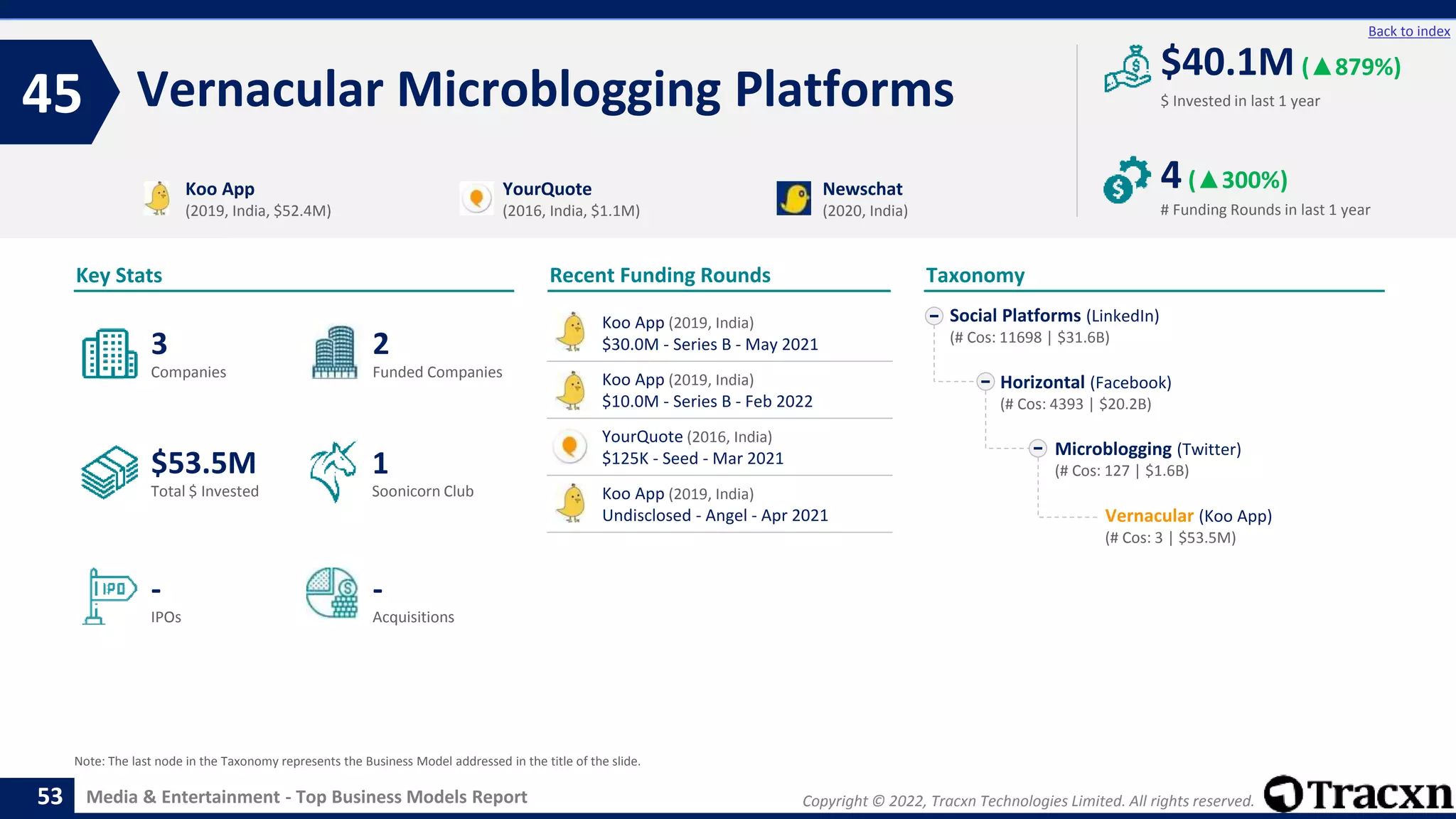

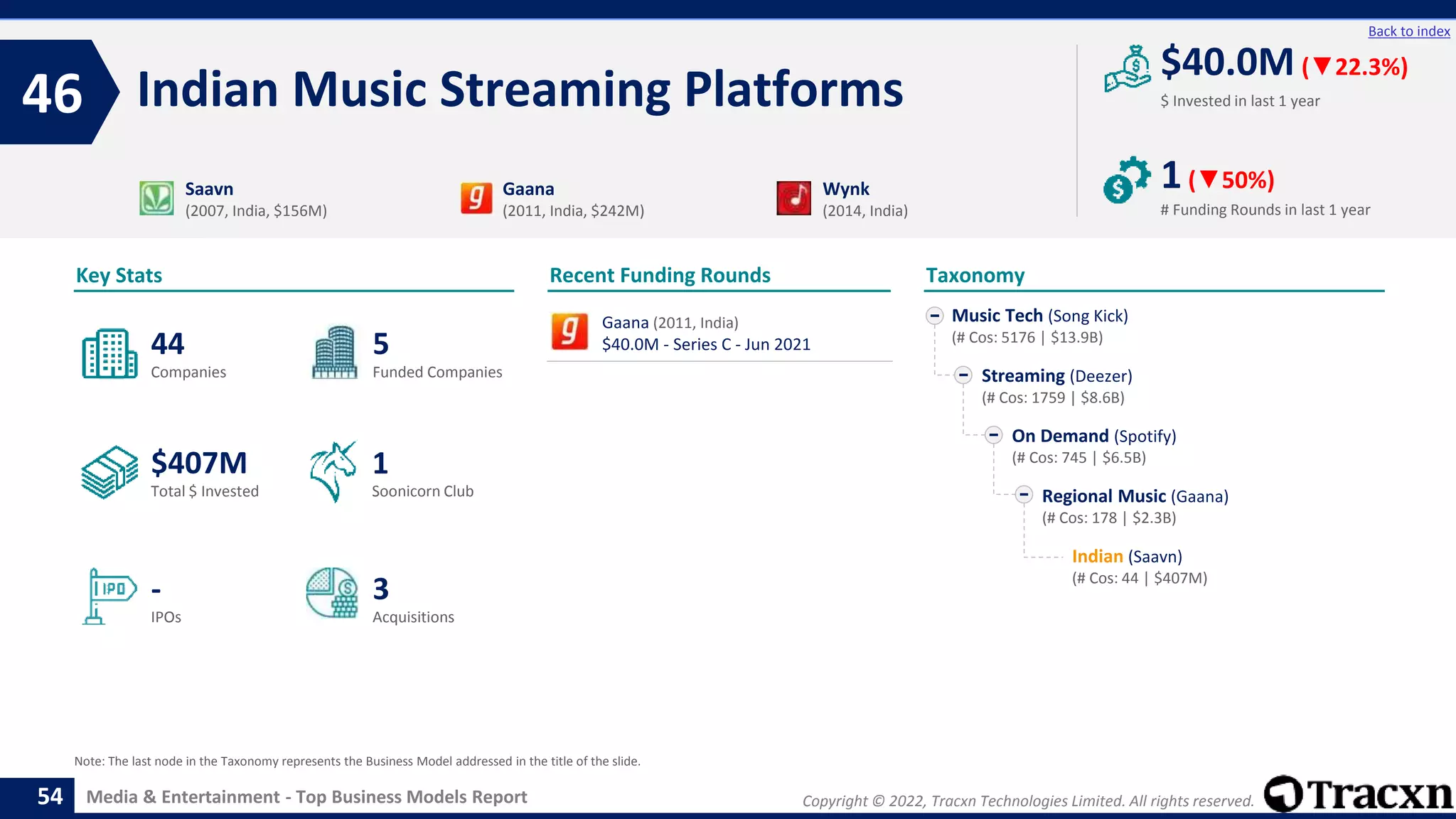

The Tracxn report on top business models in media and entertainment highlights significant funding trends and leading business models over the last year. Key sectors include vernacular content sharing platforms, which received $1.7 billion, and politics-focused social networks, with $1 billion in investment. The report provides insights into funding by geography, notable investors, and detailed rankings of top-funded business models.